Rhode’s DTC Sales Bonanza Gives Brands The Wrong Idea. A DTC Expert Level Sets.

In its first year alone, Rhode, the gen Z-loved 3-year-old brand founded by Hailey Bieber that E.l.f. Beauty just scooped up for $1 billion, generated $100 million in sales in direct-to-consumer distribution.

In nearly eight years of forecasting for DTC brands, Nishi Shah, partner and co-founder of marketing analytics firm MarketCents Inc. and former VP of marketing for Guthy-Renker, has never worked for one that’s had that kind of haul in its first year. In fact, she’s never worked for one that’s surpassed $5 million in first-year sales.

Rhode is an extreme outlier, but outliers give emerging beauty brands the wrong impression about the sales they can achieve early. Beauty Independent turned to Shah to level set. She stresses the biggest mistake founder-led DTC beauty brands make is underestimating advertising costs. She recommends that 30% to 50% of their sales should be poured into advertising at the start.

“If you look at the financial model for $1 million in sales, to spend $500,000 on media is a lot. That is the investment,” says Shah. “If you don’t do that, you won’t stand out, and that’s where so many brands fall flat.”

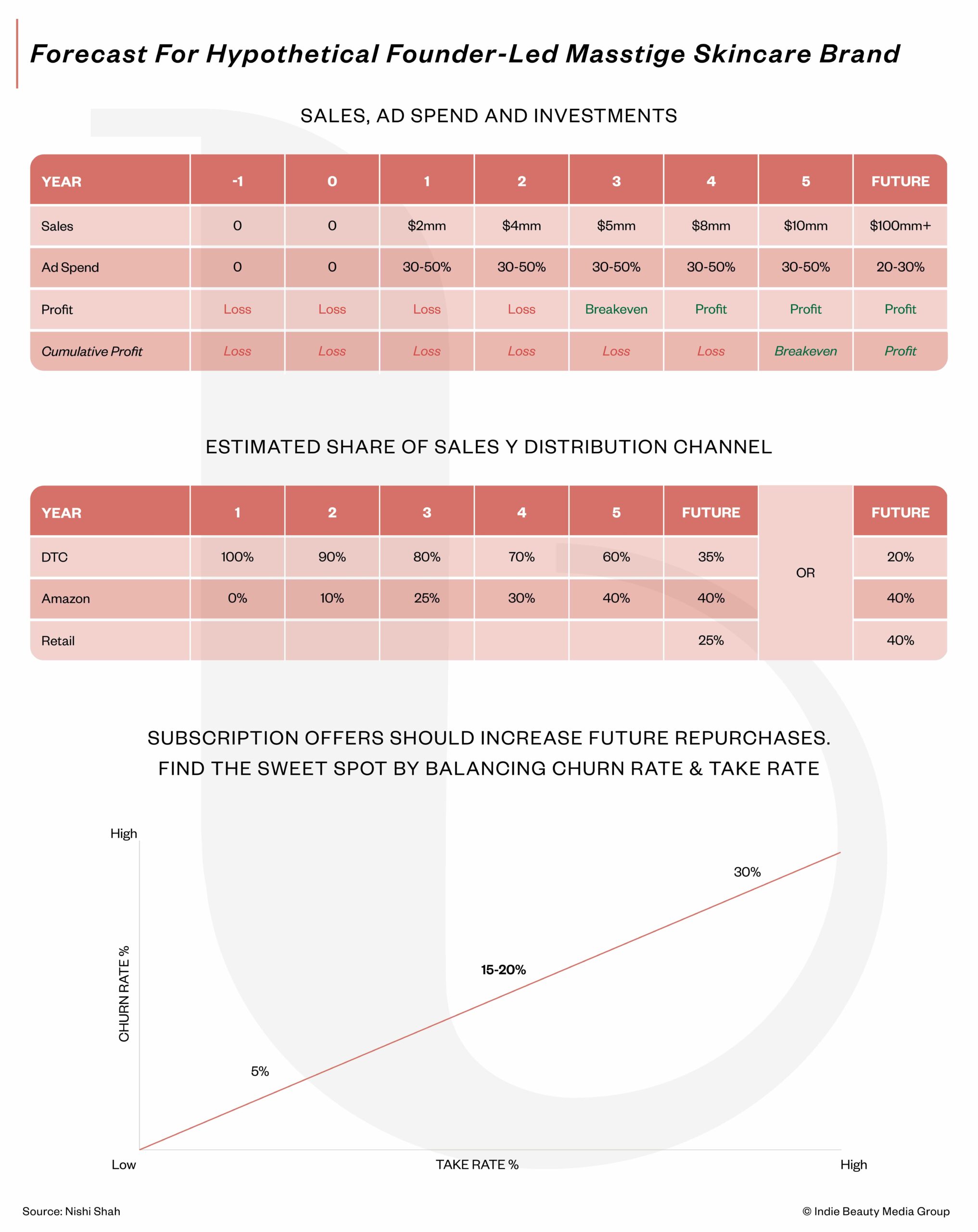

Below, she walks us through the financial model for a hypothetical founder-led skincare brand in DTC distribution with four products and an average order value of around $75, common misconceptions brands have, and how they can ensure their passion is validated by the market.

