How Settle Is Building The Back End Of Shopify Brands

E-commerce sales in the United States are expected to grow less than 10% in 2024, but Settle, a working capital lender and cash-flow management platform for e-commerce businesses, has been growing at roughly a 100% clip this year.

Settle’s momentum demonstrates that being at the right place at the right time can never be underestimated, even if that place is virtual. The company, which secured a $145 million credit facility last year and has supported over $2 billion in payment volume, is picking up clients as its competitors stumble—Ampla has notably been in the news for taking a financial hit and being up for sale—and venture capital fleas the consumer sector. Today, it has 400 clients, including several well-known beauty and wellness brands such as Pat McGrath Labs, Bubble, Snif, Soft Services and HigherDose.

Settle doesn’t want to waste the opportunity to build on its momentum. It’s assembling a toolkit to deepen relationships with the clients it currently works with and widen its universe of potential future clients. Earlier this month, it introduced two products, Landed Costs and Universal Catalog, to enable brands to quickly and accurately calculate the landed costs of their products or the complete price of those products once they’ve arrived at their customers.

But Settle isn’t operating in a settled environment. The fintech startup space has been adjusting to tough direct-to-consumer and VC realities, and consumer brands are clamping down on their finances to make sure they don’t make imprudent decisions that will decimate their balance sheets.

To explore the current environment for consumer brand lenders and help brands understand it, we talked to Settle CEO and founder Alek Koenig, former head of credit at buy now, pay later specialist Affirm, about macroeconomic conditions, artificial intelligence’s infiltration of consumer packaged goods, BNPL’s prospects, why his company is different from merchant cash advance players and how it stacks up against competitors.

When Settle first started, what was its proposition, and how has that changed?

We always had big ambitions of doing a lot of things to help brands work better, but you can’t build everything overnight. The initial proposition was accounts payable software with financing. Obviously there are other accounts payable solutions out there, so we really need to build something 10X better.

My whole background is in credit and lending. I was thinking, what if we combine this with working capital? Could we actually change the trajectory of these businesses instead of just saving them a few hours a week? That was the idea. I interviewed a bunch of customers, that all seemed to resonate with them and that’s what we launched with. It was very bare bones, but, once we got traction, we were able to build out the functionality.

No one really liked using the existing accounts payable systems. I definitely believed in this wave of the consumerization of business software, where stuff feels more like Venmo than some clunky old software from back in the day. One angle of it was, let’s make this an enjoyable experience with quicker payments, better technology, but the working capital stuff was really what resonated.

All these businesses have the exact same issue. They need to procure inventory way ahead of receiving it and being able to sell it. It’s quite cash intensive on their part. I was like, well, if they’re able to sell this inventory, then procure more of it, we will be a high ROI activity for these businesses.

If we can front them the money to do it, they’ll pay us back once they sell it, and thus everyone wins. The brand makes more money, we make money on interest, of course, and especially if they’re able to order larger quantities using this capital, they could get cheaper per unit costs from their suppliers as well. In that way, we could supercharge these businesses.

We got really fortunate because we launched in the middle of COVID. All this demand came online, and these brands were stocking out. We were able to help them fulfill those goods and grow much quicker than they would’ve without us.

How much of your business today is the working capital part of it?

More than 70%. I think it’s going to continue at those levels. It’s a big differentiator. We want to grow it. It solves a need for the brands, but now that we’re a bigger company, we’ve built out the previous products, we have larger engineering teams and can continue focusing on problems that these brands are having to make the product stickier. That’s how we think about it.

We start out with accounts payable software. What’s the most adjacent thing to that? Well, it’s creating purchase orders. Before you pay the bill, you need to tell the vendor what you want to buy. So, we did that. What’s the next thing? It’s, how do you know how much to put on that purchase order?

Let’s go to the next thing and give you insights and information to make that decision, so inventory planning. Some of what we are releasing now, Universal Catalog, is way of making purchase orders easier to generate and not having to go into all these systems to update your catalogs. You could just have one place, and if these businesses can save time doing that, they could focus on the most important part of the business, which is growing sales.

What do you charge for accounts payable software?

We have a starter tier, which is free on the SaaS side, and then we charge for the type of payment that you make, if you’re sending a check, ACH wire, international wire, FX, but that’s cheaper than the market. If you want some of the more premium features like approval workflows or purchase orders, the rate is $79 a month.

