Beauty Brands’ Procurement Problem

Founder Lin Chen started fulfilling orders for skin and body care brand Pink Moon from her one-bedroom New York City apartment in 2020, but a year into the business it was clear she should outsource the work to a third-party logistics provider. After she chose a fast-growing one focused mainly on food, beverage and home, the quality of its service deteriorated fast.

“We were paying for their growth: increased fees, surprise costs, constant mistakes, lack of transparency,” says Chen. “We were noticing mistakes here and there that I know beauty industry experts would not make. I needed somewhere more bespoke and where the team is familiar with beauty brands’ standards.”

The beauty industry’s acceleration and steep margins have been enticing entrants, including brands, suppliers and investors. Revenues in the global beauty and personal care market are forecasted to reach $646 billion in 2024 and progress at least at a compound annual growth rate of 3.33% over the next four years, according to data insights resource Statista Market Insights.

However, the influx of providers isn’t necessarily making it easier for emerging and scaling brands to find partners. As competition rises, sustainability demands soar and the industry fragments worldwide, strong procurement programs across the entire beauty supply chain have become increasingly critical.

“We are in the midst of a profound tectonic shift in our industry,” says Nader Naeymi-Rad, publisher of Beauty Independent and founder of its parent company IBMG. “Since just before the pandemic, many of the factors that had previously helped young brands get an inside track such as the proliferation of beauty retailing, which boosted the demand for new brands, and DTC, which lowered the cost of customer acquisition, have either diminished or turned into a growth barrier. DTC costs have skyrocketed, and beauty retailers have consolidated.”

While it’s tricky for emerging and scaling brands, the new phase opens up avenues of possibility for brands. Naeymi-Rad says, “There is clearly still so much opportunity out there, whether in terms of unmet consumer needs or categories ripe for innovation, and the only way large strategics seem to be able to access these opportunities is by acquiring young brands.”

