What’s Behind The Sexual Wellness Retail Revolution?

In 2021, sex stuff has become mainstream.

Consumers can buy lube at Nordstrom, vibrators at Holt Renfrew and arousal oils at Urban Outfitters rather than having to patronize sex shops for intimate goods. And the sales of sex products show no signs of slowing down. The global sexual wellness market is projected to proceed at a swift compound annual growth rate of 12.4% from 2020 to 2026, according to Research And Markets. For perspective, the global consumer packaged goods market overall is expected to advance at a 3% CAGR through the same period, per Industry Research.

The pandemic has impacted people’s sex lives and played an integral role in the current dynamics of the sexual wellness market. An online survey last year by the Kinsey Institute at Indiana University discovered that, while respondents were having less sex on the whole, 20% expanded their sexual repertoires. Nearly half of respondents in a recent poll of single Americans conducted by OnePoll on behalf of #LubeLife said they are pleasuring themselves more frequently than ever before.

During Beauty Independent’s In Conversation webinar last Wednesday, leaders in the sexual wellness retail and products space—Rebecca Alvarez Story, founder and CEO of clean intimacy and wellness online marketplace Bloomi, Taylor Sparks, founder of eco-friendly intimacy e-tailer Organic Loven, and Lindsey Peterson, associate director of beauty, personal wellness and pets at e-commerce platform Verishop—discussed trends, the evolution of consumer behavior and what will happen once the pandemic recedes.

Rebecca Alvarez Story, Founder and CEO, Bloomi

Background: When Alvarez Story was growing up and going to Catholic school, abstinence was prioritized in sex education. She mentioned it’s not uncommon for members of BIPOC communities to have received a similar message. Later, attending UC Berkeley, she was exposed to broader ideas of sexuality and went on to become a sexologist who spent time in Silicon Valley working for startups focused on bringing medical devices and arousal products to market. Identifying a gap in the e-tail segment for clean intimate care products, she founded Bloomi three years ago. It carries offerings from brands the likes of Quim, Lady Suite, Fur, Momotaro Apotheca, Foria, Coconu, Sliquid and Good Clean Love as well as its namesake line.

Pivots: COVID-19 accelerated trends that were bubbling up as people were already becoming in tune with their bodies, said Alvarez Story. “This industry has so much potential to be huge,” she asserted, emphasizing that the imperative of connecting with ourselves and others came into stark relief amid the pandemic. Alvarez Story said, “There was a lot of heaviness this last year, and people want to feel good.”

