Watch Out Amazon Prime Day: Afterpay Day Makes Big Gains In The Beauty Sector

Move over Amazon Prime Day. Millennial and gen Z beauty and fashion shoppers have an e-commerce holiday to call their own.

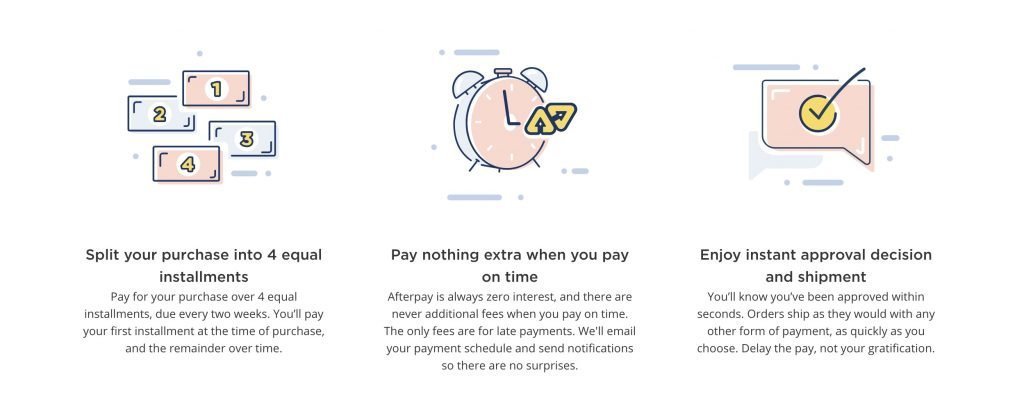

Held from Aug. 14 to 15, the second Afterpay Day in the United States showcased discounts from more than 1,000 retailers and brands, including Tarte, Credo, Dragun Beauty, Elemis, Cover FX, Lime Crime, Nars Cosmetics, Urban Skin Rx, Kylie Cosmetics, Sigma Beauty and MAC, which experienced an average sales volume increase of at least 110% during the event. Their gross merchandise value (GMV) jumped 41% for the Afterpay Day period on average, according to Afterpay, the service allowing consumers to pay for goods from online merchants in four interest-free installments.

“The most successful brands, and specifically beauty brands, can use Afterpay Day deals to attract a new customer who wants to build her beauty regime around a certain product line,” says Melissa Davis, chief revenue officer at Afterpay, who noted that 700,000-plus referrals were made to brands and retailers from Afterpay’s index of retailers and brands on Afterpay Day. “Special promotions often help introduce a new brand to a shopper who becomes a loyal customer.”

New customer acquisition was certainly a goal of brands involved in Afterpay Day. While Amazon Prime Day drives customers to Amazon, Afterpay Day is an opportunity for beauty brands to draw customers that they can retain following the shopping extravaganza. Afterpay has 2 million-plus U.S. customers shopping with retailers and brands typically 1.2 times a month. Afterpay shoppers generally buy four products in an order. The service reaches some 6,500 online merchants in the U.S. and penetrates roughly 10% of the fashion and beauty industry in the country.

Zabana Essentials took part in the most recent Afterpay Day as well as an earlier Afterpay Day in March. The indie natural beauty brand sold products at a 20% discount for both events. “Purchases increased above average on those days. Afterpay Day in March was a success as new customers were acquired through the Afterpay site. I also noticed that there were numerous return customers checking out with Afterpay that had never done so before,” says Shanell Edwards, founder of Zabana Essentials. During the Afterpay Day last month, she continues, “I noticed most sales were directed from the Afterpay site and from new customers via Instagram that had seen our announcements. Acquiring new customers is always a win.”

Algenist, a prestige skincare brand that skipped Afterpay Day, but uses Afterpay, has discovered the service is a magnet for fresh business. Rose Fernandez, CEO of Algenist, says, “We see about 67% of the buyers are new to the brand, which is amazing…Offering Afterpay seems to indicate that there is a barrier removed for trial, an openness to exploring a new brand with our retail price and positioning.”

“Offering Afterpay seems to indicate that there is a barrier removed for trial, an openness to exploring a new brand.”

Sigma Beauty saw a 613% hike in traffic to its website from Afterpay’s directory during Afterpay Day in August and a GMV lift of 180%. The brand known for makeup brushes offered 30% off on products during the shopping event. It added Afterpay in January and, in the six weeks since it did, its conversion rate and average order value shot up 42%.

“Not only is the customer able to pay later, they are able to buy more and take advantage of enticing promotions,” says Simone Xavier, co-founder of Sigma Beauty, discussing Afterpay Day. “It’s all about understanding your customers’ preferences and being able to market to those preferences. Sigma’s customers want quality and value at an affordable price, and they want it delivered fast. By participating in the Afterpay Day promotion, Sigma is able to offer its customers the best of both worlds: the highest-quality brushes, brush care and makeup on the market, and the ability to pay after the products are in their hands.”

