Standard Dose And Olika Backer LB Equity Expands Consumer Sector Reach With Defunkify Investment

Lucas Brand Equity has made its first foray into the fabric care sector with an investment in eco-friendly detergent specialist Defunkify.

LBE led a series A round with participation by sustainable product-focused venture fund Safer Made; 32 Ventures, the family office of finance expert Robert Wolf; and Ad Ventures, the investment arm of ad agency Harmon Brothers, which has created content for Purple Mattress, Poo-Pourri and Squatty Potty. The amount of the round wasn’t disclosed.

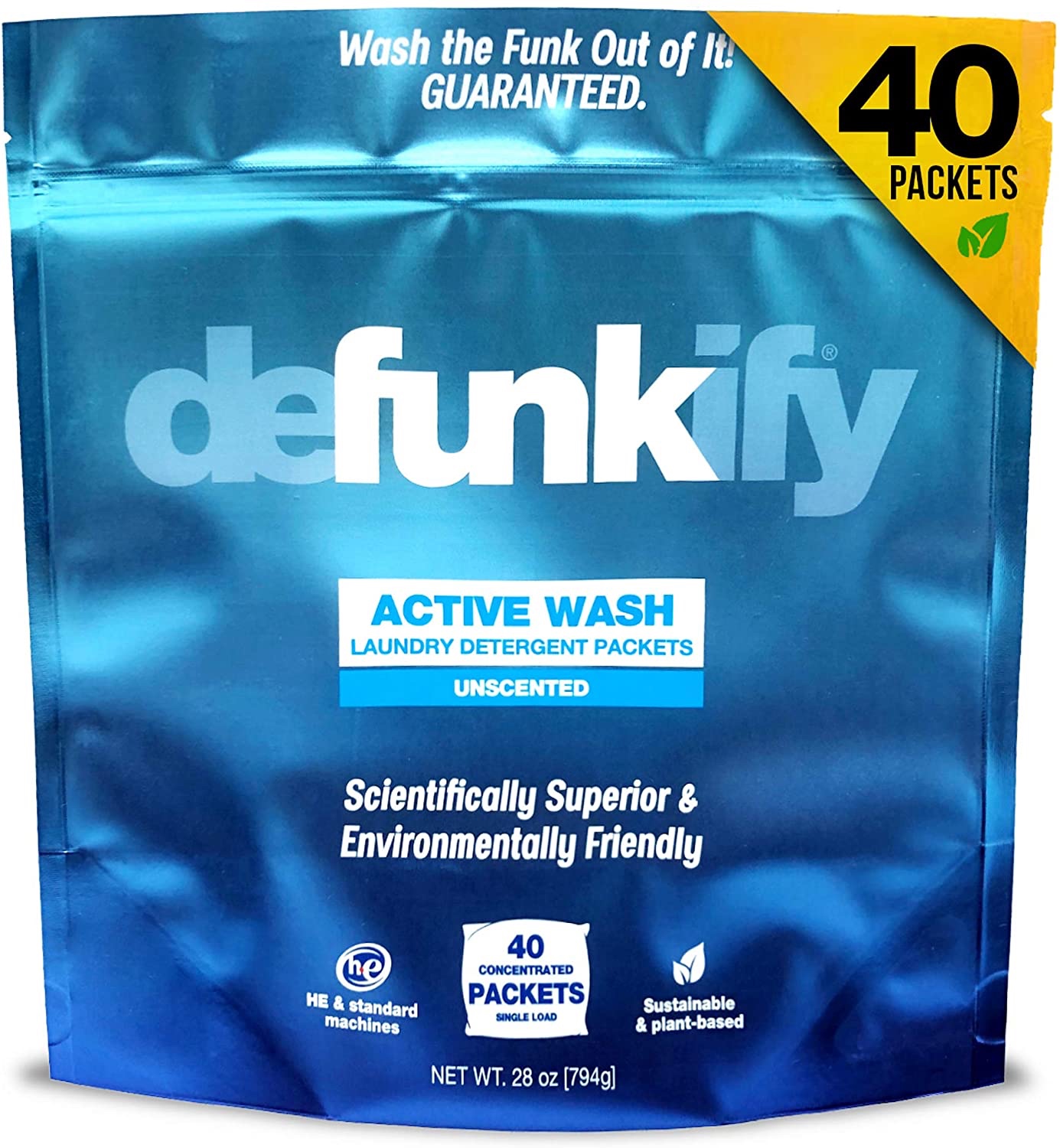

Defunkify offers liquid and powder laundry detergent priced at $19.99 for 37.7-oz. sizes as well as odor remover, stain remover and all-purpose cleaning sprays ranging from $7.99 to $9.99. The brand is sold in 1,000 grocer and specialty retail doors nationwide, including at Sprouts, Safeway, Albertsons and REI. Defunkify is entering Whole Foods this quarter and has a robust business on Amazon.

The funding will be put toward building the brand’s product offerings and e-commerce presence, and supporting brick-and-mortar expansion. “Pre-pandemic, the vast majority of cleaning products and laundry detergent were purchased in the grocery store, something like 90%,” says founder and CEO Richard Geiger. “That’s obviously been changing with COVID and, certainly for new brands, it’s especially impactful because most people go into the grocery store now. I get out of my car, I hold my breath, and I run into the store and go as quickly as I can just to get this stuff I know I have to have and then I get out. I’m not shopping, I’m not really looking for new stuff. That has an impact on anybody who’s trying to break into a market, whether food or cleaning products or whatever.”

Post-pandemic, Geiger believes that consumers will be doing a lot more browsing and discovery while grocery shopping. “Going forward, retail stores are going to become as important as ever,” he predicts. E-commerce sales, which jumped from comprising 50% of Defunkify’s revenues pre-pandemic to 80% in the past year, are also a big focus for Geiger, emphasizing the user data direct sales provide as invaluable.

“You can learn so much about your customers and what they like and what they want and really build a relationship with them where they become brand advocates,” he says. He notes consumers who have switched to mostly clean personal care products become loyal customers of Defunkify once they make the switch and realize they’re not sacrificing efficacy.

