Beauty Retail Brief: January 2022

The themes roiling retail for the past several months—consolidation, department store struggles and ongoing pandemic disruptions, for example—shaped the industry significantly at the outset of this year. Whether they’ll remain as prominent or new themes will erupt as the year moves on will be a signal of retailers’ nimbleness or lack thereof in a evolving commerce landscape. To help you stay abreast of what’s happening in the fast-moving market, Adit, a service connecting retailers with indie brands owned by Beauty Independent parent company Indie Beauty Media Group, summarized recent retail news.

- Retailers Grapple With Labor Shortages

- DTC Brands Learn to Love Wholesale

- Farfetch Enters Beauty

- Kohl’s Under Investor Pressure To Sell

- Sephora Embraces Sexual Wellness

- Walgreens May Sell Off Its UK Boots Business

- Subscription Boxes Remain Relevant Post-Pandemic

- Additional News

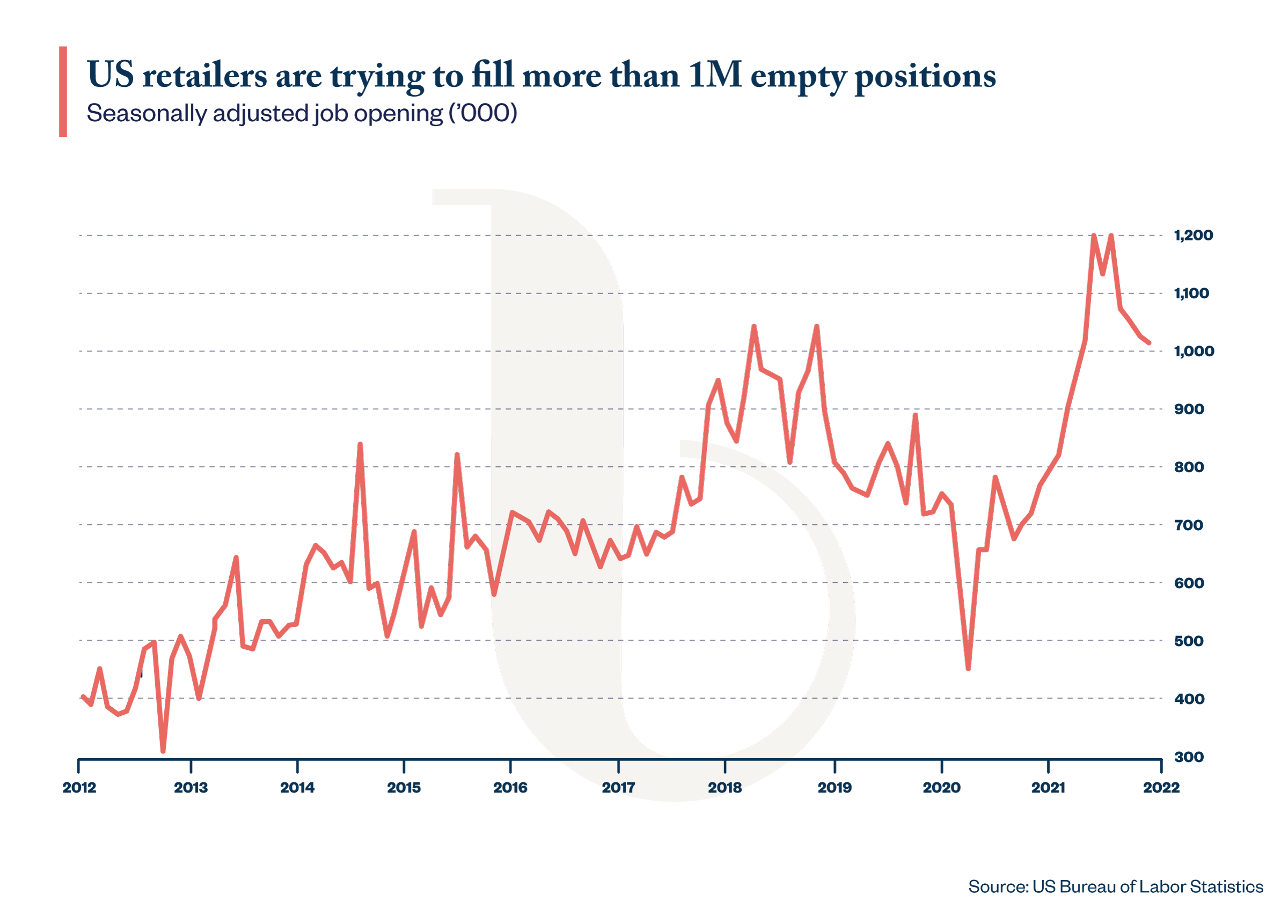

Retailers Grapple With Labor Shortages

Ongoing labor shortage issues have hit the retail sector particularly hard. Go to your local CVS, Walgreens or Bloomingdale’s, and you’ll notice remarkably fewer employees on the floor. At the start of the pandemic, government shutdowns led to prolonged furloughs and layoffs that sidelined an industry’s worth of employees, who were either forced to find work elsewhere or exit the industry entirely. But retailers are still understaffed, so much so that the general counsel of the National Retail Federation (NRF) decried the shortage as “really high“ in early January.

