XRC Ventures On Why Science-Backed Skincare Is “The Most Compelling Category” For Beauty Investors

Out of all the product categories in beauty today, Diana Melencio, general partner at venture capital firm XRC Ventures’ Brand Capital Fund, calls science-backed skincare “the most compelling category for early-stage investors.”

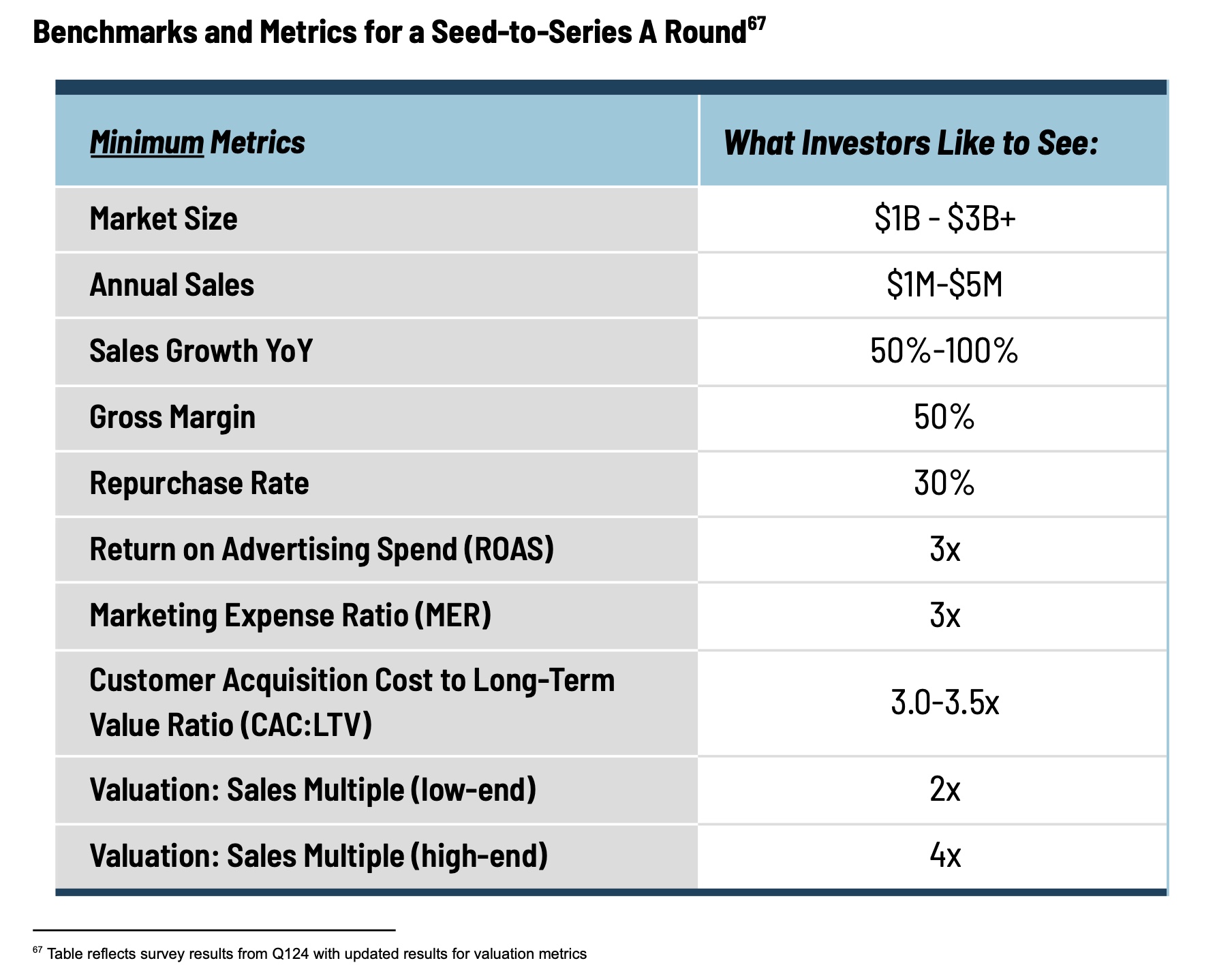

In a challenging funding environment in which brands must have several proof points to get investors to part with money, she explains science offers skincare brands “a moat, true differentiation outside of marketing.” According to a new first quarter 2025 Consumer VC Benchmarks Seed-To-Series A funding report by XRC, that moat has instigated higher multiples in deals and greater resonance with discerning consumers seeking tangible results.

