Meh And Awkward: Beauty M&A In 2024

2024 in Review: A Solid Start That Fizzled Fast

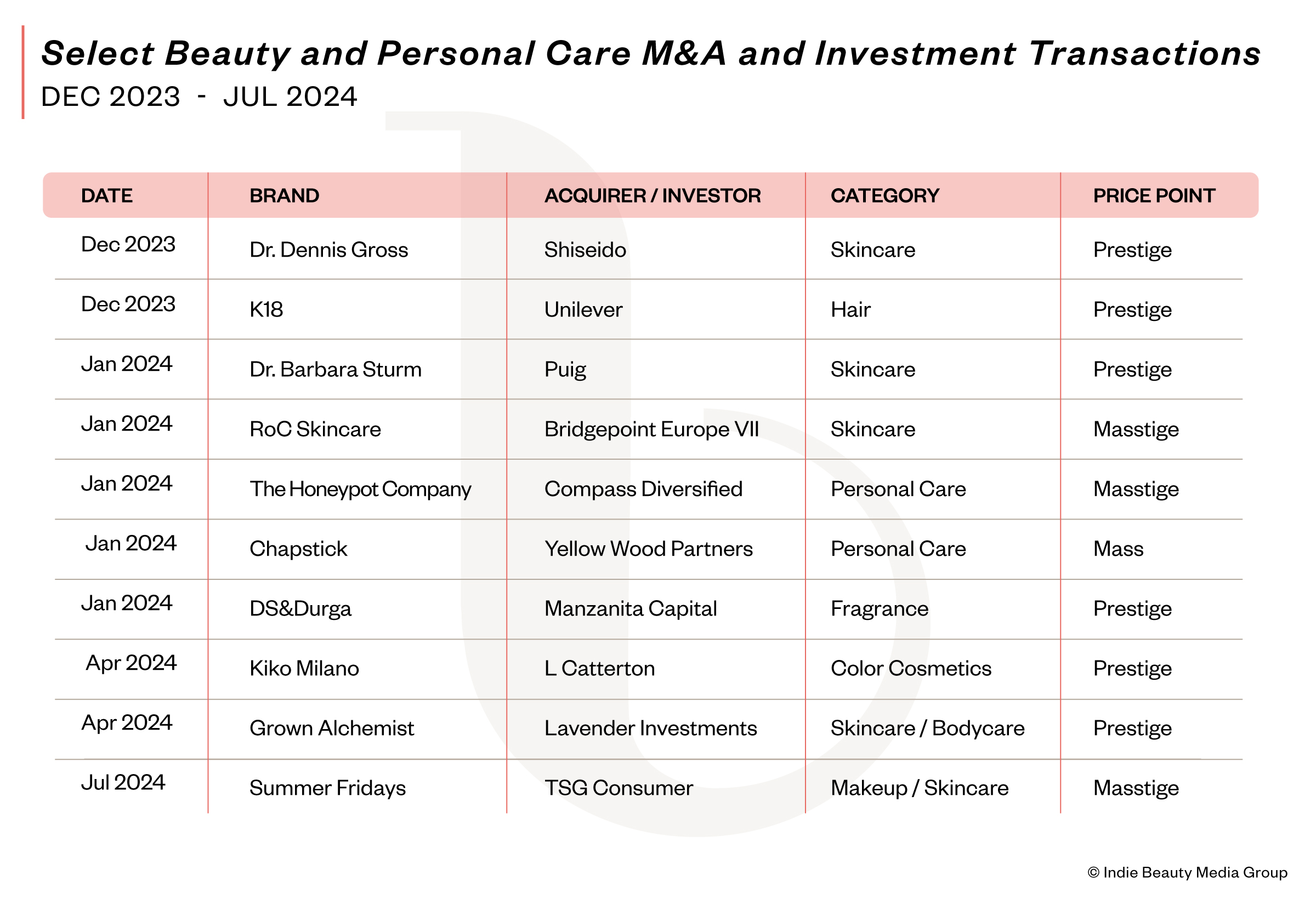

The end of 2023 and the start of 2024 seemed like a beauty M&A dream. Within 60 days, high-flying brands like K18, Dr. Dennis Gross Skincare, Dr. Barbara Sturm and The Honey Pot Company were scooped up by strategic buyers. Then came private equity-backed deals for brands like D.S. & Durga, RoC Skincare, Kiko Milano and Grown Alchemist touching every major category—haircare, skincare, personal care and fragrance at almost every price point. Things were looking pretty good.

