L’Oréal Leads Global Beauty In The Latest Quarterly Earnings

Major trade winds were on display in the most recent quarterly reports issued by four of the largest international conglomerates that followed bellwether trends familiar to today’s beauty entrepreneurs. The contrasting results and perspectives presented by L’Oréal, Estée Lauder, Coty and Unilever offer high-level insights on subjects relevant to enterprising founders: the Asian market, acquisitions, legacy labels, and consumer demand for new and natural products. Just as in the world of independents, the ups and downs of the beauty corporations’ vast balance sheets are attributable to macro movements, customer responsiveness, management skill, and the presence or absence of strategic vision.

The Roundup

L’Oréal

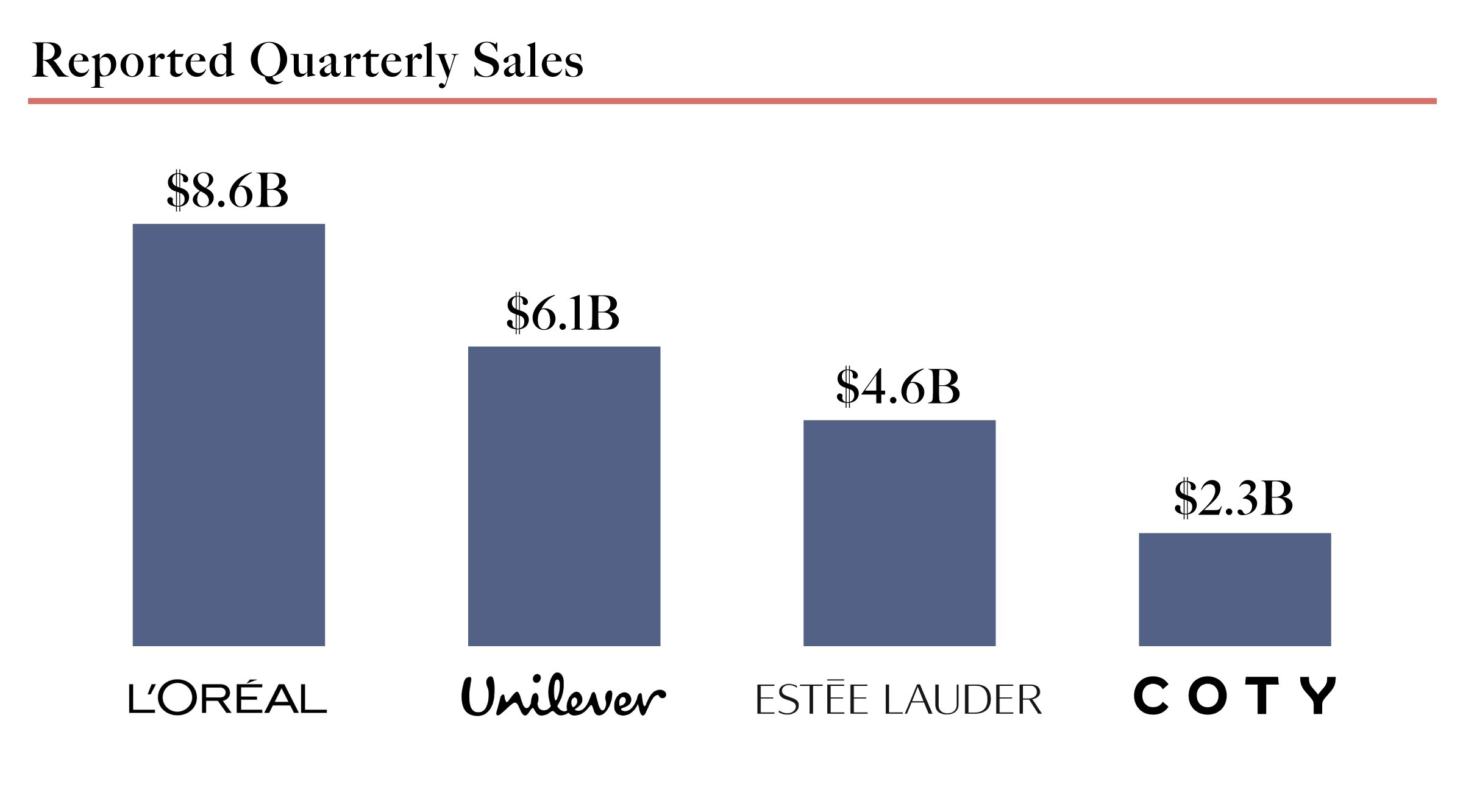

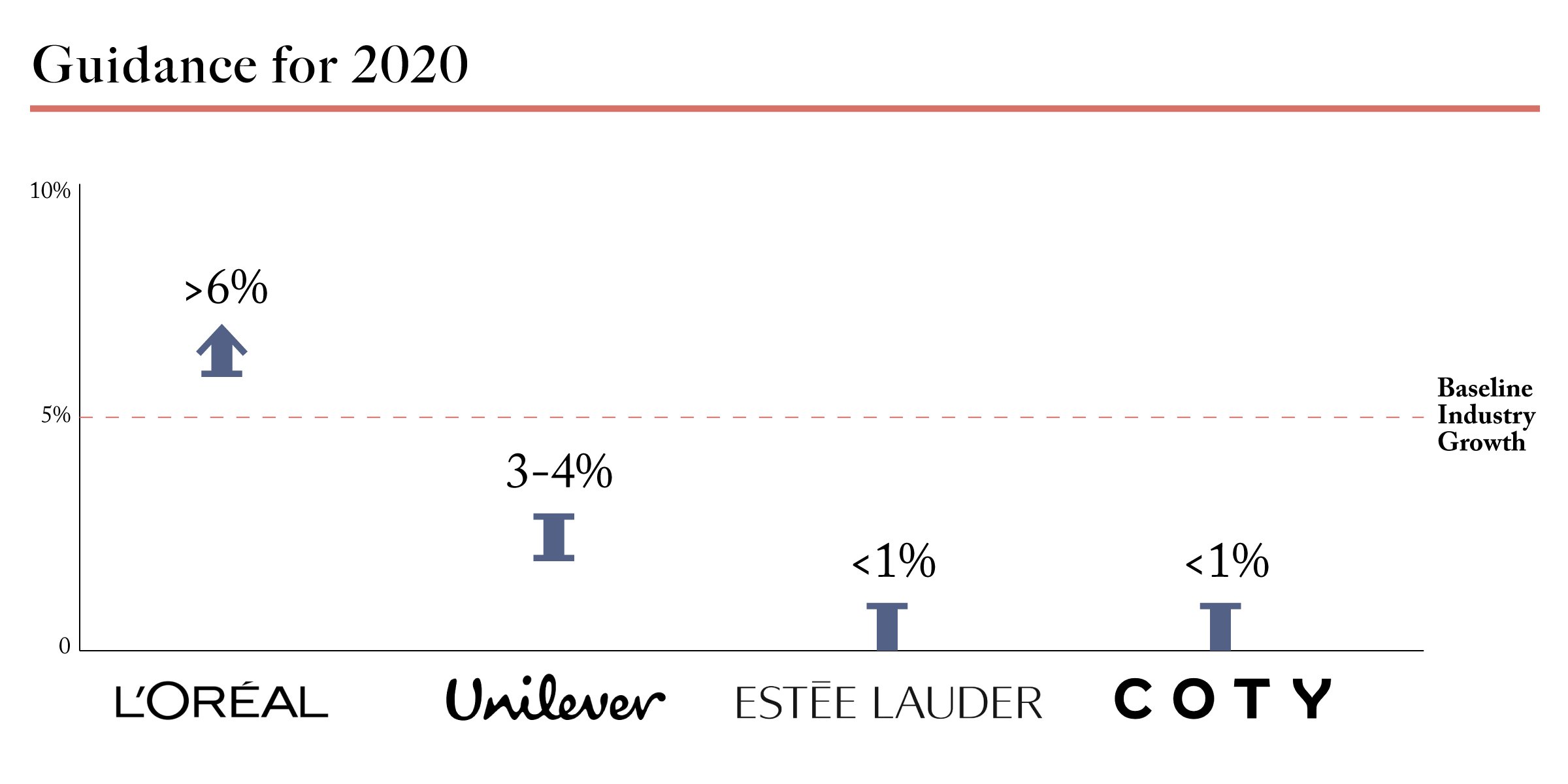

The No. 1 beauty company in the world continues to demonstrate why it’s No. 1. The French giant recorded $8.6 billion in sales for the last quarter, up 9.6% from the same period a year ago, and it surpassed forecasts and outperformed market averages. Even better, the company’s projections for the future are rosy. The 2019 quarterly results come on the heels of a banner year for the company in 2018, its best in 20 years. With brands such as Garnier, L’Oréal Paris, Maybelline, Nyx, Lancôme and Kiehl’s Since 1851 in its portfolio, L’Oréal has outperformed its peers during the last decade.

