Investment Bankers Anticipate Lots Of Beauty Deals, A Focus On Profits And A Dip In Valuations This Year

After a slow 2020 for beauty mergers and acquisitions, the end of 2021 and the beginning of 2022 have been buzzing with activity, thanks to a backlog of capital that investors and buyers have been eager to deploy.

“There’s just been a lot of catch up,” said Ashleigh Barker, a director at Michel Dyens & Co. who joined Luc-Henry Rousselle, managing director of William Hood & Co., and Lauren Leibrandt, a director in the consumer investment banking group at Baird, for Beauty Independent’s In Conversation webinar last Wednesday on beauty’s big deals. Barker explained, “Brands that were at earlier stages in that 2019, early 2020 period have now had 18 to 24 months to really ramp up and get to the scale and point of being very attractive to a number of different buyers.”

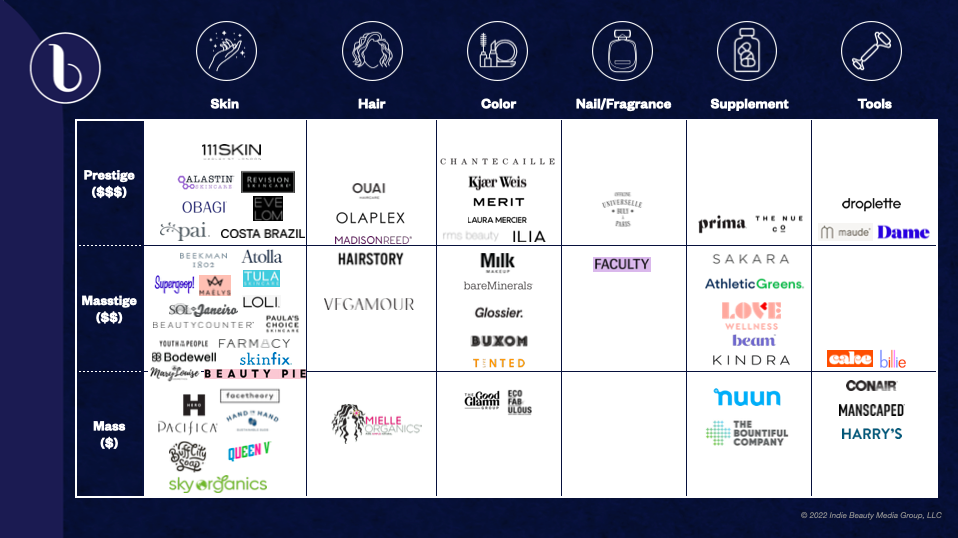

The investment bankers anticipate 2022 to be heavy on beauty transactions, but valuations may dip from last year. “There’s a lot of well-capitalized sponsors and strategics out there looking to put money to work,” said Leibrandt. She thinks haircare and makeup are categories to watch, and noted recent moves in the clean cosmetics space with the Courtin-Clarins family holding company Famille C scooping up Ilia and Brentwood Associates making a strategic investment in Pacifica. Leibrandt said, “If you look at what happened last year and you think about the focus on skincare, it’s not hard to imagine that other categories are going to have similar years and are right for acquisition.”

Further exploring the beauty M&A landscape this year, Rousselle, Leibrandt and Barker laid out qualities that make an asset attractive to investors and acquirers, and what brands should be prioritizing if an exit is the goal.

Brand Assets

Evaluating a brand isn’t a simple endeavor. There are the hard numbers like gross margin and EBITDA (earnings before interest, taxes, depreciation and amortization). Then, there are properties that can’t be as easily encapsulated in the hard numbers. Rousselle suggested a brand’s authenticity and spot-on market fit can result in long-term customer loyalty, but aren’t necessarily captured on the balance sheet. He said, “Just getting that right, which is very difficult and is really the art of all the entrepreneurs in the space, that creates a lot of value and is what first attracts the investors and the strategics.”

Rousselle detailed that investors are drawn to premium beauty brands selling in specialty beauty retailers like Sephora and Ulta Beauty, where they can push growth, and their own e-commerce platform, a route that allows them to gather consumer data they don’t have access to through their retail partners. In the mass market, Walmart and Target are retailers investors zero in on because they offer brands the potential for vast scale.

In the wake of the exuberance over many direct-to-consumer brands diminishing, Leibrandt underscored an omnichannel distribution framework is key, but Barker remarked that the views of various distribution channels can shift. “For many brands, getting into Target is just as exciting and attractive as getting into Sephora,” she said. “You’ve started seeing QVC having a lot more value with brands than it may have been perceived to a few years back.”

A brand able to demonstrate proven success in a largely untapped white space is a great M&A opportunity, according to Barker. She asked, “How can an investor or a strategic come in and lend them their capabilities or access and know-how to bring brands into new markets or new channels?”

Growth Versus Profit

The old adage—it takes money to make money—is true, but brands have know when to turn off and on the money spigot. Before 2020, high growth at the expense of profitability was encouraged. The attitude has changed of late. “Not all growth is good,” said Leibrandt. Barker stressed buyers are interested in how brands are allocating and optimizing their capital efficiently, and investigating whether customers are sticky.

“It comes down to, is this business model sustainable?” said Leibrandt. “If you’re acquiring all of your customers on Instagram or if you have one avenue for sales, at some point, it’s going to get really expensive to continue doing that, and therein lies a business model that fundamentally doesn’t work because the economics of what you have to pay to acquire customers will never make your business profitable.”

For early-stage brands, forgoing profitability in favor of growth makes sense when they’re plowing every dollar back into the business for marketing, product development or employee hiring purposes. However, they have to show a realistic path to profitability. Barker said, “A company that is growing rapidly, investing in the team, investing in infrastructure won’t be profitable right away, but, as you are reaching some of those inflection points, what does it take to hit that breakeven mark when it comes to EBITDA?”

Rousselle said more mature brands closing in on $50 million in revenues should be aiming for profitability. Young brands able to map out how they will achieve economies of scale and pull back on customer acquisition expenses while realizing top-line growth will be in a fruitful position.

Gross Margin

Buyers judge brands in different ways. For example, private equity firms are generally more concerned with profit margin than strategic acquirers that typically shift the manufacturing practices of the brands they buy to reduce overhead and improve margins. Gross margin percentages aren’t one-size-fits-all figures, but there are benchmarks potential buyers look for.

The benchmarks are highly dependent on the category. Tools, cosmetics and skincare brands have divergent operating needs. No matter the category, brand founders should erect their businesses in order to have room to expand to account for lowering the gross profit margin and still maintaining bottom-line profitability when entering retail. “Your brand from selling directly online where you might be making, say hypothetically an 80% profit margin on skincare, can you take that brand into a retailer where suddenly that profit margin is going to become something closer to 50%, and then below that you have all of the other operating expenses of your business?” wondered Barker.

Prestige beauty brands have higher gross margins than mass beauty brands. Rousselle spelled out that 80% 85% is a good gross margin benchmark for DTC brands. In prestige beauty, 70% to 75% is the rule of thumb. Mass beauty brands can function well in the 50% to 65% range.

To watch a replay of the beauty deals webinar and other past webinars, visit Beauty Independent’s In Conversation library.

Leave a Reply

You must be logged in to post a comment.