Sugar Capital Raises $75M Third Fund As Its Co-Founder Declares “Consumer Is Back”

Sugar Capital co-founder Brian Sugar has declared consumer is back—and he’s on the attack.

His early-stage venture capital firm is due to close a $75 million third fund by the fall, and it intends to invest between $1.5 million and $2 million on average into 25 companies from the forthcoming proceeds. Around half of the fund will be committed to follow-on investments.

“The name of the game in venture is ownership. You want to have the most ownership you can in the winners,” says Sugar, who co-founded PopSugar in 2006 with his wife Lisa, with whom he shares three teenage daughters, and sold it to Group Nine Media in 2019. “We believe in working with founders early on, seeing if a business is really taking off and, in the first 18 months of a business, write a second and maybe third check and increase our ownership along the way. That’s what we did with Grüns.”

Sugar Capital is the largest outside shareholder in Grüns, the gummy supplements brand valued at $500 million in its $35 million series B round in May. The firm participated in the series B round and Grüns’ $1.8 million pre-seed round in 2023. Sugar Capital was also an early investor in Olive & June, the nail products brand sold for $240 million to Helen of Troy last year.

The Sugars started Sugar Capital in 2020 after getting a taste of investing from the Sequoia Scout Program, which annually allots $100,000 to $1 million to well-connected “scouts” for backing nascent companies. Together, Sugar Capital raised $58.5 million for its first two funds. Now, it has 49 companies in its portfolio between consumer and commerce software startups. Along with Grüns, a few of them are Starface, Exponent, Kinship, Jupiter, Snif, Hello Cake, BlackWolf, Lucky Energy and Magna.

Beauty Independent chatted with Sugar about the drivers of Grüns’ traction, his focus on ingestible beauty, one of the toughest transitions for a founder, “wantrepreneur” dealbreakers, the valuation dynamics at play today, Costco distribution and how his personal health journey is influencing his investment perspective.

There’s been this belief that the VC model doesn’t work for the consumer space because consumer brands aren’t software startups, but you write on your Substack that the “new generation of consumer brands thinks like software companies.” So, is the traditional Silicon Valley VC approach a better fit for consumer now?

The problem with consumer funds is I don’t think the power law exists in consumer, so that’s going to keep a lot of people away. The power law is you invest in some large number of companies, like 30 to 50 companies, and the majority of them will become zeros, but there’ll be maybe five or six that are fund returners. I just don’t think there are as many absolute winners in consumer as there are in software.

When I talk about consumer companies taking a more software-like approach, it’s more about subscription, habitual consumable products—and that’s what we invest in. So, it’s like software where you’re thinking about your customers more like recurring revenue rather than a one-time purchase.

The whole problem with Casper was, you buy a mattress. What else are you going to sell that person? If you buy Allbirds, there’s not really much else to buy. Maybe you need another pair of sneakers in a year. With Grüns, Lucky Energy or Magna, they can become part of your daily habit. If your product isn’t something that’s going to be bought at a regular cadence, we’re not going to be an investor in it.

What put Grüns on the path it’s on now?

First and foremost, I would say the founding team. That really separates the winners from the losers. There are so many founders that we meet that are great from a taste perspective. They get the trends, the market, the customer, but they don’t have a partner or somebody on the team that understands financials, operations, the boring unsexy work that makes the business go.

When we talk to the creative right-brain people, if they don’t have a left-brain person around them on the team, it’s often difficult to see that become a success. It’s all about Steve [Jobs] and Tim [Cook], Maverick and Goose.

We oftentimes look at the operating model as the blueprint architecture to your business. If you can’t take us through an operating plan, it’s difficult to underwrite that business because you are holding on by the seat of your pants and not thinking about long-term margins.

I can easily see that right-brain person gets to maybe $5 million, $10 million or even $25 million, but they’ll tap out, and they won’t be able to raise a series A, or they’ll be able to raise the series A, and they’ll become a zombie consumer company. Operations is going to make a business go from zero to $5 million, $15 million, $25 million, $75 million and well over $100 million.