The recent surge in Omicron cases over the holiday season only exacerbated the already challenging situation, leading to reduced store hours and temporary closures at chains like Walmart and Macy’s. Workers either called out sick or quit due to the fear of infection or the threat of vaccination mandates.

When the Supreme Court blocked the Biden administration’s vaccine-or-test requirement for large private companies in early January, opinion in the industry was divided. The NRF deemed the ruling a “victory,” arguing that such a mandate would inhibit employee retention and hiring. Meanwhile, unions like the Retail, Wholesale and Department Store Union praised the federal measure’s protectiveness. The debate over the policy underscores the retail industry’s impasse between business and labor.

In the absence of government mandates, retailers are making up their own rules when it comes to vaccine requirements. Macy’s started documenting the vaccination status of its U.S. employees in early January. A mandate will surely be forthcoming. Walgreens, Walmart, CVSand Saks have instituted mandates for workers.

DTC Brands Learn To Love Wholesale

A few years ago, a combination of low digital customer acquisition costs compared to traditional wholesale costs and the ability to gather valuable insight into customer preferences and buying behaviors—information that can be arduous to obtain from retail partners—helped some direct-to-consumer brands soar. However, as competition heated up and customer acquisition costs skyrocketed, digitally-native brands began to realize the importance of retail partnerships to scale their businesses.

