“Act Now”: Kearney Report Reveals 20 Top Beauty Acquisition Targets In A Favorable Market For Buyers

Makeup By Mario, Madison Reed and Perfumer H are among 20 brands Kearney identifies as top beauty acquisition targets in a market it characterizes as conducive to buyers as conglomerates and private equity firms offloading assets and brands with institutional capital looking to exit.

“The next 12 to 18 months are a unique window of opportunity for investors,” writes the management consultancy in a new report on beauty and personal care mergers and acquisitions. “As large multinational corporations face pressure to rebalance portfolios, divestitures will become increasingly prevalent. At the same time, private equity investors seeking to return capital will dispose of assets that show longer holding periods, further increasing supply.”

Kearney continues, “We predict this will create a rare chance for investors to acquire assets at favorable valuations. But as high-quality assets become scarcer and liquidity returns, competition—from both corporations and private equity—could trigger bidding wars. For investors seeking portfolio transformation, growth, and BPC market leadership, now is the time to act.”

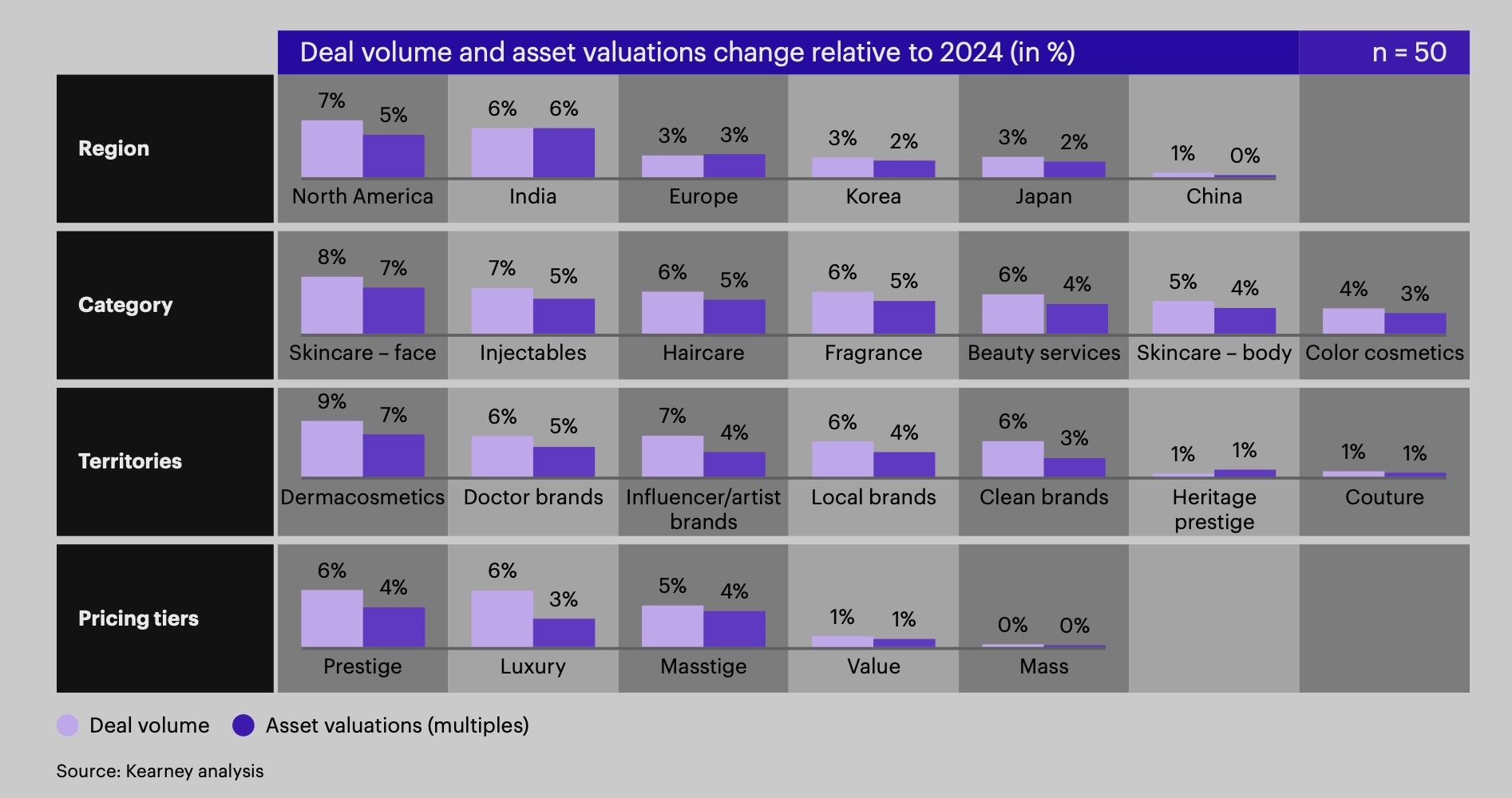

The report, which was informed by conversations with 50 beauty industry dealmakers, also singles out Augustinus Bader, La Prairie, Gisou, Versed, Kosas, IGK, Aveda, Olaplex and Dossier as M&A targets. It names skincare and injectables, particularly science-centered brands with clinical positioning like those led by dermatologists, as the most sought-after categories for M&A, although mentions local brands rooted in heritage and cultural nuance and transparent, socially-responsible brands are drawing notice as well. The publication Women’s Wear Daily reported Friday that L’Oréal has emerged as the frontrunner to buy clinical skincare brand Medik8.

