Hailey Bieber’s Rhode Combines Celebrity With Financial Rigor. Can Others Replicate It?

Can celebrity cachet be measured in dollars? At Rhode, it can, and Hailey Bieber’s is valued at about $188.7 million.

That’s the brand’s revenue in direct-to-consumer distribution alone for the year ended March 31 after subtracting marketing costs, according to a United States Securities and Exchange Commission filing by E.l.f. Beauty on Oct. 17, which gives a strikingly detailed financial picture of the asset it’s dedicated up to $1 billion to acquire. Leveraging Bieber’s fame, Rhode spent about 11% of sales on marketing, far below the 20% to 40% typical for the industry and roughly 25% for E.l.f. Beauty last year.

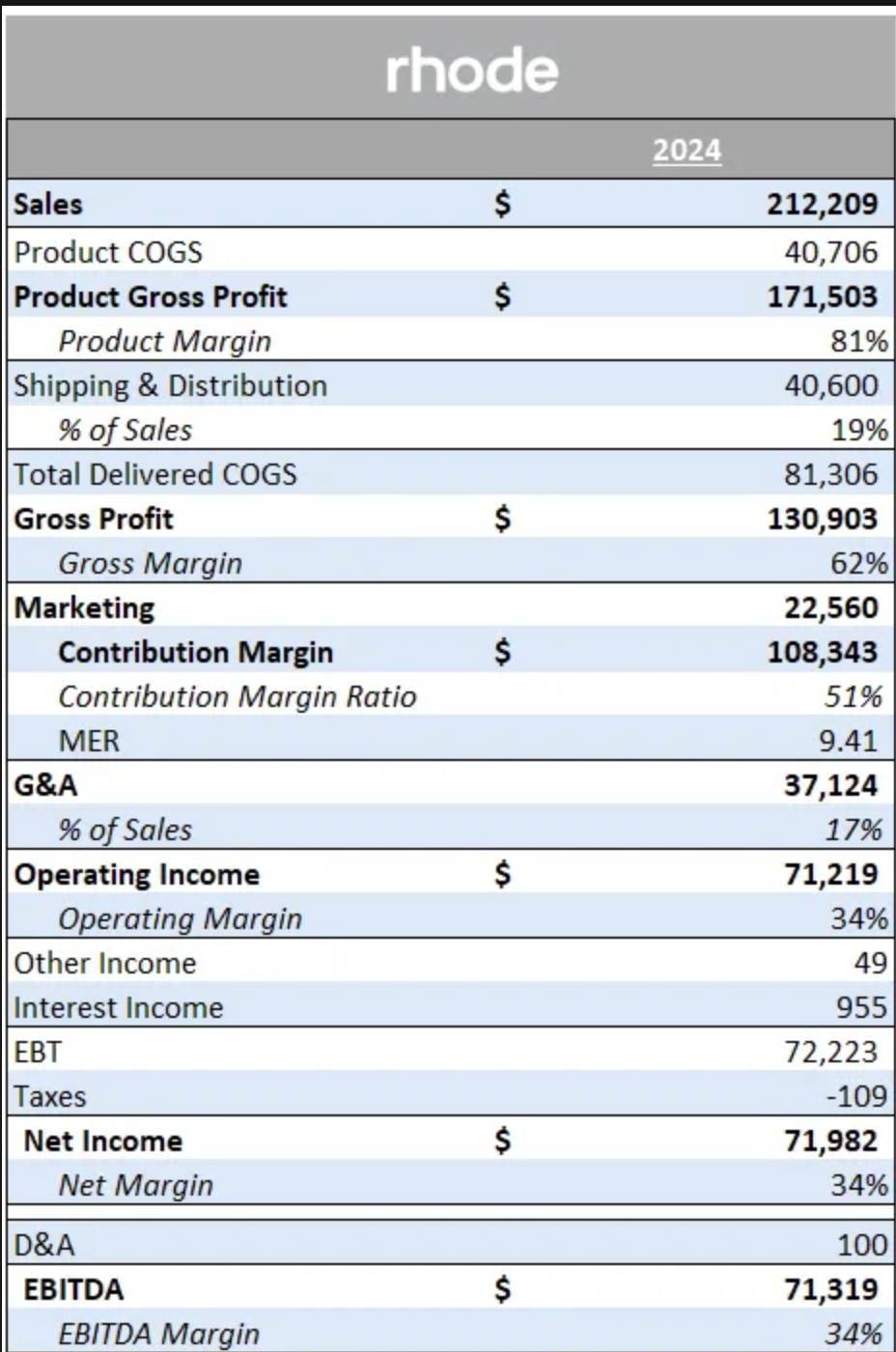

Diving deeper into the numbers reinforces Rhode’s unusually strong profitability. Rhode’s earnings before interest, taxes, deprecation and amortization (EBITDA) margin landed at 34%, well above the 15% to 30% considered strong for the industry, with its cost of goods sold (COGS) clocking in at 19%. The brand’s marketing efficiency ratio is over nine, and cost of delivery for the period was 15% while general and administrative costs (G&A) weighed in at 17% of sales.

“As an influencer led brand, we expected some pretty good marketing efficiency, but I don’t think I could have possibly guessed we would get 50%+ contribution margin ratios and MERs north of 9,” wrote Drew Fallon, co-founder and CEO of Iris Finance, in a Oct. 24 post on his Substack Making Cents. Referring to Rhode’s P&L as “exquisite,” he went on to note, “The question this raises, though, is – what happens if her relevance fades, and MERs contract? In that case, we don’t really have an A+ gross margin, and we would see EBITDA margins collapse aggressively.”

So far, Rhode’s 2025 performance has been a bit of a mixed bag. It had the largest North American debut ever in Sephora’s history in September, racking up $10 million in sales in two days, according to market research and analytics firm YipitData. However, its second quarter sales were around $40 million, down from $48 million last year.