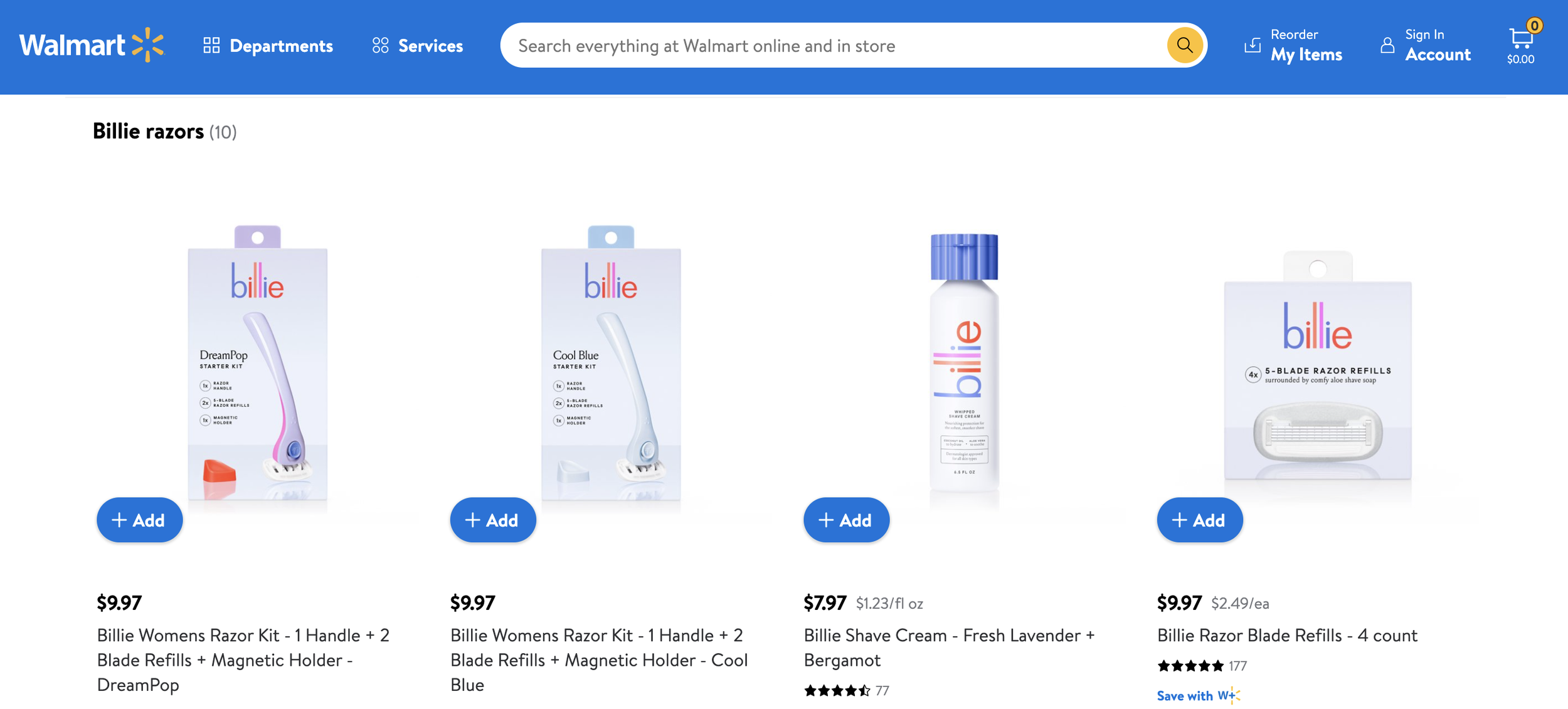

One such brand is Billie, the DTC subscription-based women’s shaving brand that was acquired in late 2021 for $310 million by Edgewell after an earlier failed attempt by Procter & Gamble. It debuted on Walmart’s website in mid-January, and a 4,000-door store launch is scheduled this month. Walmart is Billie’s first retail partnership to date. The news comes as Walmart continues to diversify its beauty assortment with indie and emerging brands to compete not only with other mass-market retailers like Target, but also with the likes of beauty specialty retailers like Sephora and Ulta Beauty.

Meanwhile, the nearly 8-year-old former DTC darling Glossier may need to rethink its distribution strategy. The brand set the beauty industry abuzz last week with the news of a second round of mass layoffs. Around a third of its corporate positions, primarily in technology, were eliminated as the company refocuses on its core beauty business. At the beginning of the pandemic, Glossier laid off nearly 200 retail employees were laid off after the brand closed its standalone brick-and-mortar locations. It’s since returned to brick-and-mortar retail with Glossier outposts.

The brand historically prided itself on a DTC-centric, zero-wholesale partnership, zero-distributor route to success. After all, it’s snagged $266 million in funding to date and hit a valuation of $1.8 billion in July 2021. Today, experts predict the once-beloved brand may need to reverse its playbook and secure retail partners to draw customers and spur growth.

Farfetch Enters Beauty

The beauty retail space continues its course toward consolidation. Farfetch is acquiring luxury beauty e-tailer Violet Grey. The purchase comes on the heels of a slew of major retail acquisitions last year, including Sephora’s acquisition of Feelunique in the United Kingdom, and The Hut Group’s acquisition of Dermstore in the United States and Cult Beauty in the U.K.

The latest acquisition marks the first phase in the luxury fashion e-tailer’s plan to launch a beauty vertical later this year. Through the acquisition, Farfetch hopes to get access to Violet Grey’s coveted assortment of brands, notably well-recognized names like La Mer and Tom Ford as well as coveted indie brands such as Vintner’s Daughter and Westman Atelier.

Violet Grey founder Cassandra Grey, who will join Farfetch as an advisor, will spearhead Farfetch’s new beauty brand incubator, NGG Beauty, helping to create in-house beauty brands to sell on its marketplace. With an expansive reach—over 1,400 brand and retail partners from over 50 countries—and a consumer base of some 3.6 million dedicated millennial and gen Z shoppers, Farfetch’s value to potential beauty partners is evident.

To gild the lily, Farfetch operates as a digital marketplace and distributor extraordinaire, making revenue off sales commissions and fulfillment services. Unlike many retailers, its brand partners own the inventory available on the site, thereby giving them greater control over pricing, merchandising and experience. It’ll be very interesting to see which brands Farfetch onboards going forward.