Do you think there’s been a DTC reckoning?

No, I don’t think so. With interest rates rising starting in 2022, it’s made venture capital less attractive across the board, not only for brands, but also for companies like us. The pullback is probably healthy because a lot of these brands were growing at all costs, burning money galore.

In the same way a lot of tech companies have taken their medicine, brands have as well. You just need to run leaner, focus on contribution margins. What we’ve seen is that businesses are running healthier. They might not be growing as quickly, but the growth is actually more capital efficient. So, they’re not losing money on every sale. We see a lot more brands that have much longer runways be much more profitable or breakeven, and they’re building a business for the long run.

There’s still a lot of tailwinds for DTC as a channel, and it’s going to grow over time, probably to 50% of all retail over some timeframe as more people come online and younger generations account for more of the spend. But brands need to grow smarter now since, as an investment class, it’s less attractive than it was probably incorrectly five years ago.

How have the lending needs changed in the current environment?

There’s increased demand for it because before a lot of brands were using venture capital to buy inventory and pay for marketing spend. I would argue that’s a poor use of capital. It’s very expensive because you’re diluting yourself, especially when ordering inventory and paying for marketing are very short term [and have] clear ROI. You know what returns you’re going to get on it.

I think you should raise equity for things that are more uncertain like product development or hiring out a team. Venture capital is more appropriate for stuff that’s going to convert in 30 days to six months.

As you evaluate brands today to provide working capital, are you raising the bar?

I don’t think we’ve changed the bar, it’s just that customers now are probably on average slightly less healthy than they were back when anyone could raise venture capital or money from angels. Because our loans are so short term, there’s not a lot of macro risk we take on. We’ve definitely tweaked things here and there as we’ve improved our underwriting models over time, but I wouldn’t say we’ve slashed approval of rates or anything across the board.

In what way have you tweaked things?

We underwrite from various data sources. As we get customers that don’t perform and become delinquent, then we generate features and signals from that data and build our own machine learning underwriting models to determine if those features are predictive of delinquencies. As we get more performance data, we could create a new underwriting model.

Give me an example. What do you think is predictive of delinquency?

Cash runways, current ratios, quick ratios, contribution margins, growth, all these types of things are very important features to determine how businesses are going to perform. As we’ve improved our underwriting models over time, we’ve been able to drive delinquency rates down.

What determines when you foreclose on a brand?

We’ve done it very rarely. We’ve only done it when the founders have thrown in the towel, and we could either have it go to zero or we could foreclose on it and try to sell it to try to recoup the money that we lost, but we haven’t since starting the company actually actively foreclosed on a company. That’s just a bad outcome for everybody.

We’ve seen the struggles of Ampla and Amazon moving out of working capital for consumer brands. Explain what’s happening.

I haven’t worked in any of those companies, so don’t have any firsthand knowledge, but there’s different reasons for what’s going on. For Amazon specifically, instead of them doing it and it being a small portion of their gigantic business, they’ve decided to just leave it to third parties. So, they’re still offering it, just not from a first-party perspective, which I think is a fairly smart way to do it as long as you have good partners.

With the other companies, there’s a lot of VC-backed companies that are shutting down. I don’t think there’s anything in particular going on. We haven’t seen anything on the capital market side really change that much as of yet. It was more fundamental business reasons.

How’s Settle’s financing? Are you looking for financing now?

We still have a lot of capacity, so opportunistically we might look at another warehouse facility, but nothing in the plans right now. On the equity front, we’re in a solid position. We’re really focused just on growing our business in a healthy manner and building out the product suites that our customers are asking us for that can really help them run their business better.

Give us your perspective on macro conditions.

A lot of us here have credit backgrounds, so we’re paranoid by nature. The consumer is definitely getting squeezed, especially with inflation. You’re seeing the unemployment rate tick up slightly, and consumer savings have been depleted over time. Credit card balances are at all-time highs. We’re very cautious. We expect some consumer pullback.

I don’t think there’s going to be a 2008-type of recession, but I do expect the economy will contract a bit, and if you believe that, then you believe the Fed will start decreasing interest rates. That will prevent a terrible recession. But the hard part to understand is, if they ease up too much, will that just reinvigorate inflation? Then, we might be in more of a stagflation period.

