After $7M Raise, AI-Powered Drivepoint Is Helping Beauty Brands Do More With Smaller Finance Teams

Drivepoint, an artificial intelligence-powered financial planning software company that pocketed $7 million in series A funding in August, is now targeting beauty and personal care companies generating in excess of $100 million in annual sales as it accelerates its pipeline of demand planning tools.

Geologie, Love Wellness, Salt & Stone, Mad Rabbit, Violette_FR and DIBS Beauty are a few of Drivepoint’s current beauty and wellness clients, and its roster generally consists of brands with between $10 million and $100 million in annual sales employing a single full-time financial professional. Beauty and personal care accounts for a quarter to a third of its brand roster, with food and beverage the leading category. Acne brand Curology, apparel brand True Classic and drinkware brand Simple Modern are its largest clients by revenue.

“As soon as you have a sales plan and a finance plan, you need to translate that into, how much of which SKUs and what units do I need to order, etc.,” says Austin Gardner-Smith, co-founder and CEO of Drivepoint. “That transition from dollars forecasting to unit forecasting is another big piece that we’re really focused on building.”

Drivepoint’s series A funding round was led by Vocap Partners, with previous investors Bling Capital, which counts Beautylish, Lyft, Square, Airtable and Instacart in its portfolio, Vinyl VC and Las Olas Venture Capital returning for the round. Good Friends VC, an investment firm founded by the creators of Allbirds, Harry’s and Warby Parker, participated, too. Drivepoint raised about $8 million over three previous rounds, including a $2 million round in 2024.

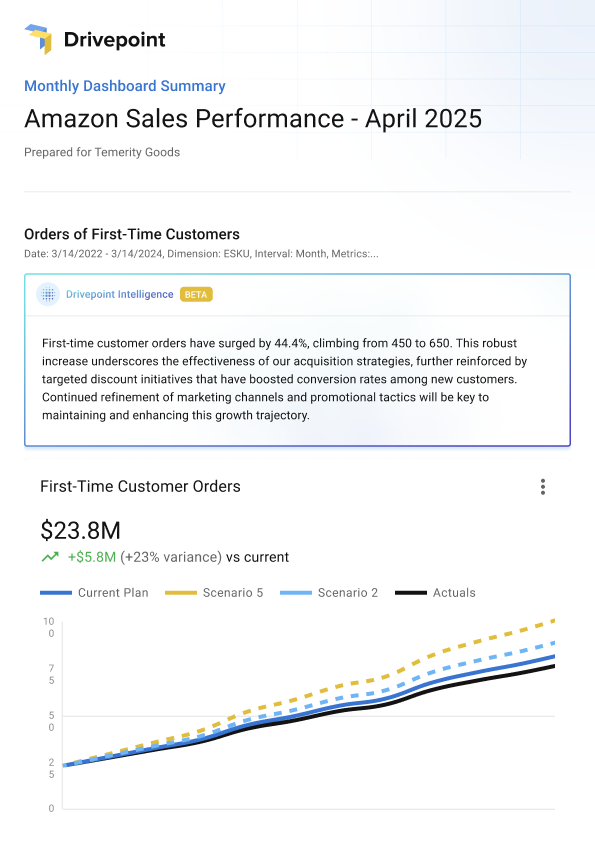

Drivepoint’s software integrates sales and financial data workflows into one hub across channels, a valuable asset for brands scaling in a highly fragmented retail landscape. Amazon and TikTok Shop connectors are available for integration, for example. Gardner-Smith says brands typically seek out Drivepoint to create financial forecasts and track variants against them, a service that can cost brands upwards of $10,000 to $15,000 a month if they hire a fractional CFO.

“People are mostly doing this with what I call Excel and duct tape still. There’s no system,” says Gardner-Smith. “So, you’re forced as a founder either to build it yourself or hire somebody that you may or may not totally trust. It’s very easy to feel like it’s sort of getting away from you.”

Drivepoint launched in 2021 as a lending platform, but pivoted to financial software a year later after realizing that most founders struggled with finance. Today, it estimates its software typically saves brands about $200,000 a year or the cost of a full-time finance employee, and it boosts earnings before interest, taxes, depreciation and amortization (EBITDA) margins by six to seven points in the first year. Gardner-Smith says Drivepoint has been able to forecast Curology’s returning customer revenue with a 99% accuracy rate.

