Estée Lauder’s Aggressive Tactics Drive Up Amazon’s Beauty Advertising Rates, According To Envision Horizons Report

Estée Lauder Cos. Inc.’s Amazon presence, which started last year after prolonged reluctance to join the e-commerce giant’s assortment, has skyrocketed advertising rates in the beauty category on it, according to a new report from Amazon growth agency Envision Horizons.

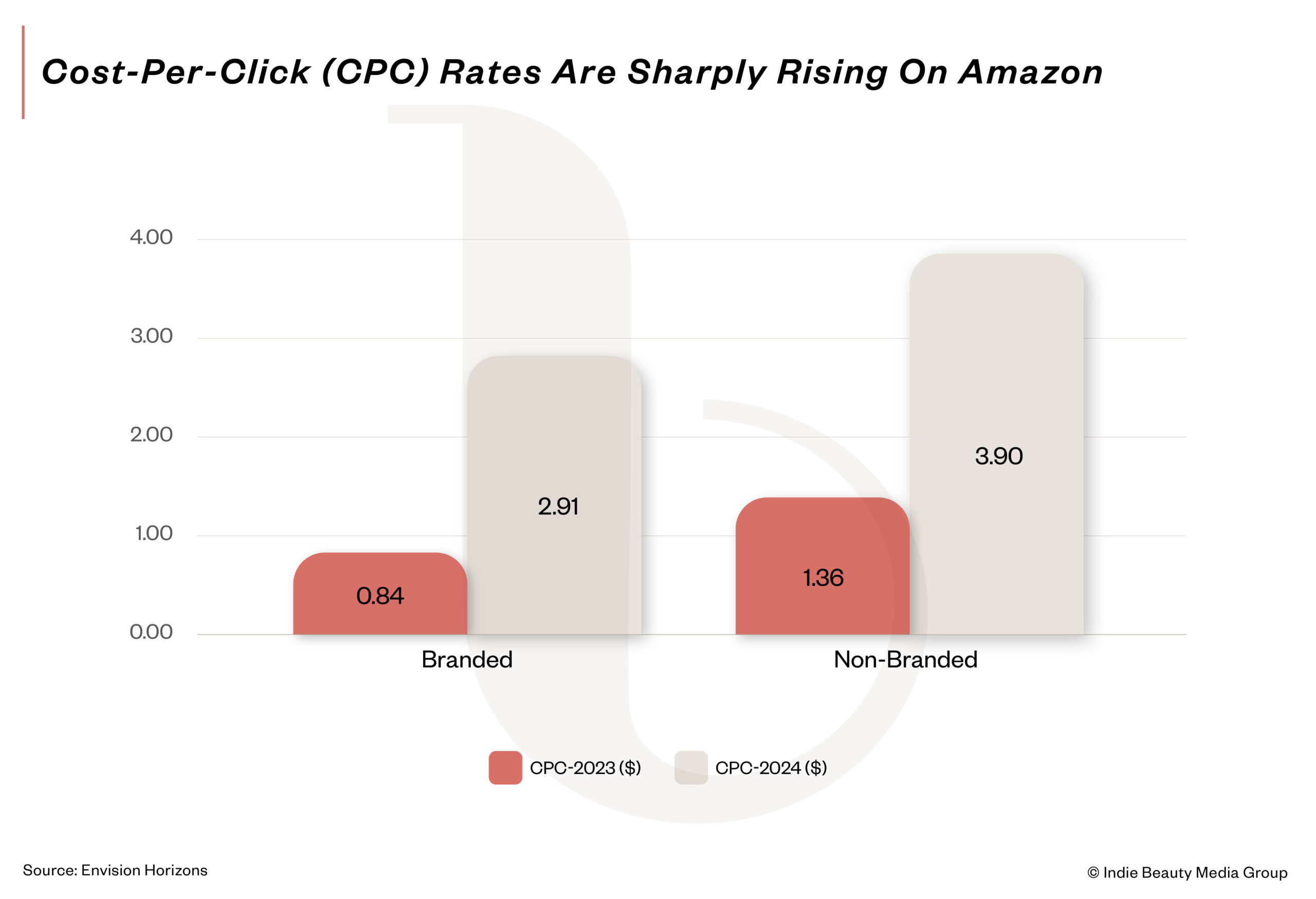

Called “The Amazon Estée Lauder Effect,” the report outlines that cost-per-click rates or the amounts paid by beauty brands to Amazon for the use of search keywords have jumped 248% from 84 cents to $2.91 since Estée Lauder has onboarded its namesake brand as well as Clinique, Too Faced, Lab Series, Smashbox, Dr.Jart+, Bumble and bumble and The Ordinary onto the platform. Along with branded search terms, non-branded search term rates on Amazon have surged about 186% from approximately $1.36 to $3.90 per click over the past year. Envision Horizons estimates that CPC rates rose 36.6% from 71 cents to about 97 cents per click between 2020 and 2024.

