Wonderskin Raises $50M In Series A Funding To Help It Last Far Longer Than Lip Stain

Wonderskin, the brand known for its TikTok-viral peel-off Wonder Blading Lip Stain Masque that’s sold over 4 million units, has scored $50 million in series A funding to help it be known for much more.

The series A round was led by Insight Partners, the 30-year-old New York City-based private equity and venture capital firm with $90 billion in assets under management, including Beauty Pie, Quince, Calm and Prose. It represents London-based Wonderskin’s first institutional capital, and it will fuel expansion of the brand’s assortment, retail distribution and enterprise resource planning tools.

“Wonderskin sits at the intersection of performance and creativity, delivering science-backed products that resonate with modern beauty consumers,” says Rebecca Liu-Doyle, managing director at Insight Partners and board member at Wonderskin, in a statement. “Their ability to translate innovation into everyday routines is what makes them so exciting. At Insight, we see a clear path for Wonderskin to become a defining brand of this new era in beauty.”

Michael Malinsky, co-founder and CEO of Wonderskin, says, “The goal is to have more sustained and healthy growth, with an even faster growing profitability curve attached to it. We’ve certainly proven our capacity is not just to ride the coattails of one viral product. We have the tenacity to develop, bring to market and defend other hero items.”

According to an estimate in the publication BeautyMatter, Wonderskin’s expected revenues for 2025 are $100 million to $125 million. Malinsky, who continues to hold majority ownership of the brand, says its sales are on track to double this year after skyrocketing 300% in both 2024 and 2023. He shares Wonderskin is running a profitable business with an earnings before interest, taxes, depreciation and amortization (EBITDA) margin of just under 10%.

