Iris Finance Raises $6.2M In Seed Funding To Become CPG Brands’ AI-Powered CFO

Iris Finance, the artificial intelligence-driven profit-planning platform, has raised $6.2 million in seed funding to intensify its technological firepower for consumer packaged goods brands.

Glasswing Ventures, the early-stage venture capital firm focused on AI and information technology, led Iris Finance’s seed funding round, with participation from the firms Founder Collective and Hyde Park Angels along with existing investors Revolution’s Rise of the Rest Seed Fund, Barrel Ventures and Rosecliff Ventures. In total, Iris Finance has raised $9.7 million in funding.

Iris Finance was founded in 2024 by CEO Drew Fallon, former COO and co-founder of tattoo aftercare brand Mad Rabbit, COO Alexander Heckmann, a three-time founder whose previous cybersecurity company, Clean.io, was acquired by Human Security, and CTO Marko Iwanik, who formerly worked in product at redaction software company Milyli. From September last year to this year, its business has grown 550%. By June, it crossed $1.5 million in revenues, and it’s surpassed well over that amount since then, according to Fallon, who says Iris Finance was breakeven at the time of seed investment.

The company has 16 employees, including 12 full-time employees, and expects to enlarge its team, particularly in customer success and engineering roles. It has about 130 customers, with roughly 70% in beauty and wellness, including Jolie, PrettyBoy, Jones Road and Marin. It charges an average of $4,000 a month for brands to tap into its proprietary database platform.

