Neptune Appoints Schmidt’s Naturals Co-Founder Michael Cammarata CEO As CPG Executive And Investor Interest In The Cannabis Segment Swells

Michael Cammarata, co-founder and former CEO of Schmidt’s Naturals, believes the cannabis consumer products segment isn’t too different from the aluminum-free deodorant segment when he jumped into it five years ago. There’s a sea of small brands—and new ones sprouting like weeds (pun intended)—no clearly dominant forces, escalating interest from consumers and retailers, and investor fascination.

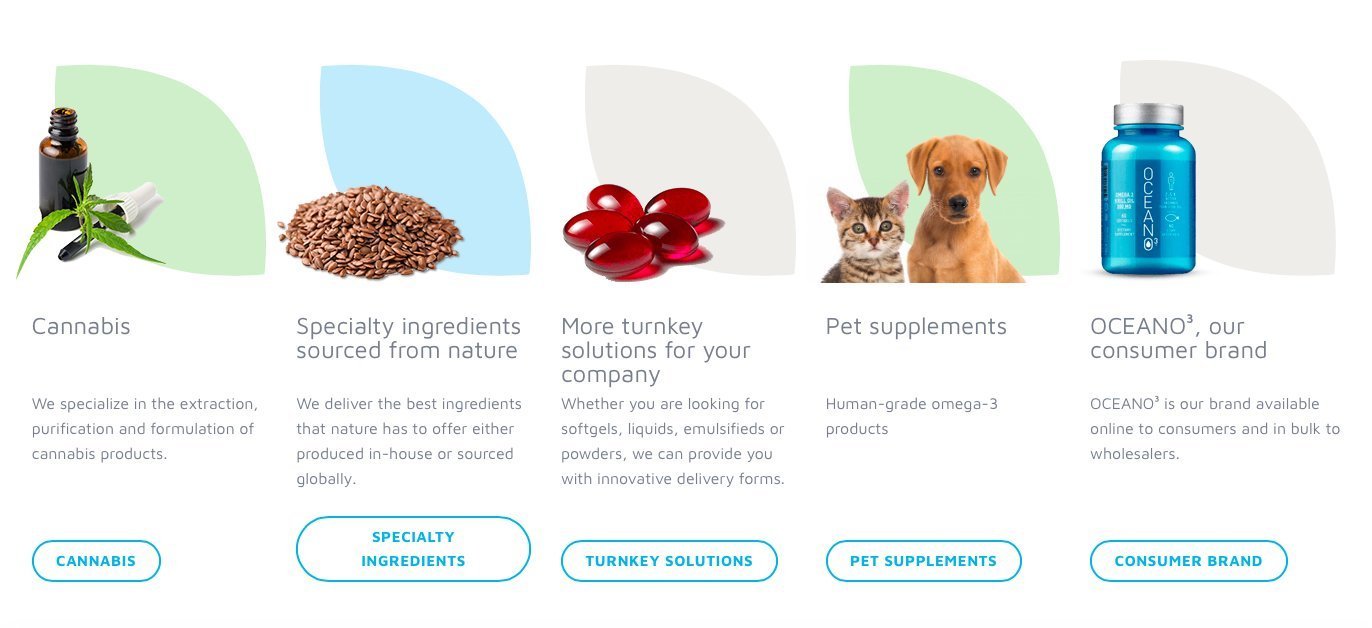

Extending the aluminum-free deodorant comparison, Schmidt’s Naturals and Native rose above the fray to score high-profile exits to Unilever and Procter & Gamble, respectively, cultivate loyal customers and solidify distribution. The emerging cannabis companies today could be the Schmidt’s Naturalses or Natives of tomorrow, and Cammarata is poised to help them get there. On Monday, it was revealed he’s become CEO of Neptune Wellness Solutions, a B2B turnkey product specialist and ingredient supplier that’s dabbled in owned brands with omega-3 supplement purveyor Oceano and botanical line Forest Remedies.

“The consumer demand is here. Now, we have to make sure we have quality products at affordable pricing,” says Cammarata. “The top brands and people who are really in it to be sustainable and promote health—all the things that consumers want out of products—and that are delivering quality from the supply chain to the end result are going to win with consumers, and the retailers are going to support those brands.”

