The Building Blocks Of Acne Product Development, According To Experts

One out of three people typically experience acne, a figure Manon Pilon, founder of Derme&Co., suggested during Beauty Independent’s Spotlight webinar last Friday sponsored by Europelab might be closer to one out of two during the pandemic, and some 600 million people worldwide develop it.

Treatment for the condition has come a long way since Pilon began in skincare four decades ago. “Today, we have so much more opportunity in treating acne in a healthier way,” she said. “We can basically change people’s lives.” And while the acne product space is definitely crowded, she noted there’s always room for acne product development, especially given the breadth of the population that has acne.

Pilon was joined on the webinar by Joyce B. Farah, dermatologist and founder of Farah Dermatology & Cosmetics, and Sara Turchetta, VP of Europelab. The trio delved into the physiology of acne, the differences between cosmetic-grade and medical-grade products, and what brands should include in an acne product line. Below, we recap key points from their conversation.

Acne 101

Acne is a complex condition. In order to cater to the enormous swath of people with it, it’s critical to understand what acne is, how it develops and its stages. Pilon described acne as a “chronic inflammatory skin disorder” visible in blackheads, whiteheads or pimples. It’s a condition anyone can suffer from, regardless of skin color or age.

Pilon said, “Of course, we see acne a lot more during puberty time due to an increase of sebaceous glands.” People with a genetic predisposition to acne tend to develop it more, too, but, for the most part, acne is universal—and it doesn’t only stick to the face. It’s most common on the face, but forms of acne can pop up on the back and shoulder areas, and beyond them.

Acne generally occurs from the occlusion of sebum produced by the skin that happen as a result of dead cells and excess oil, among various factors. When blockage happens, bacteria proliferates and inflammation can take place. Pilon outlined that there are a range of grades of acne, starting from grade one (whiteheads and blackheads) to grade five (nodules and cysts).

On top of blockage courtesy of dead cells and excess oil production, which can be prompted by stress or compounds like retinoids or detergents, acne can be triggered by imbalanced pH levels, heat or sweat, and lifestyle or dietary habits. Pilon said, “When you understand the physiology of the skin and how the entire systems work, you can actually address that instead of just killing and stripping all bacteria, and then have to deal with the rebuilding of the immunity of the skin.”

Acne Products

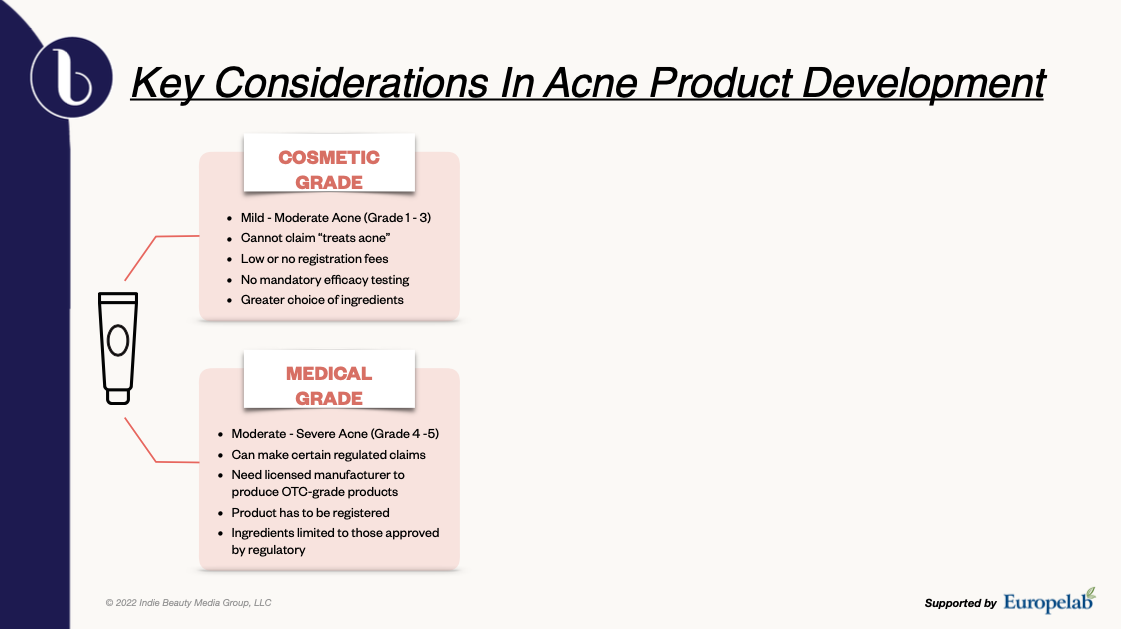

Before delving into the acne product development process, Turchetta highlighted two buckets of acne products and the disparities between them. She said cosmetic-grade skincare generally addresses grades one through three of acne, which are the most common, and medical-grade skincare addresses more severe acne falling under grades four and five.

She explained, “We have to understand what the brand’s intent is, what they want to achieve, what their goals are and what’s important for them to basically communicate to their target audience and that will allow us to determine whether we do a cosmetic-grade solution product line or medical grade.”

