Beauty Brands Go Big For Amazon Prime Day With Record Discounts

Beauty brands are going all in on Amazon Prime Day this week, offering deeper discounts than ever as they seek to combat tariff pressures that have squeezed their bottom lines and a deceleration in the beauty industry’s sales growth.

To take advantage of the four-day event happening from Tuesday to Friday, the longest Prime Day since Amazon started the mega sales event in 2015, beauty brands are offering deep discounts—some as high as 40% to 55% off—on bestsellers and high-conversion products. Vanessa Kuykendall, chief engagement officer at marketplace growth agency Market Defense, has noticed more beauty brands setting 30% discounts for Prime Day than ever before. During previous Prime Day events, Market Defense’s beauty clients typically offered savings of 20% to 25%.

Kuykendall says the heightened discounting “reflects the growing importance of this moment. Amazon reports every year that Prime Day outperforms the last. So, of course, brands keep showing up and leaning in. When you’re facing increased competition and a deal-driven consumer, you can’t afford to sit it out.”

Jacob St. John, founder and CEO of Navigo Marketing, an e-commerce growth agency, remarks that there’s a lot riding on Prime Day this year, particularly for brands that experienced a choppier performance in the first half of the year than expected. “There’s a strong appetite to offset a soft spring, tariff pressure and inventory delays took a toll,” he says. “For many, this is the first meaningful opportunity of the year to drive serious new-to-brand volume. We always approach Prime Day as an acquisition event, not just a revenue bump.” He adds, “When executed well, the revenue doesn’t just show up on the day, it echoes for months.”

Not all brands are swelling their Prime Day discounts. Promotions are more methodical this year among Navigo’s beauty clients and concentrate on products proven to keep customers sticky. While the majority of beauty brands are participating across the entire four-day event, St. John predicts traffic will be the briskest on the first day and slowly taper off thereafter, mirroring previous Prime Day patterns.

Per Market Defense, beauty brands offering 25% to 30% discounts with robust off-platform promotions have typically experienced a 7X to 13X average daily lift during Prime Day and a meaningful customer acquisition boost. Twenty percent discounts yielded an 8X lift in daily sales during last year’s Prime Day, according to Navigo, while 25% discounts drove a 10X daily lift. St. John figures last year’s discount-to-sales ratios will hold for this week’s Prime Day event. He says, “That’s made our partners more decisive about leaning into discounts that move volume without sacrificing margin structure.”

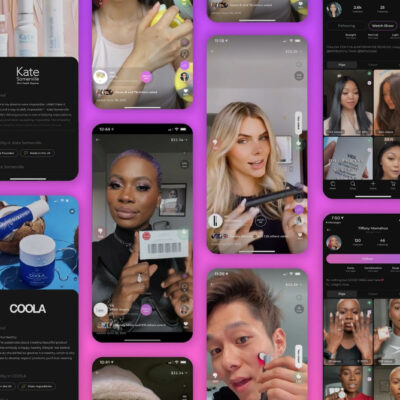

Prime Day’s influence has extended far beyond Amazon to its retail competitors and social media platforms. With cost-per-click advertising costs on Amazon set to rise between 20% to 30% during Prime Day, beauty brands are employing off-platform promotions to generate maximum impact. “TikTok is a major funnel for beauty right now, and brands are pairing that with DTC emails, influencer campaigns, and paid social to push customers toward their Prime Day listings,” says Kuykendall. “The brands that approach Prime as a full-funnel opportunity are the ones that really win.”

Walmart and Target are holding competing promotional events. In a new report from Adobe Analytics, U.S. retailers are projected to generate $23.8 billion in online spend during Amazon Prime Day this year, the equivalent of two Black Friday events and a 28.4% increase over last year’s sale. Adobe Analytics anticipates sales to be propelled by net-new demand rather than elevated prices. Discounts across retailers will largely range from 10% to 24% off the listed price, with mobile devices driving over half (52.5%) of online spending at $12.5 billion.

Adobe predicts that traffic from generative artificial intelligence sources will increase a whopping 3,200% over last year’s Prime Day as reliance on ChatGPT and other AI platforms grow. For brands, paid search is expected to be the top sales driver during the event, clocking in at 28% expected share of revenue, and affiliate-driven sales are becoming increasingly valuable, growing their expected share of revenue 16% over last year to land at 19.9%.

“When you’re facing increased competition and a deal-driven consumer, you can’t afford to sit it out.”

Amazon has become beauty’s largest retailer, and holdouts like Estée Lauder, Lancôme, Clinique and Too Faced Cosmetics have squelched any misgivings they have about it to join its selection. For the e-commerce giant, the high-margin premium end of the beauty category may help counter tariff woes this Prime Day. Amazon collects a 15% fee on top-line revenue for entrance into the e-tailer’s Premium Beauty Shop, a gated section of its website where brands have enhanced protection from third-party sellers.

Renee Parker, co-founder of consultancy firm Invinci and a former Amazon executive, told Reuters that Amazon “doesn’t make a huge margin in most of the categories of stuff that it sells online. They are making a lot of money on premium beauty products because…[they’re] small and expensive, and you can ship a ton of them.”

However, Kuykendall says Amazon hasn’t been pushing premium beauty deals more aggressively than last year. “Amazon has been pushing beauty hard for a while. They’re the largest beauty retailer in the U.S. and many of the top-selling products in Premium Beauty are 1P, meaning Amazon owns the inventory. When they own the goods, they have every reason to push them aggressively.”

The ongoing trade war is shaping consumers’ spending plans for Prime Day this year. A May poll from performance marketing agency Tinuiti found that 45% of 1,000-plus Prime members in the United States intend to buy products they believe will become more expensive later in the year due to tariffs. Tariffs are pushing about a third of consumers to seek steeper discounts before making a purchase, according to the poll. The majority of participants noted that products have to be discounted by at least 20% to be considered worthwhile.

In the first quarter this year, the latest quarter for which Amazon reported earnings, it hadn’t seen average prices bump up due to tariffs. For the quarter, the company’s sales rose 10% to $155.7 billion. In an earnings conference call, CEO Andy Jassy said, “Our everyday essentials grew more than twice as fast as the rest of our business and represented one out of every three units sold in the U.S.”

To offset tariff-related inventory delays, Amazon support agencies advised beauty clients to expand stock levels in April to meet Prime Day demand. St. John notes the timing was intentional, considering that President Donald Trump’s 90-day pause on “reciprocal tariffs” enacted April 9 is set to expire on July 8, the first day of Prime. He says, “If those exemptions are not extended, we expect some brands will hold inventory back and avoid promotions to stretch what they have.”

In February, Toronto-based skincare brand Three Ships expedited three months of inventory to the U.S. to offset the impact of tariffs on its Prime Day forecast. It’s offering discounts between 15% to 20% on select products with strong inventory levels like $32 Brighter Day Red Algae + Avocado Biodegradable Eye Masks and $40 SkinHero Calendula + 2% Bakuchiol Bio-Retinol Serum. Carried at brick-and-mortar retailers Credo Beauty, The Detox Market, Holt Renfrew and Whole Foods, Amazon accounts for between 5% to 15% of Three Ships’ total business.

Sitting out Amazon Prime Day was never an option for the brand regardless of tariff headaches. “Participating in major tentpole events is a key part of our growth strategy,” says Tierney Sterling, e-commerce marketing manager for Three Ships. “At the start of the year, we planned on growing our U.S. presence based on strong performance signals from 2024. Now with the tariff updates, we have readjusted our business goals and are focusing on the Canadian market across all channels, including Amazon.”

Leave a Reply

You must be logged in to post a comment.