Reporting by the publication Puck News suggests that a slowdown in investments and product releases leading up to the brand’s Sephora launch rather than consumer fatigue contributed to the sales growth deceleration. But Wall Street wasn’t convinced, and E.l.f’s stock dipped 7% on Oct. 20 on the information it divulged about Rhode’s performance. Still, Rhode could be poised for a star-worthy fourth quarter after a September in which Puck News pegged its sales at $40 million.

To shed light on what emerging beauty brand founders can learn from Rhode’s finances, for the latest edition of our ongoing series posing questions related to indie beauty, we asked 10 investors, consultants, founders and brand builders the following: What are the most noteworthy aspects of Rhode’s P&L? What should emerging beauty brands take away from Rhode’s P&L statement? Is it possible for emerging brands to achieve Rhode’s numbers without the influence of a celebrity like Bieber?

- David Olusegun Founder and CEO, AIYE Group

When Rhode’s financials surfaced, the industry fixated on one number: a 34% EBITDA margin. For a brand barely three years old, it was headline-worthy, but the real insight sits deeper in the P&L within two less glamorous figures: 11% marketing spend and 19% COGS. In an era when most DTC beauty labels burn through 40% to 50% of revenue on customer acquisition, Rhode did the opposite. With just 11% of spend, it achieved a 9X return, proof that fame isn’t the only factor behind efficiency.

The 19% COGS underscores operational sophistication rarely seen in celebrity ventures. Rhode didn’t rely on inflated markups or outsourced formulas. It engineered products with manufacturing precision, creating a $32 product that cost just $5.92 to produce, a ratio that offers flexibility on price, innovation and margin expansion.

Together, low CAC and low COGS form a rare equation: profitable unit economics from day one. Even its 17% G&A, seen by some as heavy, reflects deliberate investment in finance and systems, the kind of infrastructure that signals maturity to strategic buyers like E.l.f. The 70/30 revenue split with TDE further cements Rhode’s leverage, a feat few emerging brands manage to secure.

