“Not Always About The Best Product”: VC McKeever Conwell On What Really Drives CPG Success

If you wanted to get on the radar of investor McKeever Conwell five years ago, all you had to do was slide into his Twitter DMs.

Back then, he was fundraising for RareBreed Ventures, a pre-seed and seed-stage fund. While he had worked for Maryland Technology Development Council (TedCo) backing underrepresented founders and was a two-time entrepreneur himself, he was widely unknown, so he used Twitter to build his network, quickly jumping from 2,500 followers to almost 61,000 a year later and nearly 98,000 today on what’s now called X.

When Conwell noticed that his following included investors, he messaged them to set up meetings. He had over 1,000 in the span of three months. The meetings paid off, with roughly 80% of RareBreed Ventures’ first $10 million fund coming from people he met on X.

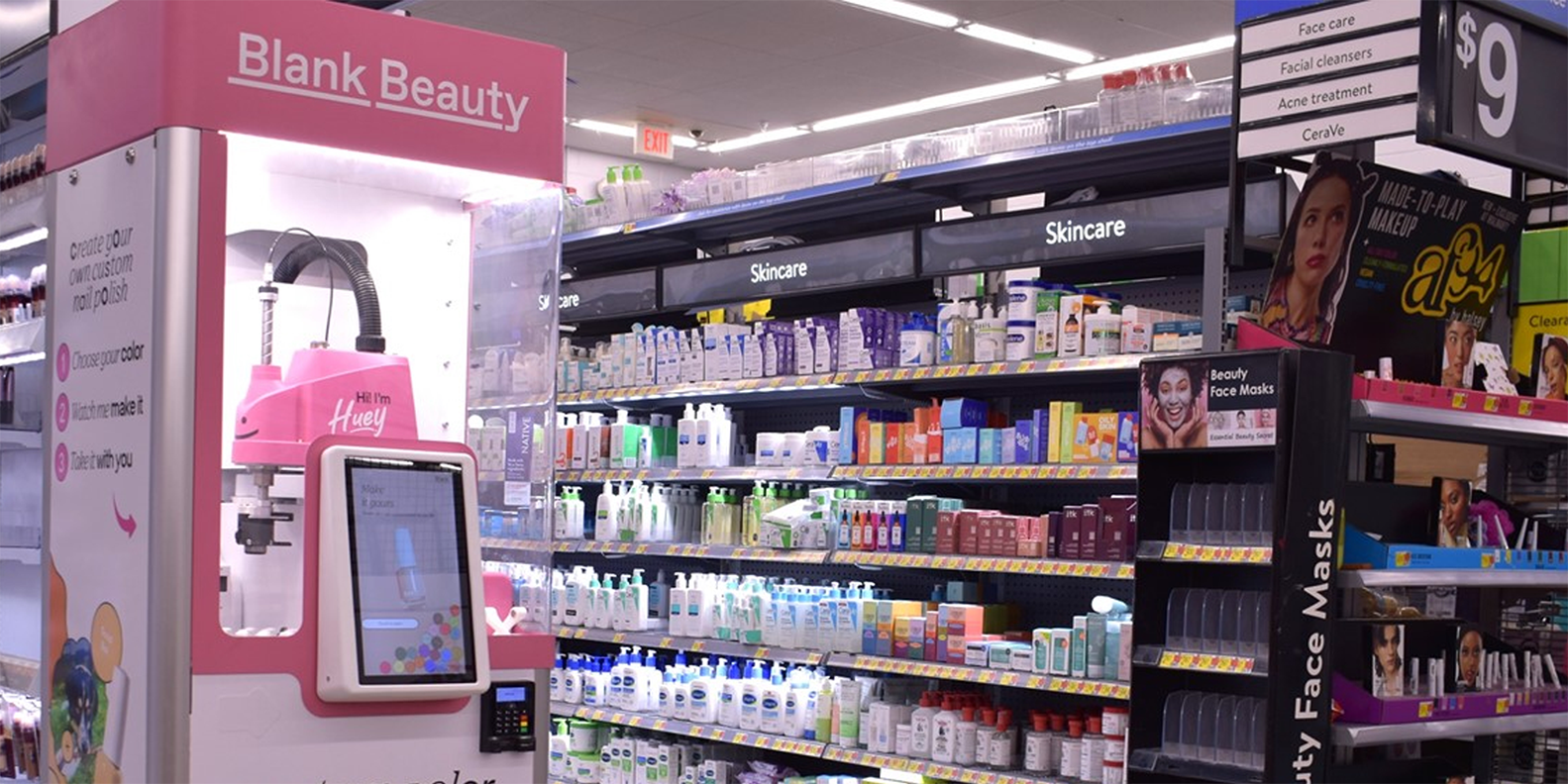

Today, RareBreed is embarking on its second raise, though Conwell isn’t relying as much on X. He declined to disclose the goal amount for the firm’s second fund, but says he’s looking to double its average check size from $175,000 to around $350,000. RareBreed currently isn’t investing in companies, but it previously invested in 25 to 35 companies a year, particularly those led by underrepresented founders. Brands in its portfolio include Rebundle, Blank Beauty, Red Drop and the forthcoming Halo Braid.

