The Future Of Beauty Includes A Focus On Joy, Phygital Environments And Biotechnology

With the pandemic, global climate crisis, war in Ukraine, inflationary pressures and, in the United States and elsewhere, threats to women’s reproductive rights, people are going through a lot right now.

Against that backdrop, at the New York Society of Cosmetic Chemists Suppliers’ Day last week, Eleonora Mazzilli, sales and marketing manager for beauty industry insights provider Beautystreams, outlined how events have shifted consumers’ mindsets in ways that will impact the beauty industry for the next three to two five years. From an interest in biotechnology and hyper-local products to an emphasis on happiness, below we cover what she predicts is ahead for beauty.

A Focus On Joy

Craving relief from the stress and anxiety of the past two years, customers are seeking happy moments. Mazzilli called the trend based on their search “joyology.” “The term ‘luxury’ was, before, really solely linked to the concept of a status, of having something material in our hands, and it’s now rather linked to the small things, the moments of joy in our life,” she said.

Joyology involves embracing a holistic lifestyle, and maintaining physical and psychological health. Beautystreams recently conducted a study that found 55% of consumers deem relationships as well as health and well-being to be their greatest sources of happiness. “This is a very widespread macro theme and is considered a new form of inner peace and beauty,” said Mazzilli.

A different survey, which interviewed 1,200 gen Z Chinese consumers last year, found 48% view their personal ambitions through the lens of work-life balance. Mazzilli described a switch-on, switch-off sentiment that’s shaping their goals and habits. She said, “We’ve been forced to work remotely and our lifestyles have changed so much that there’s really an art to disconnecting and reconnecting during our daily lives.”

Brands can tap into consumers both disconnecting and reconnecting. Mazzilli said, “The fragrance industry has a lot to offer specifically because it evokes emotion, and it creates sophisticated storytelling, enabling also psychological benefits and inner balance.” In particular, she spotlighted candles as a merchandise avenue to explore.

Ritualistic beauty is a facet of the switch-on, switch-off lifestyle. “Unplugging from the digital world and also having multi-sensorial experiences in textures, colors and scents have become important,” said Mazzilli. Cognitive care falls into the category, too, and Mazzilli singled out lion’s mane mushrooms as an ingredient surging in popularity for wellness supplements that’s meant to enhance peak mental performance.

Shifting Definitions Of Sustainability And Clean Beauty

Sustainability is factoring into consumer behavior. According to Beautystreams, 73% of customers think it’s an urgent priority. Nearly 45% of gen Z consumers report they’re willing to pay more for sustainable products. However, what consumers are looking for from sustainable brands has evolved, explained Mazzilli. “It is no longer enough to have less impact, but it is best to go for restorative actions that can repair previous ecological damage,” she said.