Rhode’s P&L is less a benchmark than a blueprint. The goal isn’t to replicate its margin profile, but to internalize the mindset that produced it. Distribution before product. Hailey Bieber’s reach offered instant scale, but the principle applies universally: build trust before launch. Founders without celebrity clout must cultivate micro-communities of early adopters long before day one.

Discipline on cost. Too many young brands accept 30% to 35% COGS as inevitable. It isn’t. Sustainable beauty businesses start by working backwards from target margins, not forwards from supplier quotes. Sub-25% is the threshold for resilience.

Rhode invested in real systems early: a CFO, clean books, scalable operations. That discipline turned a fast-growing brand into an acquisition-ready asset, not a founder-dependent project. Rhode demonstrates that brand heat and financial prudence can coexist.

Replicating Rhode’s economics without celebrity distribution is possible, but it demands time, precision and patience. The path is slower, yet more durable. Community-led distribution replaces star power with advocacy, where thousands of loyal users amplify brand stories. Product-led virality leverages genuine innovation as Starface or Hero Cosmetics did to turn usage into marketing.

Non-celebrity brands must prove unit economics earlier, often around $4 million to $6.5 million in revenue, before seeking growth capital. But those that do often hold stronger long-term value. While Rhode’s trajectory is tied to Hailey Bieber’s influence, community- and product-driven models build resilience that outlasts any one figurehead.

Rhode is a real case study on how modern beauty can unite cultural capital with commercial control. For a generation of founders raised on hype, Rhode offers something rarer: proof that profitability can be as aspirational as influence.

- Nancy Vincent Parr Founder, Onaji Cosmetics

When E.l.f. released Rhode’s P&L, the marketing world immediately showcased it as some kind of genius strategy that every beauty brand should aspire to. The obvious outlier in the P&L that stood out way above the rest was the 11% marketing spend. It’s a dream figure for any brand founder, but let’s call it what it is: celebrity reach.

When your founder has 50 million social media followers, you don’t need a marketing budget. She is the marketing budget. Her fame replaces paid media spend. That’s not criticism, it’s just the truth.

What’s interesting sits deeper in the P&L. The general and administrative numbers show a well-run business built by people who know exactly what they’re doing. This isn’t an influencer experiment. It’s a polished operation with tight unit economics and clear strategy. Rhode was engineered to make money. You can see it in the margins, the SKU strategy, and how cleanly it scaled.

And now with E.l.f. absorbing it, those overheads will likely tighten even more. Smart business. But whether Rhode’s minimalist, cool-girl image stays intact under corporate ownership remains to be seen. E.l.f. and Rhode sit in very different corners of the industry.

For indie founders, the takeaway isn’t about fame, it’s about fundamentals. Rhode was built for profit from day one. They didn’t hope the numbers would work out later, they structured them that way from the start. If you want to scale from DTC into retail, you can’t wing it. You need to think about unit economics, margin structure, logistics, and pricing early. Rhode clearly did.

Can an indie brand replicate that kind of performance without a celebrity? Realistically, no. You won’t build brand awareness on 11% marketing spend. Visibility costs money. Indie brands don’t get free reach. We fight for every bit of exposure through PR, storytelling or paid campaigns. No one buys what they don’t know exists.

Profitability is still well within reach for indie brands. Fame might fast-track growth, but discipline is what sustains it. A financially healthy brand isn’t built on hype, it’s built on focus: knowing your numbers inside out, keeping operations lean, growing at a pace that doesn’t compromise stability and developing a voice that genuinely connects with people.

Indie brands can’t compete on fame, but we can compete on integrity, innovation and execution. The beauty space is full of noise. The brands that last are the ones that pair authenticity with good business sense.

So, yes, Rhode’s P&L is impressive, but it’s not proof of marketing genius. It’s proof of professional execution and the power of influence. For the rest of us, the lesson is simple: fame might open doors, but strong economics keep the lights on.

