Valuations Slide As The Pace Of Beauty M&A Slows, But Prestige Beauty Shows Resilience

Beauty brand valuations are tumbling from last year’s peak as investors turn a sharper eye to businesses that can effectively navigate economic challenges.

To Nini Zhang, managing director of investment banking at Bank of America, the valuation shifts aren’t surprising. Instead, they’re to be expected in a market she characterizes as in the midst of “rationalization.” “There’s nothing alarming to say the market’s down 10% or 20% because we’re still in line with a 5- to 10-year average,” she said during last Wednesday’s Beauty Independent In Conversation webinar.

For the webinar, Zhang was joined by Larissa Jensen, VP and beauty industry advisor at The NPD Group, and Dimpy Jindal and Alan Wu, associate partner and engagement manager, respectively, at McKinsey & Co. Opinions expressed by Zhang on the webinar are her own and don’t represent Bank of America.

Single-category brands are facing the most headwinds from a valuation perspective. In contrast, brands with balanced product portfolios offering a range of prices for cash-strapped consumers show comparatively resilient valuations, per Zhang. Financial results from the third quarter underpin her thesis.

Shares of haircare-focused Olaplex plunged more than 40% in October as the brand reported professional and direct-to-consumer sales drops. Its market cap has degraded over 70% since its blockbuster IPO offering in September 2021. Meanwhile, E.l.f. Cosmetics, which stretches across mass-market cosmetics and skincare, reported a 33% sales spike despite raising its prices by almost 26%.

Zhang said, “Looking at E.l.f and seeing volumes up as well as price and that consumers continue to buy is a sign to us of that trade-down behavior, not just from prestige and premium beauty but also from masstige as well as mass beauty.”