And then…crickets. By summer, the M&A energy flatlined. At Beauty Independent’s June Dealmaker Summit in New York City, optimism felt forced. You could practically see “WTF happened?” floating in thought bubbles above every dealmaker’s head.

WTF Happened?

The answer lay in strategics’ boardrooms worldwide, where one CFO after another delivered the same grim script: “China’s struggling, travel retail is in free-fall, Europe remains sluggish and U.S. consumers are demanding more value due to inflation and fifty other factors. Margins are hurting, sales are stalling, and EBITDA is getting squeezed. The Street is not going to be happy.”

Strategic boards heard that, immediately hit the brakes and screamed in unison, “Stop buying stuff!”

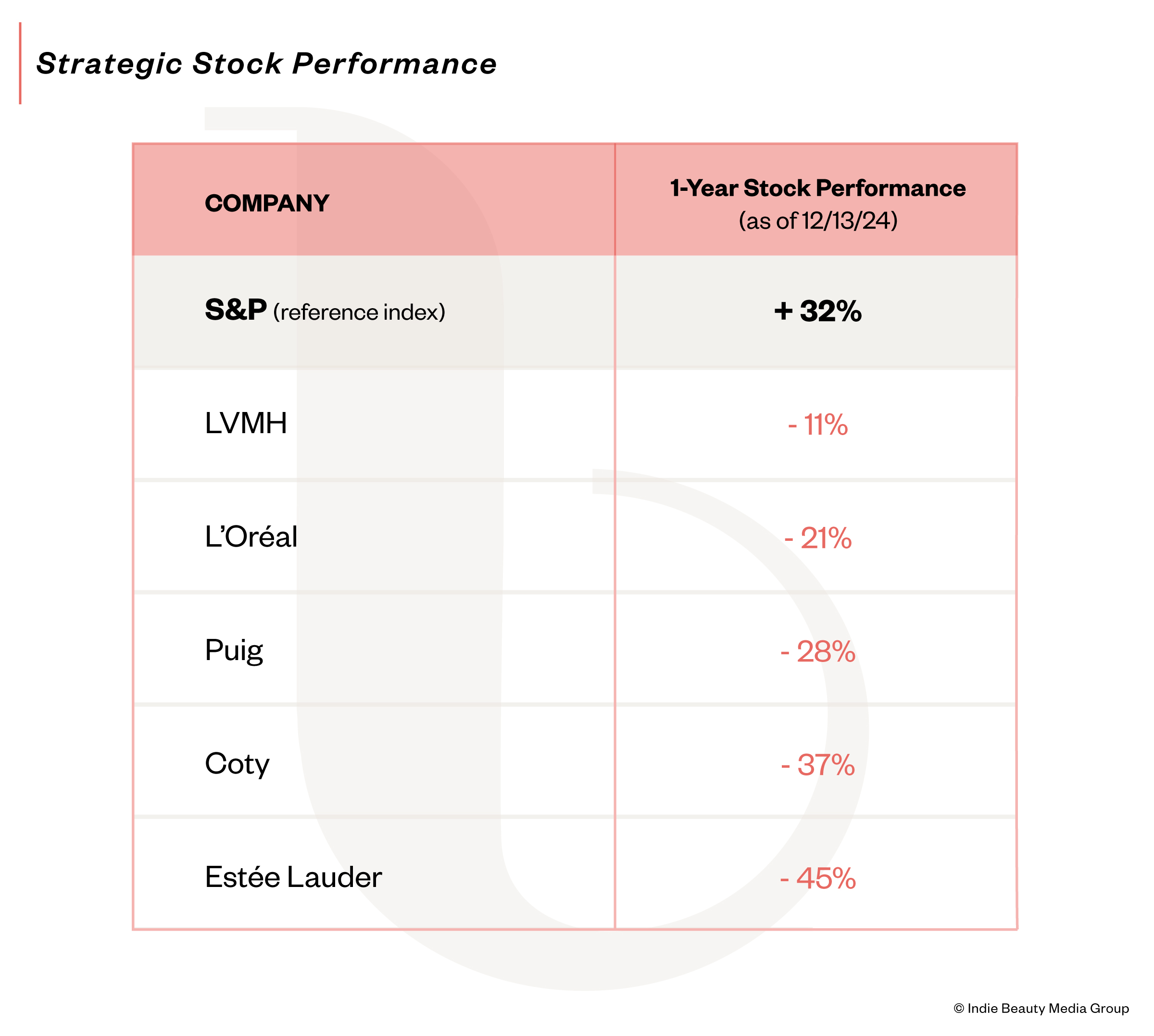

What followed was a brutal second half of 2024. Disappointing earnings and grim forecasts from beauty giants like Estée Lauder and Shiseido led to stock price beatdowns. Some companies like L’Oréal and LVMH Moët Hennessy Louis Vuitton got off with a slap on the wrist, while others faced full-on public tarring and feathering, with one CEO even offered up as sacrifice. M&A checkbooks were snapped shut.

Meanwhile…

Many beauty brands had entered their “exit window,”the perfect moment when a brand is still young, hot and growing, but also commercially scaled and profitable. Banking on 2023’s M&A momentum, they held firm on valuations. But strategics weren’t playing. They weren’t just avoiding high-multiple acquisitions, they were avoiding everything.

By fall, reality set in: Something was rotten in the state of beauty M&A. A senior M&A exec at a strategic summed it up when I asked how he was spending his time. “Anything but M&A,” he replied.

The back-half of 2024 saw some action. Olive & June, Tangle Teezer, Skyn Iceland and RéVive traded. But, by historical standards, these were all relatively modest transactions (<$250M) and none of the acquirers were among the top ten Beauty or Personal Care strategics. Considering expectations coming into 2024, it was an anti-climatic close to the year.

