Important Factors To Consider When Developing And Marketing Feminine Hygiene Products

Feminine hygiene has been getting its due of late. The category has experienced an influx of founder-led brands like The Honey Pot Company, Rael and August, which have received millions in funding and realize serving half of the population means feminine hygiene is anything but niche.

“It’s a very specific area, but it’s also, I always like to call it, high traffic,” said Beauty Independent editor Claire McCormack, during Beauty Independent’s Spotlight webinar last Friday on feminine hygiene product development sponsored by Europelab. “If you’re sexually active, even as we’re menstruating every month, there’s a lot going on down there, and so why would we totally ignore it?”

Definitely not ignoring it, McCormack was joined on the webinar by Manon Pilon, founder of Derme&Co., and Julie Chamberlain, CEO of SweetSpot Labs. The trio delved into the nuances of vaginal anatomy, the challenges producing and marketing feminine hygiene products, and areas of potential expansion. Below, we recap key points from their conversation.

The Anatomy Lesson

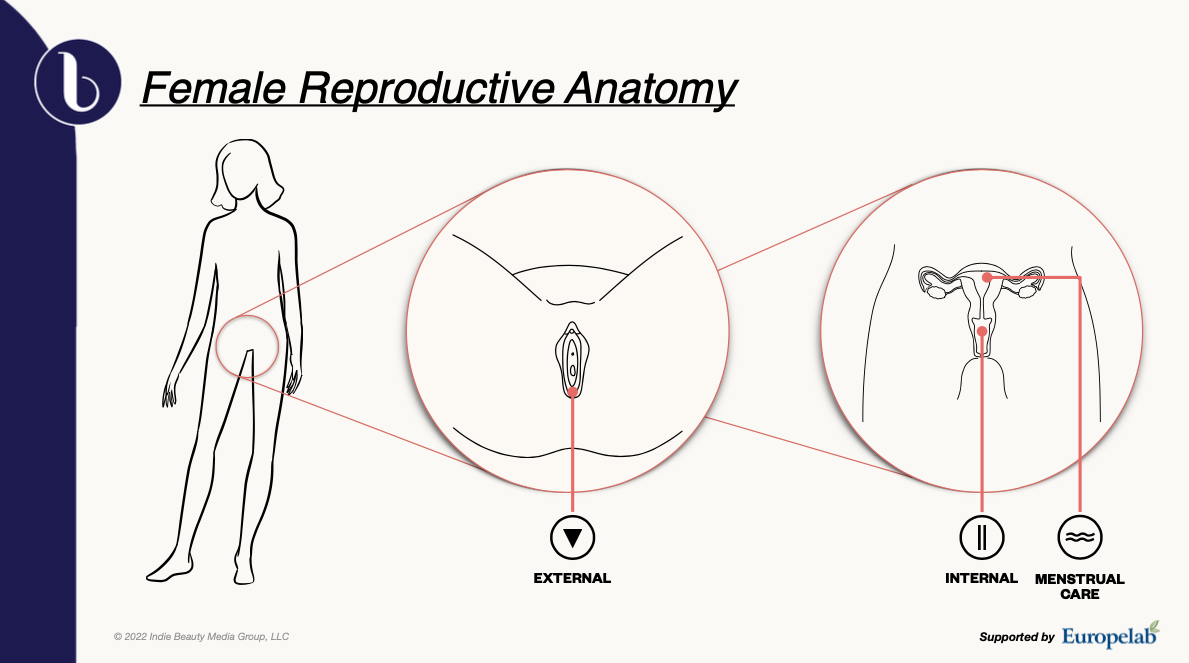

Just like it’s important to become familiar with the physiology of skin before developing skincare products for the face or body, it’s crucial to understand vaginal anatomy when entering the vaginal care market. Pilon and Chamberlain went into detail about the female reproductive system, providing a more thorough anatomy lesson than most teenagers probably receive in high school.

Chamberlain broke down female reproductive anatomy into two primary areas: The external vulva consisting of the clitoris, inner and outer labias, urethra, vaginal opening and mons pubis, and the internal vaginal canal, which includes the ovaries, uterus, fallopian tubes and cervix. Chamberlain said, “The more you know, the more you can advocate for your pleasure or champion for your pain, and I think altogether promote better products that are correctly positioned.”

