The $900M Elemis Deal: What High Valuations Mean For Indie Beauty Brands

The beauty bull market received another upward jolt earlier this month with the revelation that global beauty giant L’Occitane had acquired British skincare leader Elemis for $900 million.

L’Occitane, which was the first French company to go public in Hong Kong, picked up Elemis from Steiner Leisure and private firm Nemo UK. Reinold Geiger, chairman and CEO of L’Occitane, described the move as “a major step forward in building a group of premium beauty brands. Elemis presents a truly unique opportunity that fits us perfectly in terms of brand ethos, product quality, management capability, as well as growth and profitability trajectory.”

Despite the scale of the deal and companies involved, the deal has relevance for the independent beauty market. Look past the number of zeros, and what’s important to understand for brand founders is the underlying way in which any beauty company is being valued in today’s market. In this article we examine the possible rationale behind this deal to justify a $900 million valuation and what it means for emerging beauty brands.

Just as in the real estate market, which uses “price-per-square foot” as a key metric of valuation, the value of each beauty investment can be viewed through the lens of “multiples of earnings” or “multiples of sales.” For example, if an investor pays $900 million for a business with sales of $450 million and a profit margin (often measured in EBITDA: Earnings Before Interest Tax Depreciation Amortization) of $90 million, the deal achieved a valuation of “2x sales” or “10x earnings”.

Using the “10x earnings” measure, this means that the acquirer would have to wait 10 years just to recoup their investment. Since no one would wait that long, a “10x” valuation means that the acquirer expects profits to grow substantially over the next few years—suggesting a very high-growth opportunity. This is why some deals are also stated as a “multiple of future earnings,” providing a further glimpse of what the buyer believes is the growth potential of the opportunity. Overall, valuation trends tell us how the market perceives the future prospects—and value creation potential—of beauty companies. Deals such as the Elemis acquisition have a trickle-down effect on smaller transactions.

