Interest In Cannabis Beauty Is High, But Understanding Is Low, According To A New Report

Consumers are exceedingly interested in cannabis beauty, but don’t understand it, according to a new report.

Based on a year-over-year analysis of Google data, the report issued by machine intelligence platform Spate and Landing International, which connects emerging beauty brands to retailers, reveals cannabis beauty searches have skyrocketed 89.1% to 1.5 million monthly. The volume is so great that cannabis has become the fastest-growing ingredient in online beauty ingredient searches.

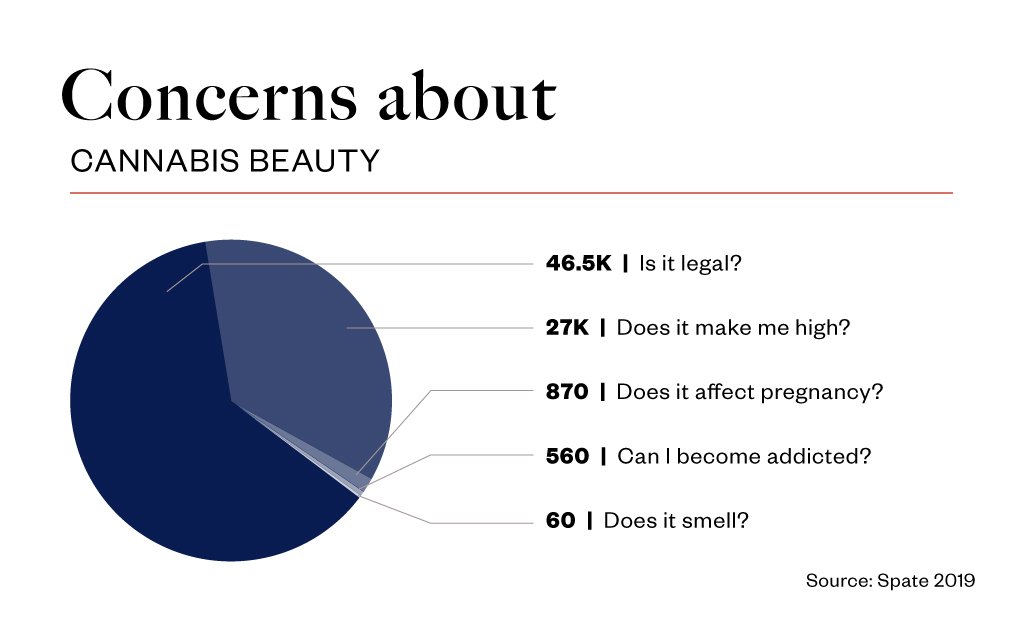

Comprehension hasn’t matched consumer fascination. The study discovered consumers remain puzzled about cannabis beauty ingredients such as cannabidiol or CBD, the non-psychoactive constituent of the cannabis plant, and hemp seed oil without CBD. The leading question consumers pose about cannabis beauty via Google is simply, “What is it?” Generating 88,400 monthly searches, the basic question is followed by questions involving the effects of cannabis beauty products and how to use them. Consumer apprehension is centered on the legality of cannabis beauty and whether it makes people high.

“The cannabis beauty market is so bullish that people are literally saying it’s going to be in everything and does everything. We wanted to put that bullishness to the test and ask: What do average people think about it? Is it just a lot of industry buzz?” explains Sarah Chung, founder of Landing International. “What we took away from the report is that awareness as a whole is still very new and nascent.”

The nascence of the cannabis beauty segment is underscored by the products consumers are exploring. With 682,000 searches, data shows oil is the top cannabis beauty product format sought on Google. Capsule, cream, wax and spray formats trail oil in order of search quantity. Bath bombs, balm and lotion are relatively low in terms of product format search attention. However, hydration appears to be a mounting benefit consumers a hunting for. Searches for creams, lotions and balms have spiked 281.6%, 246.3% and 215.1% over the last year.

While consumers in the cannabis beauty segment are currently focused on first-to-market product formats that have proliferated, Spate and Landing International argue that demand will grow for increasingly sophisticated product formats. Their report reads, “The next wave of product development will surely integrate cannabis into other formats and target specific skin concerns like inflammation, acne and aging. Further, the next evolution of cannabis beauty products will need to consider new and non-traditional formats that fit well with consumers’ lifestyles.”