Conwell founded RareBreed in September 2020 with partner Johnathan Kroll, who was previously at Andreesen Horowitz and Spero Ventures. He says, “My investment thesis is I invest in dope founders. I don’t care who you are, what you are, what you look like, I’m just here to work with amazing people so that we can all make money together.”

Ahead, we chat with Conwell about how he got started, the ways he finds brands to back, categories within beauty he’s excited about and what he thinks about the current investment landscape.

What led you to start RareBreed?

I’m from Baltimore, come from a blue collar family, went to Morgan State to study computer science before being a software engineer was a cool thing. While in college, I was lucky enough to get into the student program for the National Security Agency and that gave me top secret clearance. There are like 300 kids, 30 of us Black. So, in my early 20s, my closest friends were these young Black men and women who worked for the security agency who were electrical engineering or computer science majors from HBCUs or Ivy Leagues who all had extremely high GPAs.

One of them was Patrick Jackson who went to Howard was obsessed with being the Black Mark Zuckerberg. I learned how to code in PHP because he wouldn’t shut up about how Mark Zuckerberg built Facebook using it. He was the first person I saw who quit his job and went to San Francisco because people gave him money to work on apps. That starts the idea of, I could build something. A group of us start kicking around company ideas. In 2009, 2010, me and two of my best friends started our first company. It was a platform for crowdfunding. We eventually sold the IP to a division of a Fortune 100 company.

Then, my second company fails. I have this lull where I’m working at a marketing firm, just trying to get myself back together after having a failed startup. They get a client who I don’t agree with ethically. I quit on principle. That was a Friday. The very next Monday, I get this community-wide email from the investment arm of the state of Maryland saying they were looking for applications to replace their fund manager.

The told me I’m not qualified for the position, but that they were looking to create a new junior position on staff. I became the first person of color on their investment team in the 20-year history of that organization. That was late 2016, and they were struggling to invest in Black founders. I didn’t like any of the ideas I was hearing internally, so I showed up one day with a proposal to start a pre-seed fund specifically for Black founders. We ran it for a year and the next year they increased the designation for all underrepresented founders. In fiscal year 2020, Maryland put $1 million in the annual budget to make that a long-term program in the state. It became the first and only state-backed, pre seed fund for women and minorities in the country at the time.

I decided I was going to start my own firm in the middle of the pandemic. I invest in CPG companies that other investors might not. I was an underrepresented founder myself, so I understand their value and the hidden gems there.

How are you finding brands to invest in?

A lot of people find out about me either from Twitter, other founders or podcasts. I get a lot of cold outreach. I’ve gotten warm intros from other friends, I’ve met founders at conferences, I’ve met founders at cookouts. I’m somebody who’s not afraid to go anywhere or look anywhere for potential talent.

A lot of investors try to optimize for where they’re going to get the highest hit rate where then they have to kiss a ton of frogs, and, for every 30 companies they meet, there might be one good one. That ends up making you look in limited pools. Something like 75% of all venture capital goes to three states and a lot of that is just going to California, but there are a lot more states in the union.

Also, over the years, I’ve had a lot of fellows at the firm and friends of the firm who have done amazing jobs at sourcing great companies. When I say fellows, these are junior folks, sometimes college-level folks. If you bring me a company that you’re truly passionate about, hey, I’m willing to ride with my people’s passion.

What are you looking for in brands?

RareBreed is industry agnostic. We don’t do bio, but we’ll literally look at just about anything else, primarily tech-related. The reason we don’t do bio is because I don’t have a PhD. We care about two things. One, if you’re a software company, we like to see a clearly repeatable or unique customer acquisition strategy. Two, we like physical products in legacy industries that have lacked innovation for 10 or more years.

For CPG companies, I’m looking at how you go about your branding and engagement with your customers. I’m looking at the way your team interacts. If there are multiple founders, how the founders interact? If I ask multiple founders the same question, are you all going to give me the same answer? Are you all on the same page?

I’m looking at your customers. I might call some of your customers, ask them how they like your product. I may try your product or get somebody I know to try your product. I’ve run contests on Twitter before with founders who I was talking to and, as part of due diligence, I would give away the founders’ products and have those folks give me feedback. A lot of the financial stuff is table stakes. Every high-level founder you’re going to meet is going to have that. But we as VCs are looking for companies that have potential to be billion-dollar outcomes, and that takes a unique individual.

Because I’m a pre-seed investor, I’m typically the first check you’re going to get. I invest so early that typically, within two to three years of my investment, the companies are very different than what they originally sold me on. So, I’m really trying to find founders who are flexible in their thinking and can make quick decisions. That means you’re the kind of person who’s going to be able to make the pivots necessary and make them fast enough that, if you make the wrong one, you can double back and fix it before you run out of cash.