There are advantages and disadvantages to the two types of products. Beauty brands largely play in the cosmetic-grade skincare arena because, depending on the country, Turchetta said there are low registration fees, a substantial pool of ingredients to choose from and no mandatory efficacy testing requirement. A disadvantage is that brands aren’t able to make hard claims with cosmetic-grade skincare.

“You can’t say that it treats acne or that it’s an anti-acne solution, but you can say things like it minimizes the appearance of blemishes,” said Turchetta. If a cosmetic-grade skincare brand makes a medical claim, they risk being fined and having their products removed from shelves. Turchetta remarked, “It also just brings such shame to your brand.”

Companies with medical-grade skincare can make certain regulated claims. However, Turchetta said to keep in mind that the medical-grade skincare route obligates companies to find a manufacturer licensed to produce over-the-counter products. Additionally, the ingredient pool is smaller, it can take longer to bring products to market, and Turchetta estimated the development costs can be triple the development costs of cosmetic-grade skincare.

The Development Process

After determining what product category to play in, brand founders opt to go with stock, ready-to-market formulas or create custom products. Turchetta is a fan of the former. “[Stock formulas] have been tested, they’ve undergone all the requirements,” she said. “You’re also piggybacking on all of the R&D that a manufacturer has done over the years, and you have the ability to choose from a vast existing library of formulas depending, of course, on the supplier [and] select exactly what you want to launch in terms of products. So, this already limits and reduces your investment and development time.”

A drawback of stock formulas is that the intellectual property underpinning them belongs to the manufacturer. Still, Turchetta said, “There are supplier agreements that could be put into place to protect the needs of both parties.” Turchetta continued that brands often believe there isn’t a competitive advantage with stock formulas, but they can realize competitive advantages by selecting unique packaging to stand out on the shelves and crafting relevant marketing messages.

For brands with huge budgets selling to major retailers like Ulta Beauty, Turchetta said perhaps custom formulas are the right path, but for brands with constrained resources simply interested in putting out decent products and sparking sales, stock formulas are a very viable path. “There’s so much competition out there that you want to be able to lay the groundwork to ensure and set yourself up for success,” said Turchetta. “So, trying to reinvent the wheel, sometimes, it’s not the right approach. When it comes to risk analysis, I always think starting with an in-stock formula is much more secure and then, once you grow and increase sales, you can reinvest into developing more customized formulations.”

Whether brands opt for the stock or custom path, Farah emphasized ingredient quality is paramount. She honed in on quality in developing products for her line. “We wanted to make sure, wherever we were getting our products from, the source [of the] ingredients was the best quality that we could get, which ties into the efficacy of the product,” said Farah. “If you have a good quality product, you are going to have the end result that you need versus something that’s substandard.”

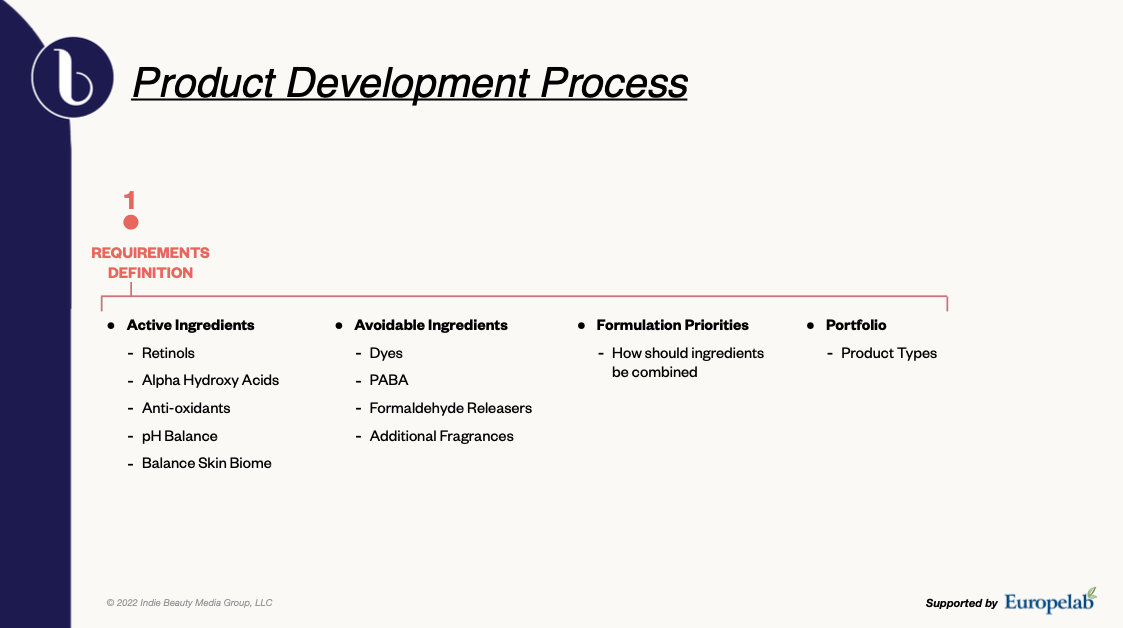

Pilon shared that a few of her favorite ingredients are birch bark and polyhydroxy acids to remove dead skin, salicylic acid and thyme to attack pathogens, chicory to restore pH balance, tea tree oil to remove excess sebum, and essential fatty acids like grapeseed oil to hydrate. Farah identified AHAs, antioxidants and retinol as valuable active ingredients. She avoids dyes, synthetic fragrances and formaldehyde releasers in her products.

