What’s Next For Private Equity Firm NextWorld Evergreen And Its Retail Wunderkind Credo?

NextWorld Evergreen has quietly become a power player in the better-for-you consumer goods universe. The private equity firm backs clean beauty chain Credo and plant-based color cosmetics brand W3ll People. Like the beauty concepts it’s invested in, NextWorld Evergreen is anything but conventional. Far from the churn-and-burn venture capital model, it operates on 100-year investment horizons. It also provides better liquidity to limited partners than traditional funds by giving them the option to take out their money every few years as opposed to locking it in. Beauty Independent spoke with Frédéric Benqué, managing partner at NextWorld Evergreen, about his firm’s unusual structure, the genesis of Credo, what he saw in W3ll People and NextWorld Evergreen’s focus in 2019.

What is NextWorld Evergreen’s approach to deploying capital?

We are an evergreen fund, which means we take a long-term view of things. We don’t have the typical time frame private equity firms would have, around a five- to 10-year window of investment. That gives us a unique perspective. We are here to invest in and provide a return to our LPs, but we do this over time. We want to help businesses be built in a very sustainable way.

We’re family-backed, and the family made its money in retail, so we have deep roots in the retail industry. That helps us navigate the retail industry. In 2017, we decided that we wanted to focus only on the natural, better-for-you space. So, we’re investing in everything that is connected to the clean and natural food, beverage or beauty sectors. In each of these sectors, we’re trying to find brands that are authentic which can be grown over a long period of time. We tend to avoid investing in areas that may be subject to a lot of hype because we can’t tell if the hype is here to stay.

We’ve invested in a three verticals: tea, indulgence and beauty. We have done transactions and taken positions where we are minority investors. That’s fine for us, but our preference is for control.

The three verticals launched out of studies we conducted within the firm. About five years ago, we started looking at the tea sector because we saw a gradual shift from coffee to tea. That’s not to say that coffee is disappearing. Obviously, it is not, but there is a shift in consumption patterns in the younger generations. They’re turning towards tea as a perceived healthier alternative to coffee.

Also, about five years ago, we were approached by a beauty entrepreneur, Shashi Batra, interested in creating an independent retail concept in the natural beauty space. We started studying that space quite heavily. That gave rise to Credo and our investment in W3ll People. In the natural beauty space, the market has caught up with us. We were one of the pioneers, but, since then, it’s become a very strong trend.

About two years ago, we decided to have a look at the indulgence segment. Indulgence is generally perceived as unhealthy, and we think there’s a lot to be done here so you can have indulgence and make it healthy. We eventually materialized that strategy by buying a company called Alter Eco. We see that company as a platform for doing more in what we call “enlightened indulgence.”

What led NextWorld to launch Credo?

Shashi was one of the first employees at Sephora in the U.S. He went on to create the Victoria’s Secret Beauty business almost from scratch. He was a beauty veteran with a lot of experience and wanted to do something on his own. We started thinking about what could be done.

We identified two trends. Coming from the retail angle and the food side of things, we had created a company called La Boulange, which sold to Starbucks. So, we had some degree of familiarity with the restaurant/CPG food business. We could see that there was a trend toward natural and better-for-you products in the food sector. We [thought] that was going to happen in the beauty space as well. This was five years ago, so it wasn’t front and center at the time.

The other thing we believed was relevant was that women wouldn’t be going to department stores anymore because they didn’t like the customer experience. Sephora had grown quite a bit, but they were getting into a phase where they would be growing with the economy, but not much more than the economy, and there are only so many Sephoras you can put in the country. Between department stores losing market share and Sephora not being able to grow at the same clip, there was an opening for independent beauty retailers.

We thought, “Why don’t we combine these two: the natural offering plus the independent retailer?” That’s how Credo came about. But that wasn’t going to be enough because the natural space has several issues. One is the retail piece of it, where brands aren’t getting the attention they need. Credo helps with that, but there are other pain points we could identify.

Brands are too small. Most of the natural beauty brands are perceived as much bigger than they are in reality. They generally go out of stock whenever there is an unfortunate event. The supply chains are a mess. They have difficulty pursuing the innovation that they want. So, we turned to Credo and said, “You’re not only servicing the customers, you also have to help the small brands get better at running their businesses.” Credo is a brand-facing organization, not only a customer-facing organization. Then, at NextWorld, we decided to invest in brands. We’ve invested in W3ll People and helped a couple of brands get over a certain financial difficulties without making a big fuss out of it or putting it on our website.

We haven’t acted upon the last pain point yet. We see a sector that is growing at about twice the growth of the overall conventional beauty space: 9%, 10% growth for natural and 5% for the conventional beauty space. Granted, the natural space is still much smaller, a fraction of the global beauty space. Still, it’s a sizable amount of money now, and it’s being serviced by very small manufacturing facilities, almost kitchens in some instances. You can’t have an industry that is growing at 10% from a customer point of view with a very high level of quality expectations and, at the other end, that industry is being served by kitchens.

Something is going to happen on the manufacturing side of things, and it’s already starting to happen. There are a series of natural beauty labs that are being bought up by other labs, and we thought NextWorld should be investing in that space. We haven’t acted upon that yet, but it’s part of our holistic view of the natural beauty space because we want to alleviate the pain points that we see. We think it’s beneficial to the sector as a whole and, at the same time, we can generate returns.

How is Credo performing based on what your goals were for it at the beginning?

There was an unforeseen event in the development of Credo, and that is that Shashi passed away almost two years ago. Basically, we lost a year in our development plan. We didn’t go as fast as we wanted because we couldn’t. Having said that, if you take away that tragic situation, we’re very pleased with what Credo has achieved.

