Inside The Fundraising Process That Led To Vegamour’s Big $80M Deal

More than three years after it started, Vegamour crossed $1 million in monthly sales in November 2019. Ultimately, its business surged 800% that year. The sales and growth attracted investors, and General Atlantic poured $80 million into the brand for a minority stake last year. Also last year, Vegamour debuted in retail at Sephora.

The bigger stage has enabled Vegamour to make moves it couldn’t not so long ago, including bringing on Oscar-winning actress Nicole Kidman as a backer and spokesperson. Last week, Kidman joined Vegamour founder Dan Hodgdon and Vennette Ho, managing director of investment bank Financo Raymond James, for the final part of Beauty Independent’s three-part In Conversation Spotlight webinar series on Vegamour.

The trio discussed the brand’s comprehensive product collection, important metrics for wooing capital, considerations for evaluating investors, and the money game within the money game.

A Well-Rounded Product Portfolio

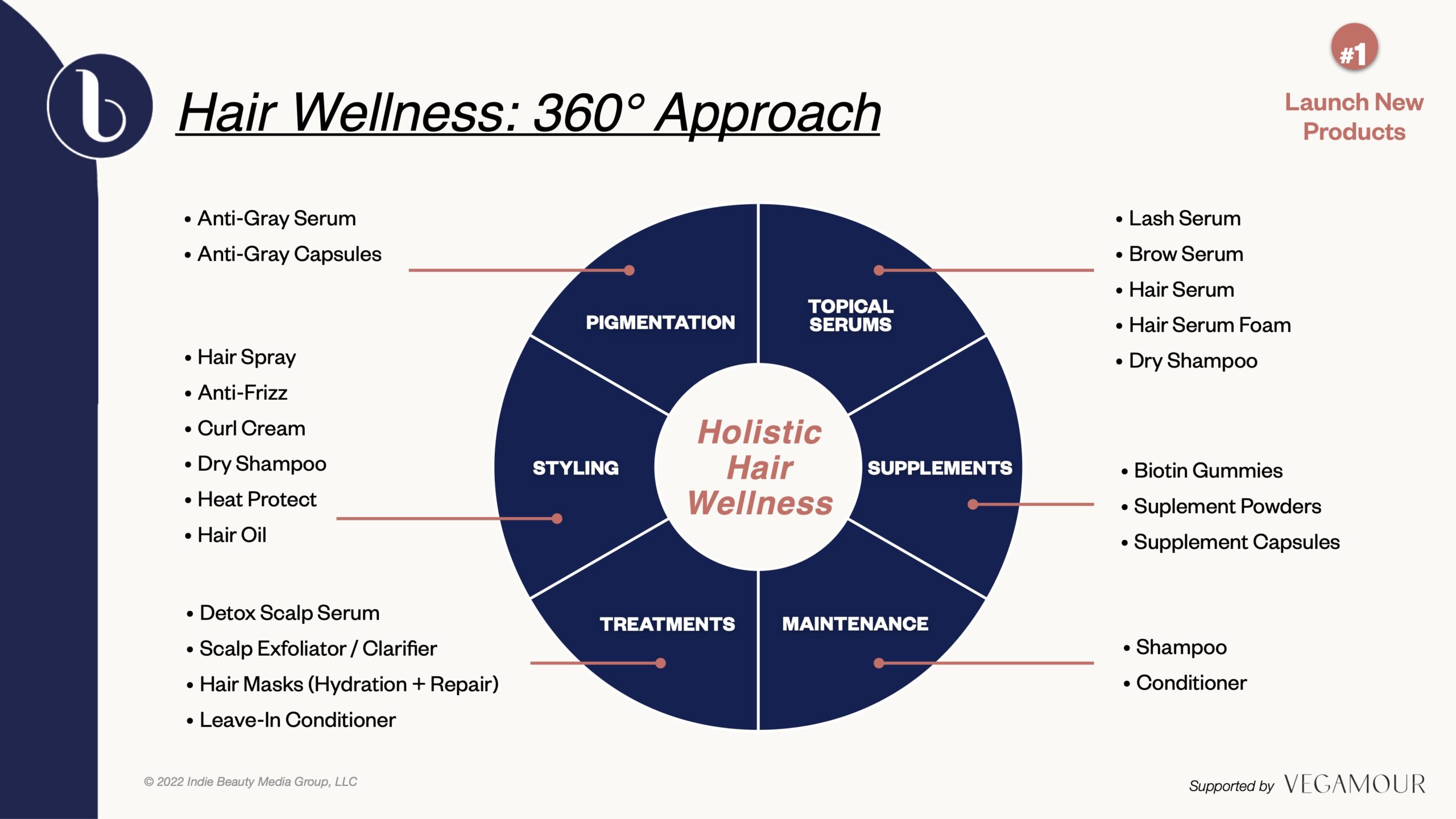

In building Vegamour’s offering, Hodgdon always knew he wanted to create what he describes as a “comprehensive ecosystem” of healthy hair products that perform, work synergistically with other products and have clean formulas. The brand’s GRO Hair Serum is a pillar product. It contains five active ingredients chosen to stimulate hair growth and reduce hair loss. Those ingredients are featured elsewhere in Vegamour’s assortment as well.

“If you were to look at our entire hair portfolio, I would say that serums typically do about 60% to 70% of the lift,” says Hodgdon, noting supplements were added to the lineup to “support all of the basic building blocks of healthy, beautiful hair.” Next came shampoo and conditioner followed by treatment products like hair mask, scalp exfoliator and leave-in conditioner. Styling and pigmentation products will be joining Vegamour’s selection soon.

Hodgdon says, “It’s an opportunity for us to introduce a level of personalization. We have different needs, some of us have oily scalps, some of us have dry scalps, some of us have color-treated hair that needs additional hydration and nourishment. We wanted to be able to address those concerns with products that would not only solve for those issues, but also are safe, clean, healthy, best in class.”