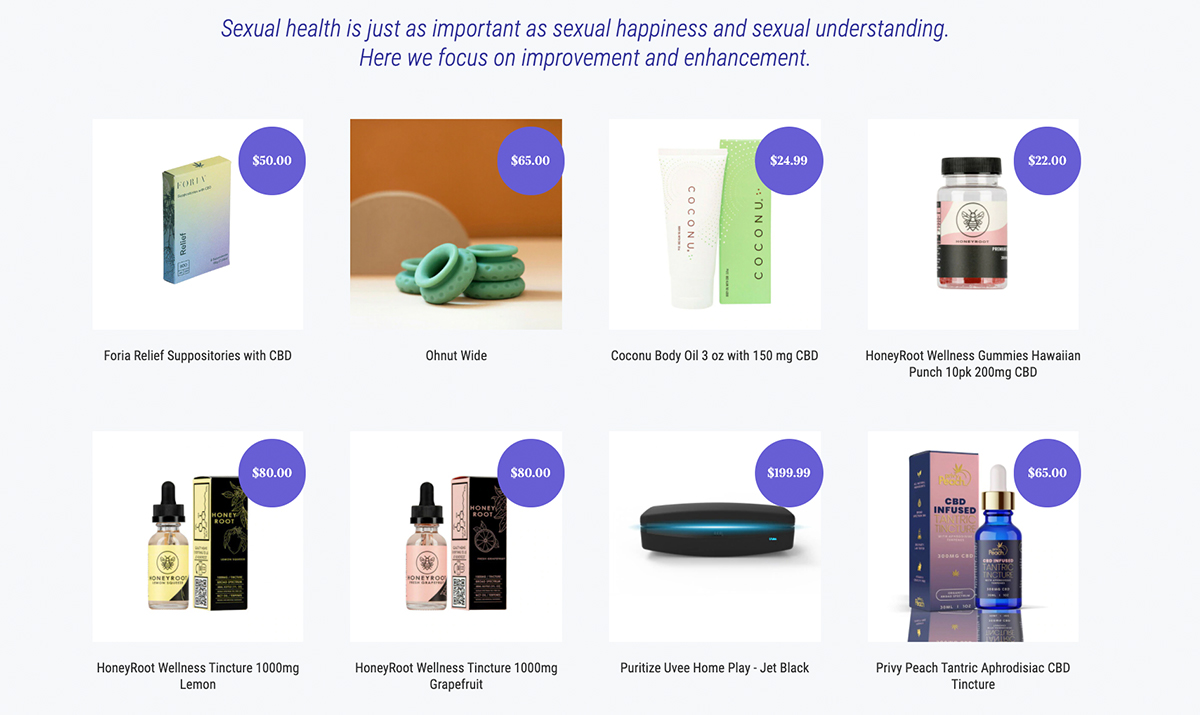

Bloomi saw sales spike as coronavirus gripped the world, a welcome development for it that Alvarez Story associated with consumers’ being preoccupied with wellness and becoming more in touch with themselves—literally and figuratively. The marketplace’s intimacy category is by far the most visited section of its site. The category stretches into body and menstrual care products. Alvarez Story predicts botanical aphrodisiacs that work to jumpstart the body’s blood flow and lubrication will continue to trend. Arousal and massage oils using CBD that launched during the pandemic have quickly became bestsellers.

Sexual wellness companies have encountered tremendous difficulties promoting themselves on social media networks, where advertising policies on sexual content have led to bans of many of their ads. Alvarez Story said Bloomi is teaming up with bigger companies to educate decision-makers about why sexual wellness and sex positivity are public health issues. But, until there’s greater acceptance of sexual wellness by social media networks, brands have to figure out workarounds.

“In paid ads, vulva and vagina care has more flexibility. Sexual wellness is the most scrutinized,” said Alvarez Story. “So, you can talk about massage oil, but, if you show too much shoulder, it can be banned.” She pronounced, “There needs to be more women and people of color that are making these decisions.” Alvarez Story suggested brands think outside the box and zero in on spreading word of mouth. “If you aren’t community-focused in this space, it’s going to be really tough for you,” she warned. “Ask your audience where they shop and what they need.”

Key Takeaways: With vaccine distribution picking up in the United States, Alvarez Story forecasts there will be an uptick in dating and sexual encounters, which will translate into increased demand for sex toys and contraceptives. Bloomi will be stocking up on those items. She also noted people dealing with past sexual traumas have been able to “do the work” during the pandemic, and they will be looking for core staples such as massage oils and vibrators. “Because there was so much inward focus during quarantine, you will continue to see people go to the next level with themselves,” said Alvarez Story, stating, “People are excited about turning up the heat.”

Taylor Sparks, Founder, Organic Loven

Background: Certified in human behavior and holistic aromatherapy, Sparks spent 15 years traveling the world as a corporate trainer advising on management and communications skills. She started making organic body and skincare products on the side. The side hustle turned professional when she founded Skin Care for Athletes, a brand that targeted elite endurance athletes, in 2007. Vacationing on adults-only cruises with her husband, Sparks connected with vendors in the consensual non-monogamy community and was hired to create a private-label line of massage oils for a travel company.

Once the line launched, Sparks realized there was a lack of online platforms dedicated to selling intimate products and providing education on the topic. She launched Organic Loven with four products in 2013. The eco-friendly online intimacy shop now stocks more than a thousand products from 150 brands such as HoneyRoot Wellness, Velv’Or, Ohnut, Zalo, FemmeFun, Bijoux Indiscrets, Intimate Earth, Lelo, Liberator and Ohmibod.

Pivots: Organic Loven benefited from the pandemic-related brick-and-mortar shutdown and the Black Lives Matter movement that shined a light on Black-owned business last year. Its sales ballooned over 1000% year-over-year. Sparks credited the diverse distributors and manufacturers she works with at Organic Loven for being able to stay ahead of the delays that plagued many consumer products businesses last year, as well as an influx of sales from the Black Lives Matter movement. The online shop obtains products from six distributors in the U.S. and several others throughout the world. FemmeFunn’s bullet vibrator is a huge seller as are its CBD tinctures and products for arousal and massage. In the midst of the pandemic, Sparks said, “People needed to find ways to just chillax. Mommy needs a break.”

