As The Pandemic Persists, Many Cosmetic Manufacturers Struggle

With global beauty sales on the upswing, the American cosmetic manufacturing sector was sitting pretty at the beginning of the year. New companies had popped up to serve indie beauty brands, and their growing antecedents were angling for rich exits.

The pandemic has transformed the sector swiftly and dramatically. According to an April survey by nonprofit trade association Independent Cosmetic Manufacturers and Distributors of 80 of its members, more than half registered revenue decreases of greater than 30% and 15% registered revenue decreases of greater than 75% since the coronavirus took hold in the United States. Only 14% report their companies are financially stable enough to survive beyond six months, and 30% predicted they will be out of business in 90 days if beauty industry conditions don’t turn around.

“The takeaway is that there is a lot of pain out there, and people are trying to hang on as best they can,” says ICMAD president Kenneth Marenus. Before COVID-19, he adds, “The economy was good. Unemployment was down. There were lots of outlets, innovation and new things coming along. CBD was huge. The transition has happened in a matter of weeks. People are still reeling from the shock of it. They are starting to accept it’s going to be a long haul back, and they’re trying to come up with a plan for what to do next.”

Manufacturers’ strategies have ranged from short-term stopgap measures, most prominently switching to hand sanitizer production, to a longer-term focus on product categories presumed to be relatively strong amid the public health and economic crisis. Companies have reduced workforces, conserved cash and pulled back on riskier products. Bigger manufacturers with well-heeled customers and those that received investment prior to the pandemic are better positioned to weather the tough environment, while smaller companies dependent on emerging brands with tiny budgets and tenuous futures are on less sure footing. The caveat is that small companies with scant overhead may ride it out with limited income.

After working for a cosmetic lab, Manjot Shergill decided to establish her own custom formulation house, Skin Affinity Inc., two years ago in Ontario., Calif., to offer personal customer service, products that delivered on their promises and low minimum order quantities of 1,000 units per stockkeeping unit. With the clean beauty sector flourishing, she cultivated clean indie skincare and makeup brands as clients. The only full-time employee at her company, Shergill hires workers on a project basis. When the coronavirus hit, the projects dried up.

“A lot of brands aren’t able to move forward on the plans that they had for this year. They have to scale back and, because of that, we are also scaling back,” says Shergill. Preceding the pandemic, she elaborates the beauty market “was really saturated. I think everybody was trying to start their own brand, and the pandemic is either pushing brands to continue doing what they can do or start doing something else. I think it really depends on how their sales do through this. I think a lot of people are struggling to hang on. Depending on how long the pandemic lasts, it could make or break a lot of people.”

“There is a lot of pain out there, and people are trying to hang on as best they can.”