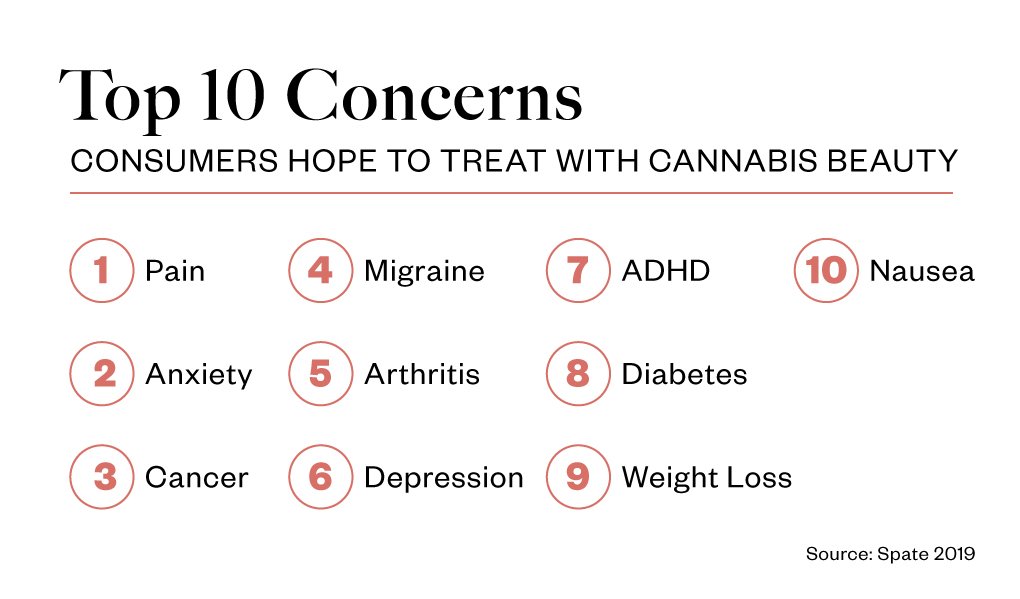

Per the report, the reasons people turn to CBD are pain, anxiety, cancer, migraines, arthritis and depression, respectively. Customary beauty rationale isn’t dominant. When consumers pick up cannabis beauty products, Landing International learned in an assessment of thousands of reviews that they appreciate the products’ abilities to calm redness, absorb easily, generate glowing skin, moisturize, clear acne, combat hyperpigmentation, smooth skin and even tone.

In a segment with little consumer knowledge, fragmentation isn’t helping matters. Landing International and Spate document cannabis beauty assortments without much overlap at a diverse group of 15 retailers, including Anthropologie, Free People, Barneys New York, Credo and CVS. Lord Jones may be the most recognizable cannabis beauty brand, but Chung says, “I don’t feel like any other brand is killing it. There isn’t enough searches around even one brand that shows that people are actively purchasing it on a scale that would make a difference.”

“What we took away from the report is that awareness as a whole is still very new and nascent.”

There does appear, though, to be rising consumer willingness to purchase cannabis beauty merchandise. Yarden Horwitz, co-founder of Spate, details, “As searches started off with consumers asking, ‘What is CBD?,” we see them now asking where to buy ‘near’ or ‘on sale’ or even looking for ‘coupons.’ This demonstrates strong intent to purchase.” At the moment, no retailer has emerged as a go-to cannabis beauty destination. Chung says, “People who search to buy CBD products don’t do it specific to a retailer. If anything, it’s mostly Amazon.”

In the cannabis beauty report, Landing International and Spate make a number recommendations driven by their findings. They suggest brands and retailers should ramp up education should be ramped up on the benefits of CBD beauty products. They also advise brands to concentrate on their points of differentiation to distinguish themselves in the crowded cannabis beauty field, speak to consumer values, address concerns about CBD and push the envelope in product development.

“The onus is on the brand to educate the sales staff and the consumer. The retailer deals with so many brands, it’s hard for them to go deeper than a surface level,” says Chung. Segueing to products, she adds, “Consumers are delighted by new things. There’s a lot of room for innovation. There are formats like mists and masks that can de-puff and target fine lines. The Good Patch is an example of a brand that’s brought something more interested to the market.”

In its infancy, Chung indicates the cannabis beauty segment is fragile. She believes it could be undermined by scurrilous marketing claims. There’s rampant weedwashing in the segment with several brands seemingly linking their products to CBD despite the fact there’s zero CBD in them. The regulatory environment is a difficult conundrum, too. State CBD rules vary considerably, and the U.S. Food and Drug Administration hasn’t firmed up its position on ingestible CBD products.

In the absence of clarity, Chung says, “The risk is that there will be consumer fatigue, and they will be overwhelmed. We were overwhelmed just trying to research it.” She continues, “There’s a lot of positive things that people associate with cannabis beauty, but we don’t feel that brands are really leveraging those things. One potential backlash we feel is it will get disassociated from the positive trends that it is sitting in the middle of, and it will become something separate.”

The report draws a comparison between cannabis beauty and natural beauty. “The natural beauty category was similar to the cannabis beauty trend in that it struck a chord with consumer values and generated a high level of interest from beauty editors and buyers. Yet, similar to cannabis beauty, there was a lack of regulation around the category and poor understanding of what ‘natural’ truly meant,” it reads. “Cannabis beauty may face similar consumer doubt about the efficacy of the category-driving ingredient.”

Leave a Reply

You must be logged in to post a comment.