Prioritizing Performance, Gen Z Consumers Name CeraVe, E.l.f. And Rare Beauty Products As Favorites, New Report Finds

CeraVe, E.l.f. Cosmetics and Rare Beauty are behind the products that gen Z shoppers mention most in conversations on consumer insights app Cafeteria as young beauty consumers prioritize product efficacy and purchase across price points.

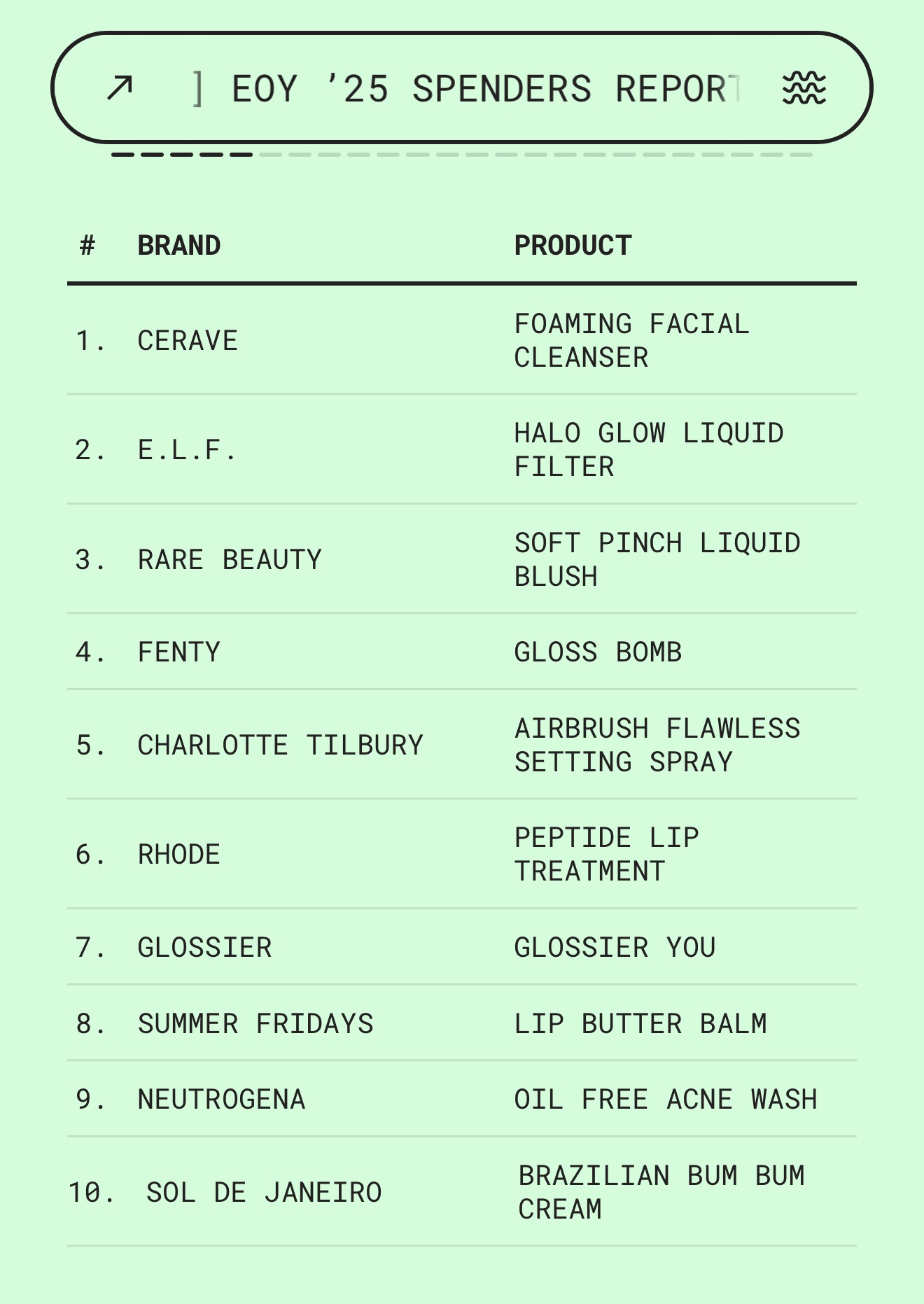

According to a report entitled “2025 Next-Gen Spenders Beauty Edition” drawing on over 2,100 users aged 14 to 26 years old discussing 270-plus beauty brands, CeraVe’s Foaming Facial Cleanser, E.l.f.’s Halo Glow Liquid Filter and Rare Beauty’s Soft Pinch Liquid Blush are the beauty products garnering the highest volume of positive comments. Fenty’s Gloss Bomb, Charlotte Tilbury’s Airbrush Flawless Setting Spray, Rhode’s Peptide Lip Treatment, Glossier’s Glossier You, Summer Fridays’ Lip Butter Balm, Neutrogena’s Oil Free Acne Wash and Sol de Janeiro’s Brazilian Bum Bum Cream round out the top 10 beauty products for mentions.

