Carbon Beauty Is Natural Beauty Brands’ Chief Protector And Growth Engine On Amazon

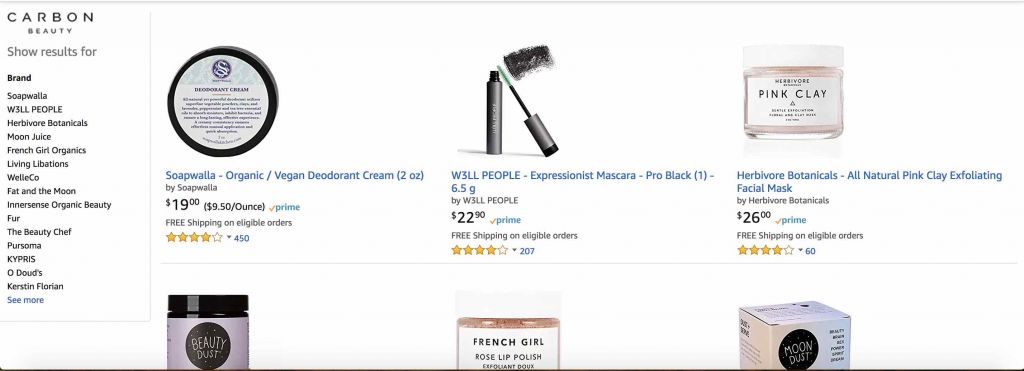

Carbon Beauty is evidence that luxury beauty can work in Amazon’s price-driven environment. The company has become one of biggest purveyors of natural beauty on Amazon because of its stellar upscale selection (Herbivore Botanicals, Moon Juice, Fat And The Moon, WelleCo, The Beauty Chef and Living Libations are among the brands it stocks), knowledge about what makes the Amazon shopper tick, protection of brand equity in a brand-killing e-commerce setting, and dedication to bettering practices to power sales. “It’s literally a whole other world, which is why brands that try to sell on Amazon realize they are way out of their depth,” says Dan Sudman, CEO and co-founder of Carbon Beauty, operator of a sleek e-tail site in addition to an Amazon storefront. “Amazon devotes very little resources to being user-friendly for an average brand, and they have incorporated new costs into the structure for doing business, so there’s a larger barrier to entry now than there had been for new brands.” As Amazon becomes the backdrop against which all retail developments take place, Carbon Beauty has helped brands balance an Amazon presence with healthy sales elsewhere and do so with class. Beauty Independent chatted with Sudman about Carbon Beauty’s take on Amazon, natural beauty trends, sales tax, the online luxury conundrum and the difficult prospects for indie brands eyeing Amazon.

What has your career path been like?

I initially planned a career in medicine. I was one of those hard-core pre-med students. Later in college, I became disillusioned with the field of medicine, the bureaucracy and ethical issues involved. I shifted gears toward an entrepreneurial focus. I like the idea of getting out what you put in. I’m really interested in health and borderline obsessed with my own health, so I was interested in natural wellness products when I first started. As a consumer, I was always looking to purchase natural supplements online. It became very apparent to me just how dated most of the sites out there were. They looked like they could have existed 10 to 12 years ago. There was a lack of curation, and the sites didn’t take advantage of cutting-edge design and functionality. That led me to create something of my own that would offer a more modern experience that was cleaner and less visually intrusive. You weren’t being bombarded with pop-up and sales ads left and right or getting 12 emails a day in your inbox. It would be much more thought-out and tailored to provide a seamless customer experience for natural beauty and wellness products.

What’s the core mission of Carbon Beauty?

We address the issues that faced natural beauty and wellness retail online. The issues were that websites were generally very poorly done, difficult to navigate and featured every product under the sun, making product selection impossible. When you are trying to navigate between 300 different facial moisturizers, you have absolutely no idea which one is the best for you, and the experience can be paralyzing. The mission was to bring the best natural beauty and wellness products online in a curated selection with a modern platform that would be easily navigated and was also well-aligned with the higher-end natural brands we represent.

When you first started three-and-a-half years ago, was it hard to get brands on board?

Absolutely. When we started Carbon Beauty, we were simultaneously realizing issues with Amazon and addressing them. A lot of the brands that we were onboarding onto Carbon Beauty had a chaotic presence on Amazon that was damaging to their brand image and integrity. They were being sold by an unauthorized retailer or, even by an authorized retailer, in a distasteful way with products being put up on Amazon in a manner that didn’t do justice to the brands. We had to pitch the brands that we had a new platform, carbonbeauty.com, where we were trying to redefine the customer experience, but we were also flipping the Amazon model on its head to bring more tasteful representation to Amazon. We have emphasized quality from day one: quality of the products, quality of the website design and quality of the representation on Amazon. We felt extraordinary brands deserved better.