“When you look at microscopic images of the fibers, what you see is all this residue from the cleaning products that you’re using on the fabric. That’s now on your skin,” says Geiger. “You just washed your toddler’s stuffed animal or their blanket or their pajamas in that stuff, and now they’re chewing on the sleeve, and they’re ingesting those chemicals.” He points out Defunkify’s products don’t leave the residue. Plus, Geiger says, “it will still get that wine stain out of your $100 top,” Geiger says.

According to a report by Grand View Research, the global laundry detergent market is expected to advance at a compound annual rate of 5.2% to reach $205.2 billion by 2025, but is a mature market consolidated around five leading companies, including The Clorox Co. Procter & Gamble and Unilever, reaping the lion’s share of sales. The lopsided market dynamic was a draw for LBE, which views the category as ripe for disruption.

“If you look at the fabric care market, you have a couple of companies that have about 80% market share in an almost $14 billion category in the United States,” says Ian Knowles, director at LBE. “If you look at those products, the majority are not clean. Gain and Tide have their clean and free offerings, but they’ve really compromised on performance with those formulas. They’re also just not that clean. We were looking at this market saying there has to be someone doing something in a way that’s positive for the body, positive for the environment and offers the same level of performance and efficacy as what these Tides and Gains purport to offer.”

The possibility of a favorable exit isn’t lost on Geiger or Knowles, who shares that there’s precedent for the big players scooping up a startup that has the combination of desired capabilities and a popular, innovative product. “This is a dusty category. Acquisition does seem to be the model more than in-house,” he says. “I think the reason is that those small brands are really engaging with their customers through this direct-to-consumer marketplace, building a really passionate customer base that the larger brands don’t have. How many people get really excited about Tide?”

LBE was founded in 2012 by husband-and-wife team Jay Lucas and Karen Ballou. Prior to its investment in Defunkify, the firm was focused in the clean beauty and wellness space. It made investments in brands like hand sanitizer specialist Olika, luxury skincare line Immunocologie, plant-based personal care retailer Standard Dose and cannabis beauty line Hrb Essntls. Ballou, a 30-year veteran of the beauty industry is also founder of Immunocologie, a brand she launched after recovering from cancer.

Leave a Reply

You must be logged in to post a comment.