Indie Beauty Brand Founders Dish On Different Paths To Omnichannel Distribution

Omnichannel distribution has become the dominant model for beauty brands, but not all brands approach it the same way. Last week, during Beauty Independent’s In Conversation webinar, Dianna Cohen, founder and CEO of Crown Affair, Psyche Terry, co-founder and CEO of Urban Hydration parent company UI Global Brands, and Camille Barreto, founder and CEO of Me Cosmetics, discussed different means to achieve an omnichannel end. Below, find out more about Urban Hydration and Crown Affair’s distribution paths.

Urban Hydration

Launched in 2009, Urban Hydration was early to create and market affordable plant-based skincare, haircare and body care products. Together with her husband Vontoba, co-founder and COO of the brand, Terry started distributing Urban Hydration to small local retailers out of a friend’s garage in Frisco, Tex.

A stint in Macy’s vendor accelerator program The Workshop followed in 2011, the same year the brand debuted at major retailers T.J. Maxx and Marshalls. Making the jump from mom-and-pop stores to enormous retail chains wasn’t a smooth transition for the brand. Terry miscalculated the inventory investment required to work with large retailers and had to clear out her 401(k) account to cover the brand’s initial wholesale order. Its supply chain also needed a considerable upgrade to match the demands of chains.

Terry said, “Our first manufacturer was a nonprofit that was making sugar scrubs and body butters for our smaller accounts, but when we got that first, ‘I’ll take 500 of each style you have’ order, that’s when we just went, ‘Oh gosh, this is expensive, and we’ve got to front the cash to do this.’”

Another early mishap Terry recounted was misreading a purchase order was thought to be worth hundreds of thousands of dollars, but was a mere 25% of that total. The brand got stuck eating the cost for the excess inventory.

By 2019, Urban Hydration secured partnerships with Sally Beauty and CVS. With its CVS entrance, the brand shifted distribution away from off-price partners to drugstores and big-box retailers. Terry said, “When we saw success at CVS, we went over to other stores of similar categories and said, ‘Hey, we also sell this product and customers are new to this area, and we’d love to share this opportunity with you.'”

Partnerships with Walgreens, Target and Walmart were next. The brand then headed to specialty retail in 2020 and landed in Ulta Beauty chain-wide by 2021. “It was definitely a slow/fast growth for us at retail,” said Terry. “Yes, we’re in thousands of stores today, but it started with almost one handshake at a time.”

Urban Hydration bypasses third-party distributors and instead prefers to interface directly with its retailers. Terry says, “No one can sell your business like you. We used sales teams [before], but I think I am the best person to share my why, my expertise and my solution.”

After breaking into Ulta Beauty, Urban Hydration had reached scale at retail and began to develop its direct-to-consumer business last year. Terry said, “DTC was always like this space-aged thing that we would figure out one day, and thank god we finally did.”