Why was it so difficult?

Some brands had an existing presence on Amazon that they were unhappy with whether it was unauthorized or authorized. In that situation, we had to draw out our vision for what it would look like for it to be done correctly. Brands were hesitant because that didn’t really exist at the time. The typical model was to have a bunch of sellers on Amazon and the cheapest price would win. That obviously isn’t compatible with high-end luxury brands, and a lot of brands thought Amazon wasn’t compatible with luxury or more niche goods. We had to convince them that, yes, it is absolutely compatible, and there’s a huge audience out there waiting to discover your brands. They just haven’t been presented in the right way. Our biggest challenge was getting brands to trust our vision for proper representation.

How many brands do you work with today?

A little over 70 brands. As more and more brands trusted our vision and gave us the opportunity to create a thought-out and tasteful presence on Amazon, it became significantly easier for other brands to see what we have done. We are becoming a leader in the natural beauty and wellness space on Amazon. Amazon requires such a different expertise and resources, that many retailers were struggling with it. Even the largest beauty retailers that have some sort of Amazon presence, they still struggle with the same things the smallest Amazon retailers struggle with. If we were going to redefine sales on the platform, we had to bring something unique to the table to disrupt what was being previously done. Otherwise, it was just another beauty retailer hopping on Amazon and not solving issues for higher-end brands.

What is the difference you bring to the table to help brands with Amazon?

It comes down to expertise as well as a business model that has Amazon at its foundation. You essentially need a full-time staff allocated specifically to Amazon. We have over 10 years of experience on the platform. We have expertise in advertising and SEO, and we devote individual attention to crafting each listing. That results in a significant difference in sales volume. We have case studies that show we see five to 10 times [more] sales volume for a product compared to the leading beauty retailer on Amazon.

What is the business relationship you have with brands?

When we set out, we wanted to make our relationship with brands as simple as possible, especially on the Amazon side of things. When a brand works with Amazon directly, it is extremely complicated. We want to make everything as streamlined as possible. We basically function as a normal wholesale account.

What should brands know about selling their products on Amazon?

Some brands may have unrealistic expectations about what’s possible on Amazon. It’s similar to their expectations of online sales in general when they are starting out. Growth takes time and tinkering. If things are fully optimized and conveyed in the best manner possible, you can achieve success on Amazon.

Do you find beauty shoppers purchase differently on Amazon than on other platforms?

People experiment more on Amazon with their purchases. They are willing to experiment with products because people value Amazon reviews tremendously, although they definitely need to be cautious. Having that customer feedback gives people the confidence to try something new that they ordinarily might not try.

Are you bringing on new brands?

At the moment, we are not taking on new brands. It was really core to our mission to not have so many redundancies where there are similar products with different labels. We really try to be as cautious as possible in selecting the brands with the highest quality, but also ones that are going to bring something unique to the Carbon Beauty platform as well as our Amazon store. Right now, our focus is to fill any gaps on our site that we feel are being unaddressed.

Are there areas you haven’t addressed with Carbon Beauty’s assortment?

Natural beauty started with skincare and, now, we are seeing more and more of this wellness boom. We have a good quantity of those brands on our website, and we are seeing more natural haircare and cosmetics brands pop up. Those are areas where I think there is room for growth in general in natural beauty and on our platform.

If a brand is carried by a large beauty retailer, would it still be a fit for Carbon Beauty?

It’s on a case-by-case basis and depends on how they envision their distribution. If they envision mass-market distribution where they are going to be sold in every big-box retailer, it is very unlikely we would carry a brand like that. We want to carry some of the more exclusive brands. There are also issues that can arise from becoming more mass market due to the drops in quality usually associated with mass-market production.

Are you surprised by the consumer demand for ingestible products?

I’m definitely surprised at how fast the category has caught on, but it makes sense that people want trusted alternatives to the previously sketchy supplement companies that were ubiquitous – and still are. Smaller natural brands are being much more transparent and have more well-rounded assortments. They are also creating branding that much more attractive. When you look at the old supplement world, it had very bland packaging. With the natural wellness boom, brands have tapped into a more modern and whimsical packaging that’s appealing to a modern audience.