- Jim Meadows Director, DTC Ventures, YMU

The most noteworthy aspect for me was how quickly the industry misread the numbers. Many jumped on the 19% COGS headline without noticing that the figure represented product costs only because of E.l.f.’s reclassification in the S.E.C. filing. Once fulfillment and delivery are added back in, the true landed cost is closer to 38%, which is still excellent, but tells a more realistic story.

The same applies to the reaction around G&A. Some interpreted roughly 17% as inefficiency when, in reality, it reflects the cost of running a responsible, regulated beauty business prior to acquisition, legal, compliance and operational talent.

These are the things that make a company acquirable in the first place. So while the ~34% implied EBITDA margin is highly impressive, what really stood out was how quickly headline ratios can become mythology when they aren’t read in context. In beauty, being able to properly read a P&L is a competitive skill. This filing made that very clear.

Emerging brands should avoid trying to photocopy Rhode’s numbers, but should study the discipline behind them. Rhode benefitted from extraordinary founder-driven cultural pull, which dramatically reduced marketing spend in a way that most early-stage brands simply cannot replicate. Everything aligned: a sharply defined product strategy, tight SKUs, high repeat behaviors, expert operators from day one and cultural heat that converted into organic demand.

The takeaway is not to try and spend 11% on marketing. It’s to build like adults or surround yourself with people who do. That means thinking about regulatory readiness, operational maturity, cost discipline and long-term unit economics, not just launch-day buzz. Rhode’s P&L rewards focus, restraint and capability, not shortcuts.

If founders take one thing from it, it should be the importance of structure and product strength before scale, not the illusion that virality alone creates sustainable economics.

It’s theoretically possible, but highly unlikely to hit that scale and valuation on the same four-year trajectory without significant cultural force behind it. Rhode’s success reflects multiple aligned factors: timing, product-market fit, operational sophistication and global visibility, a combination that is exceptional, not typical.

The danger for emerging brands is believing they can reach Rhode-level performance with a sub-11% marketing budget or by forcing product costs down before they have scale or by underinvesting in G&A because a graph on social media made overhead look unfashionable. In truth, those decisions can break a young business.

Understanding your P&L properly is the protection here. If you chase unicorn-level efficiency without unicorn-level conditions, you risk starving the very infrastructure a buyer would value. And it’s worth remembering: if Hailey were to post less or if cultural relevance shifted, Rhode’s CAC would rise.

Brands without that advantage need patience, rigor and a realistic plan for generating demand. So, brands should try and understand the mechanics behind these kinds of numbers. Fame accelerates, but fundamentals carry the weight.

- Farah Cohen Founder and CEO, The Ops Engine

Two things stand out. First, the power of credibility in celebrity-led brands. Rhode’s success proves that when the founder’s image and values align perfectly with the product, it can translate into extraordinary growth with comparatively low marketing spend. People buy into Hailey Bieber’s aesthetic and lifestyle as much as the product itself, because it feels consistent, not manufactured. That alignment builds trust and drives conversion, but it only works when backed by great product and execution.

Second, Rhode clearly mastered operations from day one. The COGS, both product and landed costs, are impressively low. That’s the sign of an extremely well-built operational backbone: tight supply chain control, strong supplier relationships and disciplined cost management. It shows that sustainable growth doesn’t come from hype alone. It comes from operational excellence behind the scenes.

Operational discipline is everything. What stands out in Rhode’s numbers isn’t just the top-line growth, but how clean the cost structure is. That doesn’t happen by accident; it’s the result of mastering the “unsexy” fundamentals early: supplier relationships, tight demand planning and strong control over landed costs.

Too many founders focus on brand and marketing before building the operational backbone that allows them to scale profitably, but the truth is every successful beauty brand eventually becomes an operations company. Getting COGS, logistics and cash management right from day one is what creates margin, optionality and longevity.

