Beauty Industry Insiders Highlight 10 Underappreciated Tactics Of Skillful Beauty Brands On The Cusp Of Greater Scale

No beauty entrepreneur creates a brand in a silo. The forces of change in the beauty industry—consumer caution, gen alpha’s influence, retail consolidation and an omnichannel advertising environment are a few of the latest—molds a brand even if there’s no intention of having them do so. But beauty entrepreneurs interested in legacy and a possible lucrative exit must maneuver their businesses to not simply adjust and withstand the forces of change now, but transformations that will reshape the market in the years to come.

At Dealmaker Summit and Uplink Expo New York, the conference and trade show Beauty Independent and its parent company Indie Beauty Media Group put on last week, investors, founders, investment bankers and more delved into current beauty industry conditions and what it takes for brands to thrive in them as well as the conditions of tomorrow. Below, we’ve picked out 10 recommendations they gave attendees based on unheralded tactics they view as underpinning emerging beauty brands with bright futures.

1. Don’t Underestimate Teamwork

When K18 sold to Unilever last year for an estimated $600 million to $700 million, its proprietary peptide and success taking haircare, a category that’s traditionally been heavy in mass, to a premium tier were identified as key catalysts of the transaction, but Rich Gersten, co-founder and managing partner at True Beauty Ventures, an early investor in K18, pointed out during a Dealmaker Summit panel that the brand’s executive team was an integral and underappreciated aspect of deal.

“At the end of the day, people will deliver on the execution of an opportunity, and without that, you’ll fail,” he said. “And the co-founders [Britta Cox and Suveen Sahib] did an amazing job recruiting an incredibly talented executive team and…they let them do their jobs. They didn’t micromanage them. They hired them to do a job, and let them do it, and they did it flawlessly.”

During a separate panel at Uplink Expo, Sahib said, “The first thing, for me, right from day one was, you have a role as a founder, and you have a role as the CEO of a company. Every day you need to ask yourself, ‘Does your team believe you are the best CEO of the company? Do your investors and the ecosystem believe you are the best CEO of the company?’ If the answer is maybe, no, then you better kind of reflect because you have these two roles. No. 2, you have to institutionalize competency. Right from day one, it was about, how do we build up a great team into a great company?”

2. Erect A Brand That Can Outlast Trends

Colin Welch, managing director and head of the New York and London offices at TSG Consumer, identified shortening brand life cycles as an enormous challenge for beauty investors. He said, “Our perspective today is we really are looking for the Rolls-Royce and ultimately our feeling is that, at any size level, a business that’s continuing to grow has attributes that demonstrate to us that the consumer is going to stay connected to the brand and has global appeal.”

3. The Power Of Good Timing Can’t Be Emphasized Enough

Anna Teal, global CEO of Grown Alchemist, said, “The timing of when you choose to put your brand on the market is one of the most important decisions that you’ll make in terms of the business’s growth trajectory, whether the market is hot for your kind of brand now, even the buyer landscape in terms of who might the potential buyers be and what situations are they in as well as, what is the macroeconomic context?”

Agreeing, Sahib chimed in, “It’s not just about you. It’s also about the life cycle of the strategic. What’s happening to that strategic’s business, their financials in that particular year, the stock market, and then how do you kind of play a part in their growth strategy? So, as a strategic, even if you are out in the market, you may not be ready for an acquisition in that particular year or in the next two years.”

