L’Oréal, Dior And Huda Beauty Top Launchmetrics’ List Of Buzziest Beauty Brands For 2025

Global heavyweights and social media darlings, including L’Oréal, Dior, Huda Beauty, Maybelline and MAC, have generated the strongest media impact value (MIV) in beauty this year, according to a new report by software and data insights firm Launchmetrics that spotlights the 20 most talked about beauty brands of 2025.

Titled “The Landscape of Beauty 2025,” the report identifies L’Oréal as the top earner in MIV, generating $863.2 million in the first six months of 2025, an increase of 20% from last year. MIV is a proprietary metric that assigns a monetary value to media and communication activities across print, online and social media. Third place-holder Huda Beauty has seen its MIV grow the fastest out of the top five beauty brands, increasing by 39% since last year. Dior and MAC, which occupy the second and fifth spots on the Launchmetric’s list, have seen declines of 2% and 4%, respectively.

Fenty Beauty, Rare Beauty, Rhode and E.l.f. appear further down the list, occupying the 11th, 14th, 16th and 17th spots, respectively. Out of the top 20 highest performing beauty brands, Rhode’s MIV grew the fastest since last year. The Hailey Bieber-fronted skincare and makeup brand, which is being acquired by E.l.f. for up to $1 billion, generated $283.4 million across its media mentions between January and June, up 58% over the same period in 2024. Shein-owned DTC makeup brand Sheglam registered a 37% increase in MIV to reach $286.6 million, slightly edging out Rhode.

TikTok was the fastest growing channel in MIV in 2025, increasing by 37%. Chinese social media app RedNote, which saw a surge in American users in January when fears of a TikTok ban were high, advanced by 4%. Instagram’s media impact for the year tied with RedNote’s.

As beauty brands trip over each other to capture customers’ attention, the companies that are winning aren’t necessarily spending more to stay visible, they’re spending smarter. Alison Bringé, CMO of Launchmetrics, explains that the beauty brands that topped Launchmetrics’ list are investing in content that connects directly with its intended audience, keeping customers engaged even after the brand pumps the brakes on paid media.

“Rhode is a perfect example: with content that embodies its consumer so clearly, it has turned its products like the lip case into a visual status symbol,” she says. “With budgets under pressure, a strong owned content strategy is key to differentiating yourself in the crowded market and cementing your brand into consumer consciousness.”

Still, large coffers and decades of established brand equity provide built-in advantages when it comes to owning the conversation online. For emerging beauty brands looking to build awareness, strategic partnerships can be as impactful for their bottom line as influencers can be. “A single placement by a stockist can transform performance and the right brand partner can magnify visibility almost overnight,” says Bringé. “Lolavie’s partnership with Rare Beauty shows the impact a strong collaboration can have, proving that the right partner can rival influencer strategy in shaping success.”

Jennifer Aniston’s haircare brand Lolavie generated nearly a third of its media impact in one week when it co-hosted a Galentine’s Day event with Selena Gomez’s Rare Beauty in February where both brands launched new products. According to Launchmetrics’ report, Lolavie’s MIV increased by 192% this year so far. VT Cosmetics, Every Man Jack, Nishane, Sacheu, Nexxus, EOS, Josie Maran, Westman Atelier, Beauty of Joseon, KimChi Chic Beauty and Phlur have also experienced triple-digit increases in their media impact.

