DC Advisory Forecast: Private Equity To Reign Over Increased Beauty M&A This Year

DC Advisory forecasts a boost in beauty mergers and acquisitions for the remainder of the year, with private equity firms leading the charge in scooping up attractive assets as they remain bullish on the beauty industry’s future.

In a new report entitled, “DC Discussions: The Glowing Outlook For Beauty & Personal Care M&A,” the investment bank lays out the conditions underpinning strong global beauty M&A activity in the second half of the year, including a backlog of beauty companies that have been in the portfolios of private equity firms for four or more years, a broad field of private equity and strategic acquirers, technical advancement in skincare and haircare, resuscitated demand for makeup, and persistent growth in beauty across established and emerging global markets.

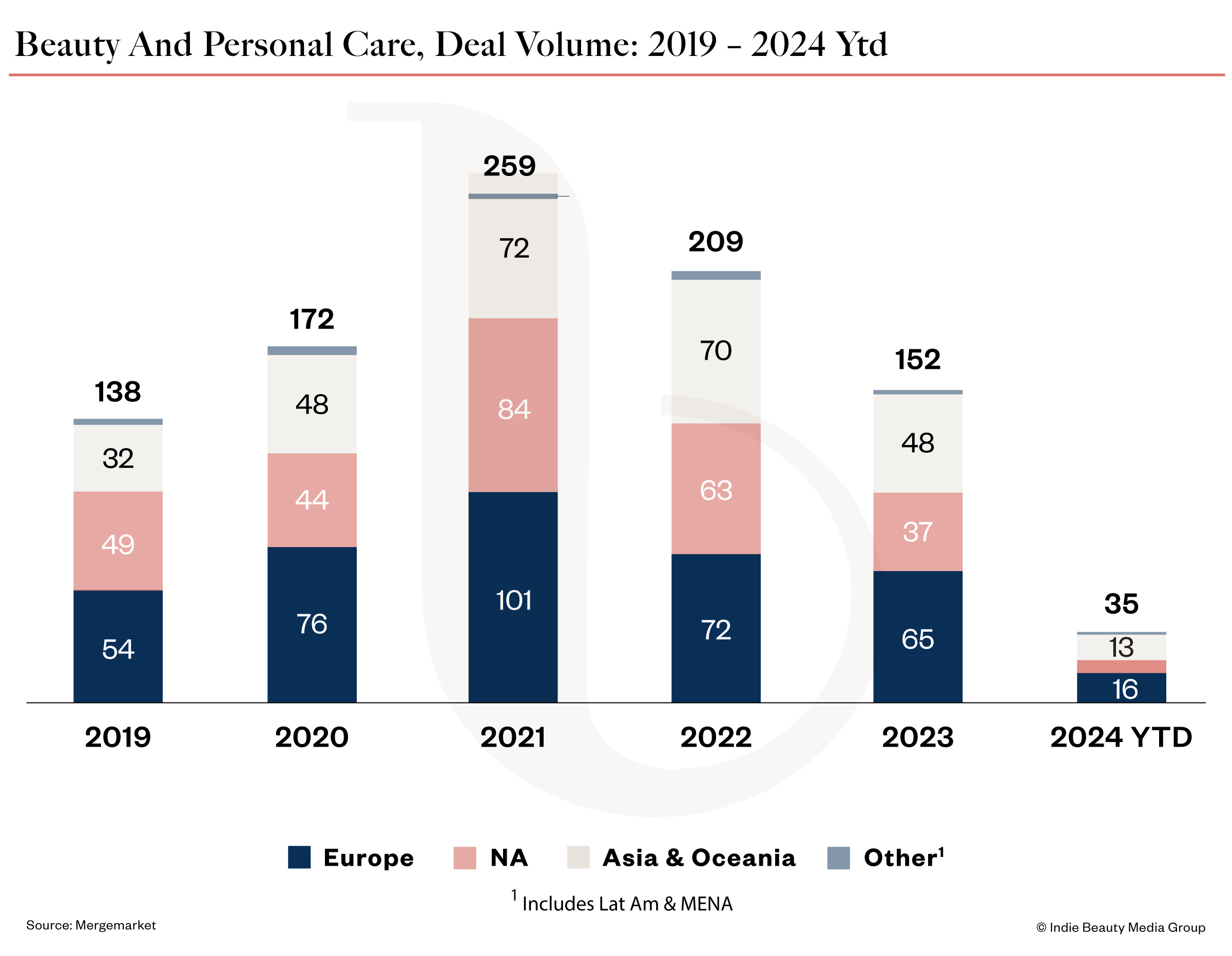

Last year, the number of beauty deals worldwide dropped 32% to 152 from 209 the year before, according to data from Mergermarket cited in the report, but deals have been on an uptick so far this year. Compared to the same period last year, beauty M&A volume increased almost 13% in the first quarter of 2024 to 35 transactions. Private equity participated in 62% of the deals, up 10% from last year, and DC Advisory points out there’s a shift to private equity from strategics being responsible for a majority of beauty deals as they were pre-COVID. Among 2024 private equity deals are Manzanita’s for DS & Durga, Bridgepoint’s for RoC Skincare and PAI’s for Beautynova.

Despite the expected volume surge, private equity and strategic players are being selective and concentrating on profitability. The report reads, “Prospective sellers should be nimble and thoroughly prepared to go to market. The current investor sentiment favors omni-channel brands, high quality products, focus on loyalty, efficacy, and volume growth trends.” For strategics exploring deals, it explains they’ll prioritize “brands and manufacturers that provide meaningful scale or complementary product, capabilities and overall acquisitions that support their top-line growth.”

Elaborating on profitability, Luc-Henry Rousselle, managing director of beauty and personal care at DC Advisory, says, “Generally, this means that for brands that have scaled past the $50 million to $75 million net sales mark, there is an expectation of at least double-digit EBITDA [earnings before interest, taxes, depreciation and amortization] margins, with a path to high teens and twenties.”

