The Indie Beauty Business Implications Of Federal Tax Cuts

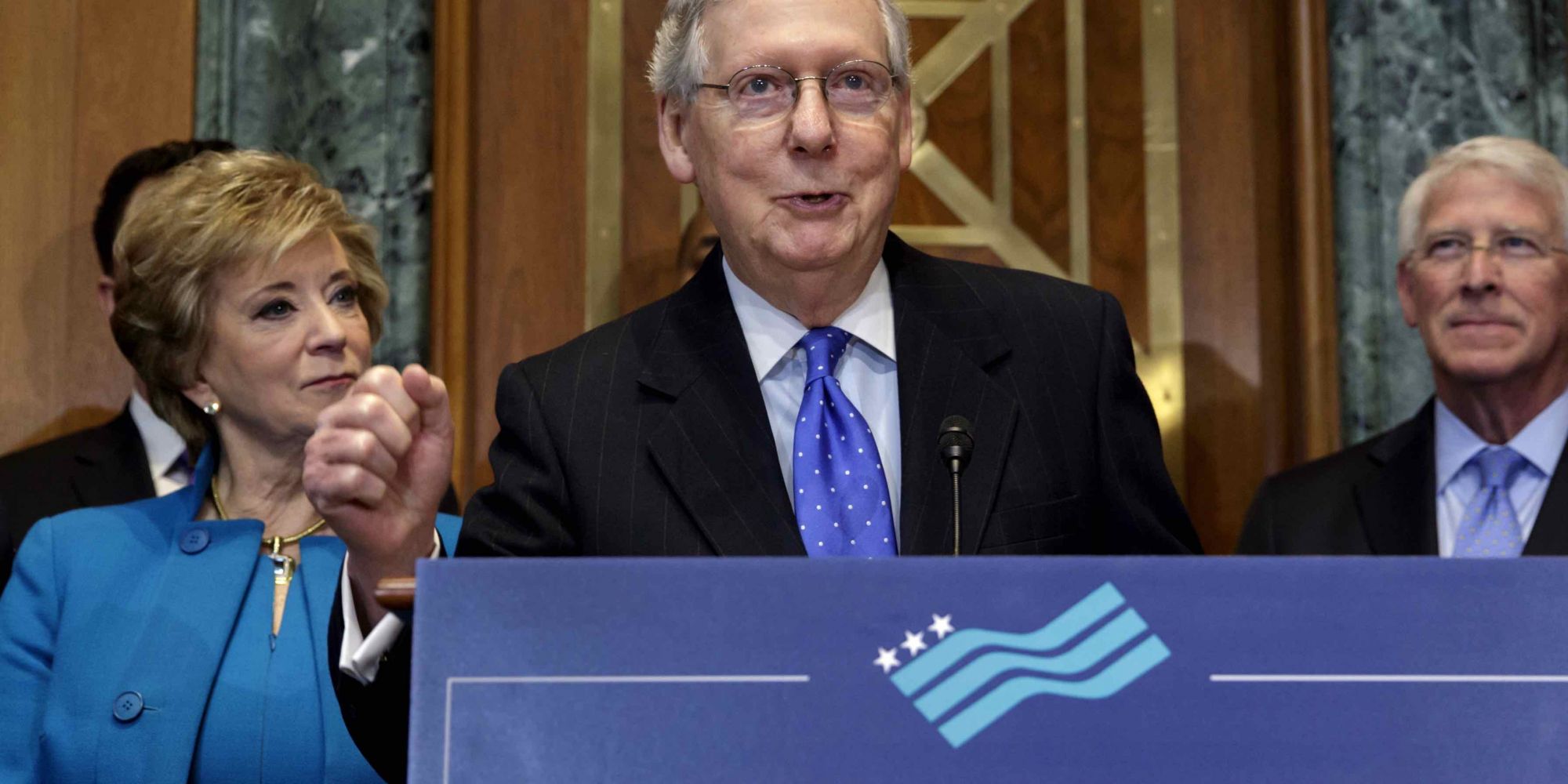

After passage of sweeping $1.5-trillion tax reform legislation in the House and Senate, owners of small businesses are scurrying to their accountants to determine what impacts it will have on their pocketbooks immediately and fortunes long-term.

