International Brands Suspend US Shipping As De Minimis Ends, Brace For Major Impact

With the United States set today to eliminate an import levies loophole that has allowed for small e-commerce deliveries from around the globe, many international postal services are cutting off services to the country and international indie beauty brands are following suit, potentially leading to significant business fallout.

The loophole, called the de minimis exemption, allows for goods valued at $800 or under to enter the U.S. without duties or extensive customs checks to lighten the load on the U.S. Customs and Border Protection that determines and collects tariffs. Last fiscal year, nearly 1.4 billion de minimis shipments entered the country. Already closed in May for shipments from Hong Kong and China, a move that led Chinese fashion marketplace Temu to stop sending packages out of China to the U.S. and its users to drop by about 50%, the de minimis exemption is now closing for the remainder of the world.

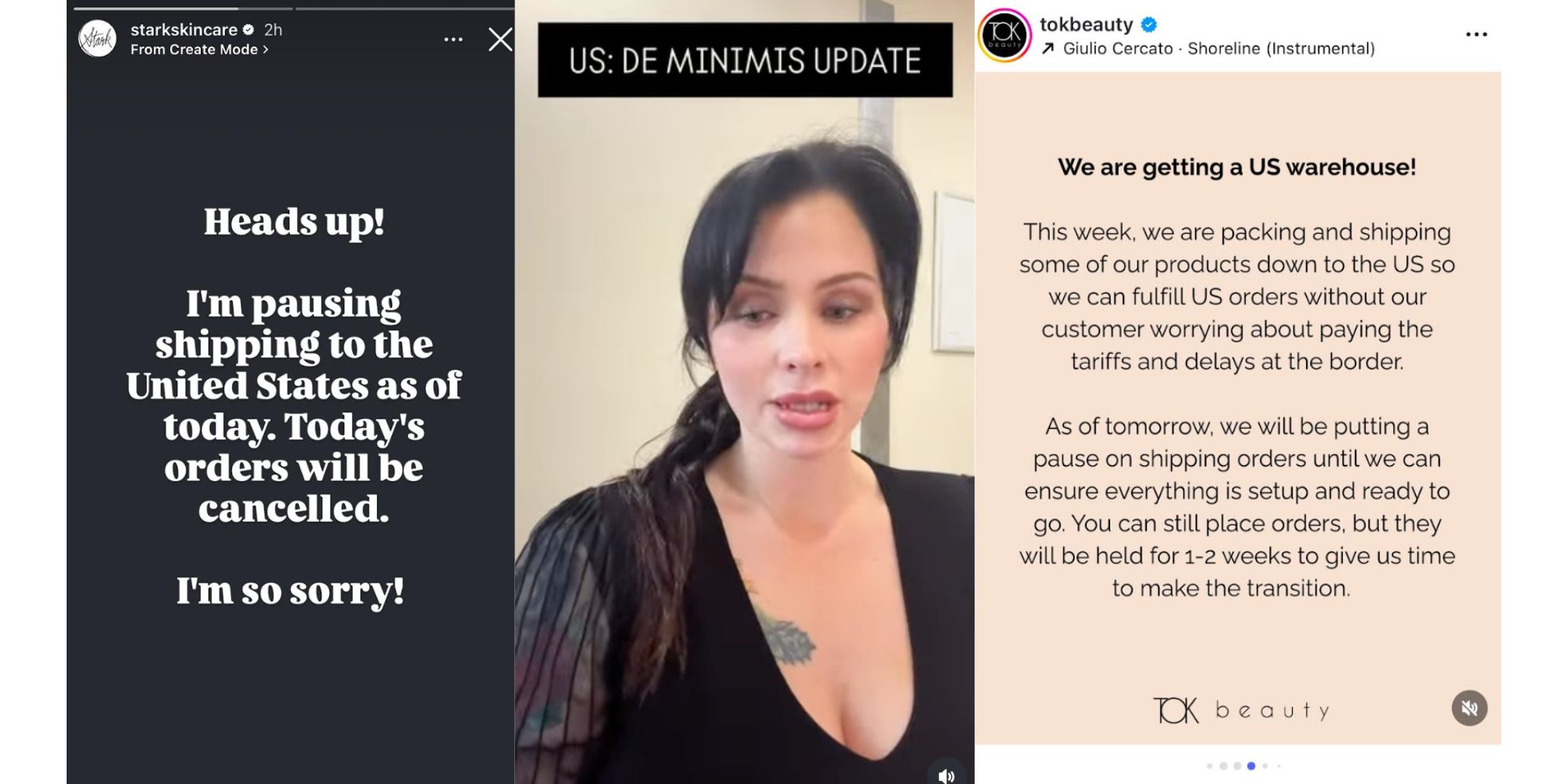

With the change, businesses could be charged $80 to $200 per parcel depending on the origin country’s tariff rate. In advance of it, indie beauty brands in countries such as Canada and Australia have been sending emails to their customers and posting on social media warning them of delivery stoppage.