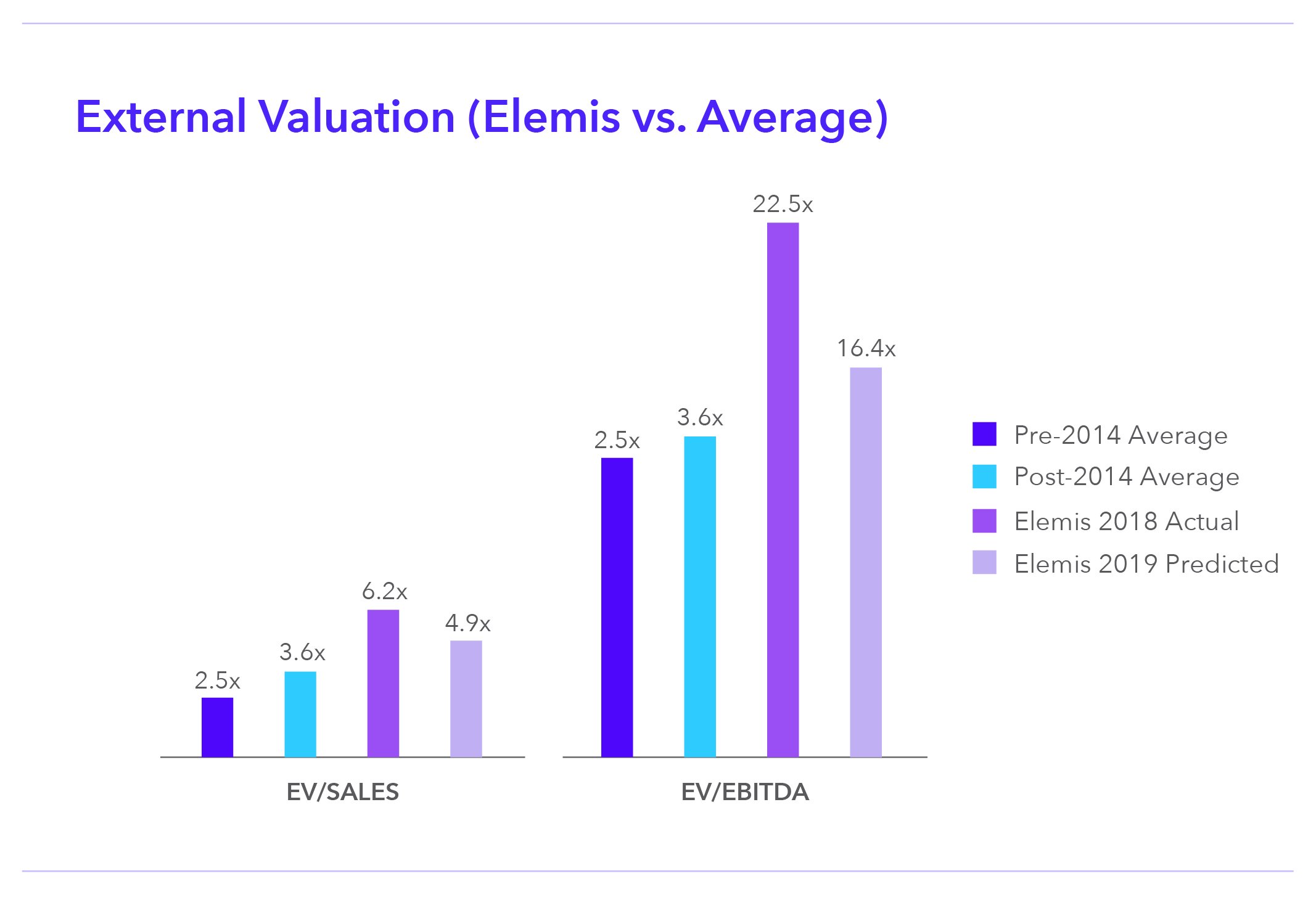

While there are no hard “standards” for multiples—each deal is unique—there are some broad yardsticks. In general, for an established asset, one would expect to see a range of 2x sales or 10x EBITDA (a “generous” valuation). Elemis is anticipated to post earnings before interest, taxes, depreciation and amortization of $55 million on revenue of $185 million for 2019, following results for 2018 of $140 million in revenue with EBITDA of $40 million. This means L’Occitane is valuing Elemis at 4.8x to 6.4x of sales and 16.3x to 22.5x of EBITDA. By any standard, even the frothy measures established in beauty over the past few years, this is a very (very) generous valuation.

“The seller [L Catterton] and their advisors [Jefferies and Nomura] probably took advantage of the fact that there is a dearth of beauty deals of this size on the market today, and that, a motivated buyer, like L’Occitane, would be more aggressive with their valuation,” said Elena DiGiovanni head of Strategy + Corporate Development at Indie Beauty Media Group, Beauty Independent’s parent company. “Even so, almost every future assumption, such as market growth, pricing, competition, commercial synergy, etc., has to turn in their [L’Occitane’s] favor for this multiple to make financial sense.”

The Elemis deal, with its high multiples, pushes the limits for beauty and reflects an extremely optimistic view of the future. The logic behind it is that L’Occitane can greatly accelerate Elemis’ earnings by plugging it in to its existing infrastructure. L’Occitane distributes to 3,285 retail outlets, including 1,555 that are under its control, in 90 countries and has 8,500 employees.

Within the beauty investment community, the purchase has turned heads. “The price is at the high end of comparable transactions,” said Rich Gersten, Partner at Tengram Capital. “It must be strategically important to them and there may be synergies to average down that multiple that are not readily apparent.” Ashleigh Barker, Vice President at independent investment bank Michael Dyens & Co., concurred, and pointed to the Asian market, the brand’s upcoming launch into Tmall, and “the plus-30% top line growth and improving EBITDA” as increasing the desirability of Elemis.

L’Occitane outbid other strategic players after investment group L Catterton, the consumer-focused investment firm that bought Steiner Leisure in 2015, put Elemis on the market late last year. Fueled by the financial support of L Catterton, Elemis grew quickly in the United Kingdom and expanded its presence in the United States through the introduction of Superfood, a line aimed at millennials. According to Geiger, “Elemis has enormous growth potential in untouched markets and channels, particularly in Asia Pacific where we have strong presence.”