Kohl’s Under Investor Pressure to Sell

The department store channel was on the decline before the pandemic dealt a blow so severe that it left many chains with no option but to seek bankruptcy protection. Lord & Taylor, Neiman Marcus and J.C. Penney went into bankruptcy, shuttered iconic flagship stores and laid off huge numbers of employees. The department stores that have managed to survive are working hard to stay competitive by doubling down on their omnichannel strategies, investing in e-commerce and diversifying their in-store product assortments. Neiman Marcus has managed to reemerge and reinvent itself.

With threats looming from Walmart, Amazon and others, department stores are looking hard at how they can extract value and profits from their existing business structures. Or, in many cases, investors are prodding them to look. After Saks Fifth Ave separated its e-commerce business in March 2021 with an impending IPO that could garner Saks.com triple its initial valuation, Nordstrom is now reportedly considering a spin-off of its once-profitable off-price Rack business, while Macy’s is said to be studying a potential spin-off of its e-commerce unit in response to activist investor urging.

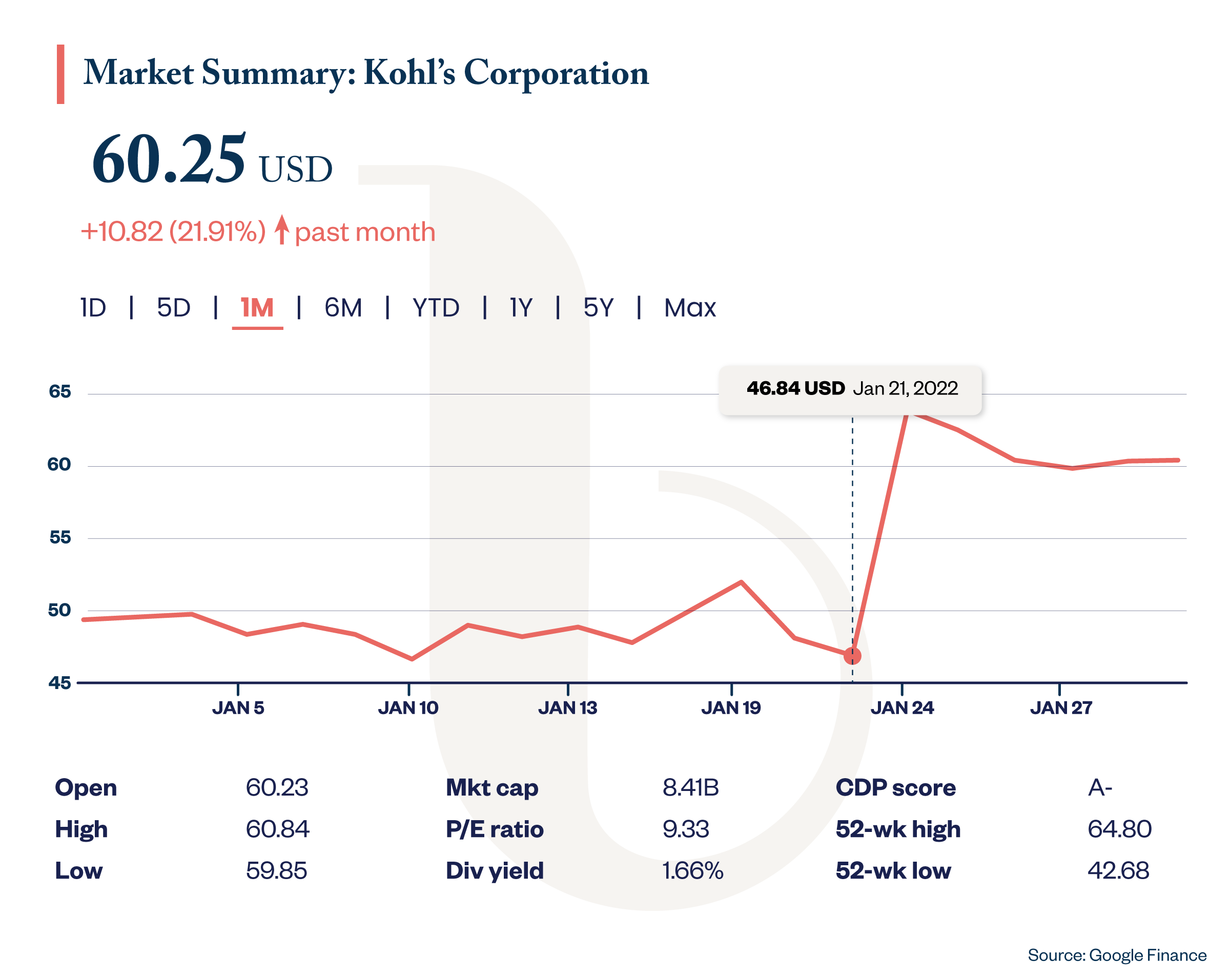

Kohl’s is a similar case. Activist investor group Macellum Advisors GP LLC, which owns a 5% stake in the chain, urged the department store chain to either consider changing up its board or seek a sale. Several buyers answered the call in January, and a $9 billion bid from a group backed by activist hedge fund Starboard Value LP led the charge. Kohl’s stock, which previously traded lower than it had in two decades, jumped a staggering 36% in response to the bid.

While Kohl’s considers the proposals, many analysts doubt the chain can secure enough capital to make any deal go through. It just goes to show that no matter how promising the outlook may be—at Kohl’s, there’s the recent sales uptick, healthy operating margins and shrewd partnerships with Sephora and Amazon—investor wariness seems boundless when it comes to department stores.