“In a crowded, slowing market, the brands that will stand out are those that prove their value with every application, while not losing an emotional connection,” reads the report. “High retention provides the soundest foundation for incremental growth in a lower-growth environment. And in a value-conscious environment, efficacy is no longer a nice-to-have—it’s a non-negotiable. It’s what drives repeat purchase and sustained loyalty as consumers become more selective with their wallets.”

To clarify the sometimes confusing world of science in skincare, XRC outlines several attributes of science-backed skincare brands, including connections to biotechnology with ingredients like peptides, exosomes and growth factors, founders with scientific or medical backgrounds (dermatologist-led brands, for instance), in vivo clinical trials with humans, consumer perception studies, instrumental testing measuring changes in skin and in vitro testing with skin cells or tissue models. The firm acknowledges that in vivo trials are expensive—it figures they primarily range from $20,000 to $50,000—and commissioned by a limited set of brands that can afford them.

“A major driver behind the shift to science-based skincare is growing consumer awareness around the credibility of product claims,” writes XRC in the report. “Terms like ‘clinically tested’ or ‘backed by studies’ are everywhere—but not all testing is equal, and savvy shoppers are starting to question what these phrases actually mean.” The report adds that Craig Weiss, president of testing provider Consumer Product Testing Co., suggests consumers look for at least 30 participants in a clinical study.