Vegamour’s 360-degree haircare approach appeals to Ho. “It melds the holistic wellness with the technology and nature conversation, which I think is really, really unique,” she says. Ho mentions investors were fond of the approach. She says, “It’s not just one way to address things, it’s multiple ways of addressing a single problem, which I think got people excited.”

The Capital Search

As early as 2017, Hodgdon put feelers out into the investor world in search of capital for Vegamour. It had become more difficult to obtain customers on social media, and he thought funding could benefit the brand’s outreach. Back then, investors told him the brand was too small, and it didn’t have a long enough track record, but that he should keep in touch.

By 2019, the responses changed. Vegamour’s sales had skyrocketed, and venture capitalists came knocking. Still, Hodgdon wasn’t sure what to do about investment. Ho, who connected with Hodgdon on LinkedIn, was essential for navigating Vegamour’s path through the investor landscape.

Brands have different reasons for pursuing capital. Ho points out funding de-risks growth and ensures a brand is well-armed to be competitive in a noisy market. Increased visibility is another bonus. “It’s not the only reason why you do a deal obviously, but there’s an offset effect of when a deal gets announced and a company has brought in a respectable capital, it sort of ups the levels of the brand and people start watching it,” says Ho. “There is something very self-perpetuating about that whole effect.”

The elevated awareness entices potential partners (ahem, Kidman) and gets brands on the radar of retailers that have confidence they can fulfill purchase orders. Ho says, “It opens you up to having access to a whole different set of people and a whole different set of resources, and then those partners know other people who know other people, and it becomes a less lonely journey.”

Vegamour’s return customers were alluring to Ho and investors. Ho says, “You can kind of sell anything to someone once…Do people come back and buy it again? What do the retention metrics look like? The first thing we asked Dan to send us was the P&L and the forecast and all that stuff, but we also asked him to show us his repeats.”

On top of the immediate metrics, Ho is peering ahead two deals into the future when evaluating the deal on the table for a brand. Of Vegamour, she says, “With the pipeline of what’s coming and with all of the clear runway and just a really, really fresh view on haircare, this would absolutely be a company that someone down the line would be so excited about. So, we really wanted to be a part of the story.”