You’ve also written on Substack that, “The market is rewarding velocity over vintage.” That’s interesting because we hear frequently about the prioritization of vintage over velocity.

I think growth is above else what everybody’s looking for. That’s what your multiple’s going to be based on. Yes, you have to have room to grow once you get bought. I was more talking about if you’ve been around for a while and you’re not growing that fast.

There are two growth points where multiples change. It’s the 25% year-over-year mark. If you’re under 25%, it’s not a great place to be. If you’re between 25% and 40%, it’s really great. If you’re above 40%, you’re going to get high growth multiples.

What are valuation dynamics today?

At the seed stage that we invest in, there are three different variables that go into the valuation. There is the actual revenue. Revenue to me equates to traction. Where are you? What risk have you mitigated? There’s the actual capital that you need to take you to your next round or profitability. Then, there’s the level of dilution that you want, and the investor wants to give you.

With the seed stage, the valuation and the amount of money are constants. Most seed-stage consumer businesses are raising like $3 million to $4 million at a valuation between $8 million and $20 million. There are obviously outliers.

You don’t want to do more than 20% dilution. Investors don’t want to invest for anything greater than that because you want the founder, the team to be well incentivized. If you grab 50% of the business at the seed round, maybe the founder’s like, screw this, I’m out. They need to have the most skin in the game. Also, as you raise money, you’re going to get diluted over and over again.

So, what does that leave for us to assess where you are? That’s the traction that you have. That’s the variable thing that has been changing over the last five years. When valuations are higher, that means in essence your traction is lower. You might have $1 million in revenue versus maybe when it was really difficult, you needed to have $3 million, $4 million or even $5 million in revenue.

A year or two ago, it was harder to raise money. It’s maybe 10% to 12% easier now. It’s not a walk in the park. A few years ago, if we were looking to invest in a company and they had less than $1 million in revenue, we’d often say that it’s too early for us. If someone comes to us now, and they’re under $1 million in revenue, but the growth is eye-opening in that first six months, that’s something we’ll write a check for.

What’s your view on distribution?

When we first started investing, we would really look at the DTC site and value that more than anything. Now, it’s, what’s your multi-channel strategy? Where are you with Target? Where are you with Walmart? Are you up on Amazon yet? We’re investing less around channel and more, are you able to sell to the right customer at the right place?

We have three teenage girls. The amount of times the Amazon guy is coming in here with beauty products is incredible, but they still love going to Sephora, and they’re on sephora.com all the time.

AG1 chose Costco for its first retail partner. What are your thoughts on that?

I think Costco is the Neiman Marcus of big-box retailing, and Target and Walmart are the mass market. Costco has a higher average household income. We always look for the top 1% product and then are like, someone’s going to do this for the mass market.

I believe that AG1 was the top 1%, and Grüns was the mass-market version. I love that AG1 is in Costco, and Grüns is in Walmart, Target and other places.

Costco is great for a high-end brand like AG1. I would be concerned that the Kirkland people are watching the velocity of AG1, and Kirkland will come out with their version, then say goodbye because you come in and out of Costco.

The ingestible beauty segment is an area of focus for you. Why?

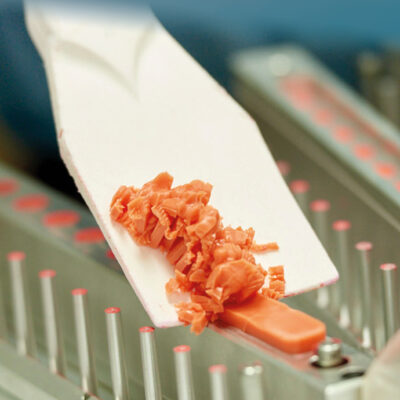

Ingestible beauty has existed for a very, very long time. At some age, mostly females, although males also, begin their search for the fountain of youth, and it’s supplements galore. Finally, we’re getting great branding, packaging and marketing. I actually believe that this is not a short-term trend, and we’re very long on investing in this ingestible beauty category.