What else are you looking for in CPG companies?

I’m far more critical about their customer acquisition strategy than their brand strategy. What I’ve learned is, in CPG, is not always about the best product. I’ve met tons of amazing founders with amazing products that far exceed the quality of what’s on the market today, but those companies don’t exist anymore because those founders spend so much time coming up with the best product, they never spent enough time trying to figure out how to get customers.

I always give people the example of the iPod. Everybody today will tell you how amazing it was, but it was just a crappy MP3 player that broke all the time. If you went to Best Buy, they would have an entire wall of MP3 players, many of which were better quality and cheaper. But people would continuously walk past that and just go to the iPod.

People tell you, it made it easier to integrate the music. No, people hold onto the sleekness of it, the design of the marketing of it. It still broke all the time, but people still kept buying them and that gave them enough runway to build the iPhone. The iPhone is the perfected version of what they were trying to come up with, but they gave you enough marketing and sleekness and that’s what beat out the competition.

As much time as you spend thinking about how innovative and amazing your product is, try to spend just as much brainpower thinking about how to get customers because, at the end of the day, that’s what’s going to get you paid.

As a two-time founder, do you provide close guidance for founders you invest in or are you more hands-off?

I tell all my founders, the day I’m making an investment, they have my cell phone number, and they’re allowed to treat me like an employee. I’m now part of this company, so they have the freedom to ask me for anything, no matter what it is. I had a founder who just raised a large round of money and wants to strategize what they’re going to do for the next year with this new pile of money, and then I have founders who are struggling to raise cash and want to go over their pitch deck or get intros to other investors. We do all of that.

The idea of the squeaky wheel gets the oil, there’s some truth to that. There’s also some truth to your best performing companies don’t tend to need a whole lot. They kind of let you get out of their way so they can just do their thing. Some companies don’t really need you involved and some companies that really want you involved it’s like, oh, you’re not at the point where I can help you much.

What’s the state of investing now?

The industry’s in flux. We had an unusual period of this big drop-off followed with an unprecedented height after the pandemic followed by even just as big, if not a bigger drop-off. We had this period where people were spending no money to people were spending too much money back to people are spending no money and trying to slowly build it back up. So, not as many VCs are raising as much money, and the ones who are are raising smaller dollar amounts. There are fewer investors for people go to and the ones that people can go to just invest in a different level or different stage.

From a pre-seed and early stage standpoint, there are fewer dollars, and there are even fewer dollars for what they call the series A gap. When you’re going from seed to series A, there’s a much bigger drop-off. All of these series A funds are either investing in AI or nothing. It’s a really high bar for companies to get to and that’s not necessarily always, in my belief, what gets you to the most successful companies, but it’s just the function of the industry. Markets are tight, interest rates are high.

The industry as a whole is resetting after post-2020 when we had this surge of capital and Web3 came in. So, it’s harder for founders to raise money. It’s harder for VCs to raise money. It’ll probably be this way for another two to three years. Four years from now, we’ll get to a more normal pattern, but it’s tough right now. There are a lot of founders that raised money in 2023 and 2024 that aren’t going to be able to raise more.

How has fundraising been for you this year?

Admittedly, it’s been tough. It’s been a really tough market. You got to keep letting people know what it is that we do. I’ve been lucky enough to have a portfolio of pretty cool companies that are doing some really amazing things. Blank Beauty just raised $6 million led by Epson, it’s a machine that makes custom nail polish. They are crushing it. Red Drop is about to be in Ulta.

I got some fintech companies getting ready for large raises. I got one company with a device that’ll braid your hair. The stylist starts the braid and the device will finish it. That’s going to be going live in the next month or two. So, it’s been a tough raise, but I’ve had some standout companies in my portfolio that make it so that I keep moving.

Are there categories within beauty you’re excited about?

In general, automation and robotics within the beauty industry. Also, I have a lot of thoughts around haircare products, and it’s not necessarily like the creams, the oils, there are tons of those, I’m talking about actual physical tools that we use in our hair.

If you go in most people’s bathrooms, devices in their bathroom for the most part outside of maybe their blow dryer, look exactly the same as it did when they were a kid. My daughter uses the same rat tail comb my mom used on my head. There’s room for real innovation there.

We’ve made a couple of investments in that space, and that’s a space that other investors don’t think about or care about as much. If you find a space that other people aren’t thinking about or caring about, that’s ripe for opportunity.

What are your short- and long-term goals for RareBreed?

Short term goal is to get fund two done. Long-term goal is to be this generation’s first round of capital. First Round Capital, when they came out, wanted to be the Sequoia of early stage investing, and they’ve actually done that. I just want to be the next generation.

Leave a Reply

You must be logged in to post a comment.