Skincare and personal care accounted for 40% of beauty M&A last year, with notable transactions involving The Body Shop, Dr. Dennis Gross Skincare and Grown Alchemist. Deals for companies specializing in beauty technology such as digital diagnostics, personalization algorithms and artificial intelligence-powered consumer insights are slated to increase, too. They accounted for 17% of deal activity last year.

Makeup deals are expected to grow, but at the slowest rate. There are the greatest number of brands available for sale in the makeup category, according to Kearney. It highlighted Merit and Westman Atelier as the brands likeliest to trade. In terms of price tier, masstige and luxury are forecast to attract the most interest for deals.

Hailey Beiber’s brand Rhode didn’t make Kearney’s list of 20 beauty M&A targets. When Beauty Independent asked over 10 investors and investment bankers this month about whether they believed the brand would sell this year, only two prognosticated it would. Last month, media outlet Reuters broke the news that the skincare and color brand was exploring sale options at a $1 billion valuation, a price that raised brows for a 3-year-old brand generating about $200 million in annual sales.

“The next 12 to 18 months are a unique window of opportunity for investors.”

“With Rhode, the hypothesis is that investors thought it was still a little too early to raise or they were not confident that it would be able to get that number that they’re looking for just yet because there’s been some other pullbacks like Rare Beauty, for example, where the initial sale did not go through,” says Oleg Isakov, a principal in Kearney’s consumer practice who co-authored the beauty and personal care M&A report. “I think these were more maturity considerations and less a testament that Rhode is not an acquisition target. I think it absolutely is.”