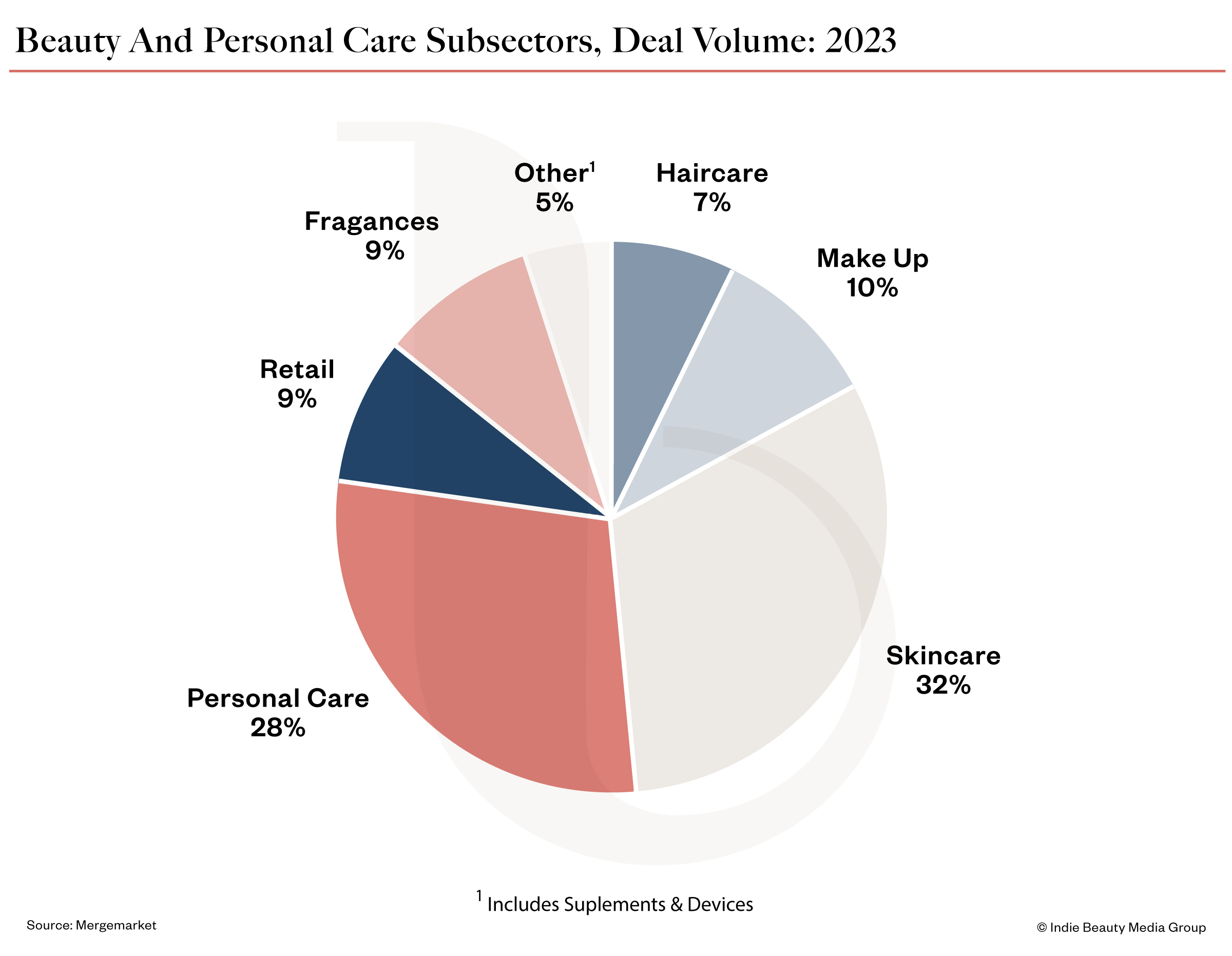

Drilling down into beauty categories, DC Advisory predicts skincare, which accounted for over 30% of the global transactions in the sector in 2023 and 40% of deals completed this year, won’t lose its status as the dominant M&A driver in beauty. Last year in skincare M&A action, L’Oreal, Shiseido, E.l.f and Amorepacific snapped up Aesop, Dr. Dennis Gross, Naturium and COSRX, respectively.

“The current investor sentiment favors omni-channel brands, high quality products, focus on loyalty, efficacy, and volume growth trends.”

DC Advisory anticipates fragrance will stay a draw. The category has been a hot ticket of late. In multibillion-dollar moves, Kering purchased Creed in 2023, and Puig acquired Byredo in 2022. Although there are a number of prestige makeup brands on the market (think Rare Beauty, Glossier and Kosas), whether prestige makeup will register a robust M&A revival is an open question.

“Makeup saw some of our industry’s most iconic transactions like MAC by Estée Lauder or Maybelline by L’Oréal. The category is rebounding post-COVID as we are back out in the world and in-store shopping is possible again,” says Rousselle. “Makeup remains the largest premium beauty category, and the opportunities presented by a new generation of brands and consumers are limitless.”