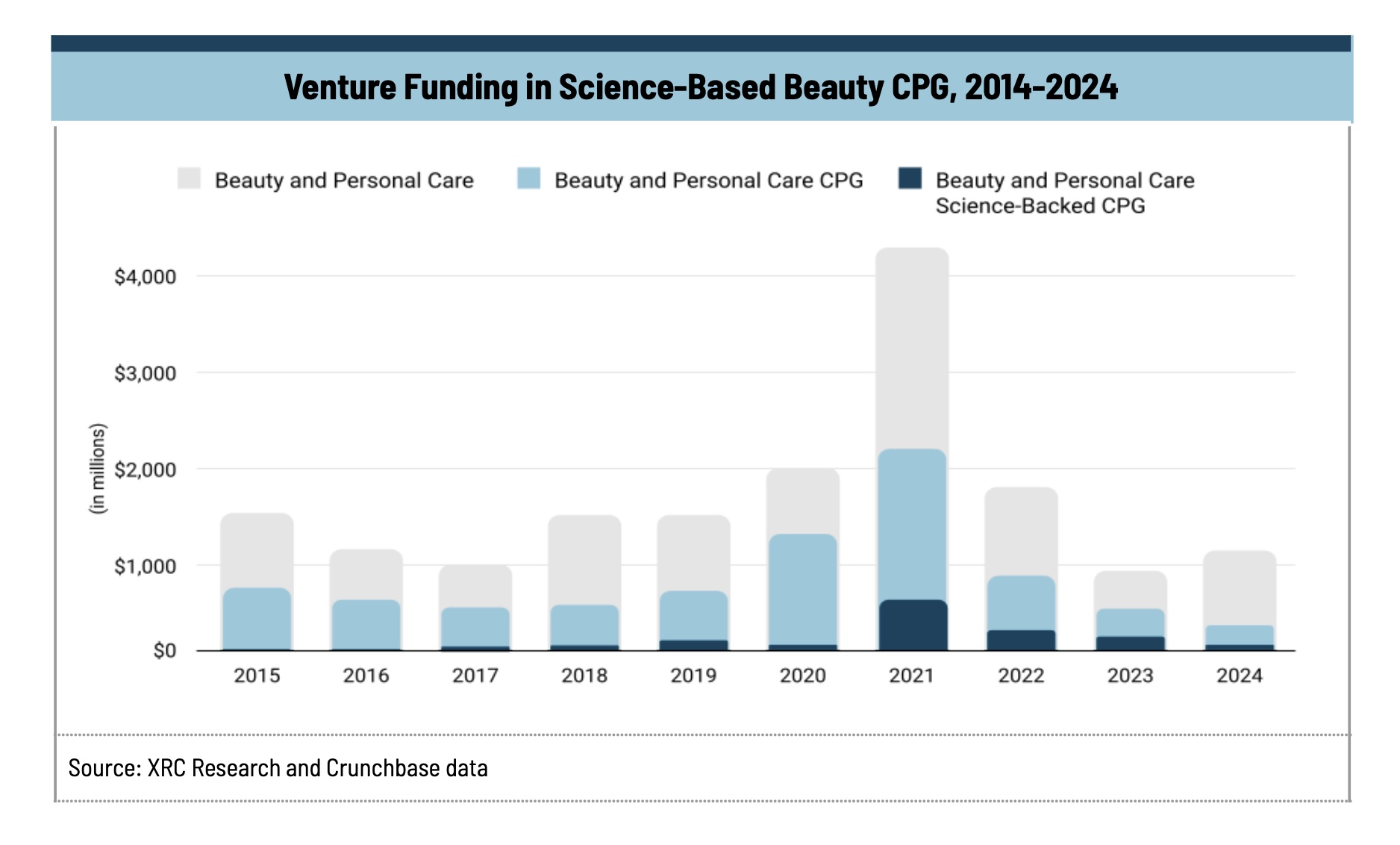

With science’s profile in skincare accelerating, market research firm Mintel estimates that 36% of science-backed skincare launches in the past five years happened in the last year. Sorting through the science-backed skincare rush, XRC identifies 19 rising brands in six subsegments.

The brands are Angela Caglia, Protocol and Exoceuticals in biotechnology-driven skincare; Remedy, Prequel, Dr. Sam’s and Dr. Idriss in dermatology-led businesses; Soteri Skin, Untoxicated and Sofie Pavitt Face in the field of sensitive skin, eczema and acne; Phyla, Symbiome, Nuebiome and Iota in microbiome-centered skincare; Lion Pose, 4.5.6 Skincare and Amoureux in inclusive clinical testing; and Skinfix and True Botanicals in clean and clinical skincare. In particular, XRC predicts strong growth from dermatologist-led and biotechnology brands.

“High retention provides the soundest foundation for incremental growth in a lower-growth environment.”

The market has spoken in favor of science-backed skincare brands in the prices they command. Based on an analysis of data from the financial resource Crunchbase, the firm found that beauty and personal care companies have traded at 2X to 8X revenue multiples in the last five years, with science-backed brands hitting 5X to 6X revenue multiples, about 20% higher than their counterparts not grounded in science. XRC discovered the premium climbs closer to 40% for biotechnology brands.

“However, it’s important to note that timing played a critical role in how these transactions were priced. Valuations often reflected not only the intrinsic qualities of the brands—such as innovation or channel strategy—but also broader market conditions and investor sentiment at the time of sale,” says XRC in the report, underscoring that the investor shift to science-backed brands occurred following the Apple iOS 14 update that impacted brands’ ability to personalize and track digital advertising and unraveled direct-to-consumer economics.

