Retail Sales Dive, Ulta And Sephora Win Big With Post-Pandemic Shoppers, And Revlon Could Exit Bankruptcy: A Look At December 2022 Retail News

Inflation has been decelerating, but elevated prices continued to plague consumers as they shopped last year’s holiday sales, spurring them to wait for deeper discounts and return items in greater quantities. Still, persistent economic uncertainty didn’t stop shoppers from pouring through the doors of major beauty retailers in droves last year. Both Ulta Beauty and Sephora registered double-digit gains in foot traffic over 2019, an illustration of beauty’s resilience. Below, we summarize recent retail news.

Retail Sales Drop

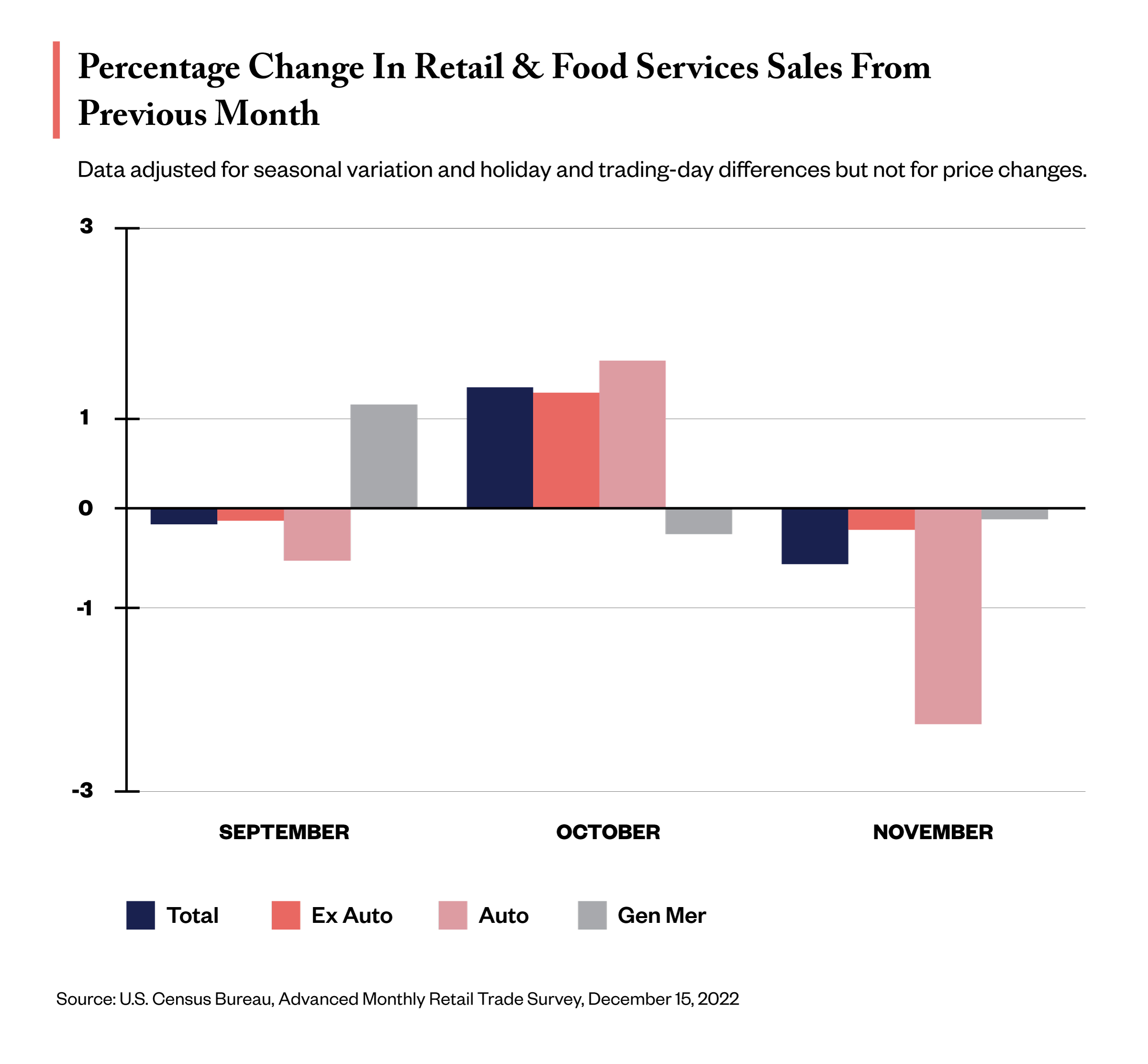

October’s holiday shopping rush dragged down November’s retail sales as consumers pulled back on their purchases after securing early deals. Despite the Black Friday and Cyber Monday period, retail sales dropped .6% in November from October, per the United States Census Bureau. It was the biggest month-over-month decrease last year after sales jumped 1.3% in October. However, November spending was up by 6.5% on a yearly basis.

While discretionary categories like cars and electronics saw a boost in October, they plunged in November as did spending on clothing, sporting goods and furniture. Food and healthcare products registered gains, and spending in restaurants was also strong.

Retail sales calculated by the U.S. Census Bureau are unadjusted for inflation and capture spending at stores, online, restaurants, car dealerships and gasoline stations. Spending on services like transportation and travel, housing and utilities isn’t included.