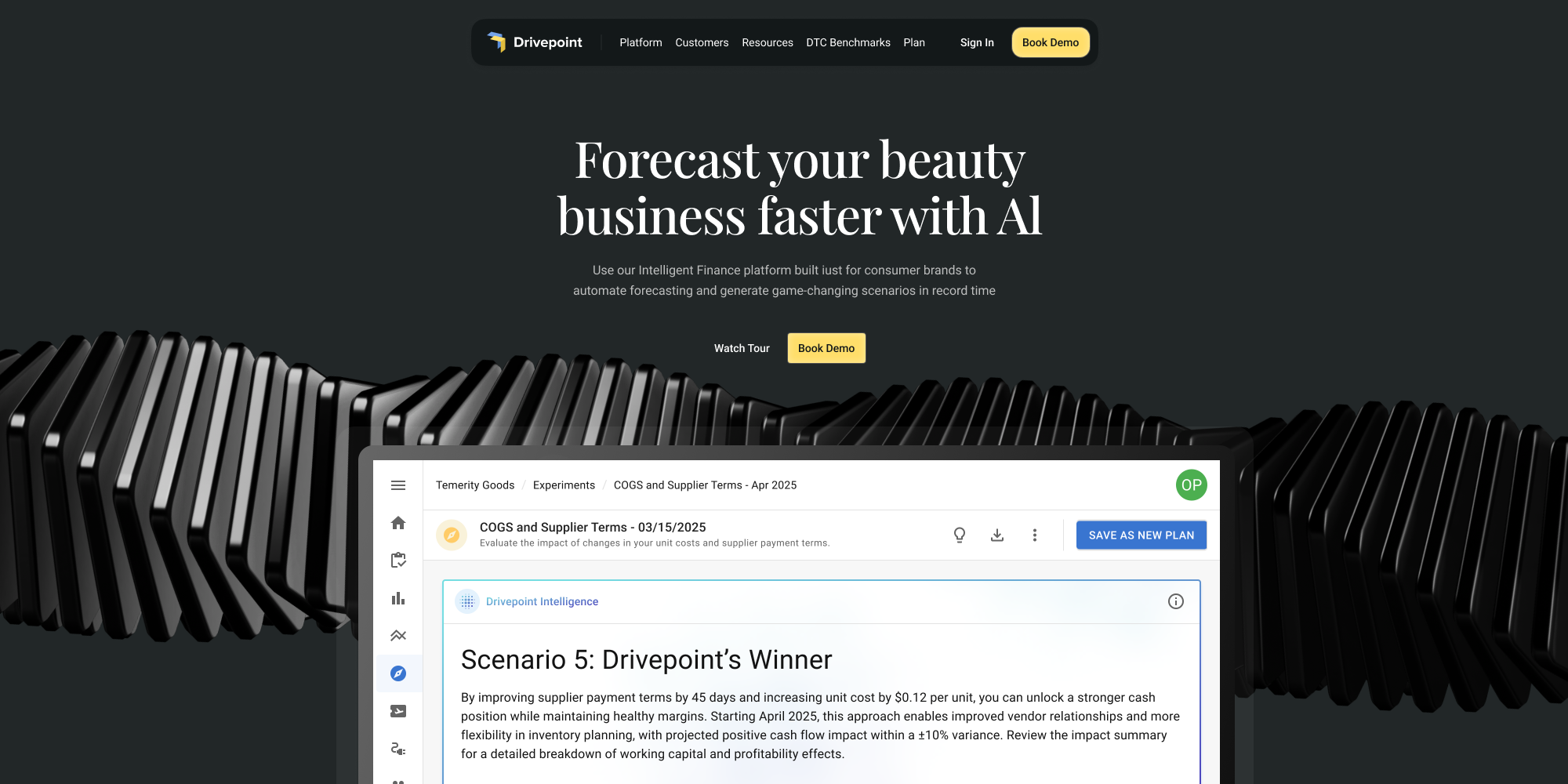

Helping companies answer key financial questions about their businesses through AI scenario planning tools is another important aspect of Drivepoint. Common questions from beauty brands tend to be around the effects of retail expansion and implementing direct-to-consumer subscription models. For brand operators struggling with financial planning, Drivepoint provides tools that can model best-case scenarios as guidance.

Gardner-Smith says, ”When you get into that habit of putting dollars next to these decisions, you make better decisions as a management team and the business grows faster and gets more profitable.”

With advancements in AI software ramping up, Gardner-Smith figures that multimillion-dollar beauty brands will have leaner finance teams in the future. “By the time you got to $100 million five years ago, you would’ve had a finance team of five or six,” he says. “I think increasingly you’re going to be able to run these businesses up through $200 to $300 to $400 million worth of revenue with one or two finance people and some really great tooling and technology.”

The company doesn’t offer full-fledged fractional CFO services, but customers can access financial planning analysts on staff at Drivepoint. Gardner-Smith says most clients meet with their Drivepoint analysts monthly while others tap analysts for big board meetings or budgeting. Consultations are available at no extra cost. Additional services from analysts can be purchased as credits either in bulk or on subscription.

Customers initially sign up for Drivepoint for a year and then renew for a two-year contract with broader services. Gardner-Smith says client retention at the company is high, with a net revenue retention rate coming in at over 100%. As large language models like ChatGPT continue to siphon traffic from Google, Gardner-Smith emphasizes, “You’re going to see a whole other wave of investment that needs to be made.”