“You want to keep everything balanced with the effect that you want without causing too much irritation,” said Farah. Turchetta said, “You want to ensure that the integrity of the skin is at the forefront of formulation design. You want to design a well-balanced formulation that will work synergistically to promote the most desirable outcome.”

For emerging brands, Farah underscored an essential aspect of the development process is obtaining a reliable manufacturer with proven experience and a willingness to partner with smaller clients. She turned to Derme&Co. for her line. “It was important that the manufacturer would be based in North America for two reasons. First, the regulations here are a little more stringent, and we are aware of them and we’re comfortable with them and we have easy access to the manufacturer. Another very important consideration for us was the carbon footprint of what we are doing,” said Farah. “If we have to ship things across the world, that’s a much higher carbon footprint than if we have to do it a little bit more locally.”

The Assortment

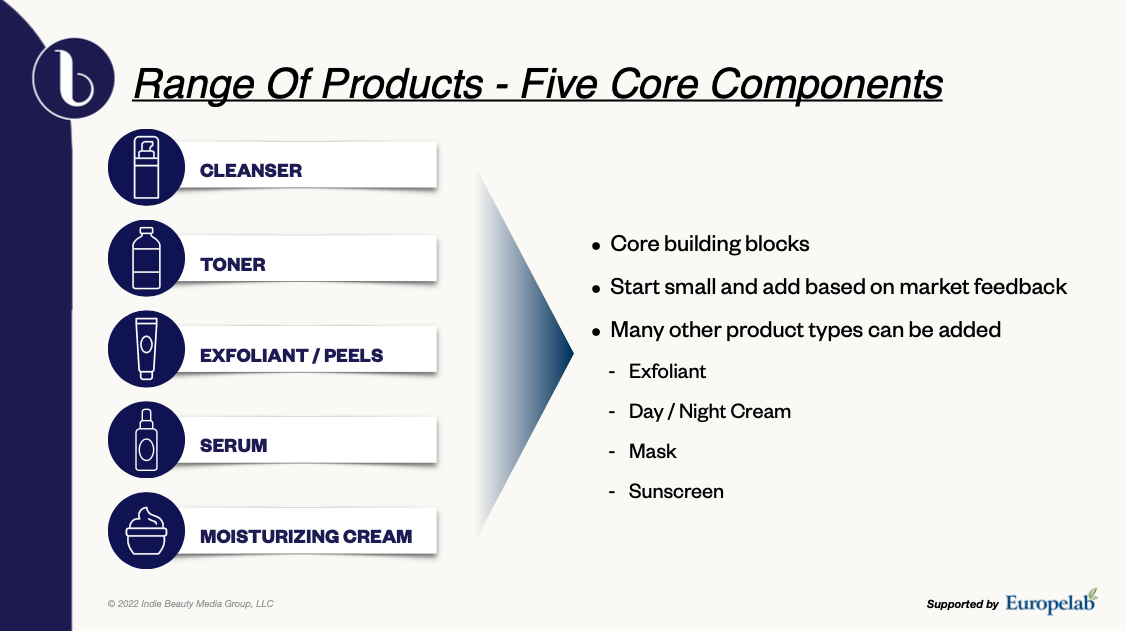

When brands assemble their initial product lineup, Farah and Turchetta advised releasing more than a single product, but not ballooning the assortment. Turchetta highlighted five core elements of an acne product lineup: cleansing, toning, exfoliating, treating and hydrating. “You can’t think of developing just one hero product that’s going to give you this miracle solution,” she said. “You have to select well-crafted products that will integrate both short-term and long-term results.”

When it comes to cleansers, it’s imperative to stay away from harsh surfactants that can strip the skin and, for moisturizers, Turchetta recommended brands steer clear of heavy textures. She has a preference for lightweight formats like gels. While toners may be disregarded by many, Turchetta is an advocate of them for acne, but stressed they shouldn’t have drying ingredients such as alcohol.

“Water is alkaline, usually coming in at 7.0 pH, and you want to keep skin at its healthy 5.5 level. You do that with toners,” she said. “They provide balance and hydration, and remove any kind of superficial debris that’s left after cleansing. They also have a capability of allowing absorption of active ingredients much deeper into the skin.”

At a minimum, Farah always counsels her patients to use a cleanser and a toner. In her product line, she also added a zinc- and titanium-based sunscreen. Farah said, “I think it’s best to start small [with a product line] and to grow as you see how it develops because you will make mistakes, and there’s always room to learn and to expand.”

Leave a Reply

You must be logged in to post a comment.