What Chinese Beauty Consumers Are Looking For Today—And How Much It Costs To Reach Them

China’s beauty market is simultaneously a tough nut to crack and too big an opportunity to ignore.

By some estimates, it’s expected to reach $73 billion by 2027. How do beauty brands decide whether to make the leap into the huge market and, if they do, what’s the best course of action for success in it? During a panel dedicated to China at Beauty Independent’s Dealmaker Summit last week, it became clear that the answers to those questions are nuanced and differ from one brand to another.

The panel was moderated by Nader Naeymi-Rad, co-founder of Beauty Independent parent company Indie Beauty Media Group, and the panelists were Charlie Gu, head of brand partnerships at Jing Daily, Kenneth Kan, founder and managing partner at Advan Capital, and Nini Zhang, managing director, investment banking at Bank of America.

Below, we highlight key points from their discussion on Chinese beauty consumer preferences, the costs of entering the country, the challenges of doing so as a budding brand and more.

Post-Pandemic Chinese Consumers

Gu: China is recovering from the pandemic, and it’s growing, but that growth is uneven. If you look during the pandemic, the Chinese middle class was hit very significantly, especially last year during the serious lockdown where a lot of small business owners had to shut down their business for a while. That had a sizable impact on their income and on this particular segment, so what we see is the middle class spending power curtailed or negatively impacted.

Last year…Chinese people’s bank deposits have grown significantly. They all saved their money in their bank accounts. That tells you, on one hand, they’ve become more careful in their spending, but, at the same time, that spending power is still there for the middle class it’s just in reserve. They’re cautiously looking at what’s going to happen.

On the other end of the spectrum, we see especially for high net worth individuals, they’re less impacted by the pandemic…If you look at Chanel and some of the watch brands Richemont Group has, they’ve all reported significant Q1 earnings. Louis Vuitton, Hermes, all are at all-time highs driven by China’s growth because the high net worth individual continues to spend. How they choose to spend that money might vary a little bit. They’re looking more for long-term value.

…The Chinese consumers are some of the most sophisticated consumers, meaning that they do their research. We have a term, it’s not unique to China, ingredient nerd, and there is a group of active voices in China, a lot of gen Z and millennials, that would spend time to study the ingredients in products and also talk about efficacy. Before, when Western brands first went to China, there was so much that was based on aspirational value. Is the brand worth the hype? Now I think you really have to deliver the results. That’s first and foremost as a brand.

Increasingly, people are concerned about safety, and then clean. Clean beauty in China has a different context, it’s about the safety of the product because Chinese people, a lot of them, have sensitive skin due two years of overly-complex skincare routines. So, the product itself is very important.

Then, the localization of your marketing strategy is very important. A good example would be, if you are a celebrity-driven or celebrity-founded brand, your celebrity impact doesn’t directly translate to China. You have to translate why I should pay attention to you. Everyone wants the Chinese people’s spending power. What do you offer that earns that trust?

Kan: In terms of categories, I think skincare, color cosmetics and skincare are super crowded now, especially on the lower end, mass. There’s a lot of local players, but things like scalp, hair and also fragrance are actually untapped categories where there’s exponential potential growth, even sexual wellness.

Gu: Beauty, especially luxury beauty, it is considered an aspirational product. For various reasons, Chinese people are very used to this idea of punching above their weight in terms of beauty purchases because beauty is something that helps them to establish confidence, establish social presence. They have to deal with a lot of pressure in their social settings. You are judged on a daily basis on the way you look. For that reason, Chinese people have invested in themselves, in beauty certainly and wellness products more and more.

Big Beauty’s China Stumbles

Naeymi-Rad: Estée Lauder just had the single largest one-day drop in its stock price. One of the reasons they cited was China. Nini, why is beauty not getting the same lift that we’re seeing some luxury brands [get] from the reemergence of China?

Zhang: It has to do a lot with the distribution infrastructure in the particular region. [Estée Lauder] has a very particular strategy within the region. Distribution is very concentrated towards a couple of very specific channels that have been hit harder than others in the pandemic and in the slower recovery.

If you look at the growth in APAC…it has been stronger in terms of growth because they have 10,000 people on the ground in distribution centers that are not concentrated to a particular region. Also, they’ve been on the ground for multiple decades and have a much deeper network that they’ve built over the years. That has also contributed to diversification of resources and infrastructure to build in that region.

China is extremely tricky. It’s extremely fickle. It is a market that changes every single day, and if you don’t have boots on the ground and you’re just depending on a trade partner to do everything for you, it’s going to be a difficult market where you’re going to spend a lot of money in investment and maybe not get what you’re hoping for.

Small Beauty’s China Hurdles

Zhang: You’re going to be spending a lot of money and a lot of margin will be eaten up by your trade partner depending on who you go with. It is a game of, can you scale in that market and reach significant size relatively quickly? For smaller brands, focus on building your brand in your native market where you understand that market and understand it well before going into China unless there is an extremely compelling financial reason.