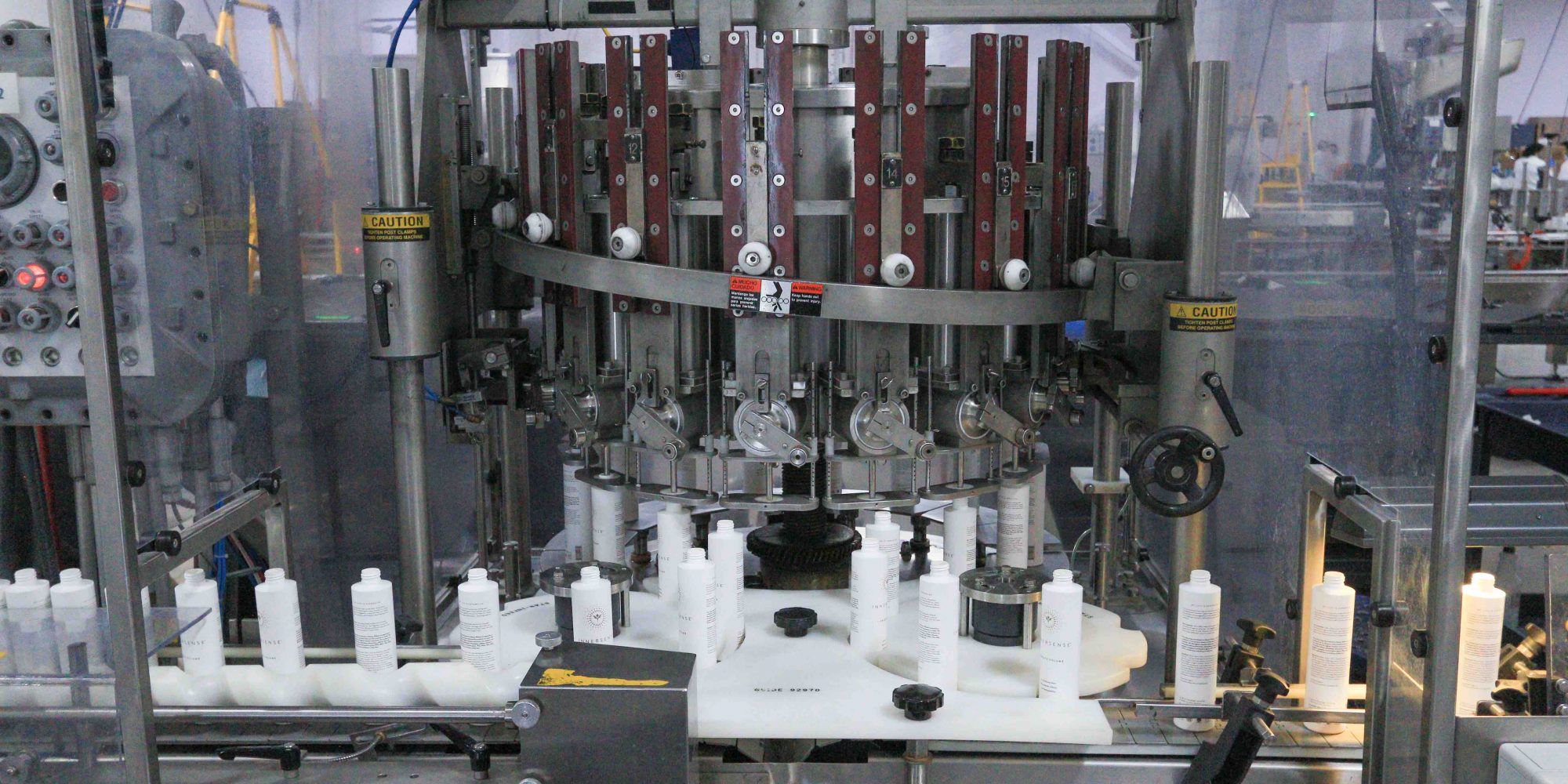

Hand sanitizer has helped several manufacturers make it so far. Driven by the coronavirus outbreak, research firm Technavio estimates hand sanitizer sales will surge 651.28% this year. At Vineyard, Utah-based Dynamic Blending, hand sanitizers are currently responsible for at least half of the daily output of 60,000 to 80,000 units. It has three buildings and, within four days, it constructed a new production line to handle hand sanitizer manufacturing meeting U.S. Food and Drug Administration guidance. Normally, the company with a natural and organic formula forte churns out lip glosses, toners, serums, tinctures, muscle balms and more.

At the outset of the pandemic in the U.S., Dynamic Blending trimmed its personnel by 13%, according to general manager Stephen Merrill. It has 69 employees. Despite the adjustments, Merrill is bullish on the manufacturer’s prospects, and it’s proceeding with construction arranged pre-pandemic to double its capacity. “If you look at our natural projection of business, we are growing rapidly in comparison to Q1 and even to the start of Q2 last year,” he says. “We have seen a lot more creation of leads, and that is because our footprint is larger. We are not seeing a big dip in requests from an R&D or production perspective.”

Discussing the economic slump, Merrill explains wannabe entrepreneurs could jump at the chance to enter the beauty space because they may be unencumbered by another job. “They might be pushing to do something different, and that’s where we can fill a niche to get things off the ground for them,” he says. “I have a positive outlook for the industry as a whole as we move forward and, not just this year, but next year as well. I think people are going to shift their priorities within the next 12 to 24 months and really check on what’s important to them and that includes the personal care aspect.”

Certainly, the next 12 to 24 months could determine manufacturers’ fates. “We expect brands to keep a close eye on their 2020/2021 forecasts as brick-and-mortar starts to reopen slowly and in a more careful manner. However, many brands have experienced a spike in DTC sales and, as a result, we are responding with quick launch opportunities to accommodate online exclusive SKUs to ensure brands remain innovative amongst a very competitive landscape,” says Amy Hart, chief innovation officer at Aurora, Colo.-based Elevation Labs, a specialist in topical CBD merchandise, and natural and organic skincare and haircare that’s pivoted to hand sanitizers, hand creams and soaps. “Given the possibility of this virus lasting through next winter and the level of unemployment we are already seeing, I believe we could see some of these challenges stretch into mid-2021, but hopefully that is overly pessimistic.”

“We could see some of these challenges stretch into mid-2021.”