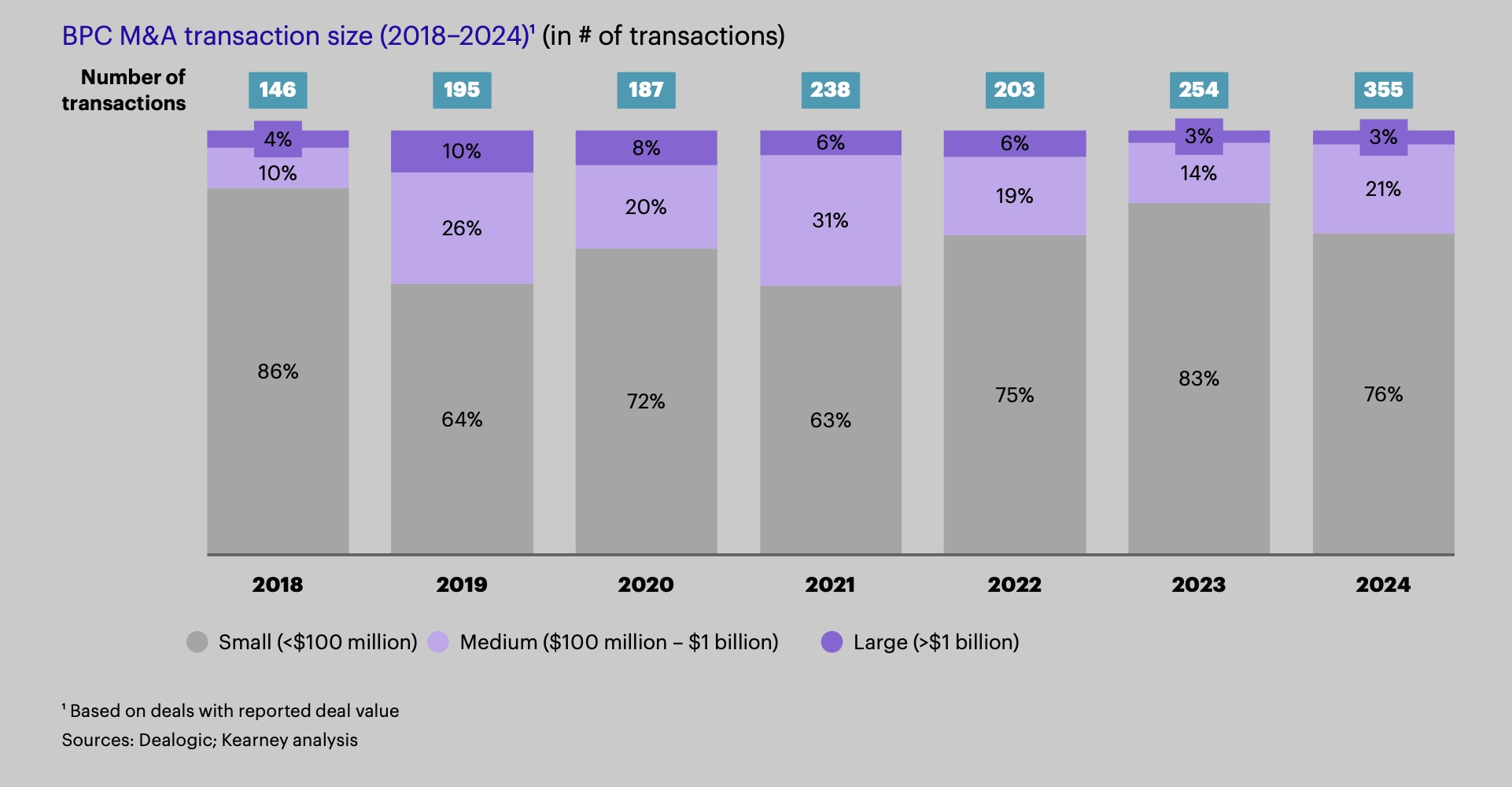

In recent history, beauty and personal care M&A has been dominated by smaller assets. The average price for a deal dropped from 400 million euros or about $450 million at the current exchange rate in 2022 to 160 million euros or $180 million in 2023 and 2024. Kearney explains the drop was fueled by what it calls “growth acceleration” investments in smaller, high-growth assets amid tighter capital availability and market corrections that saw buyers’ tolerance for higher prices diminish. In 2024, growth acceleration deals rose 4%, and what it calls “scale” acquisitions in larger, capital-intensive assets declined 6%.

Kearney’s report says, “We predict that the next 12 to 18 months will see multiple mid- to large-size BPC sector transactions…We expect most acquisitions during this period to focus on scale-ups and established companies, with selective investments in highly promising startups.” It continued, “Valuations in all categories are projected to grow directionally in line with volume but remain slightly lower.”

Kearney’s conversations underscore that, for private equity firms, the main deal motivators are strategic add-on acquisitions, chances of resale to strategic buyers down the road and organic topline and margin growth. For corporate buyers, consumer base growth, geographic expansion and category, product or service diversification and the prevention of competitive disruption are reasons for M&A.

The global dynamics of beauty and personal care M&A are shifting. Kearney’s data reveals that Asia has overtaken North America as the second-largest M&A region following Europe. M&A in India and North America is predicted to accelerate, with North America seeing the biggest jump. However, Kearney acknowledges the North American region is experiencing headwinds such as consumer caution, a slowing beauty market and uncertain tariff policies that have stalled dealmaking so far this year.

Slower M&A growth is expected in Europe, Japan and South Korea, with China neutral in M&A. Global brands are attempting to diversify to have less reliance on Chinese consumers.

“For investors seeking portfolio transformation, growth, and BPC market leadership, now is the time to act.”

“If you decouple Asia, you see that China isn’t the big driver anymore,” says Fabian Lux, report co-author, partner and managing director at Kearney and leader of the firm’s beauty and personal care practice in Europe. “Eighteen months back, everybody was talking about growing mass brands in China. Apparently that’s not the core battleground anymore. If you look at India and its position in the market shown in the report, we wouldn’t have expected that to come out so clearly already.”

What does the M&A landscape mean for emerging brands hoping to fundraise in the near future? Deals may be scant for founder-led companies in the short term. “That doesn’t seem to be on everybody’s mind anymore,” says Isakov. “That didn’t surprise us, but what surprised us was the order of magnitude that it’s not at all a target anymore.”

He emphasizes that smaller brands’ balance sheets are being heavily scrutinized. “The brands that cannot show the profitability and the growth trajectory will have a harder time raising the money,” says Isakov. “They already have a harder time raising the money. If we compare that to the past, there was more leeway, even if they weren’t showing the numbers yet.”

Brands within conglomerate portfolios are being scrutinized comparably, and Ren Clean Skincare, which Unilever is winding down after it wasn’t able to find a buyer for the pioneering eco-conscious brand, illustrates that scrutiny. A few years ago, Isakov posits a buyer would’ve scooped up Ren. Buyer or no, Lux and Isakov concur that conglomerates will persist in making tough decisions on divestitures. Private equity players will similarly hasten divestitures.

Germany-based Lux and Isakov point out TikTok Shop and Amazon are becoming key recruitment platforms for acquirers. “Amazon is the No. 1 due diligence factor for growth initiatives and likewise TikTok Shop,” says Lux. “In Europe, that’s where the growth is, and they [brands] need to change their own business model for it. So, it’s one of the No. 1 criteria to be evaluated. Can you actually accelerate and increase the growth on both platforms?”

Click here to learn more about Dealmaker Summit happening November 10 & 11 in London.