Brand Execs Predict Haircare’s Strength Will Persist After The Pandemic

Dan Langer, president of R+Co, foresees a bright future for elevated haircare driven by uncompromising consumers attracted to what he calls the “new luxury.”

“The new luxury really is about merging high-performance with conscious ingredients [and] sustainability,” he said. R+Co Bleu, a premium offshoot of R+Co with products priced from $52 to $77 and housed in recyclable packaging, launched last week to address the new luxury trend. R+Co’s products are priced primarily from $26 to $42.

Haircare is already on an impressive run. While the beauty industry has been hit hard in 2020, it’s been a shining exception. The smallest slice of the prestige beauty segment, haircare sales rose 11% in the third quarter to reach to $232.5 million, according to The NPD Group.

Haircare has been a comparatively solid performer all year. In the second quarter, haircare sales declined 10%, but were still 8% to 42% higher than other beauty categories. Their strength has been propelled by a swell of emerging premium and masstige brands, a surging interest in at-home treatments sparked by salon disruptions, and tools and color solutions designed to keep tresses tamed and vibrant for Zoom calls and social media posts.

Last Wednesday, Beauty Independent gathered three haircare leaders—JuE Wong, CEO of Olaplex, and Beth Spruance Bennett, CEO of DpHue, along with Langer—for an In Conversation webinar covering consumer preferences shaping the category, the strategies they’re pursuing at their respective brands to take advantage of them, and where haircare is headed next.

JuE Wong, CEO of Olaplex

The Market: Olaplex, which was acquired by private equity firm Advent International last year, finds itself in a very different beauty industry environment than the one existed when it started six years ago. “People used to build bands for legacy, now it’s to exit,” said Wong, who has a track record of working for brands such as StriVectin, Elizabeth Arden and Moroccanoil to guide them through geographic and distribution channel expansion. “I’ve never seen so many brands coming to investors saying they want to be a unicorn and sell it off.”

Wong believes haircare is ready for it’s close-up after long being a sideshow to skincare, fragrance and cosmetics in the beauty industry. Amid the pandemic, people have realized how much they rely on their colorists and stylists to stay quaffed as they resort to doing their hair themselves. Wong says, “If I don’t see my dermatologist for the next few months, fine, but nobody wanted to live without seeing their colorist less than every six weeks or so.”