Cosmetic companies are gazing into their beauty industry crystal balls to maneuver their businesses to take advantage of areas of relative fortitude. Hart points out everyday essentials are bright spots, and direct-sales beauty companies are gaining momentum as people search for sources of money to pad their skimpy wallets. With salons, spas and hotels likely to suffer from prolonged financial hardship, Marenus predicts manufacturers and distributors catering to e-commerce and big-box players could be comparably resilient. He doesn’t foresee consumers spending on experimental merchandise. Marenus says, “I think you’re going to see a trend in the marketplace of people staying with the tried-and-true. I am not sure how adventurous they are going to be, so new innovations may take longer to catch on.”

Cosmetic manufacturers concentrating on the clean beauty segment believe clean beauty products will be particularly relevant as consumers judiciously examine ingredients. Cindy Holland-Rodriguez, owner and founder of San Antonio-based clean makeup producer Indigo Private Label Cosmetics, says, “The demand for natural color products has increased. I think this is because more consumers are focused on buying indie products which tend to be healthier without synthetic ingredients versus mainstream beauty. For Indigo, our future looks bright.”

Hot heading into the pandemic, deal activity in the cosmetics manufacturing sector has cooled during it. Among the deals that happened this year and last year were Lee Equity Partners’ acquisition of Cosmetic Solutions; Knowlton Development Corporation’s pickups of Cosmetic Laboratories of America, Benchmark Cosmetic Laboratories, Swallowfield and ALKOS Group; Knowlton Development Corporation’s merger with HCT Group; and ANJAC Health & Beauty’s takeovers of Cosmetix West and Roval Cosmétiques.

Warren Becker, CEO of Boca Raton, Fla.-based Cosmetic Solutions, a private-label and custom formulation company that’s seen business in the midst of the pandemic shrink 15% to 20% from where it was previously budgeted it to be, doesn’t envision the deal pace declining indefinitely. “Things are going to slow down, and valuations are going to go down across the board, but, as the world becomes right again, there are still going to be M&A opportunities and consolidation,” he says. “It’s an unfortunate time in the country and the world, and there are some smaller businesses that are going to struggle through this, which, on the M&A side, could create opportunities to help those businesses along and acquire them.”

ICMAD intends to conduct another survey soon to check in again on how its members’ businesses are performing. Marenus is eager for them to convey improvement, but there are too many unknowns in the consumer economy to accurately anticipate what’s in store for them. “There’s a tremendous amount of uncertainty. Even as things open up, it doesn’t mean the consumers will come back,” he says, noting, “The one thing that seems to be true is the landscape changes very rapidly, so what we are seeing true today maybe in three weeks will be different.”

KEY TAKEAWAYS

- According to an April survey by nonprofit trade association Independent Cosmetic Manufacturers and Distributors of 80 of its members, more than half registered revenue decreases of greater than 30% and 15% registered revenue decreases of greater than 75% since the coronavirus took hold in the United States.

- Only 14% of ICMAD's survey respondents report their companies are financially stable enough to survive beyond six months, and 30% predict they will be out of business in 90 days if beauty industry conditions don't turn around.

- Manufacturers’ strategies have ranged from short-term stopgap measures, most prominently switching to hand sanitizer production, to a longer-term focus on product categories predicted to be relatively strong amid the public health and economic crisis.

- Dynamic Blending is an example of a beauty manufacturer that's pivoted quickly during the pandemic. Hand sanitizers are currently responsible for at least half of its daily output of 60,000 to 80,000 units.

- With the prospects for brick-and-mortar businesses such as beauty stores, spas and salons highly uncertain, cosmetic manufacturers creating products for them have uncertain futures, too. Cosmetic manufacturers catering to e-commerce, direct-sales and big-box players are better positioned.

- Cosmetic manufacturing executives are working to identify product categories that will be robust as the pandemic's effects continue. They consider hygiene-oriented products, essential personal care items and clean beauty as bright spots.

- Prior to the pandemic, M&A activity in the cosmetic manufacturing sector was hot. During it, activity has cooled off. However, the sector's struggles could provide opportunities for acquirers looking up to snap up assets at lower valuations.

- With so many unknowns about the course of the pandemic, cosmetic manufacturers don't anticipate a rapid turnaround for their sector. Amy Hart, chief innovation officer at Aurora, Colo.-based Elevation Labs, says, "I believe we could see some of these challenges stretch into mid-2021, but hopefully that is overly pessimistic."

Leave a Reply

You must be logged in to post a comment.