It’s possible for emerging beauty brands to achieve Rhode’s financials, but it’s usually slower. Without celebrity reach, brands need a combination of sharp positioning, operational excellence, and strategic storytelling to cut through. The playbook looks more like this:

- Community first: Build brand equity through authenticity and shared values.

- Obsessive product-market fit: Create something genuinely distinctive that solves a real customer problem.

- Operational rigor: Protect your margins early. Master COGS, logistics and inventory flow before scaling.

The halo effect of a celebrity can fast-track visibility, but, for most emerging brands, sustainable growth comes from mastering fundamentals and delivering consistently great products with a clear purpose. Take The Ordinary, which reached $300 million in revenue within five years without a celebrity founder or big campaigns. Their success came from radical transparency on pricing and a clear focus on high-quality ingredients at accessible prices.

By breaking down ingredient costs and stripping away unnecessary markups, The Ordinary challenged industry norms and built instant trust with consumers. That level of honesty paired with scientific credibility redefined what value means in beauty. It proved that if you deliver real efficacy at a fair price, you don’t need celebrity endorsement to build loyalty. You earn it through trust and consistency.

- Maggie Sellers Reum Founder and CEO, Hot Smart Rich

For me, the biggest headline is that Rhode isn’t just a celebrity brand, it’s a business with real fundamentals. The margins are exceptional, especially when compared to E.l.f.’s broader portfolio, and the lack of heavy marketing spend makes their profitability even more impressive.

A 33% operating margin versus E.l.f.’s at 19% shows that Rhode isn’t simply driving top-line growth, it’s pulling up E.l.f’s bottom line, making it an accretive acquisition from day one.

What’s also remarkable is how Rhode reached these numbers with just 12 products in three years. Most fast-growth beauty brands hit a few hundred million in revenue and then plateau, but E.l.f clearly believes the Hailey halo effect paired with disciplined expansion can sustain the next $200 million in growth.

Emerging brands should build strong fundamentals early, especially around their hero SKU. Your bestseller should be your profit center, not a cost center. Rhode proves that when you focus on product, community and operational excellence, marketing becomes amplification, not a crutch or a fleeting growth mechanism.

The takeaway is to lean into whatever your unfair advantage is, whether that’s community, innovation or storytelling. You don’t need to outspend competitors, you just need to out-execute them.

It's hard but not impossible to achieve Rhode’s financials without a celebrity like Hailey Bieber, but it will require profitability over growth, full stop. You may not have the distribution but you need an equally strong competitive advantage to compensate for the celebrity halo. That could be extreme product-market fit, a unique distribution strategy or deep cultural resonance.

Celebrity is one version of an unfair advantage, but it’s not the only one. Outside of beauty, Chomps is a great example: a brand that’s built real profitability and scale through exceptional product quality and strategic retail placement, meeting customers exactly where they are.

- Tina Bou-Saba Founder, CXT Investments

For me, by far the most noteworthy line item is Rhode’s marketing spend. The company spent $22.6 million on marketing against $212 million in sales. That represents just 10.6% marketing spend as a percent of sales, which is extremely low for a fast-growing consumer brand.

Compared to a “typical” beauty brand, this ultra low marketing spend percent (or high MER) was the most significant driver of Rhode’s outstanding 34% EBITDA margin. At the time of acquisition, E.l.f. had stated that Rhode would be EBITDA accretive. Indeed!

The slowdown in Rhode’s top-line in the second quarter of 2025 has also become a talking point. Annualized, this would imply a $161 million run-rate, compared to the $212 million TTM [trailing twelve months] sales in 2024. The brand’s gross margin contracted by 300 basis points and MER declined to 6.1 from 9.4. Given that the brand was presumably focused on its upcoming Sephora launch, we can’t read too much into this second quarter data. We simply need more information to accurately assess the trajectory of these metrics.

Rhode’s P&L is best in class. I believe that it is highly unusual to see a high-growth brand achieve Rhode’s level of marketing efficiency without the benefit of a built-in audience to drive awareness. We live in the attention economy and eyeballs must be earned, like Hailey, or bought (e.g., Meta ads). Of course, all brands have some combination of the two, but in the case of Rhode (or Kylie or Rare), the brand has a running start by building on the creator’s large following.