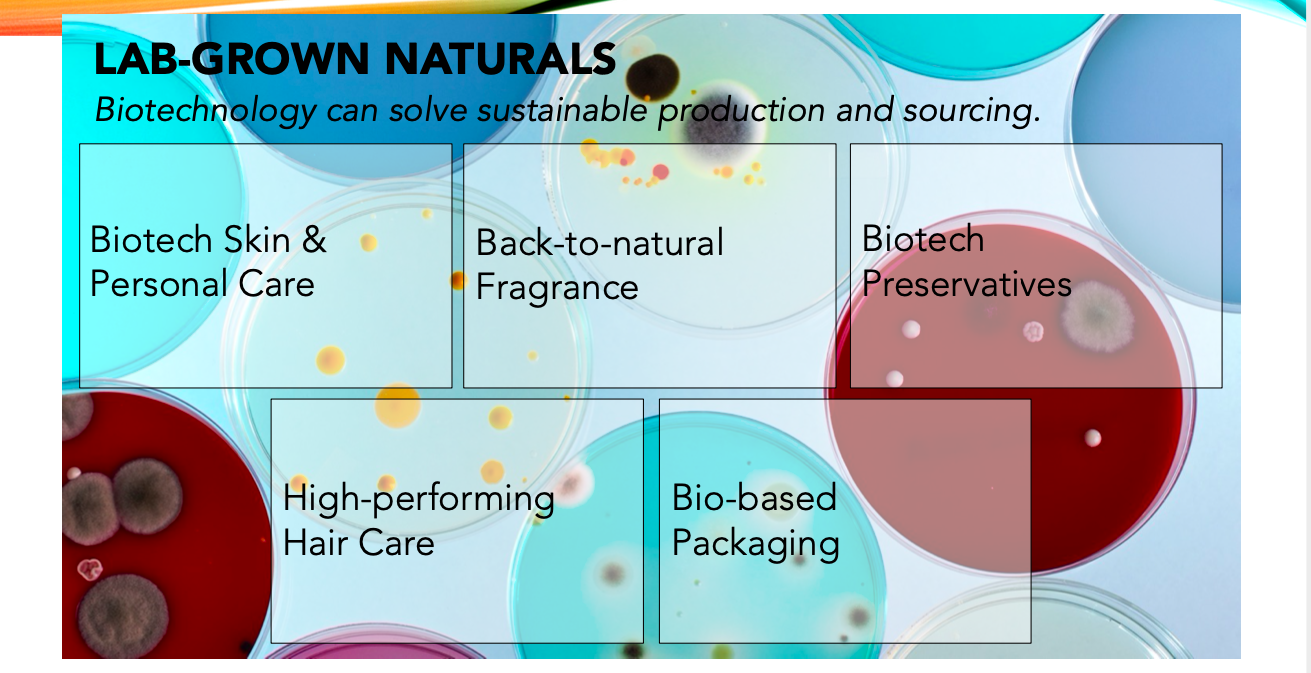

Biotechnology plays a key role, suggested Mazzilli, “because it allows brands to use ingredients that are identical to natural ones, but are made locally, so you’re avoiding creating a monoculture in subtropical countries.” She labeled biotechnology-powered natural ingredients “lab-grown naturals” and underscored the consequences of biotechnology extend beyond ingredients. She mentioned biotechnology is bringing packaging to new heights via advanced materials intended to replace plastic.

Using less water is another restorative measure. While waterless formulas have been around for some time, they may start to pop up even more, and the concept of water conversation will deepen in the beauty industry . Mazzilli explained, “The water that is used to create essential oils, for example, is enormous. Using floral water instead may be a more ecological solution.”

Mazzilli believes the definition of “clean” will progress to give precedence to safety over natural purity. The progression is due to the rise in germaphobia brought on by the coronavirus and the strong demand for immunity-boosting products. “Some consumers are open to compromising on some sustainable aspects as soon as long as the product is safe and efficient,” said Mazzilli.

Growing Ethical Expectations

Mazzilli highlighted that a number of consumers regard themselves as “influential activists,” and their activism is increasingly reflected in their purchases. They pay attention to what the brands they buy from stand for. “Taking a social stand on political and sustainability issues is important and shows that brands have a reason for being,” said Mazzilli.

Language is a consideration. Mazzilli recommended brands have a “we’re all in this together” approach to stress inclusivity. She elaborated, “We invite companies to avoid terms like ethical or ethnic or multicultural for non-Caucasian consumers and targeting consumers like a unique group.”

Simultaneously, there’s been a rise in founders embracing cultural pride and innovating grounded in native ingredients and traditions. Mazzilli pointed to brands from China and India as well as Native American and nomadic African brands as evidence of the cultural pride movement. “Chinese consumers are extremely proud to embrace their local heritage, and this is why Chinese brands are really creating their products and linking them to super local features such as their cities, their places and their regions,” she said.

Local production is also growing, which can lead to a lower carbon footprint and community support. Mazzilli said, “This is a trend that grew a lot during the pandemic specifically when it was so hard to move from one country to another to transport materials.”

