Can Caring For The Planet Positively Impact Product Sales?

Being sustainable and ringing up sales aren’t at odds, according to Tensie Whelan, founding director at NYU Stern Center for Sustainable Business. During Beauty Independent’s In Conversation Spotlight Series webinar last Friday, she asserted eco-friendly brands are growing faster than their conventional counterparts while charging more for their merchandise—and brought data to back up her assertion.

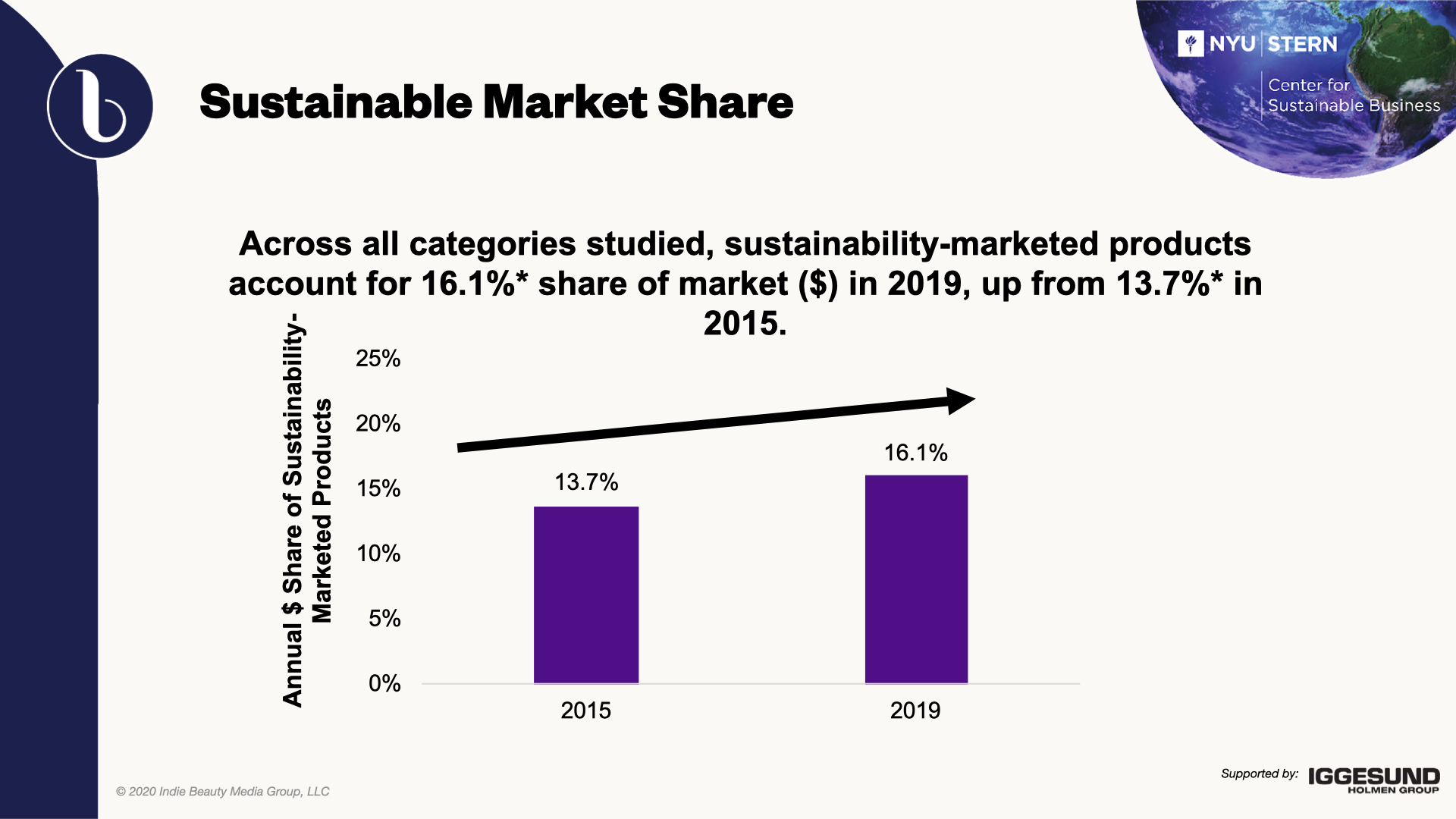

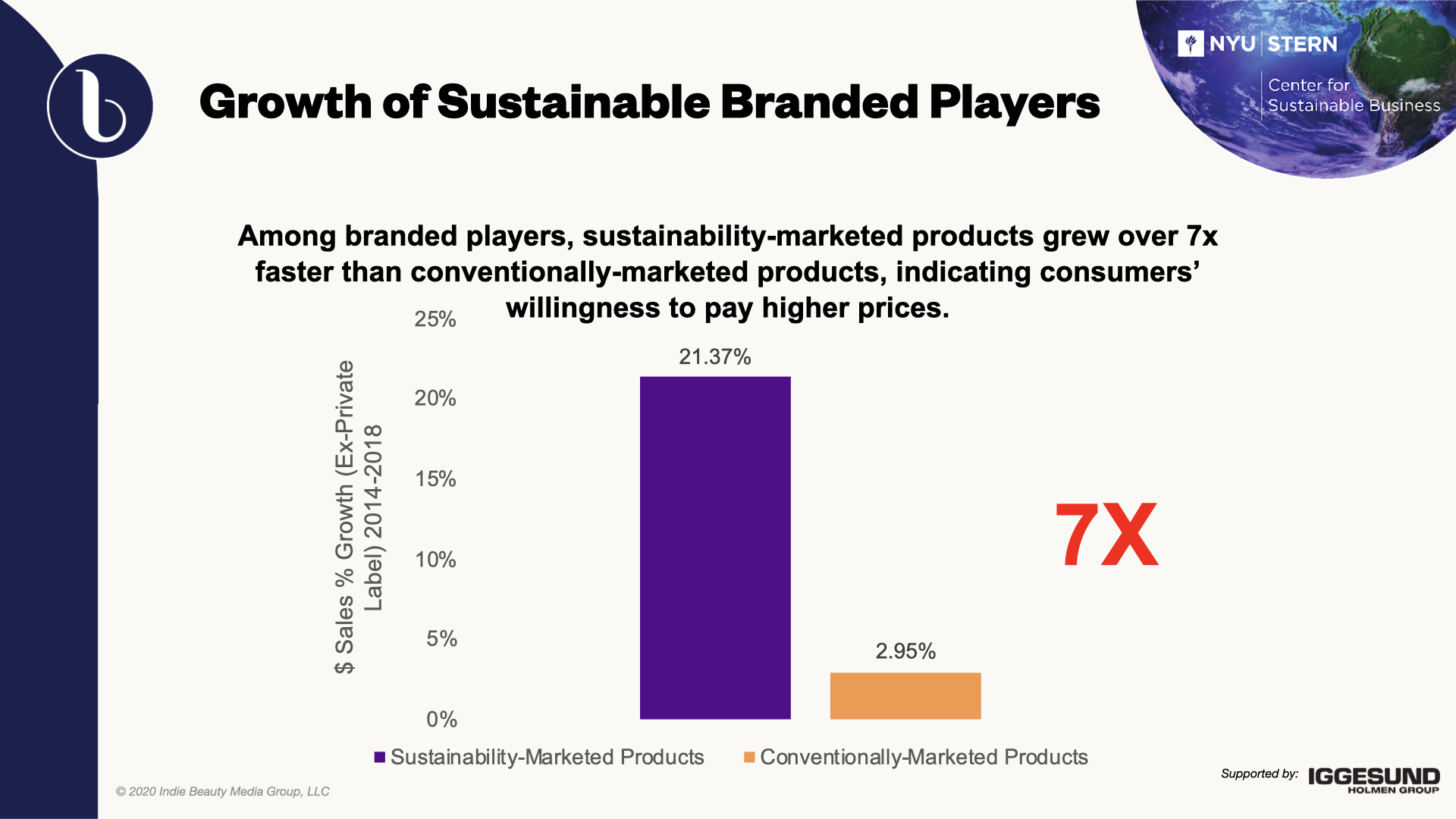

Using market research firm IRI’s information on consumer packaged goods sales across 35 categories and 73,000 stockkeeping units, the Center for Sustainable Business’s 2020 Sustainable Share Market Index report shows that, from 2015 to 2019, brands marketed with sustainable claims registered sales that were 7.1X those without such claims. In the same period, brands making sustainable claims priced their products at a 39.5% premium on average over their standard competitors and were responsible for 54.7% of CPG sector gains.

Whelan concluded the report “debunks the myth that you can’t charge more for [sustainability], that customers don’t want to pay more.” She said, “Today, whether it’s consumers, employees, regulators, investors, everybody is increasingly looking at the corporate sector to determine how they are handling their business decisions in a way that will reduce these negative impacts and also hopefully contribute positive benefits.”

Whelan joined Wenting Gao, engagement manager at McKinsey & Co.’s sustainability practice, Rachel Brown, editor in chief at Beauty Independent, and Nader Naeymi-Rad, co-founder of Beauty Independent owner Indie Beauty Media Group, for the webinar supported by paperboard manufacturer Iggesund. Here are five key takeaways from the discussion.