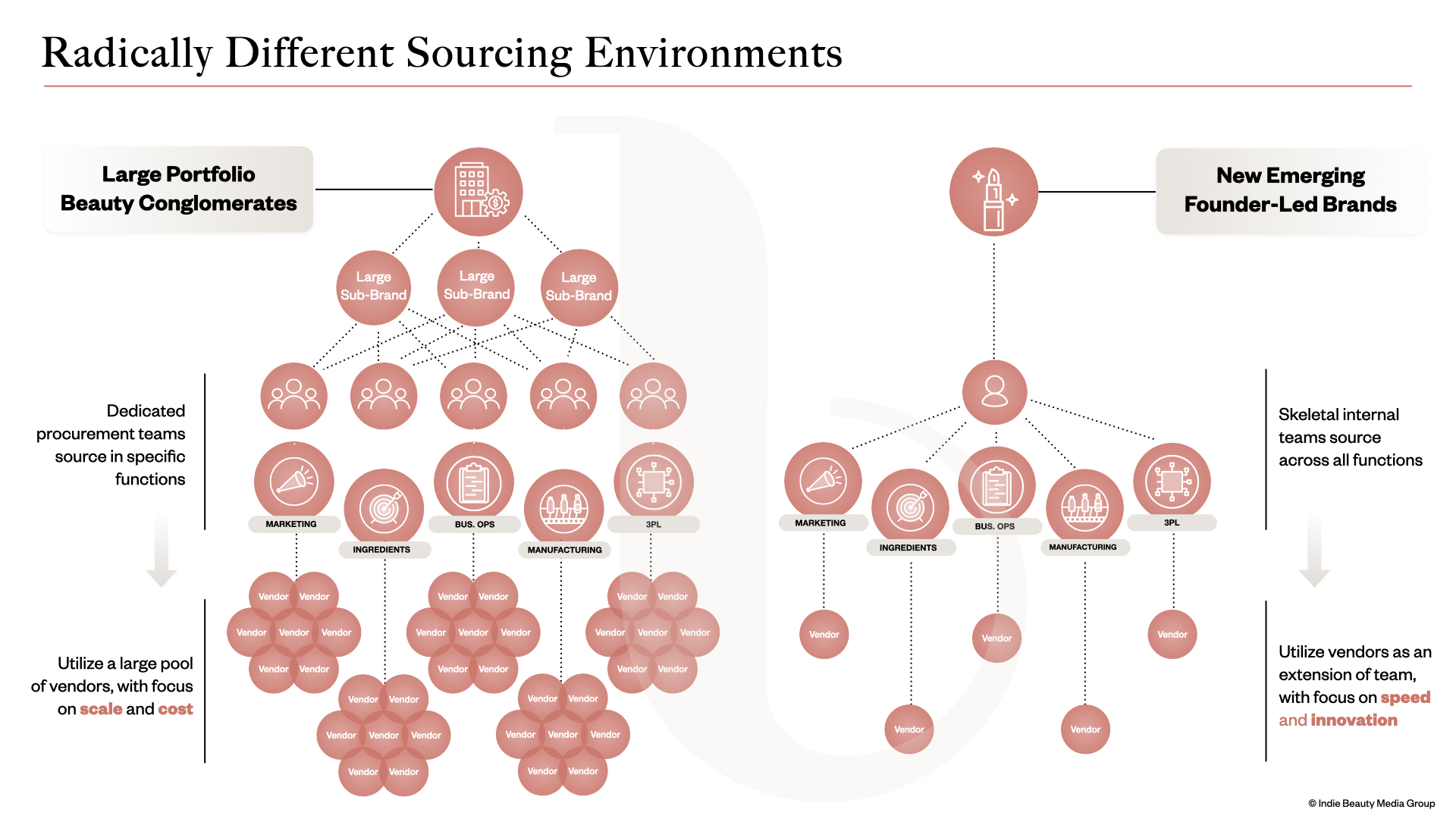

While conglomerates have procurement departments dedicated to identifying, sourcing and vetting vendors, frequently specialized by function and geography, emerging brands don’t have their resources. Maree Glading, founder of clean teen skincare line Evre, chimes in, “As the category grows, contract manufacturers and ingredient suppliers can be more selective, often prioritizing larger volume clients. This makes it harder for smaller or emerging brands to find the right fit. It can sometimes feel like a bit of a chicken-and-egg situation. Many co-manufacturers want to see volume forecasts before committing, but you can’t provide those forecasts without having a product to offer retailers.”

Millie Kendall OBE, CEO of the British Beauty Council and co-founder of the now-discontinued makeup brand Ruby & Millie, adds, “It’s really difficult because the needs of the brand are going to change throughout the journey of the brand. At the beginning, you might go to turnkey suppliers where they do it all for you, and as your brand develops, you might want to break those things apart.”

Guidance can be pivotal in connecting emerging beauty brands to the right vendors. Naeymi-Rad, whose company produces the trade show Uplink Expo, a cross-functional trade show designed to connect beauty professionals with best-in-class suppliers, retailers and investors in beauty and wellness, suggests trade shows are generally inefficient vehicles to meet vendors because they present a host of them that tend to not work with emerging brands. He says, “It can be a water, water everywhere and not a drop to drink situation.”

It isn’t much better, however, for a brand to conduct an online search or scan their inbox. “I get email pitches almost daily from various 3PLs, contract manufacturers, etc.,” says Chen. “It is hard to discern who is legit and who is out to scam or not up to our standards.”

How to Find The Best Partners

For beauty entrepreneurs, taking recommendations from fellow beauty entrepreneurs is the easiest way to vet potential providers. Chen found Pink Moon’s current 3PL provider MicroBeauté through a fellow beauty founder and made the switch in March. “It has honestly been a company savior thus far,” she says. “No products have broken in transit, customers are receiving prettier packages and more securely packed, as beauty products should be, and we are spending less time solving logistics issues.”

However, not everyone has a network to call on to source vendors. In 2023, Mark Menning was ready to press go on manufacturing his skincare brand MARK Los Angeles, but manufacturers told him the lead time would be nine months and required minimum order quantities (MOQs) out of his budget. “It was extremely costly in time and money,” he says. “You can’t get that time back.”