The National Retail Federation’s (NRF) monthly report was a bit sunnier. It showed November retail sales down by .4% from the month prior. Sales were up by 5.6% from a year ago. The NRF’s calculation of retail sales zeroes in on core retail and excludes spending at car dealerships, gasoline stations and restaurants.

Spending at grocery stores and health and personal care stores was up .8% and .7% month-over-month, respectively. Online sales, general merchandise stores, home and garden supply stores, sporting goods stores, apparel stores, furniture stores and electronic stores all registered dips in monthly sales.

U.S. manufacturing decreased for the first time since June as demand cooled in November. The Federal Reserve estimates that output dipped by .6% for the month. Although the dip was primarily driven by a deceleration in auto manufacturing, a decline in the production of consumer product goods and business equipment contributed as well.

The slowdown in U.S. retail sales comes as the Fed stays committed to hiking interest rates to curb spending in order to modulate record inflation. After four sizable .75 percentage point hikes, the Fed raised rates by another .5 percentage point in December. More hikes are expected to be forthcoming through the spring. Consumer prices increased by 7.1% year-over-year in November, down from 7.7% in October and 8.2% in September.

Despite a rocky economic outlook, the U.S. labor market remains tight as companies compete over a limited pool of available workers. Another 263,000 jobs were added in November, keeping pace with October’s gain of 261,000 jobs. Job growth is still above pre-pandemic levels, but it’s slowed since the start of 2022 when new jobs averaged over 400,000 a month. The national unemployment rate held steady in November at 3.7%.

Holiday Returns Forecast To Increase

Online spending jumped in the three weeks following Cyber Monday as U.S. shoppers shelled out $97 billion in holiday purchases during that stretch, according to a report from Salesforce. Specifically, there was a 8% year-over-year increase for the period between Nov. 29 and Dec. 19.

However, returns will likely be plentiful. The same report predicts that over 1.4 billion holiday orders will be returned, a staggering 57% year-over-year bump. Consumers are already starting the process in haste. Returns nearly doubled from last year in the the week after Cyber Monday and have been high ever since. Salesforce theorizes that items bought earlier in the season were returned because consumers wanted to repurchase them at deeper discounts amid squeezed discretionary spending.

Discounting hit its peak two weeks after Cyber Monday with rates increasing 11% globally and 14% in the U.S. year-over-year, per the Salesforce report. Skincare, general apparel and makeup were the three most discounted categories in December. The categories’ discounts averaged 26%, 24% and 20%, respectively.

Although holiday returns are increasing on a yearly basis, total returns for 2022 are expected to remain flat year-over-year, according to the NRF. The average rate of return for 2022 sits at 16.5% or $816 billion in retail purchases, compared to 2021’s rate of 16.6%.

Online return rates slid from 20.8% in 2021 to 16.5% in 2022. The NRF predicts that $603 billion in brick-and-mortar purchases made during 2022 will be returned. The amount is out of a total of $3.66 trillion in brick-and-mortar sales. For holiday sales alone, the NRF prognosticates that retailers should anticipate almost $171 billion in returns this year for an average return rate of 17.9%.

Ulta And Sephora Gain Foot Traffic

According to a white paper by foot traffic analytics firm Placer.ai, in-person visits to beauty stores during 2022 were 13.4% to 30.9% greater than they were in 2019. The uptick was primarily fueled by top beauty retailers, notably Ulta and Sephora.

Both retailers picked up market share with beauty-loving gen Zers in 2022 as they fruitfully drilled down on their positioning to meet customer needs. The retailers gained wider exposure by expanding their store fleets and shop-in-shop partnerships with Target and Kohl’s.

Foot traffic at Ulta’s 1,300-plus locations was 16.1% to 38.6% higher than it was in 2019. Sephora locations experienced a substantial three-year increase in physical visits during 2022, including a 81.8% increase in October.

Revlon Enters Bankruptcy Agreement

Revlon may be able to exit Chapter 11 bankruptcy in April if a restructuring agreement it submitted in December is approved by a U.S. bankruptcy court, according to the publication Women’s Wear Daily. The agreement would transfer ownership of the heritage beauty brand to secured lenders, ousting majority shareholder Ronald Perelman.

Perelman’s holding company MacAndrews & Forbes owned over 85% of Revlon as of March 31 last year. Meanwhile, the option of a sale of the company is still in play.

After nearly going bankrupt back in 2020, Revlon officially filed for Chapter 11 protection last June. It struggled under $3.7 billion in debt, increasing market competition and supply chain breakdowns. At the time of the filing, the company was expected to receive $575 million in financing to support its daily operations while it navigated the bankruptcy process.

Additional News

Skin Treatment Studio House of Pietro Simone Opens In New York City [Beauty Independent]

Credo For Change To Relaunch As A Career Accelerator Program In 2023 [Beauty Independent]

A Former Whole Foods Buyer Is Turning Metropolitan Market Into A Wellness Destination [Beauty Independent]

Nubyén Enters Sephora UK After Ramping Up Its US Retail Presence [Beauty Independent]

Holy Curls Gets A Big Bounce In US Retail Distribution [Beauty Independent]

Leave a Reply

You must be logged in to post a comment.