In a cross-category phenomenon, the report foresees carveouts, a factor in beauty M&A last year, as a catalyst for deal acceleration this year as conglomerates offload non-core assets to private equity firms. Yellow Wood Partners’ assumption of Elida Beauty from Unilever, Nexus’s takeover of Dollar Shave Club from Unilever, and Aurelius Group’s purchase of The Body Shop are examples of carveout deals done in 2023.

The beauty M&A landscape varies considerably worldwide. In its report, DC Advisory identifies India, the biggest country by population, as “ripe for opportunity.” Last year, there were 10 deals in the market, notably Carlyle’s around $393 million acquisition of VLCC, and Godrej Consumer Products’ roughly $345 million purchase of Raymond Consumer Care’s consumer goods business.

DC Advisory notes digital-first brands in India are enticing for beauty M&A. In the report, the investment bank writes, “Looking ahead, we believe players such as Unilever, ITC, Marico, and Godrej will continue to acquire players in the India beauty and personal care space to fill portfolio gaps. We see a particular interest in sub-segments like cosmetics, ayurveda, and dermatology, which are increasingly resonating with consumers seeking both tradition and innovation in their beauty products. Conglomerates such as Reliance, Tata, Adani on the other hand would potentially seek broader brand players.”

Leave a Reply

You must be logged in to post a comment.