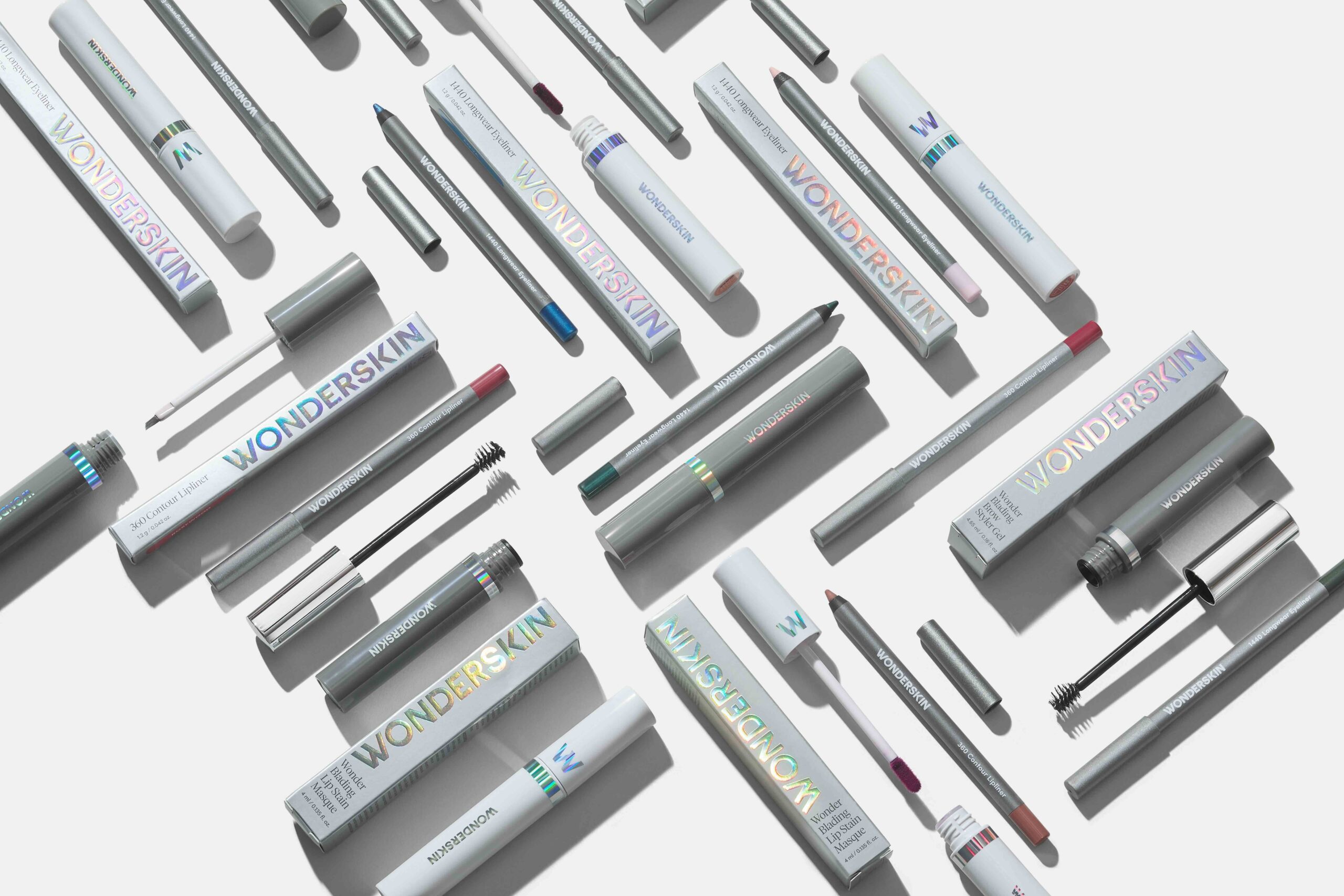

Currently, a third of the brand’s revenues are from products other than its lip stain, and nearly half of the brand’s direct-to-consumer customers purchase a non-lip stain product, per Malinsky. Wonderskin has been building its selection beyond the lip stain. It launched blush stick Phlush Stick and pressed powder FYP Filter Powder early this year and has foundation on the way for August or September, with future designs on extending to skincare. All told, it has roughly 25 products priced primarily from $15 to $35.

“We’ve certainly proven our capacity is not just to ride the coattails of one viral product.”

Wonderskin’s core consumers are millennial women. With its product launches, Marina Kalenchyts, co-founder and brand director, believes the brand has the opportunity to broaden its gen X reach. “A lot of our products, they’re not masking, they’re not old school makeup, but they really work with features to enhance them to give a little bit of oomph,” she says. “And that’s what I feel that really speaks to the older consumer.”

DTC is Wonderskin’s biggest distribution channel, followed by Amazon, TikTok Shop and retail, which is growing the fastest. The brand is available in roughly 3,000 points of worldwide retail distribution. Among its retail partners are Boots, Urban Outfitters, Anthropologie, Nordstrom, Marionnaud and Lyko.

Wonderskin forecasts it will enter an American beauty specialty chain in the fourth quarter this year or first quarter next year. Today, North America is responsible for two-thirds of the brand’s sales, with the rest from the United Kingdom and Europe. Wonderskin has 35 people on its team, with 22 of them in London. It has secured two warehouses in the U.S. and one in the U.K. It’s going to be opening another warehouse in Europe.

At a moment when many beauty brands in the United States are confronting heightened costs from President Donald Trump hiking tariffs on China, the single largest source of manufacturing and packaging for beauty goods sold in the U.S., Malinsky says Wonderskin has relatively low exposure to them and doesn’t anticipate the brand will increase prices. Most of its products are manufactured in the United States, and it’s pinned down secondary facilities outside of China for the goods it manufactures in China.

“We’ve become a sizable company now and are very much looking forward to this new phase.”

Prior to Wonderskin, Malinsky gained a reputation in the beauty industry for being a DTC and Amazon savant. He co-founded the company KF Beauty in 2013, and within three years, its brand Wunderbrow’s eyebrow product was in the top 10 eyebrow products on Amazon. At the time, it was spending $40,000 to $85,000 on Facebook advertising daily. In 2018, Malinsky left Wunderbrow, and a year later, he established DCB Lab, a brand holding and investment company. Wonderskin was conceptualized in 2020, and DCB Lab took ownership of it in 2021.

At Wonderskin, with TikTok in the mix and a highly visual product in its lip stain that swipes on blue and is peeled off to reveal pink or red shades underneath, Malinsky modernized the Wunderbrow formula to great effect. Wonderskin has partnerships with over 3,000 content creators on a paid basis, and it has an in-house machine pumping out content, too. Five people on its team are dedicated to Amazon, where Wonderskin is currently in the top three for lip products, top five for makeup products and top 20 for beauty overall.

Malinsky suggests the brand doesn’t try to directly rival the likes of L’Oréal and Estée Lauder on Amazon in mega-categories, but identifies underserved spaces in the ecosystem that can benefit from the awareness it revs up across its digital footprint. “You have to have a very intentional and a very 360-degree approach for winning on Amazon,” he says. “The things that we’re intentional about—our hero SKUs—they turn over great revenue and profit because then we take our external demand and we marry it with the Amazon ranking and a strong PPC [pay-per-click] strategy.”

The open question for Wonderskin—and it’s not alone in facing it—is whether it can withstand hype cycles for long-term success. Another brand in the same predicament is its peel-off lip stain competitor Sacheu Beauty. Its owner Gloss Ventures recently raised $15 million in series A funding.

Malinsky indicates Insight Partners’ skills are vital to Wonderskin’s chances for prospering perennially, and his decision to secure funding from the firm was informed by its skill at scaling brands. He says he didn’t hire an investment bank and conduct a process for Wonderskin’s funding. Insight Partners discloses it’s invested in 800-plus companies and over 55 of its portfolio companies have had an initial public offering.

“We’ve carried the business to a great, great point,” says Malinsky. “We’ve become a sizable company now and are very much looking forward to this new phase and new partnership.”

Click here to secure Early Bird tickets to Dealmaker Summit happening November 10 & 11 in London.

Leave a Reply

You must be logged in to post a comment.