Stepping back, for emerging brands that don’t have the benefit of a large built-in audience, I hope that a major takeaway from Rhode’s P&L is simply the importance of EBIDTA profitability. For too long, there has been inadequate emphasis on the fundamental objective of a consumer business, which is to make money.

Tech companies can get away with being unprofitable for a long time, the rationale being that they can “turn on” profitability once market dominance is achieved. This is not the case with consumer brands, which operate in a highly fragmented space with near-zero switching costs.

At reasonable scale, a consumer brand should be able to achieve profitability. If it is not, we must evaluate the key line items, like gross margin, marketing and G&A to determine what needs to be fixed. Frequently, brands have unsustainable marketing spend, often driven by unrealistic growth targets and/or unbalanced retail relationships, and/or suboptimal gross margins. Addressing these issues is usually challenging work, but it is almost always necessary if a brand is to achieve a successful exit via acquisition by a strategic or private equity buyer.

- Kelsie Johnston Founder, KJT Ventures

Three things stood out to me. Firstly, the brand margins captured a year in business where they had a tight, hero assortment exclusively offered through DTC. They haven't reached a state of maturity yet that requires discounting decisions to exit unproductive inventory, retail markdowns at scale or trade/margin support. It will be interesting to see how this changes as they scale retail distribution and keep launching line extensions.

Secondly, Rhode got their cost structures right for the product. An 81% product margin is slightly healthier than the ~75%+ industry average. Their price points are justifiably masstige, packaging is beautiful and formulation feedback from customers has been strong. The planning that went into this ahead of a splashy go-to-market strategy was well executed and is not directly tied to Hailey's celebrity status.

Thirdly, marketing spend didn't have to work as hard. Launching this exact brand playbook without Hailey would have required much higher investments.

Two of the most expensive line items of building a brand are (1) driving awareness, and (2) supporting trade at retail. Without having to pull traditional upper funnel marketing levers or tactics with fuzzier ROIs like sampling, they had a tailwind built in with Hailey. By operating a tight DTC channel, little to no discounting, masstige price points and a controlled assortment, they have not had to invest in retailer margin support or trade activations like they now will at Sephora.

Keeping the overall landscape in mind, the three key takeaways I would highlight for brands are:

-

- Awareness can be expensive, and you will need to intentionally measure an associated set of KPIs. "Spray and pray" is not a strategy to profitable growth.

- Get your price points right for your target audience, and be strategic about when/where to discount. Building a promo model and training consumers for high/low pricing is a slippery slope that is hard to claw back from, especially when supporting both DTC and retail margin support.

- Influence doesn't always mean celebrity. By designing authentic and intentional segmentation of creators through a solid community management strategy, a roster of select, key voices can be just as powerful as one famous one without the risk of brand longevity based on celebrity involvement.

Emerging beauty brands can achieve these kinds of financials, but it might not happen as quickly. With paid media strategies dramatically shifting for brands, there has been a noticeable reduction in spend as budgets pivot to support organic channels like creator and social commerce. What brands lack in access to A-list celebrities, they can make up for in access to the democratization of content through a creator ecosystem.

By intentionally designing a segmentation strategy for their creator communities, brands can actually scale more authentically and sustainably. To me, the question is not about how to leverage awareness and influence, it is about how to spend time carefully building a product, manufacturing and formula pipeline that is effective, priced right and delivers efficacy that creates loyalists without you having to buy their brand love.

-

- Laura Meyer Founder and CEO, Envision Horizons

It’s clear that Rhode’s impressive financials are the result of having strong unit economics and a solid financial plan from day one. Too often, brands focus heavily on building their product and image, assuming profitability will follow once they reach scale. In my opinion, strong business fundamentals should be built into a brand’s model from the start.