Investor Assets

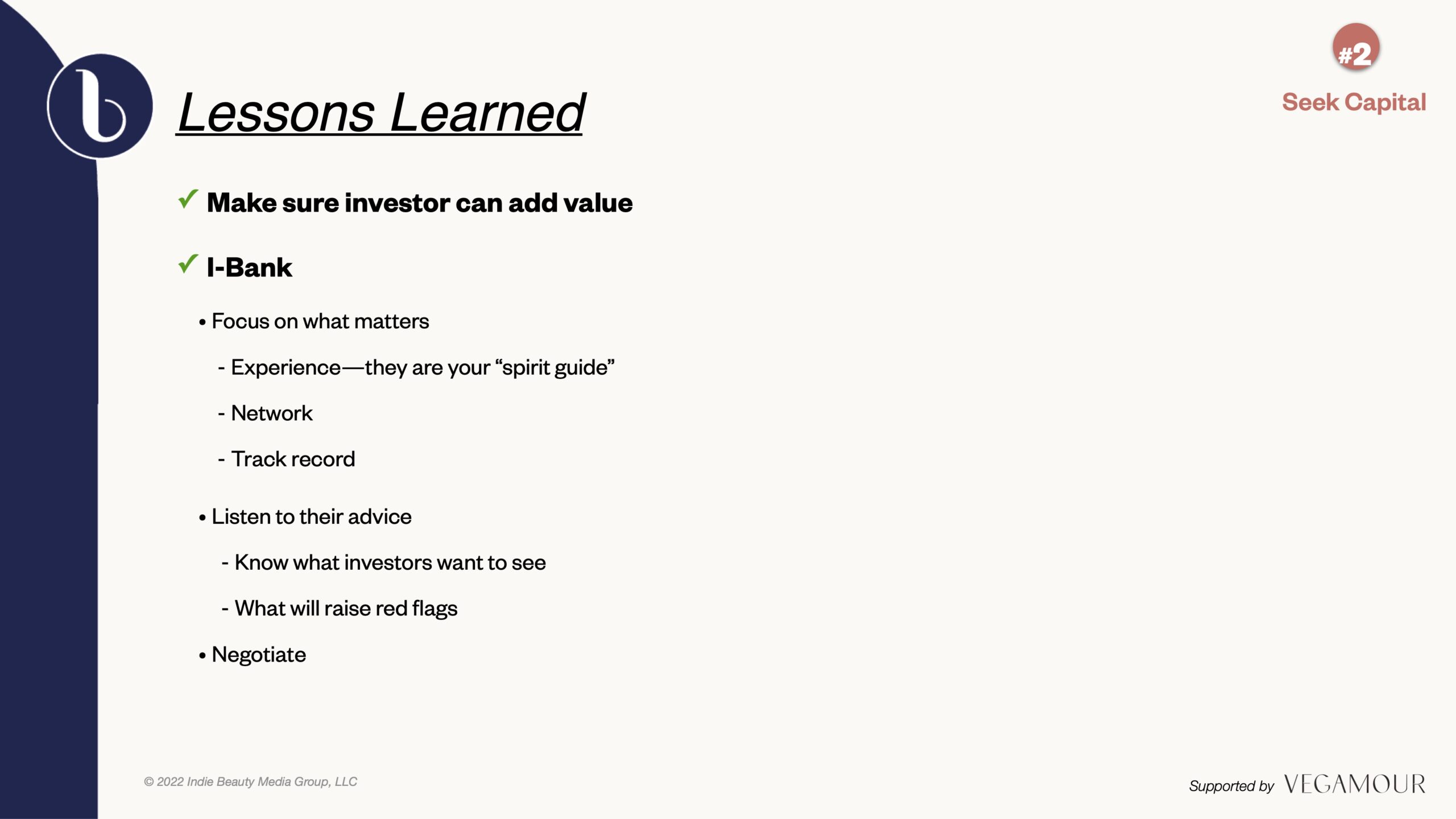

Hodgdon sought an investment banker to hold his hand throughout the fundraising process. Ho’s history working on deals involving brands such as Briogeo, Drunk Elephant, Olaplex, Tatcha and Huda Beauty drew him. He asked people about their experiences with her and received positive feedback.