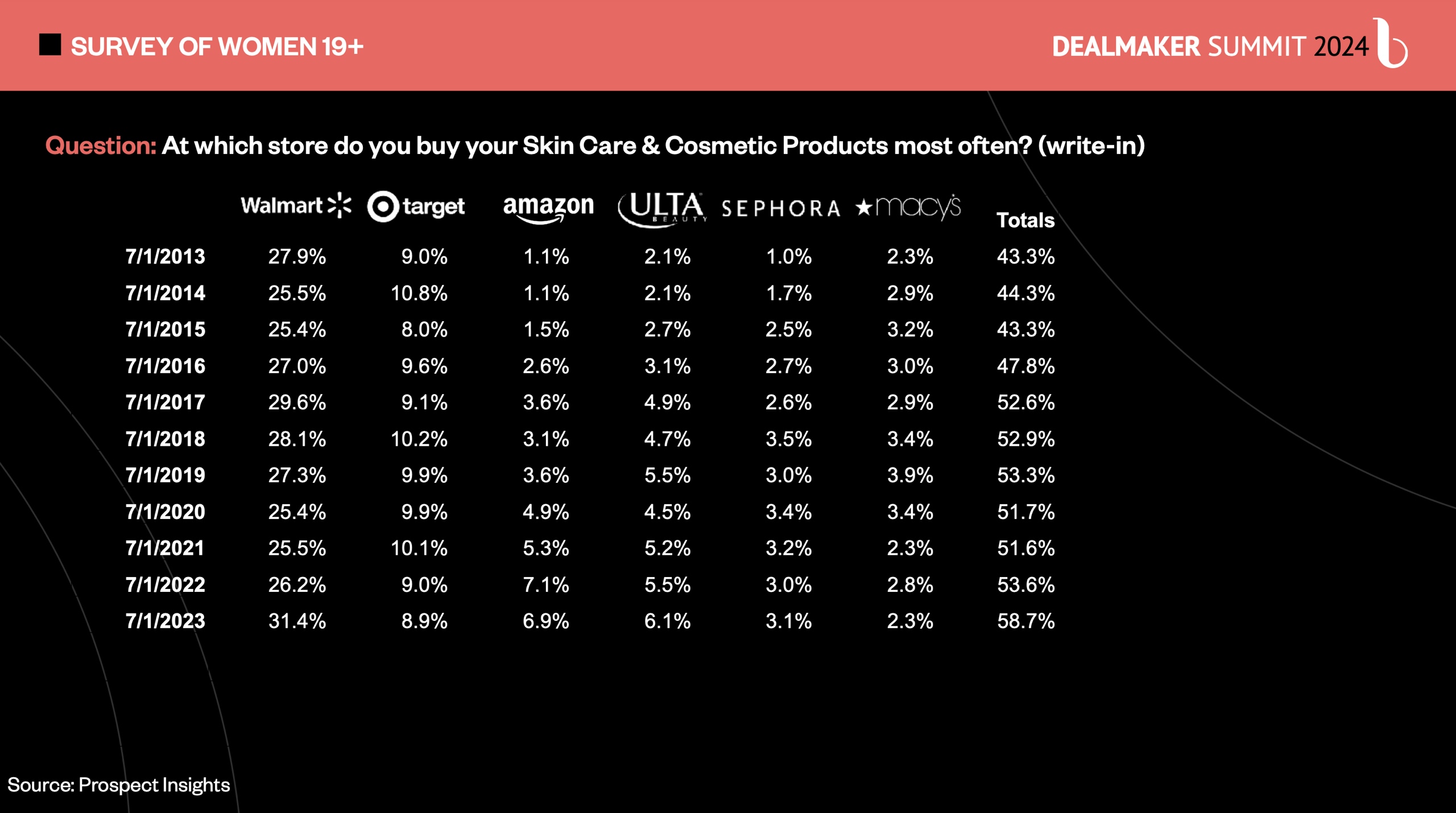

4. Be Considerate About Amazon Distribution

It seems like nearly every beauty brand, even those with long-held reservations about Amazon, are jumping on the Amazon bandwagon, but several of the panelists at the Dealmaker Summit and Uplink Expo weren’t jumping on that bandwagon with gusto. They recommended brands approach Amazon cautiously for replenishment reasons and limit their dependence on it.

“Speaking for traditional brands that are on the channel, beyond 20% to 25% there starts to be a question around, is that too much Amazon for a bigger business?” said Luc-Henry Rousselle, managing director at DC Advisory. “But then there’s a lot of assessment of the risk of the channel, which is there’s not a direct relationship or someone you can call if you have a real problem. Some reseller takes over your buy box, what do you do? So, there’s still a risk that the channel can turn on you, and it takes a few weeks or more to resolve it.”