Beauty Spending

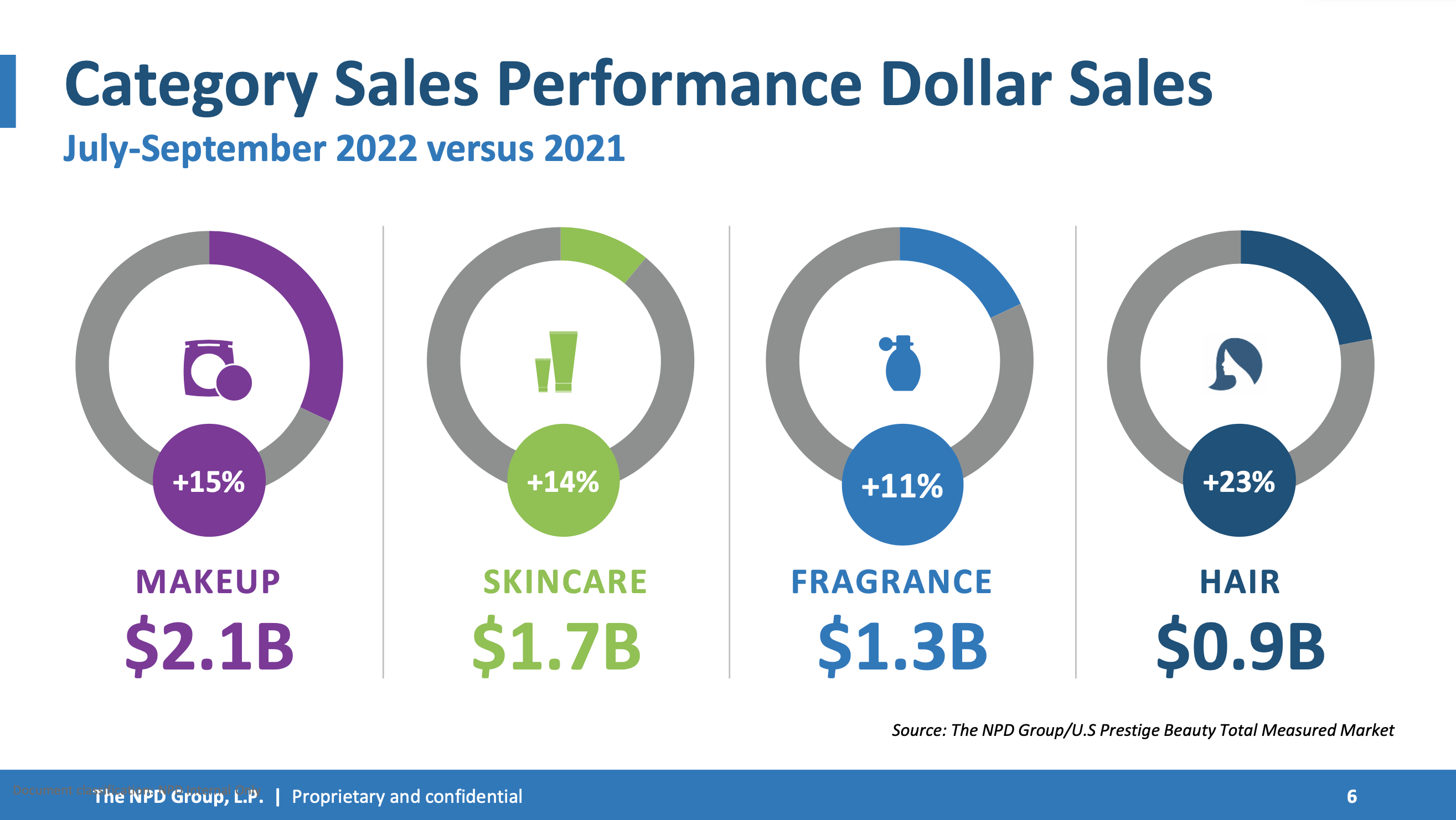

Not all consumers are looking to trade down. Prestige beauty remained generally unaffected by price increases this year, said Jensen. Sales in the category advanced by 15% year-over-year to reach $6 billion in the third quarter. Year to date, prestige beauty sales has jumped 17% from 2021 to $16 billion.

High-income customers were an important contributing factor to prestige beauty’s growth last quarter. “Households with income over a $100,000 a year are spending more than they did before,” said Jensen. “Their increase in spend is offsetting some of the pullback that we’re seeing from lower income consumers.”

Middle- to high-income consumers are driving the majority of discretionary spending in the United States as lower income consumers are hit the hardest by rising prices and inflationary pressures, said Zhang. While consumers’ deposit balances remain well above pre-pandemic levels on the whole, those making under $50,000 a year are starting to show signs of weakened credit with delinquencies up by half a percent. That’s the highest quarter-over-quarter increase since 2015, per Zhang.