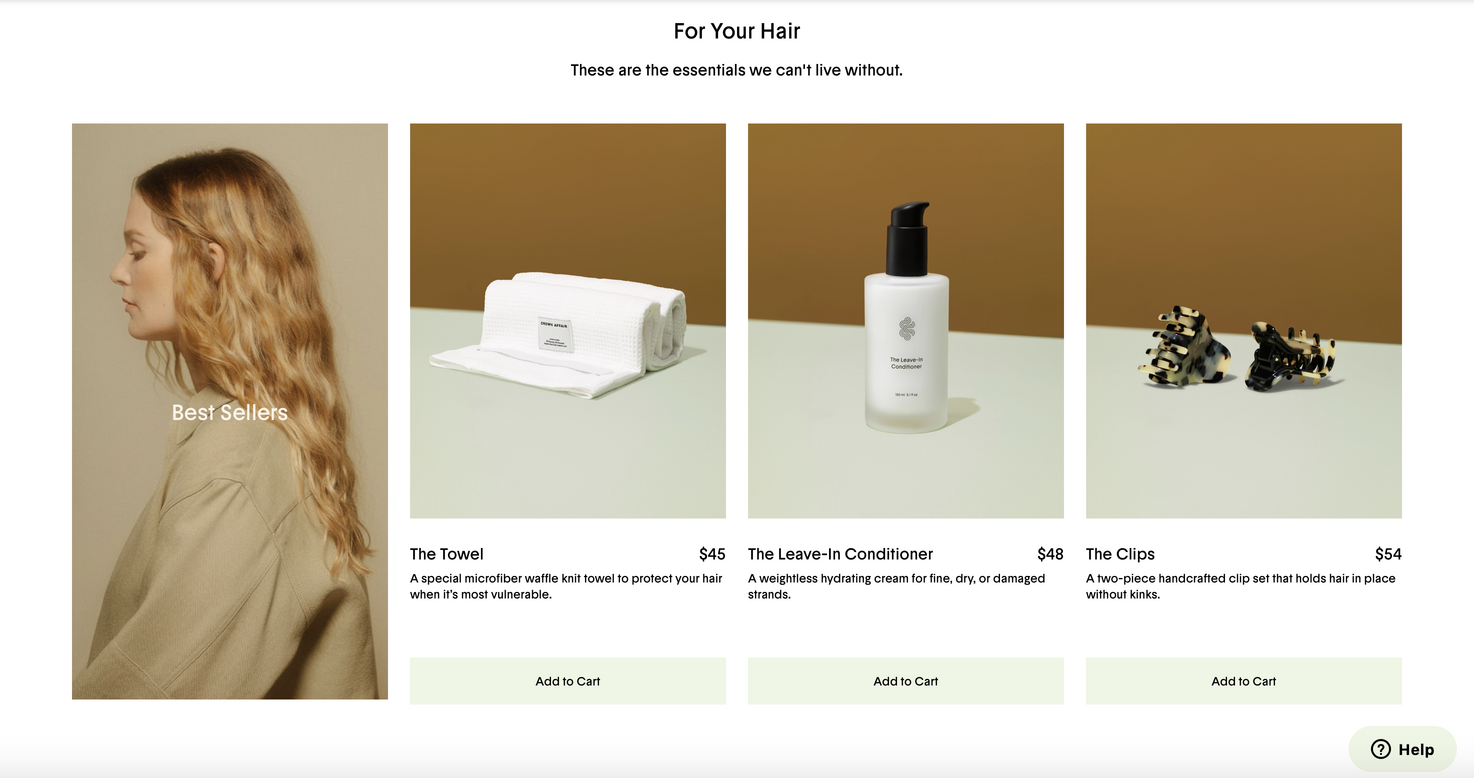

Crown Affair

Cohen started Crown Affair after in-house and consultancy roles at DTC brands like Away, Outdoor Voices and Harry’s, where she helped launch female-targeted razor brand Flamingo at Target, and she knew the haircare brand would be rooted in digital distribution and community. She says, “It’s always been about the community and the product page reviews for me. I’m not someone who comes from a boardroom making decisions for a larger audience.”

Six weeks into the pandemic in the United States, Crown Affair premiered DTC with four post-wash care stockkeeping units. At the outset, it tried to learn if the products were responding to consumer desires. Cohen said, “It was really a tight edit. I really wanted to build that with the community, get feedback and understand what was out there before we launched with dozens of SKUs.”

Although it’s rooted in DTC, wholesale was baked into Crown Affair’s distribution strategy right away, and the brand broke into wholesale at Violet Grey six months after its launch. Securing placement on the luxury e-tailer’s site was very important to Cohen as she was eager for the brand to snag its coveted Violet Code stamp of approval.

She said, “I wanted the brand to sit next to the Oribes and the Christophe Robins and the people that I’ve always really admired and I was shopping versus just being a new DTC beauty brand or a gen Z beauty brand.”

With Violet Grey under its belt, Crown Affair soon expanded to Goop and eventually became the second biggest beauty brand on the website in terms of sales. Gwyneth Paltrow took a stake in Crown Affair last year when it raised a $5 million series A round.

In 2022, Crown Affair nabbed a four-shelf endcap in 57 Sephora stores across the United States and Canada as the retailer sought to bulk out its prestige haircare assortment. Tower displays with air-drying products will roll out to 100-plus Sephora doors this summer featuring Crown Affair, said Cohen.

Similar to Urban Hydration, Crown Affair doesn’t work with distributors. Cohen cites tight resources for the decision. Instead of paying for distributors, Crown Affair channels its funds to fostering its brick-and-mortar relationship with Sephora.

“It’s all about velocity in stores. So, I’m grateful that our team is able to do activations and really focus on these concentrated doors,” said Cohen. “For me, it’s all about growing in a really healthy, consistent way over time.”

As Crown Affair grows at Sephora, Cohen is looking to increase pop-ups and other mono-brand retail experiences to further stoke Crown Affair’s DTC business. The brand recently held a pop-up in New York City that drew 700 customers who shelled out over $30,000 for its products in one day.

“The reality is people don’t shop direct all the time,” said Cohen. “So, it’s really been a dream to work with Sephora and be a partner in the next decade of what haircare is going to be.”

Leave a Reply

You must be logged in to post a comment.