I also really appreciate their 62% gross margin. It signals an investment in both product quality and the customer experience of getting that product into customers’ hands. Many brands, in contrast, over-index on marketing spend while under-investing in quality and experience.

Of course, celebrity brands like Hailey’s have the advantage of strong customer pull, which naturally drives a lower CAC compared to non-celebrity brands. That said, Rhode’s 34% EBITDA isn’t just about influence. It reflects smart business decisions, innovative product strategy and thoughtful brand management. Their limited edition approach for events like Cyber Monday instead of heavy discounting shows the kind of creative thinking that sets them apart.

In summary, I believe the 62% gross margin is possible, but, realistically, it takes a very standout brand to achieve a 34% EBITDA.

- Lane Barrocas VP of Sales and Marketing, Accelerated Analytics

Rhode’s P&L tells a compelling story of a brand that has mastered the art of digital-first growth. Generating over $200 million in DTC sales before entering wholesale is not just impressive, it’s nearly unprecedented. This level of volume achieved without retail distribution underscores the power of Hailey Bieber’s influence and the brand’s resonance with its audience.

The 34% EBITDA margin further highlights operational discipline and profitability, while a 9X MER reflects the brand’s ability to convert awareness into revenue with minimal spend.

However, it’s important to level-set expectations for other brands: Rhode’s DTC success is an extreme outlier. Most founder-led DTC brands struggle to surpass $5 million in their first year, and the typical path is much slower, often with losses for the first two years, break-even in year three and profits only after that.

The launch at Sephora U.S. in September 2025 was a pivotal moment, capturing 2% of total skincare sales within days and placing Rhode among the top ten brands by revenue. The upcoming launch at Sephora U.K. marks Rhode’s first international retail expansion and is expected to broaden its reach to new demographics.

Strategically, Rhode complements E.l.f.’s portfolio by filling critical gaps in skincare and prestige positioning, areas where E.l.f. has historically had limited presence. This acquisition not only adds volume, but also elevates E.l.f.’s brand equity in the prestige space.

Emerging brands should view Rhode’s P&L as both a benchmark and a blueprint, but also recognize the realities of building a beauty brand today. While Rhode’s success is extraordinary, most brands should expect slower growth, higher upfront costs and a longer path to profitability. Significant paid media investment is essential for DTC success—$30,000 to $75,000 per month in the first year is realistic, not including PR, content or other costs. Many startups underestimate this need and fall short.

Yes, emerging beauty brands can achieve Rhode-level financials, but it requires exceptional execution and strategic clarity. Brands must build deep community engagement through authentic storytelling and values that resonate with their audience. Developing high-performing hero and gateway products is essential, not just for trial, but for repeat purchase and brand loyalty.

Retail strategy also plays a vital role. Partnering with retailers like Sephora or Ulta can provide scale, credibility and visibility. Operational discipline—keeping G&A lean, optimizing COGS and focusing on contribution margin—is equally important.

Rhode’s success is a blend of celebrity, timing and execution. While not every brand can replicate the celebrity factor, the principles behind Rhode’s growth—operational rigor, strategic distribution, and brand clarity—are replicable and should be studied by any emerging brand looking to scale.

- Benjamin Lord Founder, Antidote

Three numbers tell the whole story:

- 34% EBITDA margin at $212 million: This is 2X to 3X what successful DTC beauty brands hit, which is normally between 10% to 15%, and well above traditional beauty targets at between 20% to 25%. At this scale, you only see these margins in luxury goods or when something unusual is happening.

- 11% marketing spend generating 9X MER: Rhode spent ~$23M on marketing for $212 million in revenue. Normal DTC brands spend 30% to 50% of revenue on paid social and get 2X to 3X returns. That six to seven point difference in marketing efficiency is the entire profitability story.

- 7% G&A costs: This is the number everyone's glossing over. It's five to seven points higher than it should be for a $212 million business. E.l.f. explicitly said they can cut five to seven points of G&A through integration, which means Rhode was operationally inefficient. They could afford to be because Hailey Bieber's organic reach essentially eliminated customer acquisition costs.