Pilon outlined three main functions of the vagina: It’s a passageway for blood and mucosal tissue, allows for insertion of the penis and a passage for sperm to the uterus, and acts as a channel for childbirth. Because of its unique responsibilities, the vagina has to be available as an open cavity for different fluids while maintaining optimal moisture level. As a result, the organ, though self-protective and self-cleaning, is often exposed to a variety of pathogens and at risk for stress and injury.

Pilon explained the vagina relies on a symbiotic relationship between microorganisms to maintain its optimal health level. The micoorganisms help keep the area acidic—the ideal pH range is 3.8 to 4.1—to prevent yeast and other bacteria from taking over and causing infections. There are a number of factors that can disrupt the pH level such as dehydration, antibiotics, excessive sugar, lack of sleep, tight clothing and chemicals. Maintaining a balanced pH should be a top priority for brand founders when developing feminine hygiene products.

The Intent Of Products

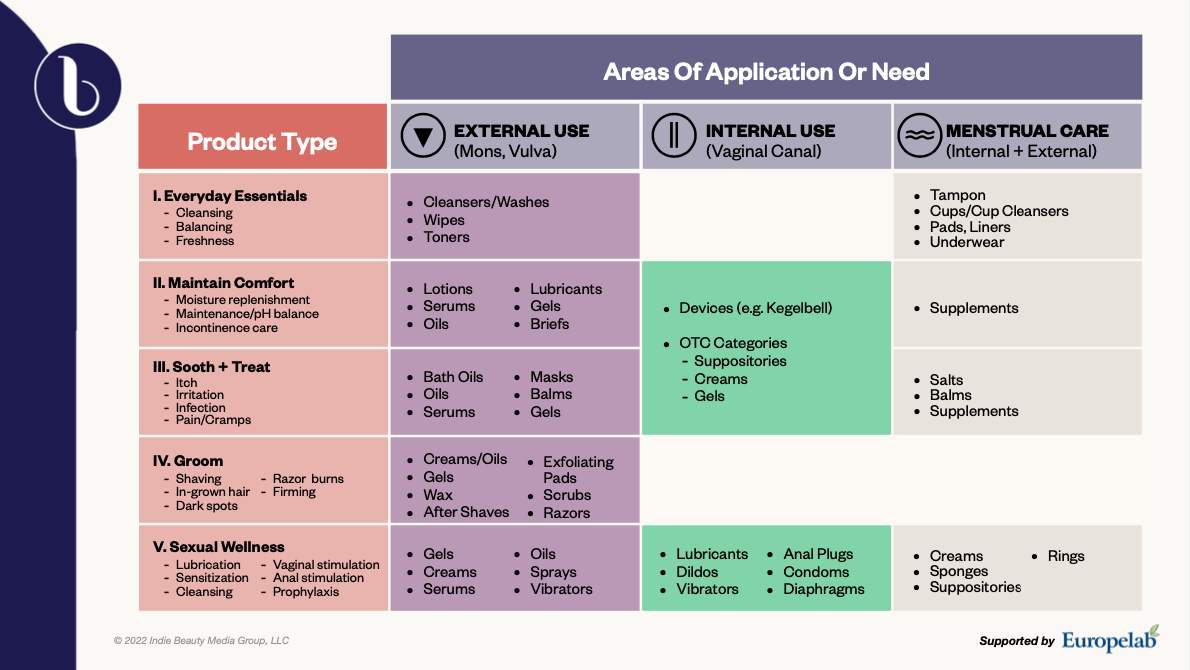

The vulva is the area most commonly associated with beauty because it involves external care like grooming. It’s the part of the female anatomy most similar to other areas of the body and, therefore, one of the least stigmatized. Chamberlain said, “It’s probably the most legacy category that you’ll find in mass retailers and increasingly masstige, and hopefully prestige as time goes on.”