Estée Lauder

Lauder’s strong $4.62 billion in sales for the quarter represented an increase of 16% from the like quarter last year. However, its earnings were down by $14 million to $557 million, and the company presented dour guidance of close to zero growth lowered from a previous projection of 1% for the second half of its fiscal year. Driven by its namesake brand and three other billion-dollar brands—Clinique, Mac and La Mer—Lauder is looking to Asia for future growth.

Coty

Coty remains in eternal turnaround mode and continues to sketch a dramatic narrative. The poor results of its consumer beauty division—a 17.4% drop in revenue from the same period last year on $800 million in sales—were 1% better than the losses for the previous quarter, which the company viewed as progress. Coty executives highlighted regional bright spots for brands such as Sally Hansen and Max Factor, and a new approach to advertising as causes for cautious optimism, but the sanguine data points were cherry-picked and don’t paint a cohesive picture of company health. The luxury and professional segments didn’t fully offset the consumer division’s slip. Coty’s luxury arm was essentially flat at $1 billion in sales, while sales in its professional division rose .6% to $529 billion.

After its financials were disclosed, changes were afoot in Coty’s c-suite. The company announced it poached Jimmy Choo head Pierre Denis to be its next CEO, citing his experience in the luxury sector and Asian market. Denis is replacing Pierre Laubies, who will step aside in the summer. “Mr. Laubies’ leadership helped bring an element of stability back to COTY’s financial performance,” wrote Wells Fargo analyst Joe Lachky in a note. “That said, we can’t help but view this as an incremental negative as a CEO transition in the midst of much so much organizational change brings additional uncertainty to the story.”

Unilever

Unilever saw .5% growth in its beauty and personal care division on fourth-quarter sales of 5.6 billion euros or $6.25 billion at the current exchange rate. The period served as a drag on the full-year sales, which gained 2.6% to hit 21.9 billion euros or $24.4 billion. The British-Dutch conglomerate, which contains a family of brands that includes everything from Lipton Tea to Dove and Pond’s to Vaseline, has initiated a review of its personal care portfolio and indicates its sales growth will come in under prior expectations as it confronts an Asian slowdown.

Key Themes

Blame it on the virus

The potential impacts of coronavirus on the beauty business loomed over corporate financials. By early February, Lauder sounded the alarm that the worldwide pandemic would significantly affect its business, resulting in such headlines as Estée Lauder Cuts Profit Goals as Coronavirus Slows Travel Sales. “As you all know, the global environment has changed meaningfully following the outbreak of the coronavirus,” said Lauder CEO Fabrizio Freda on the company’s earnings call. Unilever pointed to a softer market in China and slower sales in Southeast Asia in its earnings report for 2019. With China accounting for less than 3% of overall sales at Coty, it would appear to be freer to focus on other pressing issues.

L’Oréal CEO Jean Paul Agon proclaimed he foresaw only a “temporary impact” of coronavirus on the company’s business in China grounded in the assumption the outbreak would mimic previous epidemics. China and its neighbors in the Asian region were the source of more than 32% of L’Oréal’s overall revenue, making it the group’s largest region for the first time in its history, surpassing sales in the regions of Western Europe, North America and Eastern Europe. Agon mentioned L’Oréal’s e-commerce business accounted for half of its sales in China, somewhat insulating it from any virus-stunted retail foot-traffic. In 2018, e-commerce accounted for 11% of worldwide sales, escalating at a 40% year-over-year pace.

Class trumps mass

While Coty’s struggles with mass beauty and a slowdown in cosmetics sales are defining its trajectory, the balanced portfolios of the other giants are benefitting from advancements in other areas. The mass market of the big internationals continued to reflect the disruptive forces at play for the past decade in the industry but, in the words of L’Oréal CEO Agon, “Luxury again has been a booming channel.” Unilever’s prestige brands grew by double digits in the quarter.

Skincare outpaces color cosmetics

A dip in makeup sales in the first half of last year led to a shakeup of L’Oréal’s leadership in the United States, but the company has more than compensated for the shift in consumer habits. L’Oréal and Lauder had common sources for growth in e-commerce sales and travel retail last year, two business components that made up for difficulties in traditional retail. Lauder asserted it held the pole position during 2019 for travel retail prestige beauty, and e-commerce sales for prestige beauty in the U.S. and the world.

Sales of skincare at Lauder, which ten years ago were slightly greater than makeup, jumped 27% in the latest quarter while makeup sales rose 6%. Skincare is now the company’s largest category, outperforming makeup by $500 million for the reporting period. L’Oréal’s skincare sales for 2019 were up 22% over 2018. “Color cosmetics is expected to recover eventually,” says Kayla Villena, senior analyst at Euromonitor International. “But it may take at least five years for the color cosmetics segment to rebound once players incorporate megatrends like healthy living and personalization and skincare-like benefits in color cosmetic products. In the meantime, international expansion in promising color cosmetics markets in Asia Pacific and Latin America can be a place of growth for players frustrated by slower sales in the U.S.”