Here's what's actually interesting: Rhode's 81% gross margin is good, but not exceptional for beauty. The whole financial performance is just marketing efficiency cascading through the P&L. Take away the celebrity distribution advantage, and you have a pretty standard beauty brand with bloated overhead.

The main takeaway? Don't benchmark against Rhode. It's a cautionary tale disguised as a success story. Rhode's 17% G&A and standard gross margins would kill a normal DTC brand, but when you're only spending 11% on marketing instead of 40%, you can afford operational mistakes. Most founders read this P&L and think, "I need to optimize my marketing." Wrong lesson. The right lesson is celebrity brands have permission to be operationally sloppy because their unit economics absorb it.

Here's what emerging brands should actually target: 70% to 75% gross margins for prestige, 5X MER as "excellent," and 30% to 40% contribution margins. To hit 30%-plus EBITDA without celebrity, you need gross margins five to 10 points higher than Rhode's and G&A discipline five to seven points tighter. Every point you miss compounds.

The harder truth: brands below $15 million face systematically higher CAC and margin pressure. Rhode hit $212 million in roughly 2.5 years. Without celebrity, reaching this profitability profile takes five to seven years of grinding CAC down through creative testing, owned community building and repeat purchase engineering.

The actual playbook for brands without celebrity distribution: Forget trying to replicate Rhode's metrics. Focus on CAC displacement strategies that didn't exist five years ago like:

- GEO (Generative Engine Optimization): Artificial intelligence search is replacing Google. Brands that rank in ChatGPT or Perplexity responses get intent-driven traffic at near-zero CAC. This isn't SEO. It’s training LLMs (large language models) to cite you as category authority.

- Viral creative infrastructure: Rhode got 9X MER because Hailey Bieber was the creative. You need systems that generate organic velocity like user generated content loops, influencer co-creation and product-as-meme formats. Test 100-plus creative variants monthly until something breaks through.

- Retail as acquisition, not distribution: Rhode did $10 million in two days at Sephora. That's retail driving DTC trial at $0 CAC. The new model is: retail discovery to DTC conversion at high lifetime value.

It’s not realistically possible for emerging beauty brands to replicate Rhode’s numbers, but let me be specific about why. E.l.f. paid ~$1B, or roughly 11X EBITDA explicitly for the Hailey Bieber asset and the marketing efficiency that comes with it. They're not buying a replicable business model, they're buying a distribution anomaly.

Look at the second quarter results: sales trending toward $160 million annualized, margin compression, declining MERs. E.l.f. is already managing the post-halo fade. Their play is to cut that bloated 17% G&A, normalize MERs from 9X to between 5X and 6X and settle into 25% to 30% EBITDA margins. Still good, just not extraordinary.

Here's the contrarian take: The Rhode model is actually the opposite of what emerging brands should build. Rhode succeeded despite operational inefficiency because of celebrity CAC advantage. If E.l.f. can compress five to seven points of G&A through scale, then independent brands need to start with that discipline baked in from day one. That means:

- 75% to 85%-plus gross margins versus Rhode's 81% because acquirers can't fix product margins post-deal

- 10% to 12% G&A versus Rhode's 17% through fractional leadership and tech-enabled operations

- 50% to 75% year-over-year growth pacing versus Rhode’s hyper growth to preserve unit economics.

The path to Rhode-like profitability without celebrity isn't to "find a celebrity" or "optimize paid social." It's engineering the CAC efficiency that celebrity provides through technology and creative arbitrage. AI-driven SEO, viral creative systems, owned community infrastructure and retail-as-acquisition. That's the only sustainable model. Everything else is just hoping to get lucky with organic distribution, which, by definition, isn't a strategy.

If you have a question you'd like Beauty Independent to ask beauty investors, consultants, founders and brand builders, send it to editor@beautyindependent.com.

Leave a Reply

You must be logged in to post a comment.