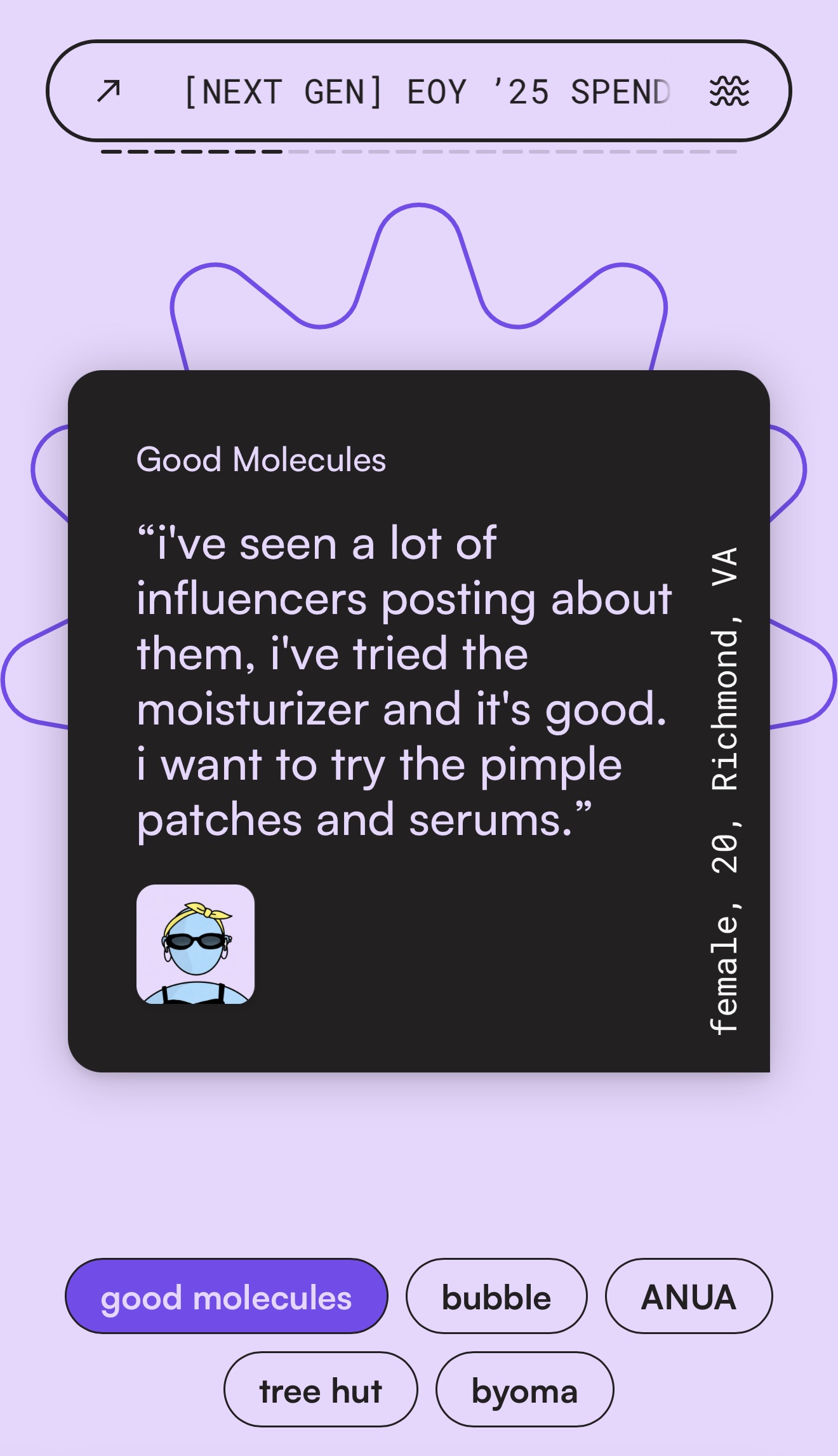

Products from Good Molecules, Bubble, Anua, Tree Hut and Byoma are also generating discussion on Cafeteria, which invites teens to provide brand and product feedback in exchange for payments of $5 and $20. Brand is often not the most important attribute for gen Z purchases. With scores of beauty brands to choose from, they gravitate toward qualities such as formula performance constancy, non-irritation and transparency around changes like formula revisions. “Loyalty is earned product by product, and kept with consistency,” the report reads. “Gen Z loyalty is product-first, brand-second.”