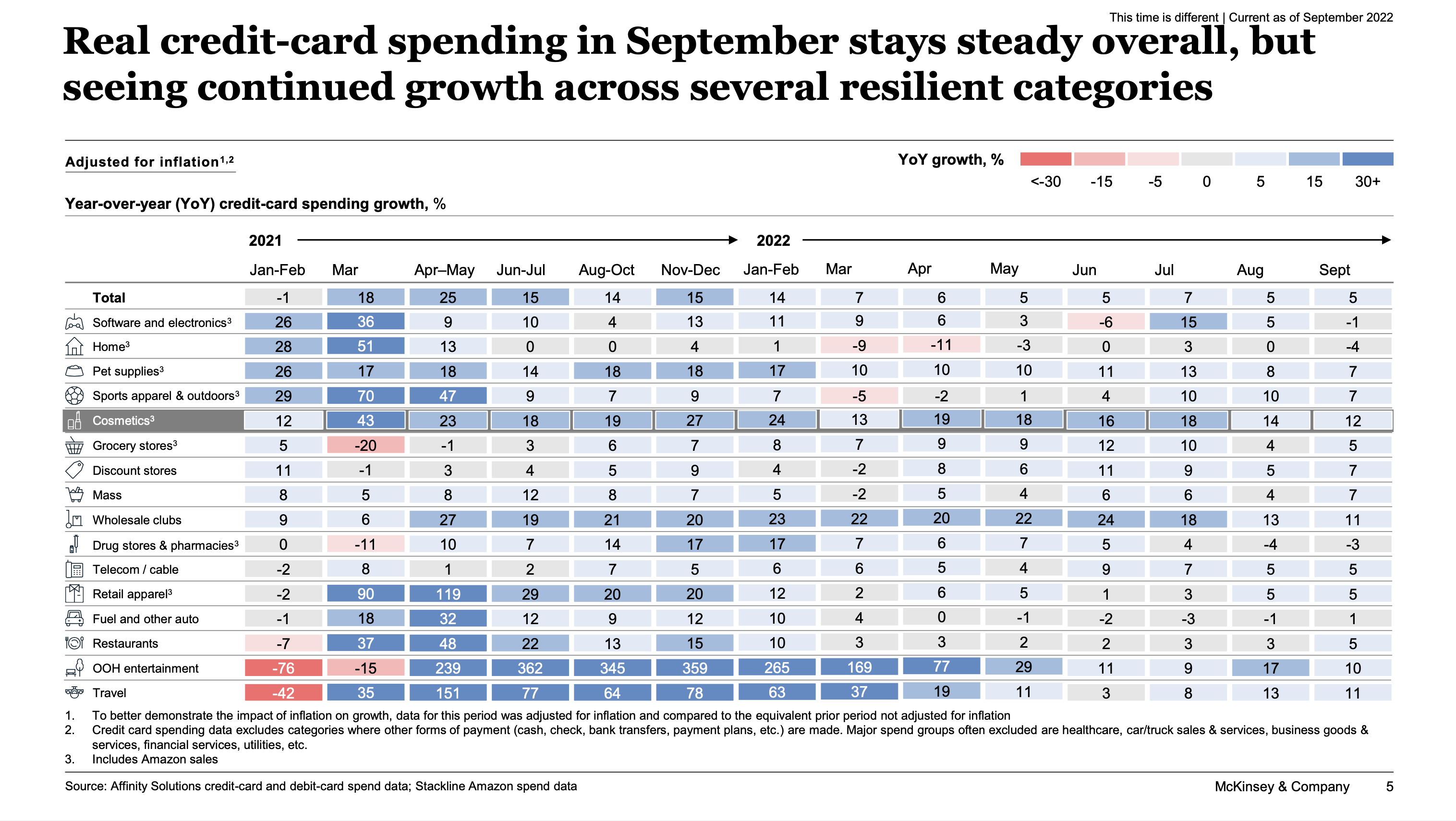

Irrespective of income, monthly credit card spending on beauty has been the most consistently up across consumer categories this year. It grew by 12% in September, the highest increase among sectors that management consultancy McKinsey & Co. monitors, ahead of electronics, pet supplies, restaurants, out-of-home entertainment and travel.

Category Performance

With $2.1 billion in sales racked up during the third quarter, prestige makeup has bounced back from its pre-pandemic doldrums in a big way. Lip products led the charge. Jensen said, “Consumer sentiment has really hit some new lows in 2022. It’s been a rough year, and when consumer sentiment declines, our industry economic indicator kicks in.”

She continued, “Consumers really look for that pick me up when they feel down. Prestige beauty has really been satisfying the need for them so it’s not surprising that the lipstick trend remains strong in quarter three.”

While makeup occupies the biggest share of prestige beauty, haircare was the fastest-growing segment in the third quarter. Haircare sales rose 23% in the quarter from the same period a year ago. Makeup, skincare and fragrance followed haircare in descending order of quarterly growth. Products concentrating their formulas and marketing on “hair health,” and with products such as masks and scalp treatments fueled haircare sales as did brands’ loyal customers.

“There is a loyalty and a willingness to spend in this category that we don’t see in other areas of beauty. About half of hair consumers stick with the brand that they like, and they don’t mind paying more,” said Jensen, who noted that haircare is the only prestige beauty category with a 50/50 split between online and brick-and-mortar sales.

Clinical skincare outpaced natural skincare during the pandemic, and it was responsible for the lion’s share of prestige beauty growth in the third quarter. Forty percent of prestige skincare sales occurred online during the period.

Fragrance slowed in the third quarter, but Jensen pointed out that the fourth quarter is a key period for the category. Some 40% of annual fragrance sales are recorded in the holiday season. As a whole, prestige beauty typically registers a substantial lift in the fourth quarter. NPD predicts strong double-digit growth to end the year, said Jensen.

Consumer Trends

Digitally enabled omnichannel experiences, holistic beauty, sustainability, AI-driven personalization and inclusive beauty are a few of the several consumer trends that McKinsey & Co. tracked in the the third quarter. With the global beauty market for halal beauty projected to reach $100 billion by 2027, Jindal singled it out as an emerging trend the consultancy is watching closely.

Beauty in the metaverse is also on McKinsey’s radar, but brands thinking about it should save their money right now, said Jindal. She explained, “Givenchy launched an NFT last year and sold about 2,000 copies in two seconds, but what that means in terms of return on investment still needs to be figured out.”

Social media helped push demand for injectables and med-spa services in the quarter as millennials increasingly seek aesthetic treatments to combat aging. “The aesthetics category is a smaller category versus the global skincare category, but you’re seeing growth rates in the high single digits to low double digits,” said Zhang. “That’s one and a half times where the overall beauty market is growing.”

Deal Activity

Along with valuations, M&A activity in beauty is declining from last year’s highs as venture capital and private equity firms contend with higher borrowing costs in the challenged financial landscape. Deal-making is happening, but large leveraged buyouts “have fallen off a cliff,” said Zhang, mentioning that brands hoping to go public via SPAC or special purpose acquisition company aren’t seeing traction as the momentum that spurred SPACs particularly last year has cooled.

The gap between what beauty brand sellers are asking for and what buyers are willing to pay has been widening. Active buyers are zeroing in on haircare and fragrance, the latter of which has received amplified consideration following Puig’s purchase of Byredo earlier this year. They’re hunting for brands that are profitable both at the gross margin and the EBITDA (earnings before interest, taxes, depreciation and amortization) levels. Zhang says, “Assets that are not profitable at the EBITDA level at this point are having a more difficult time finding a buyer.”

In the tight market, brands valued at under $50 million are losing cachet with potential buyers unless they have an especially robust growth trajectory or specialized intellectual property or capability. Zhang said, “Do you have a lower cost of acquisition? What are you doing to get that customer in the door or on your website to purchase? And how does that look different from every other brand out there?”

Leave a Reply

You must be logged in to post a comment.