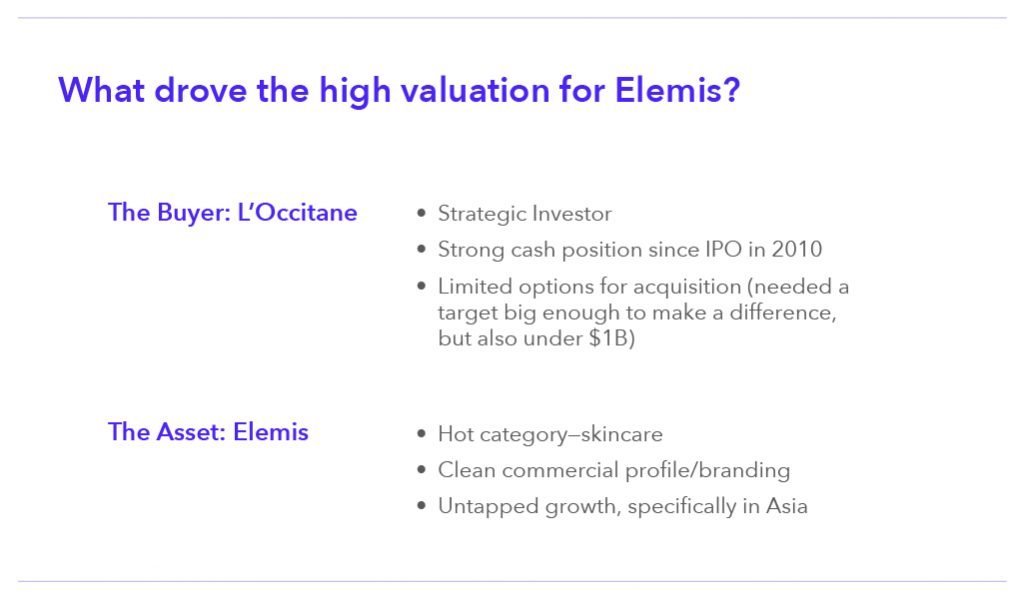

Like most deals that reflect a premium, both sides of the equation were primed. L’Occitane, which will finance the deal through bank loans and cash, reported revenue of $1.5 billion in net sales and EBITDA north of $160 million for 2018. In the investment community, L’Occitane is considered a strategic buyer like L’Oreal or Proctor & Gamble, one of a handful of multinational conglomerates at the top of the beauty food chain—i.e they don’t buy assets with the intention of selling them to someone else higher up the chain.

Strategics have the most cash and currently are operating in a competitive landscapes: brands with revenues of more than $100 million annually, which are the most attractive purchases for Strategics, are hitting the market with increasing rarity. “There is a scarcity of sizeable brands so that [scarcity] commands a premium value,” said Gersten.

For a large Strategic, acquisition targets need to be big enough to make a noticeable impact to the performance of their portfolio without costing over a billion. Deploying capital and increasing its value through investments (rather than sitting on it with low returns) is a large factor in the motivations of a purchaser. In this case, L’Occitane which had gone public on the Hong Kong Exchange in 2010 and is now valued at over $2.5 billion, was in need of a good growth vehicle.

The larger investment climate is also a factor. “From P&G’s purchase of prestige natural skincare brand Snowberry to L’Oreal’s acquisition of South Korean lifestyle and beauty brand Nanda,” said Anagha Hanumante, senior intelligence analysts at CB Insights, “the major players are tapping into the premium space, Asia’s beauty markets, and cleaner products.” As Richard Kestenbaum, Partner at Triangle Capital LLC (a mergers and acquisitions firm for consumer-facing businesses such as beauty) told Beauty Independent, “We have seen this before. There is excitement in a market because of the growth and prices get bid up.”

Skincare is a ‘hot’ category and many investors see assets in this class as very desirable right now, allowing them to pay higher multiples. “Consumers are now investing more in skincare and haircare as they have historically done with cosmetics, approaching skincare and haircare as part of their every day wellness routine that similarly requires maintenance and investment,” said CircleUp Growth Partners’ Managing Director Alison Ryu.

The commercial profile is another significant consideration. In this case, Elemis has a clean commercial profile—good branding, good distribution and no apparent management drama or bad public relations. The growth potential weighs in as well. Elemis has lots of room to grow geographically, specifically in Asia. These factors impacted Elemis’ valuation.

Even so, there is a reason to be cautious. “This is an expensive deal, even for L’Occitane. To finance it, they have used up a lot of cash and then had to take on debt. In other words, they have burned a lot of fuel to get this opportunity airborne. But that is just the beginning of the journey,” added DiGiovanni. “Like any asset, for Elemis to grow, it will need further infusion of capital and resources. The question now is: Has L’Occitane left enough fuel in the tank for this opportunity to reach its desired destination—especially in case of unforeseen turbulence.”

Even so, there is a reason to be cautious. “This is an expensive deal, even for L’Occitane. To finance it, they have used up a lot of cash and then had to take on debt. In other words, they have burned a lot of fuel to get this opportunity airborne. But that is just the beginning of the journey,” added DiGiovanni. “Like any asset, for Elemis to grow, it will need further infusion of capital and resources. The question now is: Has L’Occitane left enough fuel in the tank for this opportunity to reach its desired destination—especially in case of unforeseen turbulence.”

So, what does this deal mean to an indie brands? Directly, not much. Indirectly, it’s important. For now, the Elemis transaction establishes a public reference point for valuation and sends a message to mid-level investors that lucrative “exits” to strategics are still possible. “The deal will continue to show that PE investors can realize attractive returns in this category,” said Gersten. The Elemis deal reinforces the confidence for private equity and venture capital firms to invest in beauty—including indie brands. More noise and investment at the top of the market means more opportunity for emerging brands and investors looking for that next big thing in beauty.

Leave a Reply

You must be logged in to post a comment.