Virtual Connections

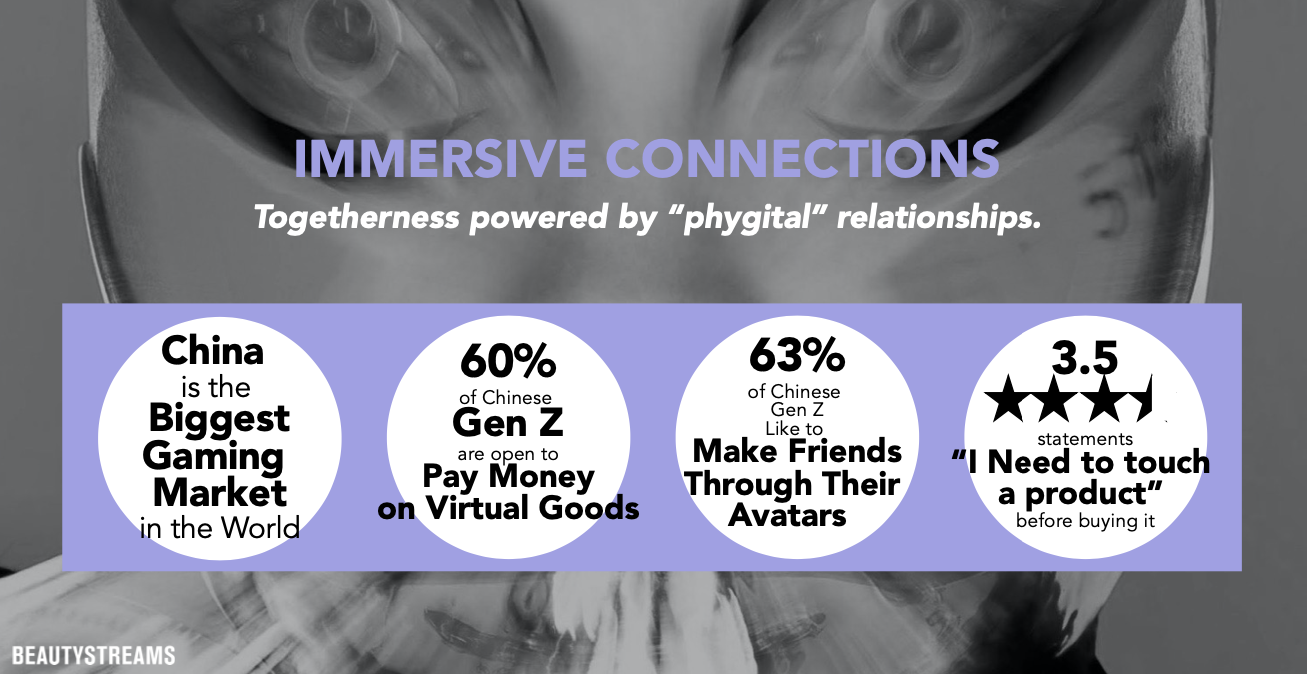

The metaverse is here to stay, at least for the next three to five years, per Mazzilli. “It’s one of the biggest transformers for fast-moving consumer goods,” she said. “The metaverse was forecasted to be $46 billion by 2020. It’s now forecasted to grow up to $800 billion by 2024, so there’s a lot to do here, and there’s a lot to see yet.”

Consumers will start to identify more through their avatars, and virtual goods and services will advance. In Beautystreams’ survey of Chinese consumers, 60% of gen Z Chinese consumers expressed openness to paying money for virtual goods, and 63% revealed they enjoy making friends via their avatars.

Brick-and-mortar stores are going to be seen as an extension of the digital world, forecasts Mazzilli. She said, “The majority of the consumers that we interviewed stated that they need to touch the product before buying it, so the idea of a phygital reality—a mixture and hybridization of the physical and the digital—is real.”

Leave a Reply

You must be logged in to post a comment.