5. Employ The Founder Story

Nicole Fourgoux, operating partner at Stride Consumer Partners, said, “I believe it’s an advantage if there is a founder story that lends itself to be consumer-facing. I think many consumers today like to know who invented this product…It’s an advantage if the story is consistent and if the founder is socially apt to get on the phone in front of the camera because…it builds another piece of authenticity and, why is the product what it is? You don’t always need it, but a K18 story where I think the molecule is the star is pretty rare.”

6. Think About Brand Vision Beyond The Founder

Teal said, “Any sustainable brand has to be able to live beyond the founder, particularly if you want to create a multi-generational brand. What’s important is that you keep the purpose and the reason why the brand existed originally.”

She continues, “You just have to make sure that the brand is clear on this purpose, it links back to its origins, and that it’s relatable to the community they’re trying to relate to, and that you don’t break any core aspects that will lose the magic of the brand. Because special brands are something that you can’t quite articulate, but you’re drawn to them for something, whether it could be that it just feels nice, or it makes you feel special, or you think it gives you something extra. That’s the thing that you have to make sure that you preserve more than any one individual.”

7. Don’t Be Shy About Soliciting Assistance

Sahib suggested beauty brands founders should seek investors that get in the kitchen with them and not be afraid to pull them into the kitchen. He said, “If something would go wrong, I would reach out to one of my investors within hours, not because something’s gone wrong, it’s just because they can help me find a solution…It’s very important that we are proactive about how we leverage this intelligence and incredible intellectual capital that you have access to.”

8. Stay Upmarket In The Upmarket

Luxury beauty goods, fragrances in particular, have seen escalating prices. At the Dealmaker Summit, Perfumehead founder Daniel Giles highlighted that Byredo has been raising the prices of its extrait de parfums lately. In the last several months, they’ve gone up tens of dollars to be priced at $375. Not talking about fragrance specifically, Richard Henry, partner at Sandbridge Capital, mentioned that luxury beauty can support the loftier price tags.

“For the luxury space, I think it’s going to continue, and there’s probably still room within that consumer for it to continue,” he said. “If there’s any category that can withstand it, it’s this one. You have a customer that’s discerning, but also less value conscious just by definition, and so I think there’s still room, and I think it’ll continue.”

He elaborated, “We have examples of our portfolio brands…where they’ve kind of held pricing as almost more of a competitive positioning to try to maybe gain some share, but what we found is it’s really not doing much, and then the interesting part is when we raise prices and actually, and I’m not talking about massive price increases, but just modest increases, there’s been negligible impact to the business, and I think everyone steps back and surprised by how little fallout there was from it.”

9. Get Your Gross Margin Right

In a Dealmaker Summit panel on early-stage investment, participants told the audience that a gross margin of 70% to 80% is the sweet spot in beauty. Although she underscored that hitting a gross margin in that range isn’t a mandate for brands True Beauty Ventures backs, Cristina Nuñez, co-founder and general partner at the firm, said, “We have to ensure that that gross margin is strong. One because it can take time to fix that. So, as an early stage investor, you don’t want to spend two years working with a brand to reformulate your products, change the packaging, move into new categories.”

She added, “The other is the capital efficiency story. So, how much has a brand raised to date, and how have they spent that money?…Then, I think the third is a path to profitability by year two roughly. So, we understand that a brand may not be profitable when we invest, but we’re looking for a path to profitability within the first couple of years.”

10. Focus On Being Focused

Gersten said, “Don’t try and force the growth. Be patient. Let it come naturally. Don’t try to take on more money than you need at higher valuations and set yourself up for failure because you can’t deliver, and if you try and deliver, you may be doing things that could be damaging to your brand in the long run…It takes a long time to build a brand and that moment, that inflection point will come—it may come in year one, it may come in year four—but it will come if you do the right things.”

Click here to secure Early Bird tickets to Dealmaker Summit happening November 10 & 11 in London.

Leave a Reply

You must be logged in to post a comment.