Lisa Price, Frédéric Fekkai, Jaime Schmidt And Gregory Bays Brown On What Beauty Brands Should Focus On Right Now

“Right now, it’s really important to keep everything focused on bringing traffic directly to you,” advised Jaime Schmidt, founder of personal care brand Schmidt’s.

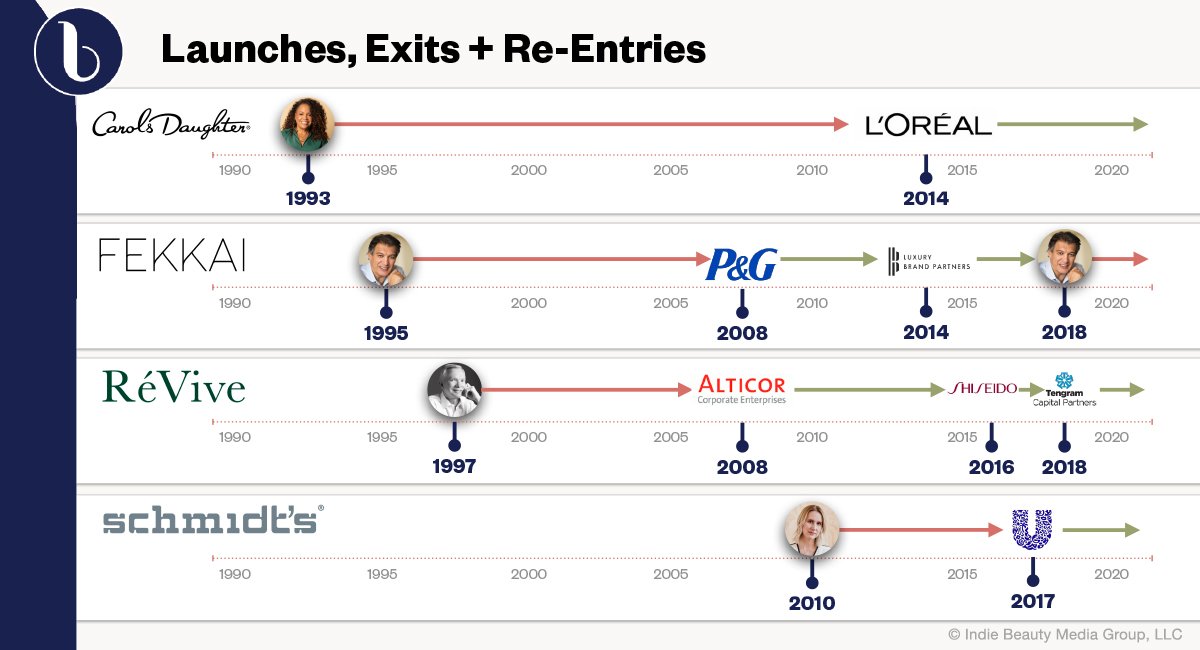

Schmidt was joined Wednesday by Gregory Bays Brown, the plastic surgeon founder of skincare brand RéVive, Frédéric Fekkai, the hairstylist behind natural beauty brand Bastide and a namesake haircare brand, and Lisa Price, founder of Carol’s Daughter, in a Beauty Independent In Conversation webinar moderated by Nader Naeymi-Rad, co-founder of Beauty Independent parent company Indie Beauty Media Group. The participants, who looked back at the beginnings of their successful brands to glean lessons relevant to beauty entrepreneurs broadly, were adamant that the brands winning on digital now stand to gain in the long term.