About those acquisitions

The beauty industry has been through an aggressive period of dealmaking, with several high-profile billion-dollar-plus transactions taking place each of the past few years. The rationale behind these acquisitions—and the often high multiples paid to secure them—was straightforward: They would fill gaps in their portfolios, improve their know-how and amplify their audiences to help drive future sales growth and earnings for the acquirers. In recent financial reports, big beauty companies however revealed a decidedly mixed picture of the results of their transactions.

Coty

Coty seemed to be eschewing the trend of big beauty companies buying up hot young brands and paying high multiples for them when it announced in 2015 that it was buying 41 old-school brands like Clairol and Cover Girl from Procter & Gamble in a whale of a deal valued at $12.5 billion. By the time the deal closed in 2016, it had propelled Coty to the No. 3 spot in the beauty industry by sales. Since then, the acquisition has weighed down on Coty’s financials like a whale, with the former P&G brands losing sales and staff year after year. In 2019, Coty wrote off $965 million in early 2019 before writing down an additional $3 billion mid-year.

By year’s end, Coty’s mergers and acquisitions strategy careened in the opposite direction, and the company decided to buy 50% of five-year-old Kylie Cosmetics for a $600 million, valuing the nascent celebrity brand at a whopping 10x sales. Coty seemed willing to pay $10 to recoup every $1 of lost sales from its legacy portfolio. Denis, the company’s incoming CEO, will be its third CEO since the P&G acquisition. “Given Coty’s struggles making Younique profitable, courting Kylie Cosmetics makes sense,” says Euromonitor’s Villena, referring to direct-sales pickup that Coty dumped last year. “However, should a slowdown in the U.S, color cosmetics market be more pronounced than previously estimated, the timing of this acquisition may generate another challenge for Coty.”

Estée Lauder

Lauder didn’t fare much better from its M&A activity. The company reported an impairment charge of $777 million for the declining makeup sales of Too Faced, a brand it purchased in 2016 for $1.65 billion, Becca, another 2016 deal valued at around $200 million, and Smashbox, which it acquired for an estimated $200 to $300 million in 2010.

Unilever

The conglomerate identified prestige brands and recent acquisitions Dermalogica and Hourglass as strong performers while touting its 2019 purchase of Tatcha, a high-end skincare brand. The question for Unilever is whether it can scale the growth of recent pickups to make a meaningful impact on its bottom line.

L’Oréal

L’Oréal’s acquisitions throughout the last decade padded its luxury division with Urban Decay, the 2012 deal for it was reportedly worth $300 million, and IT Cosmetics, which was acquired in 2018 for $1.2 billion. In 2014,L’Oréal went in the mass direction by swallowing Nyx in its consumer division for $500 million. The brands have been robust beauty plays in North America, and all notched growth in past annual reports. The performance of L’Oréal’s cosmetics business in 2019 pushed Agon to unfurl plans to “reaccelerate” growth.

Eye On The Future

For emerging independent brands, what are takeaways from the happenings at the established behemoths? Unilever is migrating into the microbiome area and has been delving into aluminum-free products for Dove. Coty unveiled a ten-year sustainability program in response to climbing consumer demand for companies to pay attention to the planet. Prestige products and skincare are defining the current market, and it’s apparent that L’Oréal is built to withstand a periodic slump in the color cosmetics category while Lauder is feeling the decline more acutely. Rising brands that catch the wind of sustained, developing trends will, with good fortune and good guidance, eventually catch the eye of conglomerates intent on maintaining vigorous returns in growth sectors of the huge global market.

“There are several key positivities takeaways in these results for beauty entrepreneurs: First, above-average growth of skincare and prestige—two categories where indie brands over-index—is great news,” says Nader Naeymi-Rad, co-founder of Indie Beauty Media Group and publisher of Beauty Independent. “Second, many legacy brands continue to underperform, compelling their parent companies to acquire growth—often by buying or investing in young brands; this is excellent news for beauty entrepreneurs. And finally, as a whole, big companies remain financially healthy and profitable, which means they have the cash to fund their external investment and acquisitions.”

Most importantly for independent brands, consumer shifts in the market and the lofty demand for new products, brands and innovations fueled a buying spree for the four conglomerates that shows no sign of abating. As with other financial results, the success of acquired brands within the large enterprises that subsumed them are reflective of their overall market positions.

Leave a Reply

You must be logged in to post a comment.