Laura Meyer, founder and CEO of Envision Horizons, ties CPC increases for beauty brands directly to Estée Lauder’s aggressive spending tactics on Amazon, where it’s adopted what she refers to as a “one-to-one” strategy to fuel the Amazon growth of its portfolio brands. She says, “If they’re doing a million in revenue, they’re spending a million on Amazon ads. You have brands that used to be able to acquire a customer for X and now the conglomerates have come in and it’s costing Y. There’s a lot of pressure…to just go and spend more. That fuels the flywheel of media just costing more on Amazon.”

Clinique, in particular, has made a big splash on Amazon since launching on it in March last year. According to data from Amazon agency Market Defense cited by the publication Women’s Wear Daily in February, Clinique’s Almost Lipstick in the shade Black Honey generated nearly $600,000 in monthly revenues on Amazon for an estimated $8 million in total sales. L’Oreal-owned Lancôme has experienced heightened Amazon demand, too, since it made its Amazon debut in 2023. Envision Horizons points out in its report that 73% of its Amazon buyers were new, and it became the second top-selling luxury beauty brand on the platform and the sixth top-selling brand overall on Amazon in eight months.

Estée Lauder’s and other beauty conglomerates’ spending on Amazon is affecting both prestige and lower-priced brands that are being priced out of Amazon keywords. For example, CPCs for the term “face wash” multiplied 10X in the past year, and rates have shot up for the terms “face oil,” “cleansing balm,” “night cream for face” and “exfoliating pads.” Approximately 100 million beauty shoppers visit Amazon’s site every month, and it’s projected to be the leading retailer in the United States for beauty this year.

“A big strategy for a long time was, let’s go find all the premium brands that don’t sell on Amazon that have search demand and buy those keywords,” says Meyer. “So, we’ll buy the keywords ‘Clinique face cream moisturizer’ and then show our $60 price point. That worked for a really long time.”

Today, non-branded searches are far more ubiquitous than branded searches on Amazon. Data from market research firm NIQ shows that 90% of purchases made on Amazon are through unbranded searches. While a lack of consumer loyalty could be part of the explanation for the unbranded search volume, Meyer identifies purchases through Amazon affiliate links, viral trends on TikTok not attached to specific brands and the decline in top-of-funnel awareness campaigns for brands that are more hyper-focused on profitability as additional factors. She says, “When you stop or pull back on upper funnel investments, your brand demand will simply come down.”

“Brands are getting squeezed.”

Envision Horizons is seeing its beauty brand clients enlarge their Amazon ad budgets 10% to 15% to maintain their market share on Amazon. Brands with more aggressive growth strategies are boosting their Amazon ad spending 50% to 100%. Most of Envision Horizons’ clients generate between $5 million and $30 million a year in Amazon sales, with a few larger clients surpassing $100 million a year on the platform.

To offset mounting CPC rates, the agency is advising clients to reallocate funds to the ad tools Amazon Demand-Side Platform (DSP) and Amazon Marketing Cloud (AMC) that enable brands to target and retarget audiences based on behavioral and demographic attributes. Meyer believes that Amazon DSP strategies are more important than ever, especially for brands netting at least $5 million in Amazon sales. She says, “The point of diminishing return on paid search is coming much faster now that CPCs have risen, so you need to be diversifying your media spend.”

However, DSP isn’t without costs. Brands that buy DSP directly through Amazon must spend a minimum of $50,000 monthly in ads to qualify. However, they can have a third-party agency buy it on their behalf to bypass the minimum spend or utilize retail advertising platforms like Perpetua or Pacvue. Meyer says, “Then, you have to have someone who’s savvy and knows how to buy DSP media, which is a unique skillset.”

Envision is also shifting some of its clients’ budgets to Amazon’s Creator Connections, an affiliate program that links influencers and brands that rolled out in beta mode in 2023 before it was shut down and relaunched last year. Meyer says Creator Connections is most impactful for brands generating $7 million to $10 million in Amazon sales per year.

She recommends that brands tapping into paid search on Amazon balance their spending between branded and non-branded keywords to maximize their Amazon ad budgets. She advises that 10% to 20% should be allocated to branded terms, with the rest going to non-branded terms.

“What you’re spending should be incremental,” says Meyer. “We’ve seen a lot of brands that were overspending on brand protection…more than 30% of their budget. We bring that down and focus on more long-tail generic keywords. They are likely more expensive, but the incrementality that they drove and new-to-brand customers was worth it.” She adds, “Brands are getting squeezed, though, there’s no doubt.”