The assemblage of contenders vying to win in the cannabis market is enormous. There are over 50 publicly-traded cannabis companies. Although the CBD portion of the cannabis sector is tiny relative to the THC portion and the CBD beauty portion tinier yet, its potential is huge. The Brightfield Group predicts CBD sales in the United States will hit $22 billion in 2022, up from $591 million billion last year. Jeffries forecasts CBD beauty sales could reach $25 billion globally by 2029. The race is on to come out of the cannabis crush on top and reap the rewards. Companies are loading up on executive prowess, capital and brand acquisitions to be well-positioned to grab them.

Prior to news breaking that Cammarata had joined Neptune, medical cannabis firm Tikun Olam announced it hired Michael Indursky, former president of Bliss and CMO of Burt’s Bees, as executive chairman and CEO of CBD beauty company Tikun Olam Skincare. Other recent developments with ramifications for CBD beauty include Canopy Growth’s $55.2 million deal for skincare brand This Works; Green Thumb Industries’ expansion of retail concept Rise and its upscale brand Beboe’s partnership with Barneys New York on in-store shop The High End; Curaleaf’s agreement to sell CBD products at CVS and Green Growth Brands’ agreement to sell them at Abercrombie & Fitch; Indus Holdings pickup of THC and CBD topical brand Humble Flower Co.; Organic Flower’s purchase of CBD cosmetics manufacturer Canutra; Aurura Cannabis’s strategic investment in Evio Beauty; and LB Equity’s backing of Standard Dose.

The activity is expected to mount. Derek Chase, president of Flora + Bast, a CBD beauty brand available at Sephora and Barneys New York that’s rebuffed external investors to date, says, “If investors are smart, they will start to snatch up brands in their infancy, and nurture them with access to funds and strategic capabilities, especially when it comes to supply chain. I also see large CPGs making deals with small, creative companies with vision. Since the category is still very much in an embryonic state, and consumers largely in the lurch for good information about the why’s and how’s of cannabis, investors will likely look for entrepreneurs with the knowledge and passion to lead their cannabis initiatives for decades to come.”

“The top brands and people who are really in it to be sustainable and promote health—all the things that consumers want out of products—and that are delivering quality from the supply chain to the end result are going to win with consumers, and the retailers are going to support those brands.”

At the moment, he suggests the hazy regulatory landscape (the Food and Drug Administration bans CBD in ingestible products, for example, but rarely enforces its ban) has been advantageous to young brands willing to take risks, and the risks have sidelined beauty conglomerates, which are certainly closely watching and figuring out their possible involvement in the CBD segment. However, the regulatory environment could shift and disrupt the balance of brand power as it currently exists. Chase figures, “If big changes happen that make it more difficult for small business to operate, it is likely that indie brands will need financial support to beat the competition.”

Richard Gersten, a partner at Tengram Capital Partners, the private equity firm that sold This Works to Canopy Growth, says the CBD brand population and deals will surge because there’s no shortage of capital pouring into the segment. As evidence, for its series B round, Indus Holdings began with the goal of raising $15 million. It ended up with $46 million. Gersten says, “The only barrier to entry for any of these businesses is capital. If there’s easy access to capital, businesses will launch and survive. It’s only when access to capital dries up that a shakeout occurs.”

Of course, ample capital doesn’t mean smart capital. Gersten argues smart cannabis investors are funding wellness companies. This Works, he notes, has a significant presence in sleep products that make sense for CBD. A typical topical skincare brand makes less sense. “If you want to be a CBD or cannabis expert, you play across multiple forms of delivery, not just topicals. It could be beverages, edibles, vape pens and more,” explains Gersten. He mentions Moon Juice could be a fit for a cannabis-minded investor because its supplements, beverages and physical locations seem appropriate for CBD. In a traditional beauty line, Gersten asserts CBD is simply a single ingredient and doesn’t translate to a compelling umbrella business proposition.

