In The Absence Of Sephora In The U.K., Boots Is Experimenting With An Open-Sell Beauty Concept

Last month, Sebastian James, CEO of Boots, informed the audience at a Retail Week conference that the Queen of England’s favorite lipstick is the Boots No 7 shade Gay Geranium.

Despite the Queen’s endorsement, the nearly 170-year-old chemist founded in Nottingham isn’t in good shape. On Tuesday, its owner, Deerfield, Ill.-based Walgreens Boots Alliance, reported earnings for what CEO Stefano Pessina described as the “most difficult quarter” since Walgreens acquired Boots in 2015. For the quarter ended Feb. 28, Boots’ same-store retail sales dipped 2.3%. Poor-performing units are due to be culled from its network of 2,485 stores.

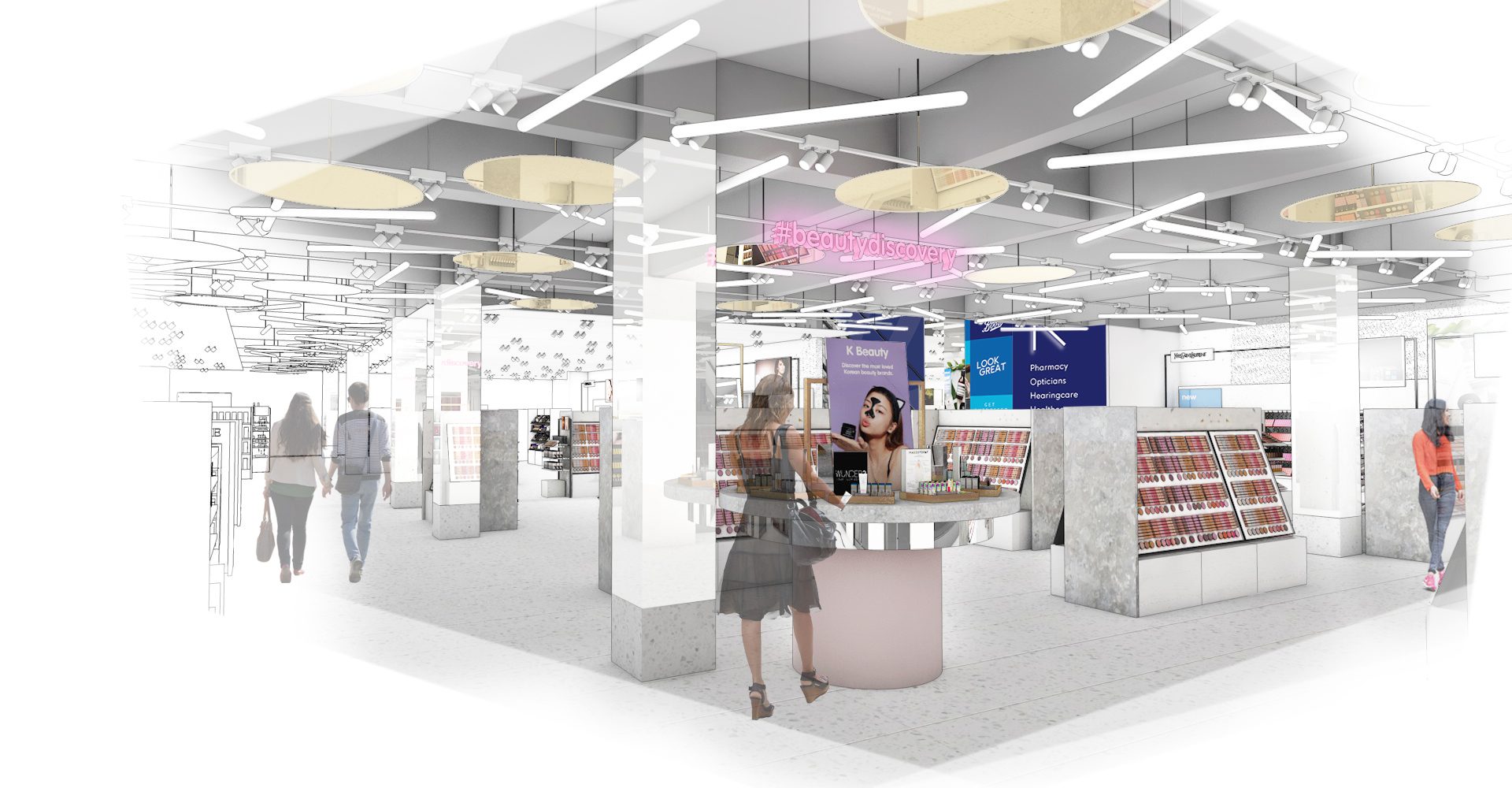

Boots’ business has been hit by the weak pound, tanking consumer confidence, Brexit-related uncertainty and a wobbly retail environment that has high street reeling. To regain its footing, Boots has to fight back—and it’s looking to the beauty category to help reverse its fortunes. Starting this month, Boots is completely transforming beauty departments in 24 locations to create open beauty halls that will more closely resemble beauty specialty retailers than typical pharmacy beauty setups.