Although it didn’t participate in Afterpay Day in August because it was concentrating on a collaboration with the Starz television show “Power,” Coloured Raine Cosmetics experienced a 95% leap in GMV during the March edition of Afterpay Day. The brand marked items down by as much as 30% for the occasion.

“Our experience with Afterpay has been nothing short of pleasant,” says Coloured Raine founder and CEO Loraine R. Dowdy. “Our customers love the price point the installments offer considering our pricing is moderately low it can range anywhere from as low as $8.25 biweekly in four installments. No credit checks once approved. The only caveat is the order minimum must equal to $35 and up.”

Pricier beauty brands seem particularly keen on Afterpay Day. “Our products might be expensive for some consumers because they have high levels of active ingredients, and Afterpay allows us to offer a more approachable method of payment to those consumers,” says Rachel Roff, founder of Urban Skin RX. For Afterpay Day in March, the brand supplied 15% deals and sweetened its offers during August’s Afterpay Day, when it featured 25% off on select products.

Afterpay has encouraged younger consumers without the disposable income of gen X and baby boomer consumers to buy Sigma Beauty’s products. Afterpay’s core audience is millennial shoppers moving away from traditional credit cards to avoid accumulating more debt than they’re already dealing with from college loans. In July, the company reveals it achieved a sales volume run rate of $1.2 billion. Ulta Beauty and J. Crew have recently signed on to Afterpay. The service charges merchants a fee of around 4% a transaction.

“Payment options like AfterPay facilitate customers moving from wish list to converted carts because even the priciest, crave-worthy beauty items become easily affordable.”

“Our clients usually, before we had Afterpay, were a bit on the older side. It was someone who was an established professional woman who had the means to pay for our products without Afterpay,” says Xavier. “Our products aren’t the cheapest. A brush set can be over $100, and our average ticket is around $89/$90. I think we were not reaching millennials as much as we could. We saw a very positive change after we introduced Afterpay.” She notes Afterpay’s appeal to millennials improves the return on investment on influencer collaborations that pull in millennial and gen Z consumers tending to pay through Afterpay.

Afterpay Day wasn’t uniformly fruitful for all brands. Medusa’s Makeup reports the event in August didn’t generate better results than its own sales promotions. In contrast, the March Afterpay Day led to the best revenue-generating month of the year for Minimo Skin Essentials. Minimo founder Mary Ware says her brand has implemented Sezzle, another installment plan provider, to its arsenal of payment services due to its sales gains from Afterpay. Along with Sezzle, Quadpay and Affirm are Afterpay competitors beauty brands are bringing into their payment service portfolio.

“AfterPay is absolutely essential to the growth of our business, and the beauty and cosmetic sector. Payment options like AfterPay facilitate customers moving from wish list to converted carts because even the priciest, crave-worthy beauty items become easily affordable,” says Ware. Xavier says, “I don’t know if Afterpay Day will ever get to be like Amazon Prime Day, but Afterpay is definitely making an impact. It has improved our traffic and reach substantially, and the type of clients we can now offer our products to. It’s definitely a strong player in the beauty industry.”

Afterpay hasn’t announced the dates of the next Afterpay Day. Davis says, “We will host them when it makes the most sense for our retail partners and customers.” Edwards has a scheduling recommendation for the payment service. She says, “I feel Afterpay should limit Afterpay Day to an annual event so it can also feel special and exclusive. Too many sales in some cases can devalue brands because customers get in the pattern of waiting for a sale to happen rather than paying regular price.”

Key Takeaways

- Afterpay, the Melbourne-based payment service allowing consumers to pay for goods from online merchants over four interest-free installments, held a shopping event in the United States from Aug. 14 to 15 in which more than 1,000 brands and retailers offered discounts. In March, it held a similar event, and 400 brands and retailers participated.

- Beauty brands and retailers big and small took part in Afterpay Day last month. Tarte, Credo, Dragun Beauty, Elemis, Zabana Essentials, Minimo Skin Essentials, Cover FX, Lime Crime, Nars Cosmetics, Urban Skin Rx, Kylie Cosmetics, Sigma Beauty and MAC were among those involved.

- On average, Afterpay disclosed that online merchants participating in Afterpay Day in August experienced a sales volume increase of at least 110% and a gross merchandise value (GMV) jump of 41% during the two-day shopping event.

- Sigma Beauty saw a 613% hike in traffic to its website from Afterpay’s directory during Afterpay Day in August and a GMV lift of 180%. Afterpay revealed the shopping holiday spurred more than 700,000 referrals from its online directory of brands and retailers using Afterpay to websites of those brands and retailers.

- Beauty brands are adding Afterpay to their payment options because it’s drawing new customers, particularly millennial and gen Z customers. For premium beauty brands, Afterpay encourages trial of pricier products that millennial and Gen Z customers might otherwise feel are too expensive to purchase.

- Afterpay emphasizes customers using it buy many products often. It reports customers paying with Afterpay typically shop with retailers and brands using it 1.2 times a month and buy four products per order.

Leave a Reply

You must be logged in to post a comment.