We wanted to experiment with opening stores in various cities across the U.S. and make sure that we could validate the existence of a natural beauty crowd that would go to an independent beauty retailer to discover brands. That was clearly validated. The stores in New York are doing very fine, and the store in San Francisco is also doing great.

The other stores that are more recent are doing great, but they are ramping up. If I’m being a bit cautious, we’re still looking at how the concept performs to see if we need to keep the same format. But, overall, we’re very, very pleased with the expansion and the visibility of the stores.

We revisited our real estate strategy when we hired our new CEO [Dawn Dobras in July 2018]. Retail expansion will be happening in 2019. We didn’t do it for a year because of Shashi’s death, but we’re back on the trail for new locations.

Probably the next experiment we’re going to run is a degree of clusterization, opening stores in areas where we already are located. We’ve already started to. In New York, we have a store in Brooklyn and a store in [Manhattan], for example. We are very selective and will probably reinforce our presence in markets where we already are active. From a retail point of view, we want to be much bigger in terms of number of doors.

We’re also putting a lot of effort into the online side of the business. Online growth is well above 50% year-over-year. Dawn Dobras has a very strong digital e-commerce background, and she’s bringing that to bear currently. We’ve got high expectations for the growth of the online business.

We launched CredoLive, our shopping platform that connects live online shoppers with associates in our stores. When you go on our website, a window pops up that connects you with an actual person in a store that will answer your questions and advise you. [The technology] is provided by Hero. Credo is the first beauty retailer to be using Hero. So far, it’s been really great. Hero connects you with a person when you are on the website looking at product. CredoLive [has] greatly improved our conversions and enabled better customer engagement.

The other thing we really believe in is education. We think the natural beauty space is in a phase where it’s trying to define itself in a proper way. The easy definition is to say, “We’re clean if we don’t have these ingredients,” and that’s a definition that customers understand very well. We’ve been very intentional around clean beauty standards. In April 2018, we introduced to our Credo Clean Standard to brands. We launched it to consumers in September 2018 and the brands have until October 2019 to comply.

We obviously have the list of [excluded ingredients], but we’re trying to go further than that. We’re trying to have the brands step up their game and [provide] quality information that will enable them to sell more. Once customers pass the list of bad ingredients, [they] will see that there’s more depth to how clean is defined.

What is the Credo Clean Beauty Standard?

It goes beyond our Dirty Ingredients List. We told the brands that we’ll be following the INCI [International Nomenclature Cosmetic Ingredient] standard for ingredients. We don’t want marketing language, that should be in marketing materials. If you show an ingredient list, it has to be standardized. You have to make it easy for everyone to read and understand.

We’re also asking the brands to be very careful when they choose their product claims and, for all those claims, we’re asking for backup with certifications. We don’t want brands to be caught in situations where they’ve got a 100% percent claim—100% pure, 100% organic—because it’s just not possible, and they’re going to be caught up in legal proceedings. And that’s not what customers want. They want authenticity and clarity. They don’t want to be told a story at a time when they’re trying to avoid another story.

Other than W3ll People, what are deals NextWorld has made with beauty brands public?

No. We are an investor. Our goal is not to provide debt financing. We don’t want brands to come to us for that. So, we’re not making it public. But we’ve been friends to brands in ways that are not just investing in equity. It made sense to us because it was helping these brands to grow. With W3ll People, it was different. It was a more formal investment.

We’re always trying to find ways to do that. In the past, we’ve loaned money. It’s not our business to lend money and, in the future, I don’t know how we’ll be helping the brands again. Maybe we will with education. We made a video with EWG, which is an example of things we do to support the industry. Obviously, it helps Credo, but it’s something we did with EWG, and we paid for it without getting a direct return.

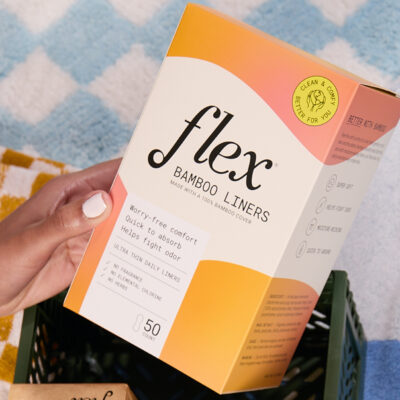

What stood out about W3ll People that prompted Nextworld to make a formal investment?

W3ll People is a leader in clean cosmetics. What we really liked about it was that the price point was friendly to the customer. We wanted to have exposure to a brand that was an entry level into clean beauty cosmetics. We were impressed by the founders, James [Walker] and Shirley [Pinkson]. We thought it was exciting from an innovation point of view because of the products the brand has introduced into the space. The other piece that was important for us is that we wanted to have a hands-on experience of how brands actually work. What’s the reality of the life of a brand?

Do you think NextWorld will make another investment like that?

We’re probably interested in investing in brands a bit more. I don’t know if we’ll be investing in color again or whether it’s going to be haircare or skincare. We’re looking at a couple of things right now.

What’s your reaction to the launch of Clean at Sephora? Does Credo need to adjust its strategy in response?

We don’t think we need to adjust much. One of the purposes of Credo is to get the excitement that is being generated by small, clean brands from a very confined distribution situation to a wider distribution network. We’re bringing small brands to life. That’s not what Sephora is going to do. That’s not what big retailers are doing. Some brands will not go to Sephora in the first place because they just can’t do that. The purpose of Credo is to say, “There’s a lot happening in the clean beauty space, and we need to bring these brands to the forefront so that people are seeing [them] in the right way with salespeople who are educated to sell the brands properly.” That’s not what Sephora or bigger retailers can do.

Leave a Reply

You must be logged in to post a comment.