Sephora Embraces Sexual Wellness

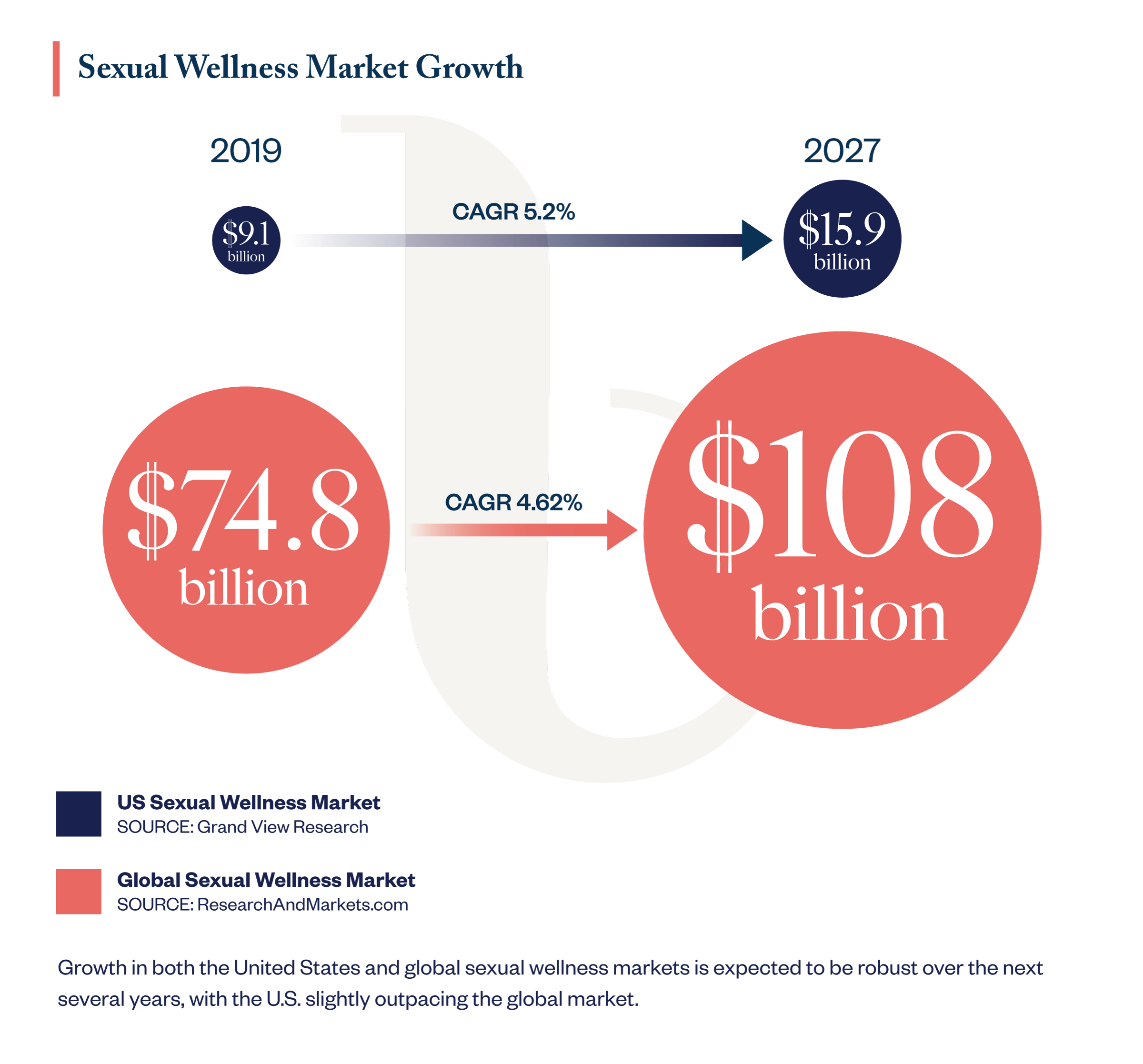

It appears sexual wellness has finally gone mainstream. Following retailers like Goop, Shen Beauty, Revolve, The Detox Market, Bluemercury, and heritage department stores like Saks and Bloomingdale’s, Sephora’s curated selection of sexual wellness products went live on Feb. 1. The selection includes lubricants, oils and devices from brands like Maude, Dame, Moon Juice and Flora + Bast.

The move comes as retailers and department stores make deeper investments in their wellness assortments, and sexual wellness is fast becoming a viable and lucrative part of that. Significant investments have helped to destigmatize the category with buyers and retailers over the past two to three years, with the U.S. projected to take a leadership position in sexual wellness market growth over the next several years. Brands like Foria, Dame, Love Wellness and Momotaro Apotheca have seen their sales soar since 2019, in some cases as high as 360% year-over-year, according to Beauty Independent reporting.

Walgreens May Sell Off Its UK Boots Business

Walgreens Boots Alliance (WBA) may soon be no more. Walgreens is looking to either sell or spin-off the U.K.-based pharmacy chain Boots as it shifts focus to its U.S. operations. Boots is currently the largest high-street pharmacy chain in the U.K., operating over 2,000 brick-and-mortar locations. In 2021, it accounted for nearly 16% of Walgreens revenue.

Several private equity firms are said to be considering bids, including Sycamore Partners, Bain Capital and CVC Capital. Boots could be valued as high as $9.6 billion in a possible sale. The possible sale is in the works as CEO Roz Brewer is attempting to transform Walgreens into a premium healthcare destination in the U.S. Through strategic investments in primary care and home care companies like VillageMD and CareCentrix, the drugstore conglomerate plans to open 1,000 doctor-staffed primary care clinics under its new Walgreens Health business by the end of 2027.