Signed by President Trump on Friday, the legislation has drawn the support of the U.S. Chamber of Commerce and National Federation of Independent Business, which criticized earlier versions of the tax plan for not doing enough for small businesses. Presuming it jumps through the remaining hoops as anticipated, the tax reform is slated to go into effect next year.

“Once the dust settles, they need to consult with their tax advisors to identify how exactly they will be taxed in their current business structure and whether they should change their business structure,” Gonazol Freixes, adjunct professor and associate dean of the Fully Employed MBA Program at UCLA Anderson School of Management, advises small business owners. “It is helpful for a company to think about how they should incorporate to take advantage of new rates.”

The tax overhaul lowers the corporate income tax rate from 35% to 21% and cuts individual tax rates across the income spectrum, but the most direct bearing on beauty businesses comes from a modification to the deduction available to owners of pass-through businesses. Under the Congress-approved tax regulations, owners will be able to deduct 20% of pass-through income for the first $157,500 of that income for individual filers and $315,000 for joint filers.

In pass-through companies, including sole proprietorships and limited liability companies or LLCs, Freixes details that companies pay zero taxes as income is distributed to the companies’ owners and taxed at individual rates. He says, “If Susan and Betty own a beauty shop together that makes $200,000 in net income, they each have to report $100,000 of income. Susan and Betty will now be able to say, ‘Ok, I made $100,000, I can deduct $20,000, and I will pay regular taxes on $80,000.’”

Freixes continues that the changes to the tax code could influence the relationships small business owners have with the people they hire. “They need to think about the employees or independent contractors working for them. These folks may opt to set up one structure or another,” he says. “Hairdressers in a hair salon that rent stations might be set up as employees, but maybe they should be independent contractors to take advantage of it [the pass-through deduction].”

The Brookings Institute estimates 95% of U.S. businesses are currently classified as pass-through businesses. It underscores that small businesses account for most of the country’s pass-through businesses, but the classification is certainly not limited to small enterprises. In fact, large businesses are responsible for the bulk of pass-through profits.

Eric Allen, assistant professor of accounting at USC Marshall School of Business, figures the federal tax adjustments aren’t likely to have a “huge effect” on most small businesses. The effects of the pass-through deduction could be muted by other elements of the tax reform such as the curtailment of deductions for state and local taxes. Under the legislation, those deductions are capped at $10,000, a limitation that will cost residents in West Coast and Northeastern cities with average deductions for state and local taxes over that amount.

“When we talk about pass-through in this country, the overwhelming majority of that income is going to very wealthy taxpayers through hedge funds and entities like that. Although it sounds like it is going to help small business in America, which is true, it is really going to be helping the very wealthy a lot more, but it incidentally happens to help small businesses as well,” says Allen. He predicts more high-earning freelance workers will form LLCs to capture the pass-through deduction.

Hans Keirstead, a Democrat running for Congress and founder of a skincare brand called Root of Skin, concurs that big companies will be the primary beneficiaries of the taxation shifts. “The GOP tax bill disproportionately favors corporations and the largest pass-through business entities that are disguising themselves as small businesses,” he says, noting that “54% of these small businesses report a household income of less than $100,000 per year…We need to be protecting and supporting the development of small business. This plan does nothing to help small businesses.”

The Chamber of Commerce begs to differ and backed the tax legislation because it holds states will experience job expansion as a result of the tax changes. The business organization, for example, estimates California will add nearly 102,000 jobs and New York almost 58,000 over 10 years. “We applaud each of the representatives who voted today for pro-growth reform that grows the economy and improves the lives of America’s families, workers, and job creators,” says Thomas J. Donohue, president and CEO of the chamber.

Freixes asserts the tax bill could have a modest impact on the broad economy. “There is evidence and even some studies done by independent groups that show business growth overall for both big and small businesses, and the gross domestic product will increase, but not by a lot. The figures I have seen show that, over 10 years, the GDP growth is about 4% and 1% GDP growth is expected in the first year,” he says. “There will definitely be some growth and additional disposable income for some businesses.”