Citruslabs And Sula Labs Partner To Close The Inclusivity Gap In Clinical Studies

Citruslabs and Sula Labs have joined forces to put representation front and center in clinical studies as they’re becoming table stakes for beauty brands.

Historically, clinical studies of all sorts have excluded people of color, and while that’s increasingly being rectified today, the contract research organization and the research and development lab are working together to ensure beauty brands meet the highest standards of inclusivity with their clinical study programs. Those standards mean having a broad range of people participate in clinical studies and examining product performance for attributes relevant to people with dark skin tones.

“If brands don’t enroll people in their studies, it can affect the generalizability of their results,” says Susanne Mitschke, co-founder and CEO of Citruslabs. “The good thing we’re seeing right now is that more and more brands are looking for specific participation rates for minorities. Ideally, we make the cut at 60% white people and 40% minorities for what we want to see in our studies, and many brands are accepting this. It’s a great step forward for the entire industry.”

Even beyond sheer percentages, AJ Addae, cosmetic chemist and founder of Sula Labs, underscores that clinical studies should be populated with people with the darkest skin tones, for example, those with Fitzpatrick skin types four through six. Sula Labs has deep ties in consumer communities to aid in incorporating people with the darkest skin tones in clinical studies. Addae says, “The whole point of a clinical is to capture data on your product, and if you’re not capturing this data, then it’s not really replicable with endpoints like redness or hyperpigmentation you’re trying to test.”

Contract research organizations frequently have charged greater amounts to locate people with darker skin tones for clinical studies and haven’t grasped the product attributes pertinent to them. As brands seek to have clinical studies done, Addae emphasizes they shouldn’t simply zero in on their products, but should pay close attention to the claims they’re attempting to pin down and if they resonate with people of color. She says, “Vitamin C is traditionally heralded for hyperpigmentation and moisturization, and what you want to do is start with what endpoints you want to measure.”

Another hurdle in clinical study representation is that people of color may not trust organizations conducting clinical studies due to longstanding racism and abuse. Sula Labs’ deep community ties can assist Citruslabs—and, in turn, brands—with garnering trust. “CROs often are not recruiting in neighborhoods where there are people with darker skin tones primarily,” says Addae. “You can’t just send a message to your group chat and be like, ‘Hey guys, come test.’ It requires you to go out into the community, and that’s something CROs tend to struggle with.”

Mitschke explains that recruitment has fortunately gotten easier because clinical studies have become decentralized, and test subjects don’t have to come to a single specific location to participate, cutting down on commute time and related transportation and childcare costs. Typically, studies conducted by Citruslabs have 40 to 50 participants, but randomized control or split-face studies can reach 80 to 100 participants. The organization generally draws people for its studies from across the Los Angeles region.

“A lot of brands treat their studies as a big secret, and they should be proud that they have done a study.”

At Citruslabs, prices for consumer perception studies that glean insights on people’s perceptions of products using questionnaires start at $10,000. Single-group clinical trials start at $20,000 and randomized control clinical trials start at $40,000. Clients that come to Citruslabs through Sula Labs get preferred pricing, and Sula Labs receives a referral fee for them. Sula Labs can handle smaller clinical tests in-house than Citruslabs conducts.

While the timeframe for a study is usually eight to 12 weeks at Citruslabs, the entire process from recruitment to the analysis of results can last five to six months. “One mistake I see brands make is they come to us too late. That happens a lot,” says Mitschke. “Brands have a launch date in mind for eight weeks or twelve weeks from now, and we have to conduct the study with an eight-week intervention period, and that’s just not going to happen. What brands should really think about is when they are launching a product and having enough time to conduct the study.”

A fast-growing organization, Citruslabs has conducted clinical studies for clients such as Saie, Arrae, Common Heir, Dame, Cardon, Sourse, Semaine and Fleur & Bee. Sula Labs has formulated for brands with products in Credo Beauty, Ulta Beauty and Sephora. Advising brand founders on vetting contract research organizations, Addae recommends they request itemized pricing quotes. “You definitely want to make sure there’s some cost transparency. Ask questions,” she says. “If you can do data analysis yourself, if you can recruit a statistician, that can help you bring the price tag down.”

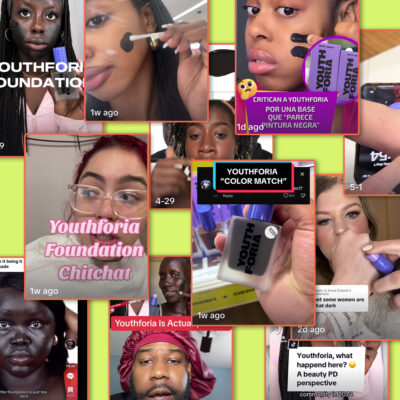

As consumers become educated about clinical studies, the demands for diversity that have pressed complexion shade ranges and advertising to boost inclusivity could extend to clinical studies, especially as Addae points out avid beauty enthusiasts have become interested in data to guide their purchases. Mitschke suggests it could be advantageous for brands to be open about the clinical studies they commission to highlight their commitment to scientific rigor and diverse study subjects.

“A lot of brands treat their studies as a big secret, and they should be proud that they have done a study,” she says. “I’m honestly not sure where this has come from that studies are behind closed doors almost in a safe where nobody can access them. This is something that definitely has to change.”