Products can range from cleansers and oils to razors and vulva serums designed to protect the skin barrier. Specific treatments have also come out to address issues that arise from grooming like ingrown hairs and post-inflammatory hyperpigmentation. McCormack adds that brands like Fur are responding to consumers who don’t want to remove pubic hair, at least not all or most of it. She says, “There are companies saying, ‘OK, you don’t want to get rid of all of your pubic hair, so how do you take care of that hair? How do you treat it?”

Products for the vaginal canal area are typically for internal use, and they’re more regulated over-the-counter products. Some are suppositories, creams, gels, lubricants, dildos, condoms and anal plugs. Chamberlain said the category is becoming associated with beauty via wellness “in terms of either preventative or maintenance aspects.” She mentioned that there’s innovation happening in the pelvic floor health department concerning bladder control as well as gels and creams to use during perennial massages leading up to birth.

McCormack and Chamberlain identified vaginal suppositories as an exciting product segment. They assist with lubrication and are frequently made for women who have gone through menopause, but are directed at women dealing with endometriosis or polycystic ovary syndrome (PCOS), too. Chamberlain said, “Estrogen is to the vulva and vagina what collagen is to the face. So, as our estrogen is declining, this is where hyaluronic acid suppositories come in as a different way of bringing moisture replenishment to the vaginal canal, but also to the vulva.”

Menstrual care is a massive product arena. Among the products in it are creams, sponges, supplements, tampons, pads, cups and underwear. The category encompasses products used pre-menstruation and post-menstruation. It’s been disrupted by direct-to-consumer players chasing legacy brands’ market share. Chamberlain described period care as a replenishment category, and McCormack noted that subscription models make sense for it because of the replenishment aspect. August has incorporated subscriptions into its business. McCormack said, “Boom, it comes to my house every month, I don’t have to worry about running out to Walgreens to go get something in an emergency.”

Menopausal care is a blossoming category. McCormack highlighted Womaness as a brand aiding women with navigating this stage in their lives. “For so long, women have had an almost nonexistent arsenal of tools to deal with [menopause], and now brands are coming into the space and saying, ‘No, we are going to deal with hot flashes, we’re going to deal with things like incontinence, we’re going to deal with sexual pleasure and how that changes as we get older,’” said McCormack.

Playing in the feminine care space doesn’t prohibit a skillful brand from playing in other categories. Overlap is possible. McCormack brings up Rael as an example. “The brand started with organic pads and tampons, and now they’ve moved into skincare, but kept it related where it’s skincare based on where you are in your cycle,” she said.