If I had a time machine, I would go back and short denim and go deep in Lululemon around when Britney Spears shaved her head. It was a critical moment in pop culture where all of a sudden everybody cared about looking fit. If you look at Lululemon’s chart and you look at when Britney Spears shaved her head, they coincide too closely for it to be coincidence. Everybody wanted to virtue signal that they work out in Lululemon and look really great.

Well, through the lens of a 12-year-old, 15-year-old and 19-year-old, they not only look good, they actually feel good about it. I think, in the next five to 10 years, we are extremely bullish on creatine, protein, magnesium, all the stuff that’s in pouches and ready-to-drink powder.

You’re going to see an onslaught of all of that, much like you’re seeing in the whole sex category that has become mainstream. We’re investors in Hello Cake. That business went from zero to $100 million pretty quickly. They had this whole idea that, coming out of COVID, people were going to have more sex and have an openness around all of it, feeling good about themselves sexually as well as just health conscious.

Recently, Business of Fashion ran a story based on their beauty report with McKinsey & Co. where they declared the founder-led era is over. Do you believe that’s right?

A business lives and dies because of the founder. We invest in founders first and foremost. Usually, a company falls into two categories in why they’re successful and why we would invest. No. 1, the founder has encountered a problem themselves, and they will not go to sleep at night until that problem is solved. No. 2, there’s a moment of transition and some new technology changes the way that we operate that a founder sees the future of and goes after it before somebody else.

The last thing that we want to invest in is a goal-seeking MBA guy, the person that is like, “There’s white space in underwater basketweaving that nobody’s gone after that yet. We think we can do that because the market size is this,” and all of that backing into a startup.

People think this is derogatory, but I call them wantrepreneurs. They want to be entrepreneurs, and they don’t necessarily care what the business is they start, they just want to start a business. We’re constantly looking for the wantrepreneur red flag.

What’s one of the hardest things you’ve had to tell a founder?

The hardest thing I’ve had to do with founders is when the company’s hit a scale where it’s time for that founder to think of bringing in a new CEO, telling them, “Listen, you got us to $100 million in revenue, and the business is more about blocking and tackling. You want to innovate and maybe you’re bored by keeping the trains running on time. Well, In order to continue to grow at 40% year-over-year, we need to increase our margin from 59% to 60% or whatever it is, and that’s not what you love, let’s figure out a transition.”

What recommendations do you have for founders making that transition?

Don’t be the No. 1 point person on hiring your replacement. We all have egos, and you’re constantly going to be like, this person isn’t as good as me, and you’re going to regress to, why do I have to leave? I would be part of the hiring process, but I wouldn’t be the point person.

Also, you have to make sure you’re going to step away. I have never seen it where the founder hangs out and allows this new CEO to really, really flourish. That’s a rare thing. It can take a long time, quarters to get the founder to go through all the steps and understand.

Tell us about your health journey.

I lost 40 pounds over the course of a year. I changed everything that I eat, and I stopped drinking alcohol. I microdosed Ozempic. It really helped me stop drinking. It was quite amazing. It interacts with your brain in a productive way where it’s easier to change bad habits.

Not that I had a huge drinking problem, but, coming out of COVID, we all drank a little bit too much. When I thought about my daily calorie intake of alcohol plus the bad decisions I made because of the alcohol in terms of food, I probably took a thousand calories out of my daily life.

I’m 5’ 6”. I was 175 pounds. I’m now 135 pounds. I look great. I’m muscle. I’m 51 years old, and I look and feel like I’m 18 again. My blood pressure’s awesome. My cholesterol’s come way down.

How has your healthy journey influenced your investing?

We’re looking at businesses creating product that is going after GLP-1 side effects. That’s going to be a big category. I think the distribution channel and positioning are very important. When your doctor prescribes you GLP-1, they could also at the same time say, “Here’s the diarrhea medicine, the constipation medicine or the dehydration medicine.” And there will be aisles in CVS of products that will be Starfaced if you will.

GLP-1 users are like a little cult. The community helps each other, and they tell you about products that work and that don’t, when to take your shot, should you change where you put the shot. I’m going to my doctor next week, and I can’t wait to go for the first time in my life. I think it’s going to be recommended like a statin in the future.