As Walgreens possibly separates from Boots and makes an aggressive push into the healthcare sector, it’ll be interesting to see how its beauty business will fare. Launched early in the second quarter of 2021 with bold plans to innovate and grow across WBA’s retail network, No7 Beauty Company is its newest business unit. The unit encompasses its owned beauty brands, including No7, Liz Earle, Soap & Glory, Botanics, YourGoodSkin and Sleek MakeUP. Could a possible Walgreens/Boots divorce throw a wrench into the beauty mix? We’ll be watching.

Subscription Boxes Remain Relevant Post-Pandemic

Subscription boxes surged at the beginning of the pandemic when brick-and-mortar stores were temporarily shuttered. Although the segment has since dealt with some controversy as well as some turbulence (Birchbox sold last year for less than half of the capital it’s raised), subscription boxes continue to serve as a valuable channel for discovery and play, especially for smaller indie brands. Here are two noteworthy new entrants.

Oilee Skincare is a subscription box that launched in December centered on people with oily and acneic skin. Its product curation focuses on indie and POC-owned skincare brands.

Curls + Controllers is a beauty and gaming mashup box that got revitalized in late 2021 after the business spun-off into gaming apparel. Now, the box offers an assortment of haircare and gaming accessories targeted to Black women and girls.

Additional News

Adit Spotlight: Beauty Heroes’ Jeannie Jarnot On Why “There Should Be Fewer Brands” [Beauty Independent]

Checking In With Credo Co-Founder and COO Annie Jackson [Beauty Independent]

The Beauty Brands, Products And Trends Thriving at Thrive Market [Beauty Independent]

Acupuncture Concept Ora Opens Second New York City Location, Expands E-Commerce [Beauty Independent]

VC-Backed Upgrade Reimagines The Hair Color Experience For Women of Color [Beauty Independent]

At Brightly, The Product Drop Model Is Getting More Ethical and Environmental [Beauty Independent]

Leave a Reply

You must be logged in to post a comment.