Obviously, you have a lot of data on brand sales. Are there certain brands or channels that are outperforming the market?

We definitely work with a lot of beauty brands, and a lot of them are celebrity-backed. Just by using the celebrities’ following, they’re able to make a lot of sales with very little marketing spend. They have a leg up. As long as the coolness of the celebrities’ brand is intact, we’re seeing those companies grow at incredible paces, and we’re just trying to keep up with them.

A lot of businesses are doing this kind of drop model like, I’m going to come out of nowhere and release this new product, you can only get it today online or offline. That creates a lot of demand and buzz in a very creative way.

What AI tools do you think will have traction for CPG brands?

I think they’ll be very widespread in every product, and everything will be AI enhanced both from a targeting perspective, but then also just doing the work for you. There’s a lot of opportunity in creating AI agents and having them run tasks in the business. A lot of the stuff businesses do is very repetitive, and this is just another way of automating that and hopefully making smarter decisions in even quicker timeframes.

These types of decisions will have to be approved by the actual operators, but, over time, as they gain trust in these systems, they could actually throw them on autopilot. They’ll continue to drive costs down across the board. My view is that, if a company doesn’t want to adopt it, they’ll get eaten up by someone who does. So, everyone’s forced to play and use these new tools to create more value for the customer.

When a founder walks up to you on the street and is like, “I’m looking for working capital,” what do you tell them about Settle versus your competitors?

We’re one of the larger ones, so we’ll definitely be around, but what’s very different is most lenders will just drop money into your bank account and immediately you’re paying interest on it even though you haven’t used it.

Our view is, once you pay the vendor, that’s when interest will charge. That’s why we’ve combined the working capital with accounts payable software, which has definitely made it more difficult for us, but that’s where we think the value is. You’re only going to start paying interest when the money’s actually used instead of just paying interest and principal if it’s just sitting your bank account. If anything, you should be getting paid interest, not the reverse.