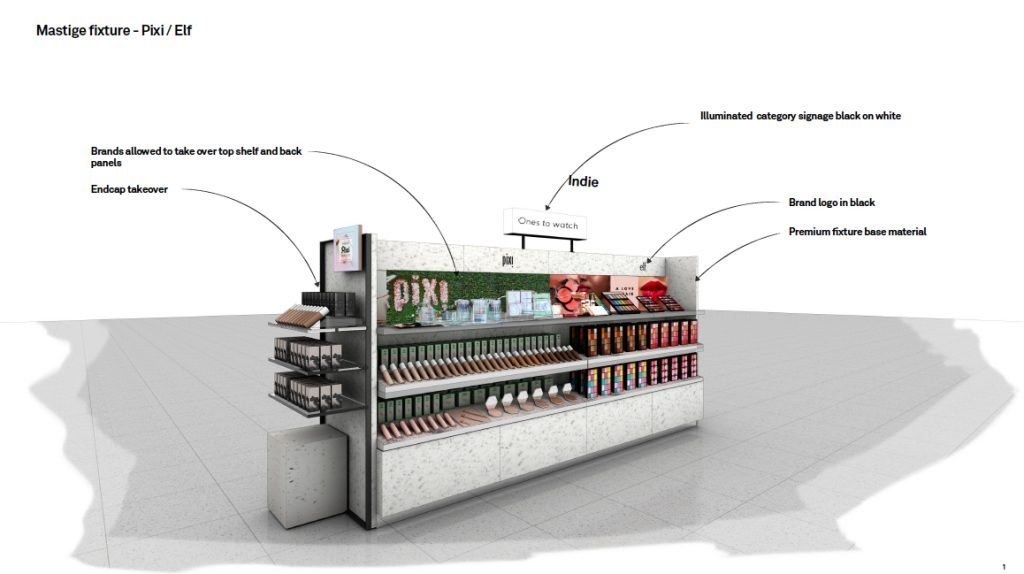

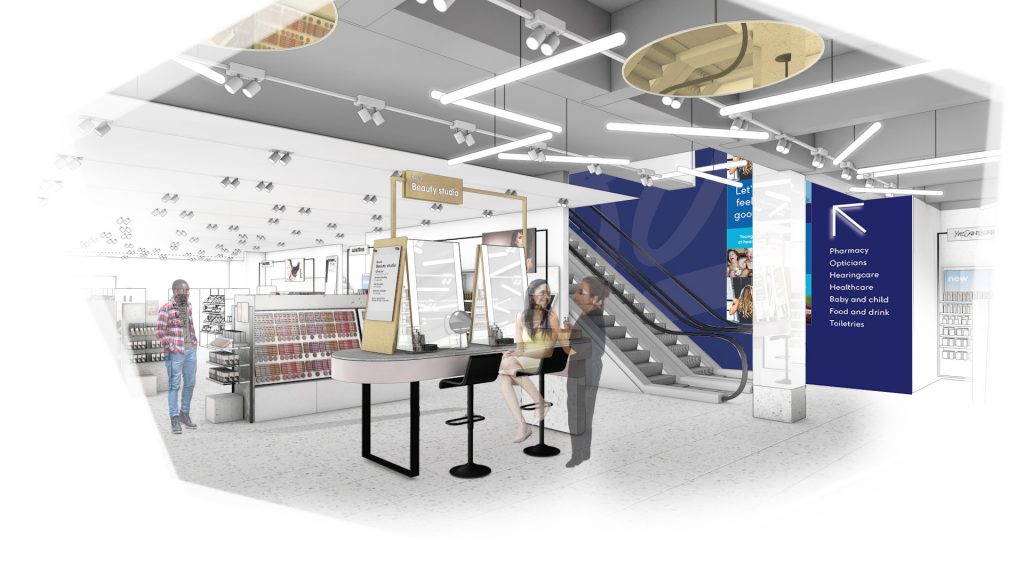

The traditional beauty counter will be out in the refashioned beauty halls. In its place, Boots will put trend-driven zones, play stations, discovery areas and live demonstrations to encourage customers to interact with products. Beauty specialists, staff members that haven’t existed at Boots before, trained on all the brands in the assortment will be on hand to dole out neutral advice across them and conduct master classes. Customers will be able to test merchandise without fending off the hard sell as they do.