During Vegamour’s fundraising process, Ho says, “We didn’t want to waste a ton of time with low-probability people. So, we thought really hard about what Dan was looking for from a check size, from a partnership perspective…Then, if the objective is not to drag out a process forever, who’s ready to do a deal? Who’s going to run, and who’s going to be fast?”

To Hodgdon, it was crucial to ink a deal with a partner that would be relatively hands-off and primarily provide support. “Make sure that they’re on the same page with you on the vision and that they have the same interest in terms of their level of participation” he advises. “For me, I prefer a navigator versus a copilot, but some people might prefer the other way around.”

Hodgdon suggests, “It’s important that you’re thinking about not only the visible money, but the invisible money. What are the other value-adds they have in terms of capability, relationships, network? Are they able to help you recruit? For us, a global marketing strategy was important, so we wanted to have someone that had a global reach.”

And he emphasizes, “Make sure that you’re comfortable with the terms,” and keep track of the overall costs associated with the deal. He remarks that lawyers, for example, can be a real money drain. He recommends brand founders negotiate the contracts if possible and try to get weekly updates on any timelines associated with the deal.

“You need to just be mindful that all those guys in your Zoom calls are charging you by the hour,” says Hodgdon, adding, “They’re all going to tell you like, ‘Oh, there’s no way we can like give you a fixed price,’ but, based on the size of your deal and what it is you’re trying to achieve, they can give you a ballpark.”