Hypothetical Brand Model

The process of building a profitable DTC brand is slower than many beauty entrepreneurs think, and Shah regularly encounters brands that anticipate crossing into the black long before they do. For the hypothetical skincare brand, she predicts it will notch losses for its first two years in business and break even in its third year, after which it can accumulate profits.

In the year it launches, Shah surmises the hypothetical skincare brand can reach $2 million in sales. Reaching five times that amount is a practical goal for year five. In the initial year, the brand should commit $30,000 to $75,000 a month to what she calls working media spend. That amount doesn’t factor in public relations or grassroots marketing efforts, and it doesn’t extend to content development, legal, website hosting, packaging, and research and development.

For the hypothetical skincare brand with $2 million in first-year sales, 50% of the $30,000 to $75,000 a month in working media spend goes toward paid social, 30% toward paid search and 20% toward other channels to test. “Invest in SEO, and you can reduce your paid search spending,” says Shah, mentioning that television advertising is too expensive for nascent DTC beauty brands.

Shah suggests new DTC beauty brands skip affiliate marketing, too. She says, “It seems like an easy win, but it’s actually not great for your brand equity.” She elaborates, “You’re paying an agency like 15% or sometimes more. Then, on top of that, you’re paying per order for every order that’s collected, and sometimes you don’t even know if those orders are fraud…Sometimes customers who buy from affiliate are returning customers who already knew your brand.”

Amazon Distribution

Most brands Shah works with are reluctant to jump on Amazon right away because they don’t have a direct relationship with Amazon customers and can’t remarket to them. In their second year in business, they may enter the giant e-tailer’s universe with a product or a holiday bundle, and sales on Amazon could account for 10% of their business. That could grow to 40% by year five for the hypothetical skincare brand.

Even as brands are just getting underway, Shah advises them not to completely ignore Amazon. “You need to be on Amazon as a defensive strategy no matter what,” she says. “Set up your Seller Central account and be on there for the reviews. Be on there because, if you’re not on there, your resellers will be on there.”

Subscription

Shah is a fan of DTC beauty brands pulling subscription levers. That doesn’t mean they’re perfect, though. She says, “The bigger your discount, the more people are going to get it, the more churn you’re also going to get.”

Shah identifies the sweet spot for discounts tied to subscriptions as being in the 15% to 20% range. She observes most brands provide 5% to 10% plus free shipping. She recommends DTC beauty brands to balance discounts with additional incentives like free gifts, exclusive offers and early access.

Early Misses

Shah frequently runs across DTC beauty brands that don’t value claims highly enough. As a result, they don’t budget to verify them. She says, “They believe in this product so much that they haven’t gone out and tested it enough.”

The operational and supply chain sides are undervalued as well. Unreliable shipping, freight and manufacturing can be disastrous for emerging DTC beauty brands. She says, “You’ve lost $1 million in your bottom line because you realized you’re paying outrageous rates to not just ship the product, but your products are getting returned to you.”

Because they don’t fully grasp shipping, Shah finds DTC beauty brands regularly want to house their products in glass, which she determines is a no-no for e-commerce deliveries. “It’s very heavy,” she says. “Your bottles do not need to be looking like that when you’re sending them off DTC or Amazon. They need to be shelf-ready when they’re on the shelf.”

Test And Learn

Another mistake Shah sees brands make is they purchase too much inventory upfront, convinced they’re going to be a smash hit out of the gate. She believes they should slow their roll a bit and consider purchasing three months’ worth of inventory and spend three months testing their paid media and influencer program.

“They’re saying, ‘I need to be able to see how my audience truly perceives my brand and then make my tweaks and then go back out and push for more media,’” she says. “It’s the founders that are really saying, ‘I don’t think I have this figured out,’ those are the ones who win. It’s not the founders who say, ‘This is the best product ever, I know it’s going to work because the family loves it.’”

Leave a Reply

You must be logged in to post a comment.