Sparks doesn’t fight the uphill battle of advertising on social media. Instead, she concentrates on building Organic Loven’s newsletter database. “It creates slower growth, but it’s a more loyal fanbase,” she pointed out. Though she admitted to occasionally receiving NSFW direct messages on LinkedIn, she recounted, “As buttoned up as LinkedIn is, I get more pictures there than through IG and Facebook, but I just send them my link and say, ‘You can book a Q&A session with me where we can talk about anything you want there, but this isn’t the space for this conversation.’”

In typical years, Organic Loven has gained traction by attending in-person events like sex and swingers’ conventions, and adults-only resorts and cruises. Since in-person events and traveling has been on hold, Sparks hosts digital Q&A sessions with shoppers to get to know their preferences and challenges during lockdown. Sparks said, “People were discovering more about their sexual preferences, and COVID has helped people communicate about what they want and what they don’t.”

Key Takeaways: Sparks remarked that virtual swinger parties on platforms like Zoom have been on the rise during the pandemic. She’s been able to host them and offer workshops while promoting Organic Loven. The digital activities have ensured the online shop’s momentum hasn’t decelerated in the pandemic. Sparks anticipates in-person events in the ethical non-monogamy consensual space will be back with a vengeance as the pandemic ebbs and a jump in sales will likely follow. Specifically, Sparks is looking to onboard cruelty-free artisanal brands that formulate without certain chemicals and brands that give back.

Lindsey Peterson, Associate Director, Beauty, Personal Wellness and Pets, Verishop

Background: Peterson’s retail career had stops at multi-category retailer Saks Fifth Avenue, where she was introduced to the booming indie segment, and Violet Grey, where she developed a passion for intimate and sexual wellness products. “It was really great to have products like sex toys or lubricants sitting next to a Chanel lipstick,” said Petersen. She became a founding team member of e-tailer Verishop in March 2019, launching its sex and intimate care vertical that currently features several hundred stockkeeping units.

Pivots: Verishop has leaned on virtual education during the pandemic. It’s been hosting Instagram Lives and Q&A sessions on various channels with sexoligists, brand founders, vibrator designers and couples’ therapists. “People used to feel embarrassed to have these conversations,” said Peterson. She added, “There’s never enough time to answer all of the audience questions, which goes to show how much education in this space is needed.”

Peterson said there was a new group of consumers becoming acquainted with sex toys and intimacy tools in 2020, and a “leveling up” of consumers who had previously dipped their toe in this segment. In 2019, she said entry-level or more user-friendly vibrators like those from SmileMakers were selling well. In 2020, there was a bigger focus on intimacy accessories like gold handcuffs or collars and Kegelbell, a weighted kegel device, along with high-end fetish items like braided leather whips.

Peterson remarked Verishop has been interested in delving into how its customers are using intimacy merchandise to understand them better. “We wanted to just start testing to see what our customer was looking for in terms of fetish items, and we saw the response so quickly,” said Peterson. She added, “It’s all very high-end, and the customers could not get enough.” While masturbation is often thought of a solo act, Peterson explained Verishop’s customers are exploring ways they can use vibrators with their partners. Dame’s couples’ toys are hot sellers. “This opened up an entirely new channel for us,” said Peterson.

Key Takeaways: Verishop co-founder Imran Khan proclaimed to his colleagues that they weren’t going to build the e-commerce destination on the backs of external platforms like Instagram or YouTube. As part of that strategy, Verishop has developed its own social commerce app that consumers, brands and influencers can upload content onto. The app doesn’t come with regulations about what sexual wellness products can and can’t be marketed. “From inspiration to educational content, we are the barriers for what is appropriate,” said Peterson.

She anticipates that, once the pandemic subsides, there will be a shift in what people are purchasing, but doesn’t expect sales in the sex products category to decline. “It’s going to be really interesting to see how comfortable people are using some of these couples toys with people that might not be their significant other and may be a stranger,” said Peterson. “But I think it is going to be a really big shift within this industry of just people wanting to be more experiential.”

Leave a Reply

You must be logged in to post a comment.