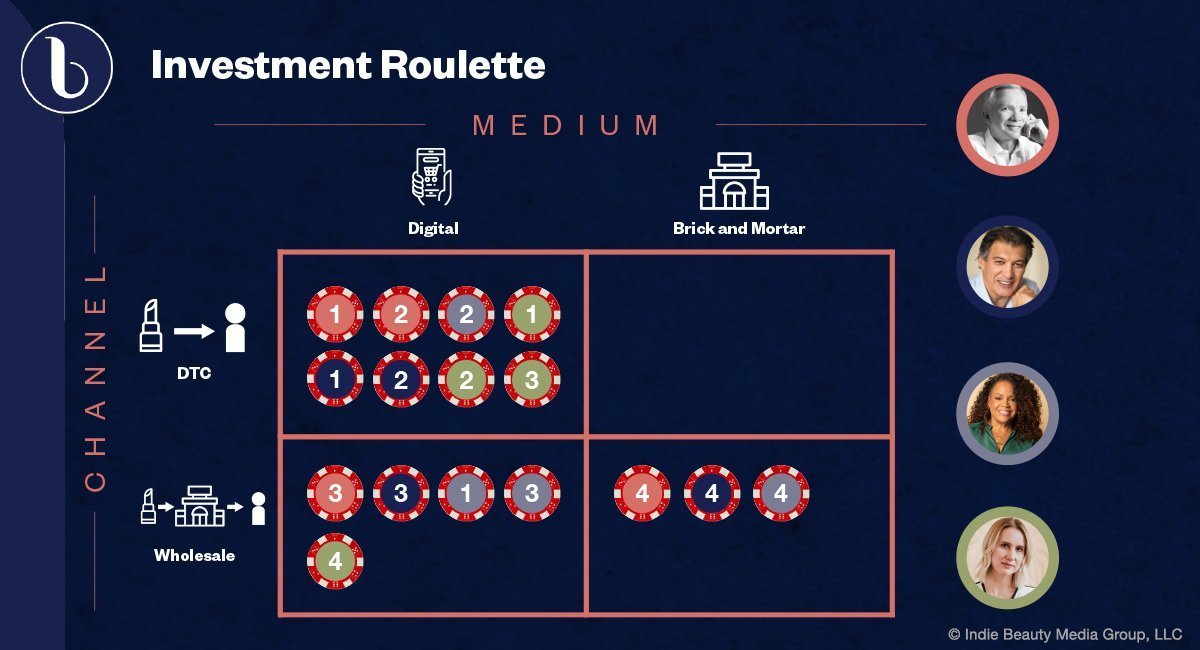

Schmidt’s laid the foundation for a strong business online in advance of heading into big retailers such as Costco, Target and Walmart. “DTC is where we’re going to make our highest profit, right? Straight up, sell it [the product] for 10 bucks, make 10 bucks out of it. If I’m selling digital wholesale, we have to consider the wholesale cost. So, maybe I’m making $5 versus $10,” said Schmidt. “I’m going to put that extra money into ads and just draw so much traffic to my website. All of the money that you’re saving from wholesale is just going to feed directly into ads that’ll bring traffic to your site.”

Price is an omnichannel enthusiast. She asserts the digital offshoots of physical retailers are increasingly important, especially amid the pandemic as shoppers turn to the web outlets of their favorite stores. According to Earnest Research data cited by The New York Times, Target and Walmart are making e-commerce headway against Amazon. Carol’s Daughter is available in 20,000-plus retail doors, including at Target, CVS, Walgreens and Walmart. Price said, “You may reach more customers through a walmart.com than you would your own dot-com site.”

In the 1980s Price went through a personal bankruptcy, an event that was a defining moment for her. Later, in 2014, the retail arm of Carol’s Daughter filed for Chapter 11. The personal bankruptcy and the problems that caused it gave Price an understanding of financial struggles. That understanding continues to influence the choices she makes. “It didn’t make me risk-averse. It just made me smarter about the risks that I could take,” explained Price. “You can recover, and you will make mistakes. The important thing is to learn from them.” Since the bankruptcy, with every initiative her brand embarks on, she drills down on the return on investment. Price said, “If I couldn’t really pinpoint that, I wasn’t comfortable taking that risk.”

“You will make mistakes. The important thing is to learn from them.”

Thinking back on the inception of her brand in the 1990s, Price suggests entrepreneurs hone in on efficiencies and the ability to scale. She wished she had invested more quickly in high-grade equipment with significant production capacity. Price also emphasizes there are some tasks entrepreneurs should seek help with. For example, she recommends connecting with lawyers and accountants to deftly handle business taxes and licenses. Price warned, “You don’t get a kit in the mail that says now you’re a business.”

Brown notes RéVive’s back-office services such as accounting were neglected early on in favor of building its salesforce. “We always felt like, if we didn’t have sales, we wouldn’t have anything since we were growing organically,” he said. “And, when I went to sell the business, that was more obvious. I think that was one of our biggest shortcomings.” Alticor acquired RéVive in 2008 and, six years later, Shiseido took it over in a package deal encompassing Laura Mercier. In 2017, Tengram Capital Partners purchased RéVive in partnership with Brown.

“Shiseido didn’t want RéVive, and they were very open about that. And, of course, RéVive was severely neglected,” said Brown. He elaborated, “Entrepreneurship is not for everyone. You just have to have the guts for it. I’m glad I’ve stayed through all of this.”

In a similar situation to Brown and RéVive, Fekkai is back involved with his namesake haircare brand after he ceded control. Fekkai sold the brand to Procter & Gamble in 2008, and the ownership group of Dilesh Mehta, Tony Bajaj, Joel Ronkin and Amy Sachs outbid Fekkai to acquire it in 2015. In 2018, Fekkai teamed up with Cornell Capital to recapture his brand.

At the helm of his haircare brand prior to its P&G exit, Fekkai mentioned he relied on skincare manufacturers to put quality ingredients in its formulas and selected elevated packaging. He felt P&G didn’t foster the brand in the ways it needed to in order to maintain differentiated market positioning. Fekkai said, “The lesson here is there [are] so many moments where you fail, and you know you’re about to lose your company. It’s so important to believe in yourself and still go.”

A recording of the Beauty Independent In Conversation webinar with Schmidt, Price, Fekkai and Brown is here.

Leave a Reply

You must be logged in to post a comment.