How Croda Is Helping Brands Build Products For Textured Hair

When Lisa Price made headlines by buying back Carol’s Daughter in early March, it was more than a feel-good founder story. It marked a full-circle moment for a category that’s become one of the most dynamic and fastest-growing segments in haircare: textured hair.

Once underrepresented, the textured hair market has seen a surge in innovation, investment and personalization. This growth is fueled by the natural hair movement, increasing demand for inclusive beauty and the rise of indie and Black-founded brands like Beyoncé’s Cécred, Pattern by Tracee Ellis Ross and Mielle Organics.

“It’s about more than just products,” says Arayna Singh, technical marketing manager at Croda, a leading ingredient supplier. “Consumers are embracing their natural textures as a form of self-expression, and they expect brands to meet them where they are.” To Singh, that means science-backed formulations, transparent ingredients and education.

According to search intelligence firm Spate, searches for “textured hair” have jumped 65.7% in 2025 and are expected to grow another 35.5% by the end of 2026. Textured hair is any hair with a wave or curl pattern, where the hair strands create shape such as curves, spirals and zig zags. It transcends race and ethnicity.

Not only is interest up—so is spending. Textured-hair consumers shell out an average of $205 a year, compared to $130 among those with straight hair, per a report from the curly hair content website NaturallyCurly. That delta reflects not only product variety, but the complexity of care routines and a desire for targeted formulas.

The beauty industry has long recognized that no two heads of hair are exactly alike. Because hair textures and curl patterns vary widely, classification systems have emerged to help consumers and professionals better understand hair types and their unique needs. Two of the most commonly referenced systems are the Andre Walker Hair Typing System and L’Oréal’s Hair Classification System.

The Andre Walker hair typing system is broken down into four broad categories, from one to four, referring to straight to kinky hair, with subcategories A through C. It’s popular among consumers, who have formed communities on social media based on their hair type to share knowledge about products, routines and brands.

The L’Oréal hair classification system features eight categories, from straight to extremely coily, with types one to four covering low to moderately curled hair and types five to eight representing curlier to coily textures. L’Oréal assesses curliness using morphologic parameters like curve diameter and curl index, while kinking is determined by analyzing the number of waves, twists and kinks along the strand. The L’Oreal classification system is a well-known reference in the research community for data generation on textured hair.

Croda is doubling down on the textured hair category, expanding its product testing across a wider range of hair types, including Asian, Latin American, African and European, to ensure performance across the texture spectrum. Its multicultural lens is matched by a growing focus on personalization, a trend led by brands like Prose and Function of Beauty.