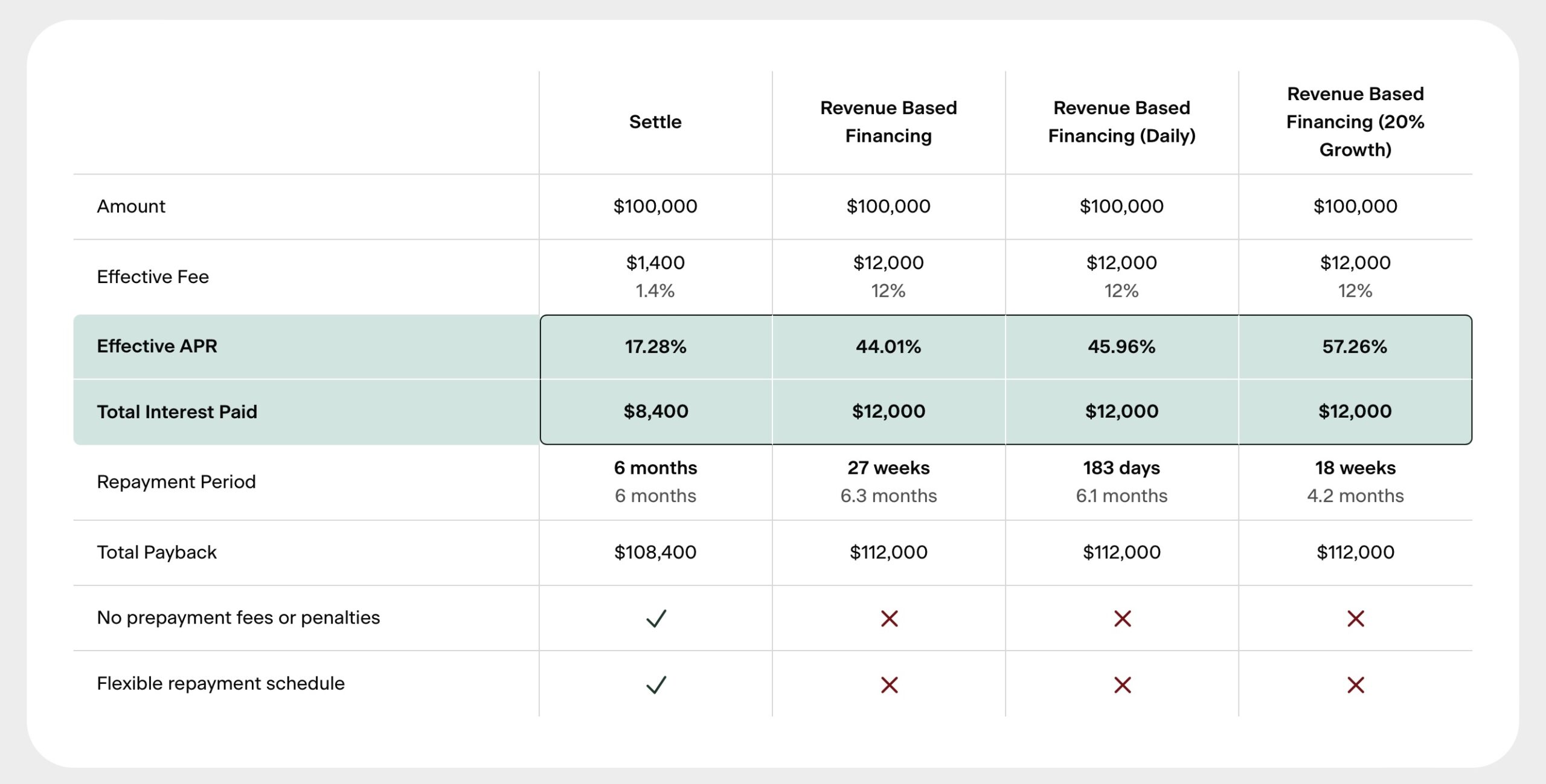

Another thing is the structures that we have are very flexible for what they need. We have two kinds of repayments. One we have is interest only and then principal at the end. If it takes 90 days to get inventory and start selling it, then that works for you. We also have an amortizing loan structure, which we could go longer durations, but you’re paying equal payments interest in principal every month. The big difference is we’re not a merchant cash advance player, so our APRs are lower.

What’s the APR range?

Anywhere from 11% to 24%. While some of these merchant cash advances, they might look attractive because they’re tricking you with the structure, but it could be 40%, 50% APR, and you only realize it once it’s done. We’re trying to be very honest, transparent, easy, simple.

One brand that participated in a No Stupid Questions story we’ve done on fintech lenders mentioned that Settle has a holding account for it. Can you tell us about that model?

It’s more of an experimental product. It probably accounts for 1% of all of Settle. Generally, for brands that are slightly riskier, normally with our current structure, we can’t approve them as is, but if we have this holding account, then that helps us expand the approval rate a bit. That’s what we’re testing. It’s not something we’re going to roll out to everybody.

What are the options? We could give them a 20% APR loan, but it’s going to come with this holding account, and maybe at some point as they grow, they could graduate out of it.

You come from BNPL. What’s your sense of the state of that business today and where it’s headed?

Very bullish on it. I think Affirm and others will continue doing well. There are still merchants that haven’t adopted it, and, as I mentioned before, the e-commerce tailwinds are going to continue to grow. They’ll take larger share out of that.

As gen Z and millennials take over more of the overall purchase volumes, then BNPL will grow as well because it’s cheaper than credit cards. It’s more convenient as well. And I think they’ll branch out to offline channels. The user experience is a little bit trickier there to solve, but it’s doable. They’re very short-term financing as well, so they don’t bear a lot of macroeconomic risk as well. They’ll be around for the long term.

Do you think any alternatives to Shopify can take off?

No, I don’t think so. Shopify is too good and has too much market dominance, and they’re still innovating at an incredible pace, so it’ll be very, very difficult for anyone to really chip into their dominance. I don’t see it.

What are some future goals for Settle?

The way I think about it is, if Shopify is the front end for these businesses, Settle is the back end. If we look at all the jobs that finance and ops are doing, that’s what we want solve for. We want to make their life as easy as possible, help them make better decisions.

If we do that, it becomes a no-brainer that every brand should use us. If you’re starting off, if you’re growing, if you’re opening up additional channels like selling it to Sephora, we’re going to make that easy for you and give you all the tools all in one place instead of trying to piece together these 20 different systems that you might be looking at.

Leave a Reply

You must be logged in to post a comment.