Mark Silverstein, co-founder and chief business officer at Cafeteria, which has raised about $6 million in funding over two rounds since 2024 and counts H&M, Roller Rabbit and Hiya among its clients, explains that gen Z consumers are incredibly fluent in the language of beauty ingredients and typically describe their favorite beauty products by formulation over brand name. Hyaluronic acid, salicylic acid, glycolic acid, vitamin C, niacinamide and caffeine are a few of the ingredients mentioned most in the beauty discourse on Cafeteria.

“We keep hearing from teens that they find personal beauty to be a form of self-care and emotional wellness,” says Silverstein. “Many tell us that they see their morning skincare routine as a grounding ‘me time’ to begin their day. They are proud of the time, energy and money they spend curating products to keep their skin and lips healthy.”

TikTok is the most meaningful social media platform for gen Z’s beauty product discovery. The report says around 61% of Cafeteria users get product recommendations from TikTok, about 3.4X more than Instagram. Fifty-eight percent of users prefer shopping in stores, while 21% shop omnichannel.

Sephora is the big winner for beauty retail, and the report finds 14- to 17-year-old teens are shopping at Sephora more frequently than older teens and young adults, at a rate of 75%. Sixty-three percent of users on Cafeteria had their first visit to a Sephora store by 13 years old.

Ulta Beauty gains popularity as Cafeteria users mature. Fifty-six percent of 18- to 21-year-olds head to Ulta for their beauty shopping as they shop up and down the price spectrum and seek deals from affordable brands like E.l.f. and NYX. About 31% of 22- to 26-year-olds on Cafeteria spend between $50 and $100 per month on skincare. They prioritize high-performance brands like The Ordinary, Paula’s Choice and Cosrx. About 58% of the 22- to 26-year-old cohort shops at Ulta.

Gen Z’s beauty shopping isn’t siloed to a particular price tier, and they pick and choose carefully which products they’re willing to pay a premium for. One in five females and males are using products from drugstore staples like CeraVe and Cetaphil, with one in three females assembling skincare regimens that blend drugstore and prestige together.

“They are looking for makeup dupes and bargains on high-volume basics like cleansers and moisturizers and are spending for ‘worth it’ toner and serum formulations,” says Silverstein. “The efficacy-to-cost trade-off is everything. On Cafeteria, one in four who criticize a brand for being too expensive praise a different SKU from the same brand.”

Sixty-two percent of Cafeteria users say that makeup is the most dupable category, ahead of fragrances at 28% and skincare at 8%. E.l.f. is considered the leading makeup dupe brand. However, younger beauty shoppers will splurge for color cosmetics products they deem worthy, with 18% listing prestige Sephora brands like Saie, Ilia, Tower 28 and Merit as favorites for functionality and performance.

When it comes to holy grail makeup products, it’s all about the lips. Seventy-nine percent of Cafeteria users list lip products ahead of foundation and concealer at 29%, blush, bronzer and contour at 21% and mascara at 20% as daily essentials. Lip gloss surpasses lip oil in popularity by a three to one ratio.

Gen Z takes fragrance seriously, with 44% of females owning six or more fragrances that they rotate and layer to create scents to match the season or their mood. Sweet gourmand scents are by far the most popular with Cafeteria users, accounting for 55.7% of their favorite fragrances. Fruity, fresh and floral scents snagged 19%, 16.7% and 14.9%, respectively. Thirty-nine percent of females are drawn to lower-priced body sprays, with Bath & Body Works and Victoria’s Secret their top two destinations to buy them.

TRESemmé and Pantene are gen Z’s favorite mass haircare brands on Cafeteria, with prestige brands Amika, Olaplex and Ouai luring their dollars on Sephora and Ulta trips. Half of female users purchase both prestige and mass haircare. Prestige wins the hair oil category with Moroccan Oil, Ouai, Olaplex, Gisou and Kerastase garnering the most mentions.

For users with textured hair, curl definition is a top concern. Leave-in treatments from It’s A 10 and Not Your Mother’s are tied for hair oil favorites, with Shea Moisture coming in second, and Mielle and Cantu tied for third place. Mentions of Tracee Ellis Ross’s Pattern Beauty are ramping on the app in the category.