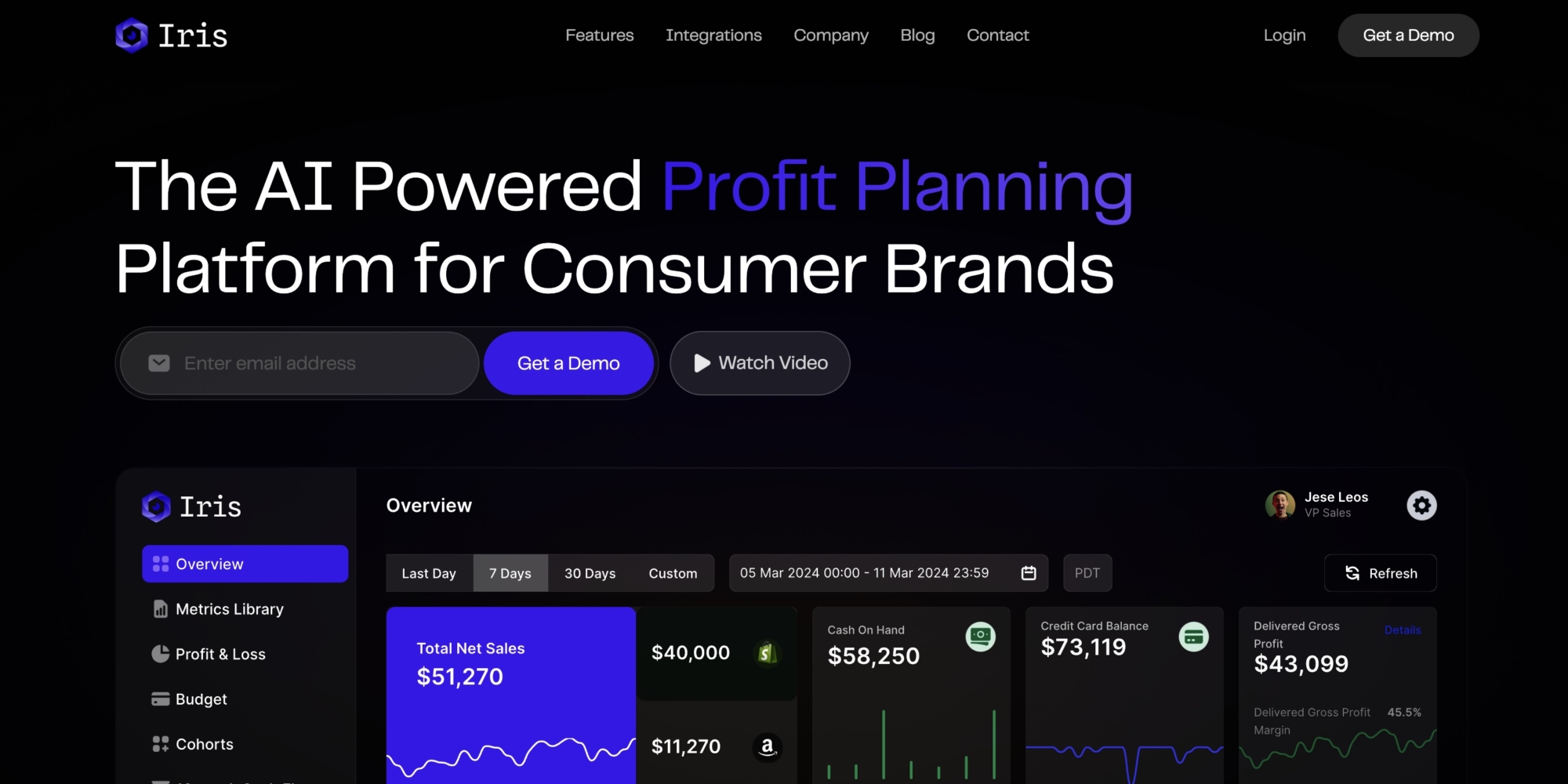

The proprietary platform, which is called Iris DB, handles weekly cash-flow forecasting; sales, profitability and margin tracking; financial modeling with profit-and-loss visibility; benchmarking and inventory planning. Iris Finance connects with brands’ data sources like Shopify, Amazon, NetSuite, payroll systems, third-party logistics providers, and TikTok and Google advertising.

Fallon recounts Iris Finance’s seed fundraising process took five weeks, and among several offers, it decided on Glasswing Ventures as its lead seed partner to prioritize technology over client base expansion, although the funding will partly go toward expanding clientele, particularly up and down CPG’s supply chain, from manufacturers to distributors. He envisions Iris Finance becoming the go-to AI CFO for CPG brands and increasingly act proactively rather than reactively to data.

“We didn’t necessarily need the money to stay alive, but the sheer magnitude of the product we’re building requires a significant investment,” says Fallon. “It was almost bittersweet. Do we build what we think this can be or do we want to run a cash-flowing type of business. We decide to raise the money because, in order for what we envision to manifest, it’s going to take good investment.”

In its seed funding round, Iris Finance achieved a valuation that’s slightly higher than median identified by Carta. The funding software estimates the median pre-money valuation in new seed rounds was $16 million for the first quarter this year. Fallon anticipates Iris Finance potentially fundraising again in 18 months. Thinking about possible exit strategies for the company, Fallon imagines Enterprise Resource Planning software specialists like NetSuite, Intuit or Oracle possibly eyeing it to access its AI capabilities.

“The sheer magnitude of the product we’re building requires a significant investment.”

Those AI capabilities are poised to get much more sophisticated. Looking to the future of Iris Finance’s technology, Fallon says, “It’s there in the boardroom with you. You are talking to it, and it’s answering questions. It can dynamically build you forecast models and give you benchmarks on the industry and help you figure out how to position. It can literally be there with you as a strategic partner and do all the number crunching that now takes teams to do seamlessly and automatically.” Already, Iris Finance has an AI agent dubbed Fin allowing for testing of different financial scenarios, querying data and surfacing insights.

In another example, he says, “We have all your inventory values. Right now, you can use the tool to help you understand when you are going to run out of inventory. Tomorrow’s use case is it understands when you are going to run out of stock, drafts a purchase order ahead of time and eventually places the PO.”

Referring to Fallon, Heckmann and Iwanik in a statement, Rudina Seseri, founder and managing partner at Glasswing Ventures and an ex-senior manager in Microsoft’s corporate development group, says, “By building the infrastructure, in the form of their vertical-specific database, Iris DB, they have created the bedrock to transform how data is ingested and processed at these companies. By building the applications on top of that such as forecasting, margin tracking, and advanced business intelligence, they deliver unprecedented results and ROI to their customers. Iris has turned what once were challenges for brands into strategic and operational advantages.”

When President Donald Trump hiked tariffs starting in January, Fallon was nervous Iris Finance would experience a business falloff this year as CPG brands tightened spending, but the reverse has happened. Brands flocked to its platform to assess the elasticity of various pricing strategies as they sorted through how to confront greater input costs. “It all comes back to cash flow,” explains Fallon. “People would rather shrink their revenue if they have more cash flow.”

The concentration on cash flow management addresses a critical struggle for small businesses. Highlighting the importance of adroit cash flow management, Iris Finance points to a survey by data and insights outlet PYMNTS of small businesses published last September showing that cash flow mismanagement contributes to 82% of small business failures and that 70% of small businesses are holding less than four months of cash reserves. In addition, 45% of small business owners don’t pay themselves because of cash flow shortages, and 22% have difficulties covering basic bills.