Geographic, Retail And Brand Awareness Expansion

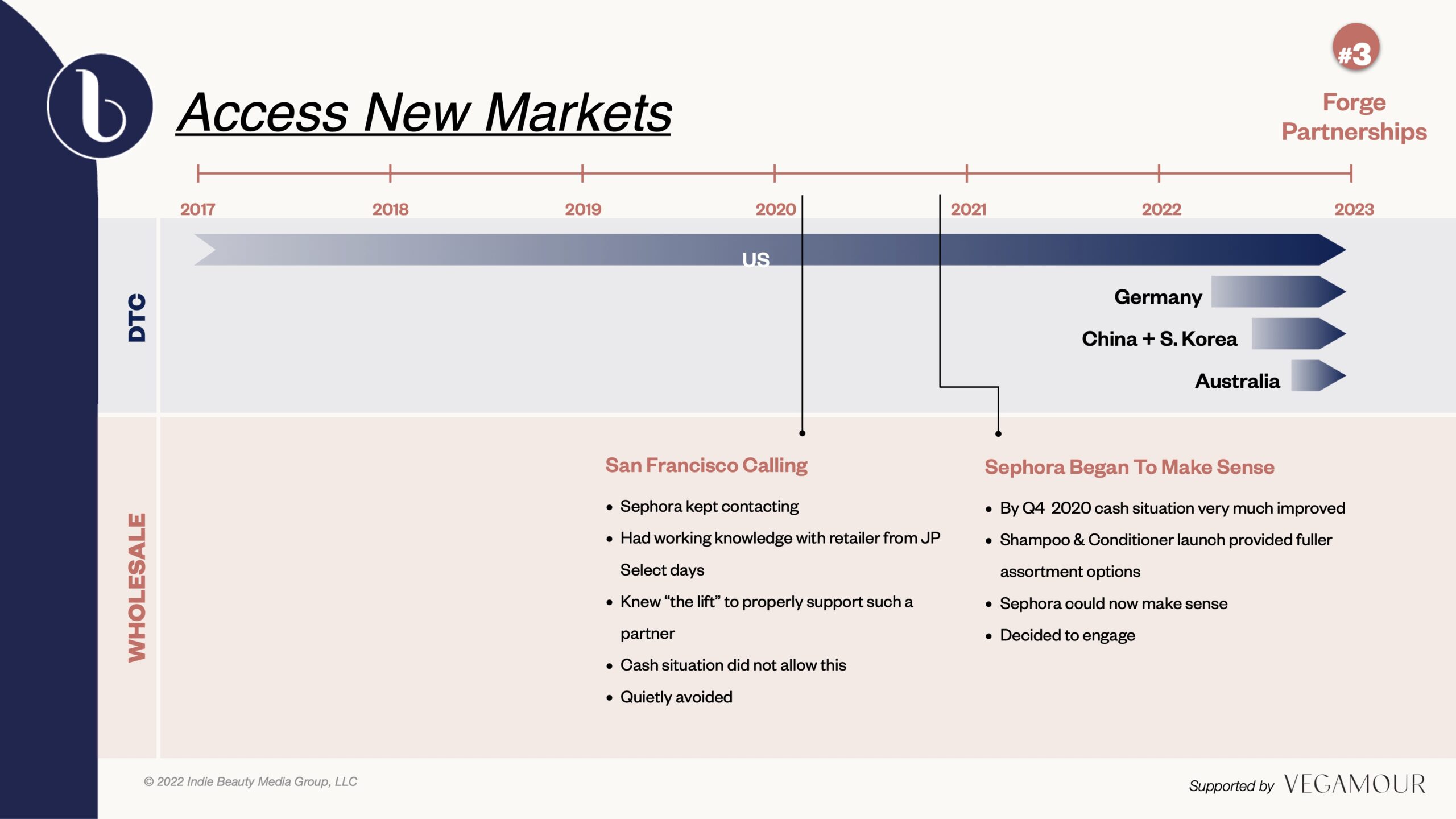

Hodgdon grew up abroad and isn’t afraid to push Vegamour into international markets. Vegamour is testing websites for international audiences in local currencies and languages. It begun with the United Kingdom and Germany, and is poised to roll out similar web capabilities for China, South Korea and Australia. “There’s always a strategy to start off in the U.S. and in your own backyard, but eventually you’re going to your run out of eyeballs,” says Hodgdon.

Sephora, of course, will be a key player in Vegamour’s expansion. The retailer initially reached out to Vegamour in 2020, but Hodgdon didn’t believe the brand was ready for it. He says, “I knew that it was a heavy lift, and I wanted to make sure that we had the financing in place and the people to support all that and also the product line because we, at the time they originally contacted us, only had like four or five SKUs.”

Vegamour kicked off at Sephora stores and online last year with the products Revitalizing Shampoo, Revitalizing Conditioner, Scalp Detoxifying Serum, Hair Serum, Hair Foam, Dry Shampoo, Lash Serum and Brow Serum. Hodgdon anticipates the brand will roll out 25 dedicated spaces and brand-dedicated gondolas within Sephora stores next year.

“Everyone in the world looks to see what Sephora is buying and who they’re working with, and as a digitally native brand, you don’t have that luxury,” says Hodgdon. “They had a global presence, and they were everywhere that we wanted to be.”

Sephora is a huge awareness booster. Hodgdon refers to Vegamour as “the fastest growing hair brand that nobody heard of”—and he’d love for people to hear of it. Sephora reported to Vegamour that it had less than 1% unaided brand recognition. “By being in a partnership with Sephora, that helps to build that back up to a far more healthy and respectable number,” says Hodgdon. “They have a much larger platform and louder megaphone than we do.”

Kidman is a megaphone for Vegamour, too. Anointed its “hair wellness advocate,” she began using the brand’s during quarantine. She was impressed by the results, and what Hodgdon and Vegamour stand for. Discussing what she looks for in partners, Kidman says, “I want the people to be good people, and I want to believe in their mission, and I want to believe in what they’re doing for the world.” She continues, “I have a lot of knowledge of what women want and what people want in certain things, and that’s exciting to me to then go and find a brand that I can support and be a part of, but I don’t have to build it.”

Leave a Reply

You must be logged in to post a comment.