Amazon Launches Indie Beauty Shop Dedicated To Emerging Brands Within Its Marketplace

The Indie Beauty Shop is open for business on Amazon.

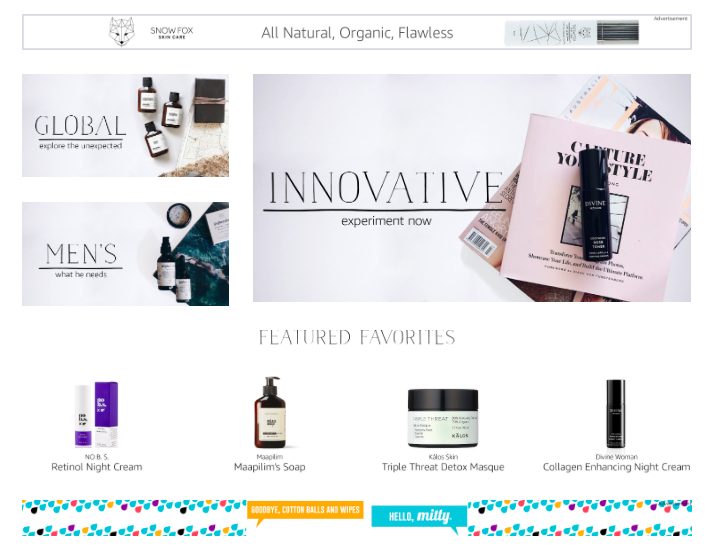

The world’s largest e-tailer is looking to the little guys to elevate its presence in the beauty industry with a new destination dedicated to emerging domestic and international players in the skincare, men’s, natural and color cosmetics categories. Among the brands involved at the outset are Maapilim, La Sirène, Divine Woman, Take My Face Off, Laguna Herbals, Nail & Bone, Gnarly Whale, No B.S. and Eleni & Chris, but the brand population is expected to increase as the Indie Beauty Shop establishes itself and additional beauty upstarts ready themselves for Amazon commerce.

The brands flocking to the Indie Beauty Shop bet it will improve their chances of being seen by Amazon’s enormous customer base. “It’s good to be there to have more exposure and reach,” says Ebru Karpuzoglu founder of AveSeena, a skincare brand scheduled to launch soon on the Indie Beauty Shop. “My brand is still a baby. It’s 14-months-old and, to be honest, I was afraid that, if I got on Amazon, we were going to get lost in all the brands there. There are tons of brands, what kind of exposure would we have? But, with the Indie Beauty Shop, I think they’re going to show extreme care and help the brands to make the platform perform on Amazon.”

Celeste Bernabe, co-founder of Wake Up To Beauty, owner of Level Naturals and Das Boom Industries, brands sold on the e-commerce giant by third-party intermediary Maxton and Co. and possibly headed to the Indie Beauty Shop, believes the shop may foster beauty product discovery, not typically a strength at Amazon, where customers tend to search for specific items. “People will go to the Indie Beauty Shop to learn about products and figure out the ones that are best for them, and people that know and love a brand will go to Amazon [without employing the indie platform],” she says. “It’s two different customers, and we want to be able to talk to both.”

Brands are eligible for the Indie Beauty Shop if they exhibited at the trade show Indie Beauty Expo (IBE), which shares parent company Indie Beauty Media Group with Beauty Independent, within the last year, but brands don’t have to be IBE exhibitors to be eligible. In general, they must be at least 50% owned by an independent operator and not be carried by major retailers, notably Target, Walmart or Ulta Beauty, to qualify. Amazon takes 15% on sales of products from Marketplace brands selling directly to consumers, and the brands have to pay a monthly fee of $39.99. The Indie Beauty Shop is located in the Amazon Marketplace.

“My brand is still a baby. It’s 14-months-old and, to be honest, I was afraid that, if I got on Amazon, we were going to get lost in all the brands there. There are tons of brands, what kind of exposure would we have? But, with the Indie Beauty Shop, I think they’re going to show extreme care and help the brands to make the platform perform on Amazon.”

Sabrina Yavil, a marketing consultant whose clients include Rodan + Fields and Walker & Co., suggests Amazon, already the retailer of choice for online beauty shoppers, is broadcasting it’s serious about raising its beauty profile by staking claim to the sizzling indie segment. “Indie beauty is still a small percentage of beauty overall, but it’s been growing double digits and has been successful for other retailers like Sephora and Ulta that have a portfolio of indie brands,” she says. “It’s strategic that the brands participating in the Indie Beauty Shop must not be sold at competitive retailers like Ulta and Target as a way for Amazon to differentiate its assortment and experience from its competitors just as Sephora often requires a period of exclusivity with new brands.”