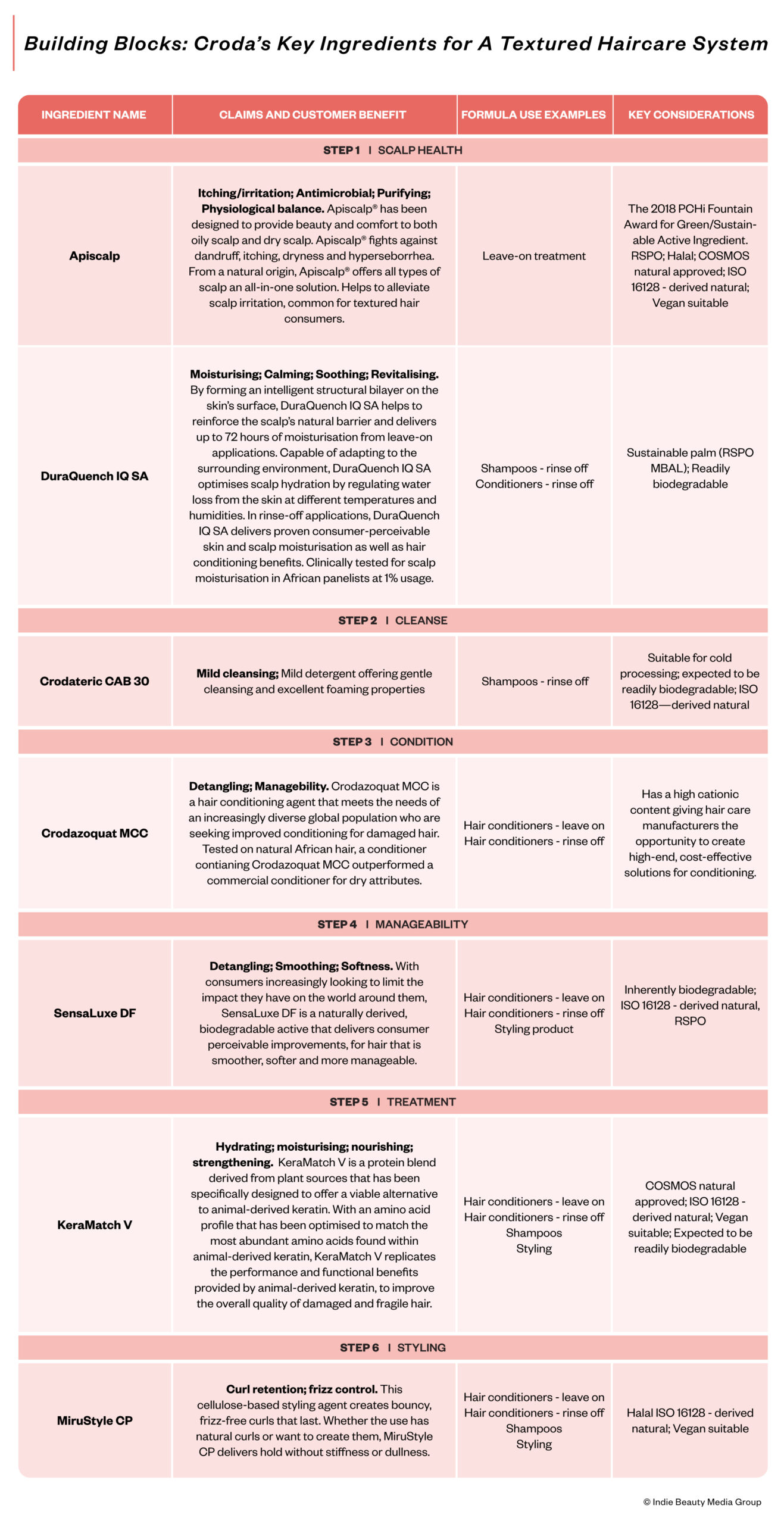

Consumers are demanding ingredients that check every box: vegan, biodegradable, cruelty-free and—above all—proven to work. Croda’s latest offerings for curly to coily hair types include KeraMatch™ V, a plant-based keratin alternative to improve the strength, and SensaLuxe™ DF, a silicone alternative to impart smoothness, softness and manageability.

“There’s a huge emphasis on strength-building claims right now, especially in textured hair,” explains Singh. “The spiral structure of textured hair makes it more prone to breakage, so there’s a need for ingredients that fortify the hair without compromising on feel.”

Beyond performance, textured hair routines are often steeped in culture and heritage. “A lot of the care rituals for textured hair are passed down through generations,” says Singh. “Think rich butters, nourishing oils, natural ingredients that are deeply tied to identity and community.”

T’prene Clemons, lead applications scientist at Croda, emphasizes that the category is far from one size fits all. Croda’s R&D team is actively advancing test methods for product validation and claims substantiation developed for straight hair and adapting it for textured hair, starting with wet combing, curl retention and anti-frizz, with additional methodologies in development.

“What works for 4C coils won’t necessarily work for 3A waves and vice versa,” says Clemons. “Consumers want to be educated about their hair type, understand their options and find formulas designed specifically for their needs, whether that’s moisturization, curl definition or scalp health.”

Haircare product textures matter. Singh notes that lightweight soufflés are having a moment. According to Spate, the search “hair souffle” is predicted to jump 223.9% in the next 12 months as consumers want moisturization without heaviness.

For beauty operators expanding into textured haircare, Clemons offers clear advice: Start with the consumer’s hair texture, condition and curl type, and identify a specific concern. “Are they dealing with product buildup? Dandruff? Dryness? Manageability?” asks Clemons. “The concern can then be addressed based on the profile and performance of the substantiated ingredient solution. Have the ingredients you have chosen been validated on textured hair? Will these ingredients resonate with your audience?”

Ultimately, the textured haircare renaissance isn’t just about more products—it’s about smarter, more culturally attuned and scientifically sound solutions. The demand is there. Now, it’s up to brands to deliver.

Below, Croda outlines its key ingredients for building a textured haircare system.

Leave a Reply

You must be logged in to post a comment.