In the CBD beauty segment, brands that have made splashes at stores or have prominent names in charge are the subject of deal speculation. Cannuka pushed Ulta Beauty into CBD; Prima is a DTC darling with previous The Honest Co. executives Christopher Gavigan and Laurel Angelica Myers at the helm; Lord Jones, stocked by Sephora, is a celebrity favorite; Kush Queen has cannabis pioneer Olivia Alexander in the driver’s seat; Vertly is led by stylish married couple Zander Gladish and Claudia Mata, a former magazine editor; and Sagely Naturals has spread its products from CVS to Neiman Marcus.

“The only barrier to entry for any of these businesses is capital. If there’s easy access to capital, businesses will launch and survive. It’s only when access to capital dries up that a shakeout occurs.”

The CBD segment remains extremely nascent, and uncertainty surrounding the brands that will make the most headway is the overriding sentiment among observers. As the segment matures, Cammarata isn’t in a rush to strike deals. “M&A is going to be very active, and I think there will be consolidation,” he says. “I focus on building companies that are financially stable and being conservative on acquisitions. I think that’s the discipline we will continue to have.” Indus CEO and president Robert Weakley told Beauty Independent in May that the company is zeroing in on underserved consumer niches in the CBD segment for acquisitions. He elaborated, “Those of us in the industry already know the healing benefits of CBD. It’s a matter of identifying who this helps, taking that message to consumers, and building a broader platform to market that message.”

If the investor money and CPG executives entering the CBD arena portends consolidation, is the heyday for indie CBD beauty brands coming to a conclusion? Entrepreneurs don’t think so. Alexander isn’t convinced the investors and CPG executives entering the cannabis market will necessarily succeed. “They may be able to leverage their experience when it comes to scale, supply chain and building teams, but these types are a dime a dozen. There’s a huge learning curve when dealing with this molecule and the current state of the industry. Even people with extensive resumes running huge operations don’t know how to dose CBD products at a massive scale. I’ve seen a revolving door of big talent and executives coming in and out for years,” she says, stressing, “I doubt people jumping in now have the real connection required to build an authentic brand.”

Brandi Leifso, CEO and founder of Evio Beauty, agrees, saying, “Sometimes it’s easy to think large companies in any industry have the upper hand because of size, resources and accessibility. With today’s consumer patterns, that’s not necessarily the case. Emerging brands have a unique relationship with their consumer and many have accomplished a trust with their consumer that is incredibly important, especially for a blooming industry that is peppered with stigmas and mysteries.” Chase concludes, “Indies will always be more nimble, more creative and more innovative than the big CPG players.”

Back at Neptune, Cammarata argues the company’s extraction expertise will separate it from the cannabis pack. “Right now, there are a lot of brands that slap a logo on a CBD product, but you need quality, you need to know about the CBD you are using and how to get it. It’s just like there was a lot of people doing natural deodorants, but not a lot doing it correctly,” he says. “The knowledge of science and extraction that we have is going to allow us to be effective through the brands we support and with the consumer.”

KEY TAKEAWAYS

- As part of a wave of experienced CPG executives entering the cannabis sector, Schmidt’s Naturals co-founder and former CEO Michael Cammarata has joined Neptune Wellness Solutions as CEO. Preceding the annoucement of his new post, former Bliss president and Burt’s Bees CMO Michael Indursky was hired by medical cannabis specialist Tikun Olam to spearhead CBD beauty company Tikun Olam Skincare.

- The executive appointments come as capital is pouring into the cannabis sector as a whole and CBD in particular. The money is chasing a potentially huge business. The Brightfield Group predicts CBD sales in the United States will hit $22 billion in 2022, up from $591 million billion last year.

- Small indie brands and larger publicly-traded companies are jockeying for position in the open cannabis segment. Consumers and retailers haven’t fully made up their minds about the brands that will get their backing. The companies that have skillful management and pools of investment could be poised to win.

- Deal activity in the cannabis sector as a whole and CBD more specifically is expected to continue to be strong. Access to capital within it is readily available.

- As consolidation occurs, there could be a shakeout in the indie beauty portion of the cannabis segment. However, at the moment, entrepreneurs and investors don’t envision a widespread collapse of the smaller players. There remains plenty of room in the market for niche offerings.

Leave a Reply

You must be logged in to post a comment.