Menning went to Uplink Expo in Los Angeles last year and discovered it was beneficial for sourcing partners for a small brand. He says, “We walked the expo and found several competent suppliers. That’s thanks to Uplink’s vetting process.” Uplink Expo’s next edition is happening June 20 in New York, and suppliers such as International Products Group (IPG), Merit Manufacturing, Cosmetics Solutions, ABA Packaging, On Air Direct and Dewolf Chemical will be exhibiting along with 50-plus emerging brands.

A bigger brand, Tengram Capital Partners-owned RéVive Skincare has a sourcing team and is constantly reviewing and meeting with vendors across the entire supply chain. CEO Elana Drell Szyfer says, “We do set a high bar to work with us, which includes meeting our minimum runs and our cost targets, timelines, meeting our product quality expectations and high degree of sophistication in working with active ingredients that are globally.”

Drell Szyfer figures the best partners are typically locate through referrals, but RéVive attends trade shows selectively. “The ones that are most relevant are related to technology advancements,” she says. “We have worked with all current partners long enough that we can see their innovation across packaging and formulas without being at a trade show. That said, attending a show may allow you to be exposed to new vendors and opportunities.”

International Products Group (IPG) co-founder and CEO Bob Goehrke likens finding the right formulation and manufacturing partner to online dating. “Often, the slick photo or website is not an accurate representation of the potential partner,” he says. “The key to finding the right partner is peeling back the onion and really getting to know the personality and philosophy to see if there is a meaningful and long-lasting connection based on a shared vision.”

IPG wanted to exhibit and sponsor Uplink Expo because the company is focused on partnering with founder-led brands. It has Fortune 500 brands on its client roster, but Goehrke believes IPG can offer the greatest value as a turnkey partner to these emerging brands. He says, “While there are some risks focusing on this end of the market—lack of investment, distribution and resources by the new brand—the rewards are phenomenal when IPG can help our customer get to the ‘promised land.'”

Goehrke notes that, while growth in beauty is being fueled by founder-led brands, many manufacturers serve high-volume players. “The issue and opportunity are exacerbated as the beauty market becomes increasingly bifurcated,” he says. “Like finding the right life partner, finding the right commercialization partner is perhaps the most important decision one can make when building a brand.”

Goehrke emphasizes that solid supplier-brand relationships rely on open communication, long-term perspectives, innovation and shared values. He says brands and providers should be discussing questions such as, “Are the potential customers and vendor speaking the same language when it comes to innovation, nimbleness, MOQs and cash-flow management? Are transparency, confidentiality, exclusivity and intellectual property extremely important to them? And, most importantly, does the vendor partner exude enthusiasm and passion which is paramount for any influencer/founder-led/startup brand to succeed?”

Menning advises founders to pay special attention to contract negotiations at the beginning of a relationship. “If it’s painful and inflexible during negotiations, you can only imagine how the working relationship will pan out,” he says. “It’s always been a great indicator for me.”

The pain points of scale

Global expansion can present difficulties for brands’ supply chain. Theresa Callaghan, CEO and owner of cosmetic claims consultancy Callaghan Consulting International, says, “Without doubt, the beauty industry has become an increasingly globalized ‘machine,’ with brands sourcing ingredients and manufacturing services from around the world. This globalization has led to a fragmented supply chain, making it more challenging for brands to identify and vet potential partners who meet their quality, ethical and sustainability standards.”

When Ruby & Millie launched into the United States, the brand was interested in partnering with American manufacturers, but most couldn’t swing the brand’s existing designs and formulas, and turnkey suppliers weren’t up to snuff in terms of quality. Kendall says, “I had an eye and lip pen made by Mitsubishi, for example, so I didn’t want the knockoff version, I wanted the actual version.”

Globalization is tough for suppliers as well as brands. “Beauty ingredient and packaging suppliers face various challenges when working with a diverse range of brands, including customization, scalability, cost-effectiveness, innovation, regulatory compliance, supply chain management, relationship management, and sustainability,” says Callaghan. “Successfully addressing these challenges requires suppliers to be adaptable, proactive and customer-focused while maintaining a commitment to quality, innovation and sustainability.”

Leave a Reply

You must be logged in to post a comment.