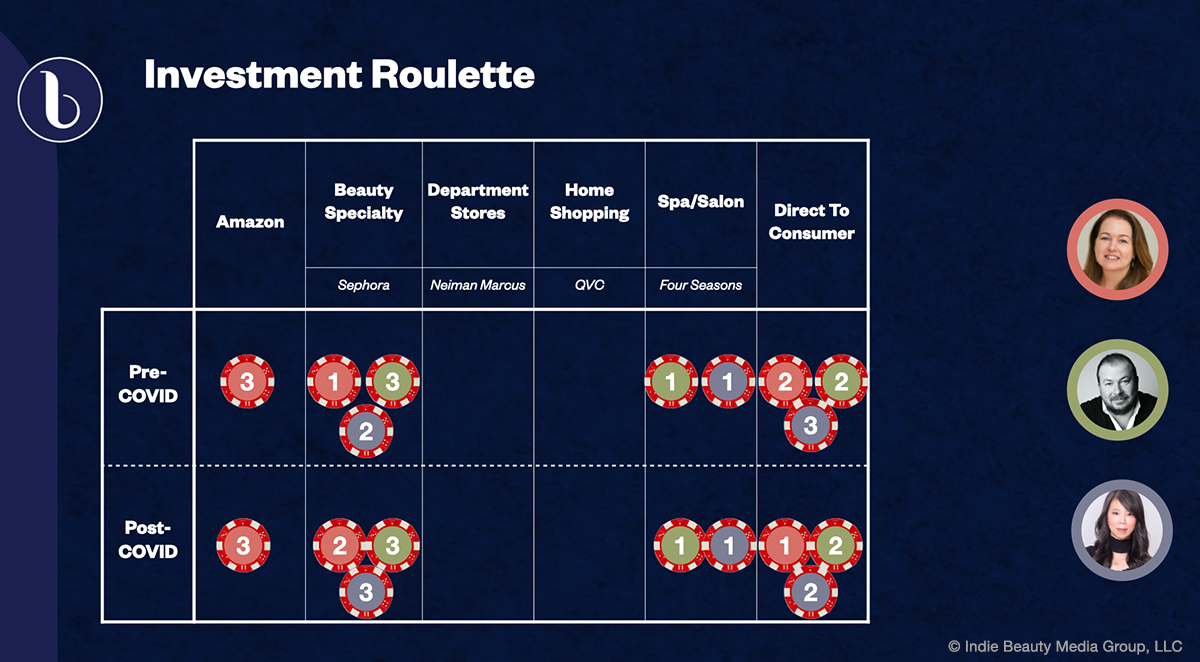

Distribution: Olaplex has established its credibility in salons, where Wong emphasizes haircare is steeped in emotion charged by the close relationships between stylists and clients. She continues that the professional salon channel isn’t the most lucrative, but can foster a halo over direct-to-consumer and retail distribution due to the authority gained in it. She recommends brands depend on retail for awareness and equity and look to direct to consumer channels for material revenues. Wong cautions them against churning out dozens of products in pursuit of sale. “Understand that you have to be highly productive,” said Wong. She noted, “If you generate revenue and occupy a very small shelf space, distributors will support you all day long. If you have 40 mediocre SKUs, it won’t work.”

In pre-pandemic beauty shopping, brick-and-mortar retailers were go-to destinations for experiences. During the pandemic, online experiences have gained and brick-and-mortar stores have become more transactional. Brands that can leverage the assets of the various channels have won in the pandemic period. Wong said, “You see from NPD data that a lot of the growth came from brands that can pivot and that have been truly omni-channel, providing a seamless and frictionless opportunity for their customer. Essentially, what all of us have done is fast track what we thought we were going to do in three years in 12 months.”

Beth Spruance Bennett, CEO of DpHue

The Market: Bennett, a former Clinique and Origins executive who was consulting DpHue prior to becoming CEO role in June, explained the pandemic has enlarged the market for consumers that value salon services, but want to touch up their roots or repair their hair with a mask treatment at-home has increased. Case in point: DpHue’s current bestseller is its Root Touch Up Kit. The brand is renowned for its ACV Hair Rinse.

Spruance Bennett anticipates the so-called skin-ification of hair, a movement of skincare ingredients and benefits into the haircare segment, will pick up speed. She said, “There’s an element of the consumer making a stronger connection of how to take better care of your scalp and hair, and that extension of skin and what that means to you,” she said.

Distribution: DpHue’s DTC channel is its most lucrative avenue of business, and the brand is investing more in its online presence. But Spruance Bennett stressed that specialty beauty retailers like Ulta Beauty and Sephora remain critical to it having a well-rounded operation. “There are those consumers that, because of loyalty programs these stores have, they would prefer to shop there then on your DTC site,” she said. “You can make money at these retailers as a small brand, but you have to be very careful with what you choose to invest in.”

DpHue’s celebrity colorist co-founder Justin Anderson has been essential to the brand establishing itself in the salon world. “The goal is about finding that sort of magical relationship between the salon and DpHue, showing how our products are helping what stylists are doing by keeping the client’s hair in as good condition as possible,” said Spruance Bennett. “So, when they get back into the salon, it’s not a complete fix for the colorist.” Amazon has been an important new venue for the brand. By becoming a vendor, DpHue has been able banish unauthorized resellers discounting its products and ensure retail prices are consistent. The brand has widened its consumer base on Amazon, where it draws different consumers from those shopping on its website, and in Ulta and Sephora.

Dan Langer, President of R+Co

The Market: Incubator and acquirer Luxury Brand Partners has honed a specialty in haircare with brands such as R+Co, IGK and In Common. Its mission has been to make haircare a sexy, invigorated segment. “You had fragrance and skincare and makeup, and all of those were very sexy categories,” said Langer. He elaborated, “Hair was traditionally this category that was sold through a different channel, at a different price point.”

Luxury Brand Partners has been behind influencer-fronted brands like One/Size by Patrick Starrr and Elaluz by Camila Coehlo, too, and had successful exits from Becca, which notably collaborated with Jaclyn Hill, and Oribe, a brand Langer describes as instigating growth in the luxury haircare segment. “When we started Oribe, there was no Rolls Royce-type product in hair like there was in other categories,” said Langer. He envisions haircare as a critical growth catalyst in the prestige beauty sector over the next five years, and projects it will eventually be on par with skincare and fragrance.

Distribution: Langer advised emerging brands to zero in on what what makes them special. “Perspective is everything, whether it’s the makeup artist or a dermatologist or the hairdresser, it is a perspective that helps make something successful,” he said. At a moment when beauty consumers are shopping across channels, Langer insisted omni-channel distribution is key. He said, “Many people have this impression that you can be a digitally native brand and customers will just come, but they spend a lot of money on customer acquisition.”

Langer maintained that salons and stylists have to adopt a digital-first mentality going forward. He mentioned affiliate programs allowing stylists to remain connected to their clients outside of the chair is a great place to start. R+Co’s affiliate program generated 30,000 transactions throughout the shutdown. Langer also detailed that salons are perfecting home delivery, pickups at their locations and virtual consultations. He said, “If you can turn the restaurant industry virtual, you can do it here.”

Leave a Reply

You must be logged in to post a comment.