“If we’re going to make Boots the place you choose for beauty, we will need to make radical change,” said James at the Retail Week conference. “We have been behind the curve, no question.”

Addressing the beauty hall renovation, Joanna Rogers, commercial director and vice president of beauty at Boots, adds, “Boots’ position in beauty is unique–precisely because we’re about beauty, wellness and health. Beauty is changing, and so are we. Customers want more. They want to play, try on products, discover trends and edits, and see live demonstrations from their favorite brands. That’s why we’re reinventing beauty at Boots with a dramatically different store experience.”

“If we’re going to make Boots the place you choose for beauty, we will need to make radical change. We have been behind the curve, no question.”

Samantha Dover, senior retail analyst at Mintel, calls Boots’ beauty hall reimagining “a well-considered move.” She notes it comes on the heels of supermarket company Sainsbury making over its beauty selection. Dover says, “At a mass-market level, the supermarkets are key in terms of competition, and Sainsbury’s plans to create a more premium in-store beauty experience is likely a driving force behind the Boots’ decision to overhaul its own store environment, giving its customers more reasons to shop with a specialist as opposed to fulfilling their needs whilst grocery shopping.”

Boots estimates that 800 million customers will visit the 24 stores with the updated beauty environments during the next year. To make the concept a success, the retailer has loyal customers on its side. Mintel’s research reveals Boots benefits from near-universal brand awareness and patronage in the U.K., and almost 60% of customers that have gone to the retailer in the last year state they go frequently.

The same research finds that two out of three U.K. consumers have shopped at Boots in the last year, and roughly the same number say it’s a retailer they trust. However, just 6% think Boots is a cutting-edge retailer. It’s like a cozy pair of slippers rather than a sexy pair of Jimmy Choo shoes.

Boots’ loyalty program is integral to its operations. Some 14.4 million U.K. customers are Boots Advantage card holders. Brands can discount by offering extra loyalty points for purchases. IT Cosmetics, for example, sells Your Skin But Better CC Cream for 31 pounds, but throws in 800 Boots Advantage points with a purchase of the product to make it come out to 8 pounds. And Boots is pioneering a three for the price of two initiative that can be a sampling opportunity for beauty brands.

“Beauty is changing, and so are we. Customers want more. They want to play, try on products, discover trends and edits, and see live demonstrations from their favorite brands. That’s why we’re reinventing beauty at Boots with a dramatically different store experience.”

At the revamped beauty halls, newness is an important strategy to woo customers. Boots is introducing more 20 new beauty brands selling 805-plus stockkeeping units over the next two months. Among the new brands are Too Faced, Skyn Iceland, Balance Me, Nude by Nature, Frank, Skinny Tan, Nip & Fab, Soaper Duper, Frank, Tan Luxe, BYBI, Bondi Sands and Too Cool for School.

Boots is also betting big on exclusives. Garnier is introducing Micellar Milking Cleansing Water at the retailer, and E.l.f., hungry for a win after closing 22 stores and experiencing sales declines, is branching from makeup to skincare with two exclusive products, including Hydrating Day Cream. One of Korea’s bestselling skincare lines, J.One, is headed to Boots, too.

Will Boots’ beauty reboot work? The skincare brand Ole Henriksen, which is in the portfolio of LVMH Moët Hennessy Louis Vuitton-owned Kendo, presents a compelling case study. Ole Henriksen staged a complete relaunch in the U.K. and Ireland on Feb. 1, and is now exclusively in around 35 Boots stores with more doors expected later this year.

Success has been quick for Ole Henriksen. Ole Henriksen, founder of the eponymous brand, says, “Glow2OH Dark Spot Toner is one of our more recent global launches that became a cult favorite from the beginning. In fact, it sold out online at Boots just four days after it launched in February.”

Mintel’s Dover is optimistic about the prospects of Boots’ open-sell beauty halls. She says they “will offer a beauty shopping experience that aligns more closely with Sephora—something that the UK market is lacking at present.”

Leave a Reply

You must be logged in to post a comment.