How has business been for Carbon Beauty?

We have grown extremely fast. We are projecting $7.5 million in sales this year and, most years, we have doubled in size.

What’s fueling the growth?

It’s due to us growing on the Amazon platform and reaching a broader audience through our advertising and SEO methods. People are also following our Amazon storefront like they follow the Carbon Beauty website as a website in itself. When I shop on Amazon, I don’t shop that way, but it makes perfect sense. We are finding people shop our Amazon store like a website because it’s a curated assortment. If you are looking for organic skincare products, it’s significantly easier to look at Carbon Beauty’s assortment of organic skincare products than the thousands and thousands of pages Amazon will pull up for you. We are seeing a surprising amount of loyalty. The natural beauty industry is also growing, and more people are converting and being more conscious of what’s in the products they put in and on their bodies. That’s contributing to the growth of natural beauty companies as a whole.

What’s an issue that you see shaping the future of commerce on Amazon?

States are going after third-party retailers for sales tax. Basically, the requirement going forward is that, if you are a third-party seller on Amazon like we are and you are using Amazon fulfillment, so you have Amazon Prime-eligible products, you have to collect sales tax in every single state where your products are being stored. Because Amazon has such a large distribution network, that could be a majority of the United States. For a small business to collect and file sales tax in every state or a high percentage of the U.S. is beyond the capabilities of a small business. This is something that has only applied to Best Buy or Apple because they have a physical presence in many states. It’s an operational cost that’s going to make it virtually impossible for small businesses to operate on Amazon.

What do you forecast for the presence of indie brands on Amazon going forward?

It’s going to be increasingly difficult with the new sales tax hurdle for indie brands to market themselves on Amazon. That’s a hurdle on top of the expertise that’s required to succeed on Amazon and the rapidly growing competition in the beauty category on the platform. It will ultimately be quite a task for small indie brands to take on. I think that’s why a lot of brands choose to partner with larger third-party retailers representing an assortment of brands.

What beauty and wellness trend do you see surging?

We are going to see an increased focus on probiotic supplements, and the relationship between the gut and our health. You are going to see a larger emphasis on particular strains of probiotics linked to newer scientific studies.

You have concentrated on premium natural beauty brands. What do you detect happening in luxury beauty on Amazon?

Amazon created a Luxury Beauty category to gate brands. Amazon’s overarching policy is that anybody can sell the product for any price. That is an issue for luxury brands. They see 40 people selling their products for half off. So, Amazon created the Luxury Beauty section to go against their previous policy of anybody selling at any price. They said, “We’ll choose who can and cannot sell. You sell your products to us, and we will basically eliminate every other seller from selling them on Amazon.” To all the third-party retailers, they say, “You have to abide by these rules, but we don’t have to.” Brands can be lured into that type of partnership, but they experience problems with it. Payment terms start out at 30 days, and they end up at 120 days. There’s the question of curation. Amazon by nature is not a curated platform. One would assume that, by creating Luxury Beauty, they would have a curated assortment, but that’s not the case. They are collecting as many brands as possible, which kind of defeats the original purpose of the category and what made it attractive. Brands are also roped in with the understanding they would have a close relationship with Amazon, but that ends up not panning out down the road. If you want to make changes to your product pages, you may not hear from people for weeks.

Why do you think Amazon has had so much trouble with luxury brands?

Amazon hasn’t evolved enough to accommodate those brands. At the end of the day, Amazon is still Amazon. They don’t quite grasp luxury goods and how to sell luxury goods. They are doing everything possible to lure those brands, but they still don’t get it, and that’s why those brands haven’t come on board.

What are Carbon Beauty’s goals for the near future?

We are working on an international presence both for the Carbon Beauty website as well as Amazon. We are hoping to expand to the U.K. and, then, from the U.K. to the EU. We are working on rolling out Amazon U.K., that’s the next market for us and one of Amazon’s larger markets. With the buying power in the U.K. and the indie beauty market there, there is significant potential for the brands we work with in the U.K.

Where do you predict Carbon Beauty will be a decade from now?

It’s an extremely difficult question. I hope we are upholding the same principles that we set out to establish. We want to constantly evolve and create a platform that’s modern, unique and unlike any other natural and beauty wellness platform. We are always open to collaboration with companies that share our philosophy. If it ever were a possibility, we would want to make sure our principles weren’t compromised in a partnership. If it were a partnership with a huge corporation, we wouldn’t want to lose what makes us unique.