The Development Process

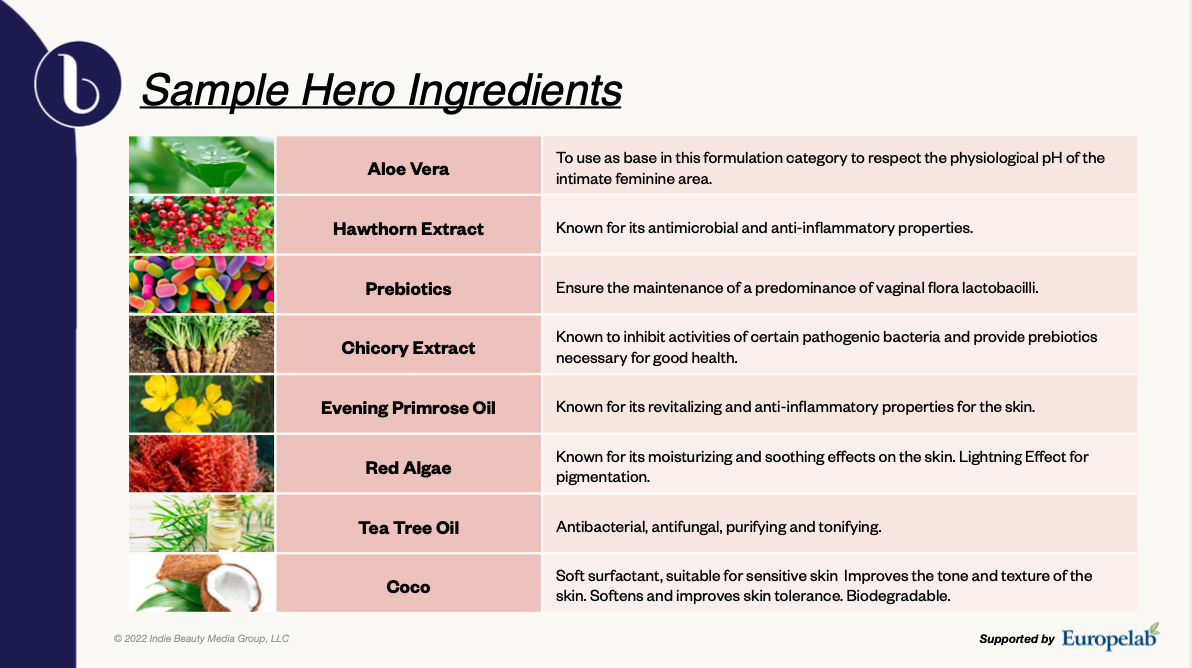

The vulva and vagina are sensitive, permeable areas. Those qualities must be kept in mind when developing products for them. Maintaining pH balance should be considered at every step of the development process. Chemicals that can throw the pH out of whack include certain sulfates, silicones, preservatives, dyes and chlorine, according to Pilon. She listed aloe vera, hawthorn extract, probiotics, evening primrose oil, red algae and tea tree oil as possible hero ingredients.

“It also comes down to where is this extracted from? What’s the concentration? How is it actually put together? That’s goning to make a difference, of course,” said Pilon. Chamberlain said “clean” ingredient lists can be subjective, and founders should make the final call on formulations. She stressed, “Make it an informed choice whether to put [a particular ingredient] in your product or not versus like, this is a hot market, I want to go after it.”

Pilon recommended finding a manufacturer that has experience developing feminine hygiene products. Chamberlain emphasized that safety testing is a must. She said, “The No. 1 thing we hear from consumers of these products is that they want to know that it’s a safe product…It’s fundamental to have third-party labs and hopefully gynecologically validated safety tests to ensure that there’s no irritation to the skin.” For an OTD product, she said the manufacturer should be GMP certified. Chamberlain underscored, “Do the research to ensure that, end to end, you have the team in place that can help you bring this to market with no unwanted surprises.”

Product clarity is vital. Chamberlain said, “We do a disservice to women if we don’t call the product what it is. If it’s not a vaginal wash, don’t call it a vaginal wash because women are going to put it up there, and they’re going to disrupt their pH balance.” Mishap can come down to a lack of education on the consumers’ parts, which Chamberlain has witnessed. “We have consumers searching for vaginal itch when in fact they mean vulva itch,” she said. “That’s like me saying something’s happening in my mouth versus on my face. That’s a pretty huge difference.”

McCormack said education is generally central for brands in the feminine hygiene category. They’ve formed Facebook groups where they bring in experts to answer questions. She spotlighted SweetSpot Labs’ salon sessions with “a more intimate group where people get to talk about what they’re dealing with, and they’ll be on specific topics about women’s health and reproductive health.”

Marketing is a huge consideration. Brands have shamed women in ways that are harmful and passé. “All of the brands that are trying to make you smell like a tropical flower, if you’re selling it in that way, I have issue with that,” said McCormack. Chamberlain chimed in that, if odor and freshness are consumers’ priorities, that’s fine, but they should feel empowered picking up a product rather than shamed. Messaging is definitely evolving. McCormack said, “Most aren’t saying there’s something wrong to fix, it’s more of ‘are you caring for the skin down there?’”

A sales and innovation driver in the feminine hygiene category is the shedding of stigma. “We have more language around this, we have more willingness to talk about it,” said McCormack. “The categories within feminine care, feminine health, feminine hygiene have gotten a lot clearer and that really helps consumers get their problems solved.”

Of course, improvements can always be made. McCormack sees room for growth in including non-binary and transgender communities, wider advertising access and global expansion into countries that might lean more patriarchal. She said, “What’s exciting is that are so many brands launching and talking about these issues and bringing products to market.”

Leave a Reply

You must be logged in to post a comment.