For massive Amazon, the risk of introducing the Indie Beauty Shop is low – it’s been known to experiment with and pull the plug on various initiatives such as QVC-esque shopping show “Style Code Live” and flash sales site MyHabit – but the risk of partaking in it could be high for small beauty brands. Indie brands are particularly worried customers could be dissatisfied with product deliveries from Amazon. Monica Watson, founder of Berlin Skin, a possible Indie Beauty Shop entrant, reveals Amazon requires Indie Beauty Shop brands rely on Fulfillment By Amazon, a service shipping merchandise out of Amazon’s warehouses, to be accessible to the over 100 million members of its Prime program. Amazon declined to comment on the Indie Beauty Shop for this article.

“Although they do a fine job of getting products to your house safely, we really take pride in how we package our products. [Fulfillment By Amazon] is pulling us away from that experience,” says Watson. “That was one of my biggest hesitancies. We use branded tape around boxes and put inserts into them, and customers take photos of them. It’s those touches that go a long way for people.”

Dana Jackson, founder of Beneath Your Mask, has stayed off of Amazon in part due to concern that poor product deliveries could sour the skincare brand’s nascent reputation. “As someone who shops on Amazon quite a bit, when I have a bad experience with a product, it’s often because of how it arrived to me,” she says. “I have no control over the customer experience. I feel like my brand needs to be a little bigger for a first-time customer to be able to look past that.”

“It’s strategic that the brands participating in the Indie Beauty Shop must not be sold at competitive retailers like Ulta and Target as a way for Amazon to differentiate its assortment and experience from its competitors just as Sephora often requires a period of exclusivity with new brands.”

Jackson is also apprehensive about the investment needed to gain traction on Amazon. Justin Boettcher, senior strategic business development leader at Amazon, who unveiled the Indie Beauty Shop at the BeautyX Retail Summit last month in Dallas, recommends brands that have recently arrived on Amazon Marketplace commit 30% of their sales from the e-commerce site to advertising at the beginning and reduce that percentage to 15% later on as their concepts prove to be winners on the platform. He doesn’t recommend brands dedicate an internal employee or consultant solely to Amazon until they hit roughly $1 million in sales via Amazon.

Dan Sudman, co-founder and CEO of Carbon Beauty, a firm managing the Amazon enterprises of brands the likes of Moon Juice, The Beauty Chef, Soapwalla and W3ll People, argues Boettcher is understating the manpower essential to build lucrative Amazon operations. He estimates one to two employees with Amazon expertise are mandatory for an indie brand to yield significant sales at the e-tailer. “We have seen many brands attempt to sell their brand directly on Amazon, only to find their products buried below thousands of other items in their respective categories with sales being pretty much non-existent,” says Sudman. “While Amazon does hold tremendous potential for indie brands, these brands are almost never properly equipped to succeed on the platform.”

Sudman points out the Indie Beauty Shop may attract indie beauty brands to Amazon that have traditionally targeted brick-and-mortar environments, but brands beyond the beauty conglomerate universe are far from alien to the e-commerce company. Amazon is flush with brands designed to excel on it that have generated millions (i.e., InstaNatural and ArtNaturals) by tinkering with their offerings to cater to Amazon shoppers, amassing excellent customer reviews and commanding Amazon keywords. Indie beauty brands without their Amazon proficiencies may discover their Amazon ventures underwhelming.

“Some indie beauty brands we are familiar with will experiment as sellers in the category. However, the majority of brands in the category will be brands which already exist on Amazon and were specifically created for the Amazon platform with little to no distribution outside of Amazon,” says Sudman. “If thousands of these types of ‘non-indie’ brands flock to the category, as I think will likely be the case, it will provide true Indie brands with further evidence that this category is no different than any other on Amazon.”

“We have seen many brands attempt to sell their brand directly on Amazon, only to find their products buried below thousands of other items in their respective categories with sales being pretty much non-existent. While Amazon does hold tremendous potential for indie brands, these brands are almost never properly equipped to succeed on the platform.”

For many indie beauty brands, even those selling on Amazon, there remains a disconnect between convenience- and price-driven Amazon, and their model distribution partners cultivating curated, high-end assortments. Watson aims to protect the 20 indie stores Berlin Skin is stocked in as she considers placing her brand on the Indie Beauty Shop. She won’t showcase all of Berlin Skin’s products on Amazon – it will likely receive three or four products rather than the brand’s complete repertoire of five or six – and plans to bump up prices on Amazon to encourage customers to purchase at stores or on the brand’s site.

“We have found so much success with our smaller stores. I have a retailer in San Diego called Shop Good, and our products kill it with them, and I love that. Our products resonate with their audience, and that’s my ideal store,” says Watson. “But it’s hard to ignore Amazon, and I’m not anti-Amazon. I’m actually a fan, but it’s really important to us that the people that partner with us understand small business and indie beauty brands. It [Indie Beauty Shop] intrigued me because Amazon is paying attention. It is really cool what they are doing as far as featuring indie brands and giving them exposure.”