Retailers are feeling the shock of the policy shift, too. Olive Young, the leading health and beauty retailer in South Korea, announced on Thursday last week that it would add a 15% customs duty to all orders starting Aug. 29. British beauty specialty chain Space NK announced in April that it was halting online purchases for U.S. customers.

With the de minimis exemption ending, beauty businesses are exploring strategies to offset lost business in the U.S. if they’re pausing shipping or to continue serving U.S. customers, including expanding to countries outside the U.S. to diminish their dependence on it or shifting logistics to the U.S. to sidestep import levies. Despite grave concerns about sales erosion as a result of the loophole closure, most businesses don’t expect to completely pull out of the U.S.

On Tuesday, Montreal-based Stark Skincare posted in Instagram Stories that it was suspending shipping to the U.S. and would cancel orders placed that day. Around half of the brand’s customers are in the U.S., according to founder Jessica Lafleur, and if it loses that portion of its sales, Lafleur acknowledges the impact could be tremendous. “A lot of us make most of our money in Q4 with Black Friday and Christmas,” she says. “So, it’s really scary.”

Stark Skincare could only pause shipping for two to three weeks, depending on if the postal and tariffs process becomes clearer and less costly. It’s exploring courier options such as Stallion and Chit Chat that advertise low postage rates for Canadian businesses. Stark Skincare has employed the latter during high volume periods.

“The directives are constantly different and our own postal system doesn’t even have a good system in place yet,” says Lafleur. “I have a post-it note on my wall that says just wait and see.”

Some of Stark Skincare’s consumers have half-jokingly offered to act as “skincare mules” for the brand, carting its products down south as Americans endure its U.S. shipping pause. While they may have to delay gratification, Lafleur assures Stark Skincare’s American customers that the brand isn’t abandoning the U.S.

“It’s not even just the money, obviously that’s an important part of my business, but it’s the relationships that I’ve made with these customers over the years,” she says. “I’ve seen them move on with their careers and get married and have babies. I’d be heartbroken. So, pausing shipping is definitely just a pause. I can’t see myself moving forward without my American customers.”

Toronto-based Glow Green Co. informed its customers on Wednesday that it would be pausing U.S. orders and explore warehousing in the U.S. for faster shipping and to avoid customs delays. Founder Jean Raffiuddin figures it will take at least two months to sort out American warehousing. Other indie beauty brands like Cipher Skincare in Australia and TOK Beauty in Canada have also shared plans to transition to U.S. warehouses.

Laura Burget, co-founder of Toronto-based Three Ships, estimates it can take up to three months for a Canadian brand to transition to a U.S. warehouse. The 8-year-old skincare brand has used a third-party logistics provider in the U.S. since 2021 to lessen shipping costs. “You save quite a bit of money on postage,” says Burget. “You also streamline the process, you decrease transit times, which is all in all about our customer experience, and now we have the side benefit of not having to be impacted by de minimis charges.”

With the de minimis exemption poised to end, Glow Green Co. is considering focusing on capturing Canadian customers rather than Americans. Americans have constituted more than 50% of the brand’s sales after it advertised stateside starting in February, and they have a 40% repeat purchase rate. Prior to that, they only constituted 10% of the brand’s sales.

Raffiuddin fears the pause on Glow Green Co.’s U.S. deliveries will zap its momentum following months of acquiring customers in the country. “It’s so sad that you take the time to move in that direction and then you have to pause,” she says. “And, now, whenever we go back, it’s almost like starting again, and it’s going to be more expensive.”

Ever Amid, a Canadian skincare brand based in Nelson, British Columbia, is attempting to diversify its customer base as well. Currently, 90% of its customers are in the U.S., which it credits to a wholesale partnership it has had with e-tailer Moda Operandi since 2023. To diversify, it’s reaching out to spas and galleries in Scandinavian countries and Germany.

“Pausing shipping is definitely just a pause. I can’t see myself moving forward without my American customers.”

While President Donald Trump’s trade policies have fluctuated, Burget cautions fellow beauty entrepreneurs to take him at his word and prepare their businesses for the policies he’s promoting. She recommends they should be assessing whether they should increase prices and the potential amount of those increases and if they should double down on the Canadian market. She says, “Always have some sort of contingency plan in place and plan out those models of what happens if Canadian goods do get subjected to a 35% tariff going to the U.S.” Thirty-five percent is the present tariff rate being levied on Canadian imports to the U.S.

Before it announced on Aug. 17 that it would suspend shipping to the U.S. today, the almost 4-year-old Ever Amid touched base with long-term customers about the impending suspension, and many purchased enough product to last six to 12 months. Ever Amid’s products start at $130.91, and its inventory is currently sold out on its website.

“That was amazing and validating and also made me really sad because it’s unfortunate to see the love in the final hours,” says founder Nadine Boyd. “I have trust that when this transition is settled and sorted and we know what to expect, or if it is eliminated, that may be six months, it may be three years, but I do trust that I will have clients who have kept tabs on me and who are waiting for me to reappear.”

Leave a Reply

You must be logged in to post a comment.