1. WIDE Interest In Sustainable Goods

High-earning, college-educated, city-dwelling millennials are the sweet spot for sustainable CPG brands. Still, that doesn’t mean other demographic groups aren’t purchasing green goods. Together, baby boomer and gen X consumers drive 65% of sustainable CPG product sales, per the 2020 Sustainable Share Market Index. Whelan pointed out they have an appetite for sustainable shopping reflective of the overall appetite for sustainable products. She said, “If 70% of the category is sustainability produced, then they are buying 70% of it.”

The stereotype of eco-conscious consumers may be Brooklyn hipsters poring over the feeds of zero-waste Instagram influencers, but Whelan stressed plenty of people not fitting the stereotype purchase sustainable products. She highlighted research by BBMG finding that 10% to 20% of consumers are activist consumers, but the slice of consumer who are aspirational is much larger. “They are very big in India, Brazil [and] a lot of the emerging [countries], and they are looking to buy products that align with their values,” said Whelan of aspirational shoppers. “There is I believe a significant developing world market for products that are more sustainable.”

2. The MURKY Beauty Industry Picture

The growth of skincare products with sustainable marketing claims soared more than 110% from 2015 to 2019, significantly outpacing skincare growth more broadly. The share of the skincare category commanded by products positioned as sustainable for the five-year stretch was greater than 20%. However, sustainable skincare products didn’t command a price premium. In fact, they had a 33% price discount relative to their rivals not marketing sustainability.

Whelan reasoned the discount could correspond with a lack of sustainable skincare products at mass retailers. “The beauty products industry is not convinced of their ability to really sell this and, so, when you go into the mass market, there’s not really that much available in this sector,” she said. “So, I would suggest that they don’t feel that they can charge a premium, and I would say that’s not necessarily correct when you look at everything else.”

Outside of skincare, the 2020 Sustainable Share Market Index identified beauty and personal care products that carried price premiums. For example, sustainable deodorants were priced at a 22% premium and eco-friendly soap was priced at a 32% premium relative to general merchandise. Sales of eco-conscious deodorants and soaps jumped 150% from 2015 to 2019. For both products, growth for the category at large didn’t cross 30%.

3. The Packaging Problem

Gao singled out packaging as the beauty industry’s biggest environmental issue. She noted the industry is estimated to generate 120 billion units of packaging annually. But Gao emphasized pollutants associated with the supply chain are a huge problem, too. Maritime ships produce about a billion tons of greenhouse gases every year. Airplanes produced 915 million tons of greenhouse gases last year.

An important strategy for reducing the beauty industry’s packaging footprint is to start with less packaging at the beginning. Whelan argued beauty brands can minimize packaging and simultaneously communicate their products are luxurious. She advised, “Really think through how you design a product.”

Although plastic pollution is top of mind for eco-friendly companies and consumers, Gao explained there are tradeoffs to switching away from plastic. In a study of beverage bottles’ life cycles, she detailed it was discovered plastic bottles yield less than 6X and 2X the amount of greenhouse gases that glass and aluminum bottles yield, respectively.

“The first order of priority is to reduce consumption,” said Gao. She continued, “When we are thinking about alternatives, I think it’s very important to take a more holistic view because just swapping out a material without understanding what the next best alternative is and what that footprint looks like is not necessarily the most environmental choice.”

4. The Complexity Of Compostable Materials

Brands are undoubtedly well-intentioned when they pick compostable packaging, but their aims aren’t always realized. The packaging can end up in the waste stream commingled with non-recyclable containers. “The challenge is whether or not it ends up in compost,” said Whelan. “The opportunity is interesting, but not realistic for consumers.” On the plus side for compostable packaging, she expounded that sending a compostable product to the landfill is better than regular plastic. Whelan said, “I would say it’s better to have that than not, but it isn’t the panacea.”

Education is needed to inform consumers about the correct disposal of compostable packaging. Gao said, “Sometimes people throw it in their recycling stream, which very negatively affects it.” She added that, currently, there are few plastic applications that can be replaced by compostable materials, and substantial room for innovation to improve compostable options.

5. THE Persistent Growth Of SustainablE PRODUCT SALES

Whelan is optimistic the pandemic isn’t derailing consumer interest in sustainable CPG goods. The Center for Sustainable Business hasn’t yet finished examining the price premiums consumers are willing to pay for eco-friendly items amid the pandemic. It has, though, conducted early studies of how sales of merchandise marketed as sustainable is fairing. Whelan revealed, “Sustainable products are keeping their market share and actually have grown a little bit.”

Leave a Reply

You must be logged in to post a comment.