…If you look at the last five years at the growth of the top 20 brands overall in beauty, about two out of the 20 are foreign brands, multinationals. If I look at the growth rates of the top brands from the L’Oréals and Estée Lauders, the Cotys of the world, that is the region that is boosting the growth, and it’s not 10% growth, it’s 30%, 40%, 50%, 60% growth in that region in terms of over the past five years year-on-year. That is where you’re going to get profitability if you can do those types of volumes, but, if you’re a smaller brand, it’s much more difficult to make that region profitable.

Retail Strategy

Kan: You have to start online and build out the presence with social media, influencers, to get that authentic credibility. Bricks-and-mortar is kind of secondary. It’s when you want to expand distribution past a certain point, then you do have to go bricks-and-mortar. But, for most brands, especially when we’re talking about growth brands, niche players, definitely online’s the way to go. Watsons, Sasa, they’re all bricks-and-mortar in China, they do exist, but I would say from a risk reward perspective and then from an investment perspective, it’s definitely secondary.

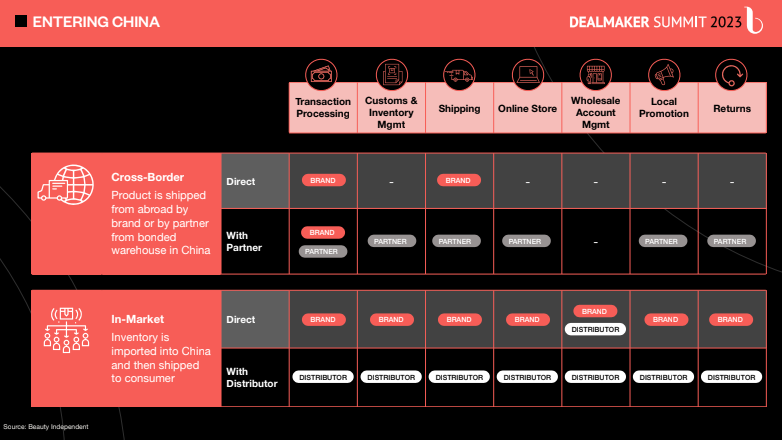

The Importance Of Trade Partners

Kan: In the beginning, definitely working with a local…distributor is the way to go. It minimizes investment and allows you to enter a market and get a feel for things. Because China isn’t for every single brand. You have to pick and choose, do you have the right story? Does it speak to consumers there? And, if the decision is yes, based on the number of factors, then I think the low-risk way is to work with a partner…to say, I’m going to invest $500,000 or a million and a partner takes care of it, and let’s see if I get consumer traction.

For a lot of our previous investments, including Erno Laszlo, which has been very successful in China, we ended up doing a dual track. We started with a distribution partner, got traction, sales were on the way up. Then we decided to, at the same time, in parallel, grow and build our own team and get the registrations to become a local Chinese company and distribute products. At the end of the day, that’s really the way to go. Low risk, step by step. As you see milestones and traction and results, then you invest in the next layer.

Gu: When you look at a partner in China, it’s about finding the right match, kind of like dating. It’s not the bigger, the better. Sometimes I would talk to brand founders and then they would say, “Who does this other brand use?…Maybe I should just follow their footsteps.” If you are a small brand, the partner for the bigger beauty brand might not be the best partner because you can be a very small brand in their portfolio. The way they are able to scale that brand and operate is a very different model. You have to look yourself in the mirror and ask if you’re prepared to go to China. Do you have what it takes and what is your commitment to it?

Then, what level of risk can you take? When I say risk, it also means trust. How much control do I feel comfortable letting go of in this process? Do I have the resources in my team to manage this process? When you go through the selection process with partner distributors, you have to take the time. Don’t say look at a deck, say, “Oh, they did X amount with this brand.” You have to talk to them, understand who is actually operating your team, ask them lots of questions about how they plan to run your brand.

Realistic Cost Expectations

Gu: If you only look at a one year horizon, your P&L is going to look terrible. Your partner might tell you you need to put 40%, 50% of year one [sales] in marketing and that might not be money that you’re seeing. At year one you’re scared, but are you prepared to have the resources go to year two and three? Maybe you might eventually achieve profitability in three years. I’ve seen it take two, three years at least.

Kan: If I were to start a brand in the U.S. market, how much do I have to invest to really build a presence? I’ve seen ROI anywhere from 2X to 4X to 5X. The figure really varies. [In China], I’ve worked with brands where they’ve spent $500,000, a million, and it became viral with influencers. Their ROI became 4X to 5X, and it just kind of snowballed in China. I think the mistake a lot of people make is to throw cash at it and think it’s going to work. That’s where people get into the hole of losing money. You’ve got to be realistic and evaluate each opportunity on a case-by-case basis and have a budget.