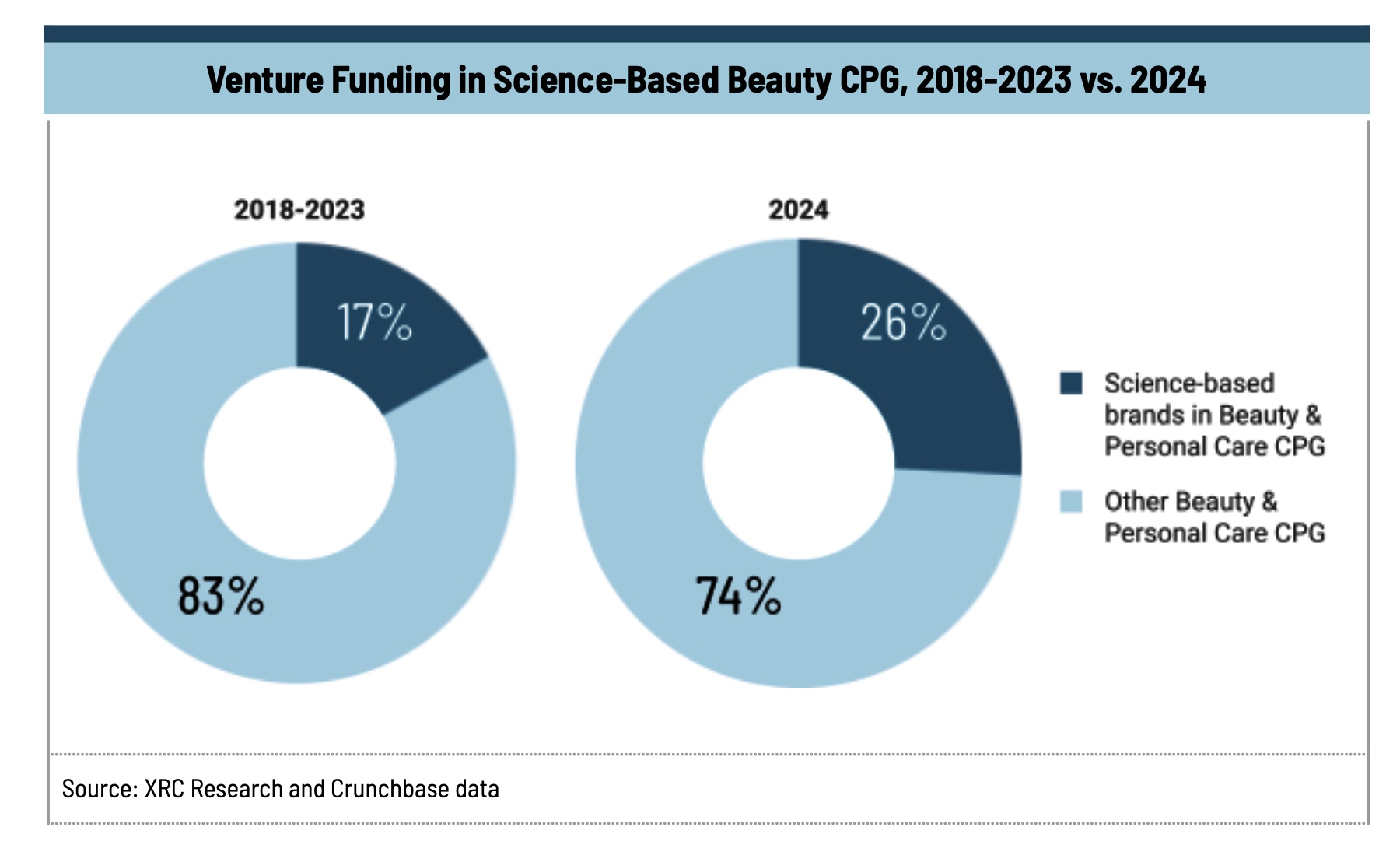

XRC’s Crunchbase data analysis shows that 26% of VC funding in beauty and personal care went to science-backed or clinically validated brands in 2024, up from 17% on average in the five prior years. In 2023, information from professional services Accenture shows science-backed brands drew 2.5% more VC funding than natural or sustainable brands.

Investors in science-backed skincare brands are betting current consumer trends will hold or strengthen. XRC’s report is packed with insights from surveys on the relevance of science to consumers. It highlights that 92% of American shoppers state product efficacy is crucial, 66% value clinical and scientific studies, 53% declare that product claims affect their purchase decisions now more than two years ago, and 52% are excited about the potential for science-backed, high-performance products.

Clinical effectiveness, in fact, surpasses clean positioning for consumers as a purchase motivator, and nearly 70% of them say a dermatologist’s recommendation improves their purchase likelihood. Almost 70% hunt for a blend of proven and trend-forward ingredients, and 49% want high-performance products on the market to increase.

E.l.f. Beauty’s $1 billion purchase of Rhode and L’Oréal’s rumored circling of Medik8 fall in line with investors singling out skincare as a leading area of focus. In April conversations with 13 CPG investors in the United States and Europe, XRC discovered that scalp care and haircare are other areas of focus, and men’s grooming, sexual wellness and shave are lower-order priorities.

“A major driver behind the shift to science-based skincare is growing consumer awareness around the credibility of product claims.”

“We see a major opportunity in brands that treat skin health as an integrated system, combining topical innovation with nutrition, diagnostics, and preventative care,” Rachel Hirsch, founder and general partner at seed fund Wellness Growth Ventures, tells XRC. “As consumer demand shifts from surface-level solutions to foundational health outcomes, we believe the most enduring beauty brands will be those that operate at this intersection-supporting not just how we look, but how we heal, thrive, and age.”

Referring to science-backed skincare, Melencio says, “I have spoken to a number of heads of M&A or CFOs at various CPG public companies, and they’re all looking for this, which is why we as investors are all looking for this.”

Investors are sidling up to skincare despite sales softening in the category. For the first quarter, market research firm Circana approximates that prestige skincare sales fell 3% in dollars, but were up 1% in units. Mass skincare sales grew in both dollars and units.

Melencio says, “I don’t see, long term, a decline for skincare…If anything, I think more people are spending more dollars on topicals and what they do to their face.”

Melencio emphasizes that investors are zeroing in on brands registering a 30% repurchase rate or above. The report mentions that investors cite repurchase rate as the metric that’s a deal breaker if it doesn’t meet their standards, and they’re homing in on the customer acquisition cost to long-term value ratio and sales growth, too, targeting them to be 3 to 3.5 and 50% to 100%, respectively. XRC’s poll of investors revealed about 90% plan to invest the same or more in beauty this year.

Click here to secure Early Bird tickets to Dealmaker Summit happening November 10 & 11 in London.

Leave a Reply

You must be logged in to post a comment.