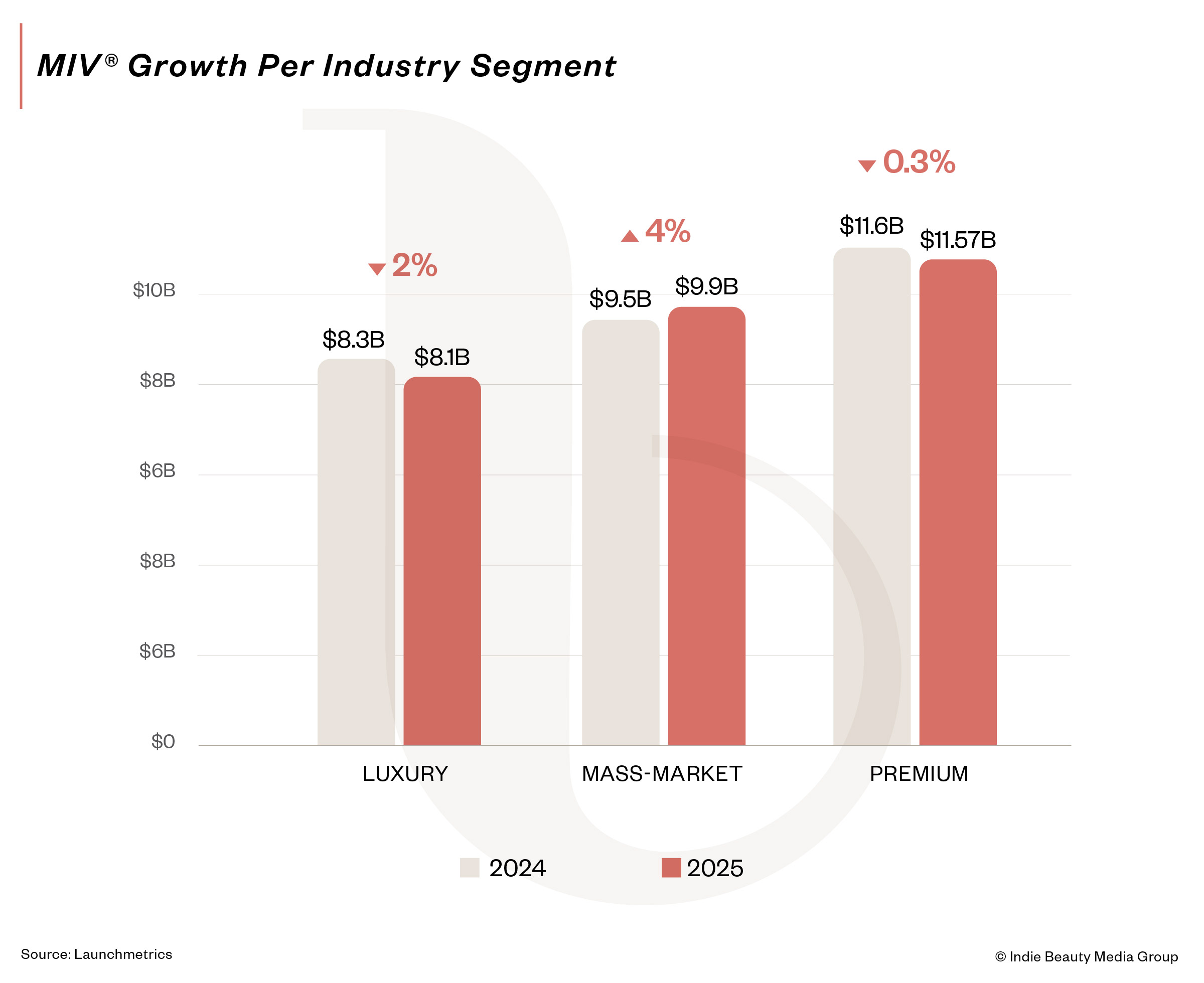

With beauty industry growth cooling and discretionary spending under strain, customers are gravitating towards beauty products that don’t break the bank. According to market research firm Circana, mass beauty outperformed prestige during the first half of the year, increasing 4% to prestige’s 2%. Launchmetrics’ data aligns with Circana’s, showing that mass-market MIV increased by 4% to $9.9 billion. Meanwhile, luxury and premium saw declines of 2% and 0.3%, respectively.

“In this environment, consistent brand-building becomes essential,” read Launchmetrics’ report. “When wallets tighten, it’s the brands that stay present, invest in community and reinforce their value that remain part of the conversation and the cart.”

On a category level, haircare pulled far ahead of skincare, makeup and fragrance in terms of media impact with an 81% year-over-year increase. Wellness-related conversations in haircare that centered on scalp and overall hair health increased more than any other beauty category, per Launchmetrics, up 83% between 2023 and 2024. Fragrance, beauty’s fastest growing category, advanced by 13% while skincare and makeup saw increases of 9% and 5%, respectively, during the first half of the year.

Bringé advises beauty brands to adopt diversified media strategies to engage customers in a fragmented retail landscape. “When a single strategy is delivering strong results, it’s tempting to double down, but overreliance creates vulnerability,” she says. “In today’s unpredictable market, resilience comes from a diversified portfolio of strategies, ensuring that a brand can withstand sudden shifts without losing momentum.”

Leave a Reply

You must be logged in to post a comment.