Worse still? A common transaction type was founders buying back their brands for pennies on the dollar like Beautycounter, Goli Nutrition, Vita Liberata and Violet Grey. Sure, technically M&A, but not exactly trophy deal material.

Looking Ahead: What Does 2025 Hold?

If I knew that, you wouldn’t be reading this article for free. But here’s what I think:

- Watch the Strategics: They Set the Tempo.

Strategics have the deepest pockets, so M&A won’t heat up until their earnings improve.

→ NN Recommends: Follow Oliver “OC” Chen at TD Cowen. His team tracks every major strategic and will be the first to spot a shift. Chen will be at our BITE event in Los Angeles on Jan 30. Nab a ticket here and catch him live.

- Focus on the U.S,: It’s Still the Biggest Prize

China’s stuck in an induced economic coma, and the U.S. consumer is skittish. But the U.S. is still the world’s biggest, most profitable beauty market. Just don’t expect an easy jog, you’ll be sprinting uphill. As for India or other emerging markets: Unless you are strategic with deep pockets and a 20-year planning horizon, forget about it.

→ NN Recommends: Be laser-focused. Nail your U.S. strategy, own your niche, and earn your place.

- Keep Perspective: Build for the Long Haul

The golden age of beauty M&A isn’t over, but the manic period is. Cheap money, hyper growth in China and frenzied DTC demand are gone. Welcome to a more disciplined, value-conscious era.

→ NN Recommends:

- Build a brand that lasts—not just one that’s primed for a flashy exit.

- Balance growth with profitability—in the long term both matter.

- Focus on a few channels and geographic markets—nail them before expanding.

- Secure a patient, long-term investor who gets your vision.

- Build real brand loyalty—not just promo-driven one-time buyers from Meta ads.

Final Thought

Strategics may be cautious now, but they still can’t start brands from scratch to save their lives. And even if they could, it would take them twice as long and ten times as much money. So, it makes perfect economic sense for them to buy new brands, which means M&A will be back, but only for brands built on authentic missions, loyal customers and real staying power.

Leave a Reply

You must be logged in to post a comment.