New Report: Aesthetics Market Growth Cools With Maturation As GLP-1 Boom Tempers

The American aesthetics market is entering a more mature phase, marked by slower growth, greater category divergence and a shift toward operational efficiency rather than rapid expansion, according to a new report from med-spa data analytics firm Guidepoint Qsight and healthcare investment bank Skytale.

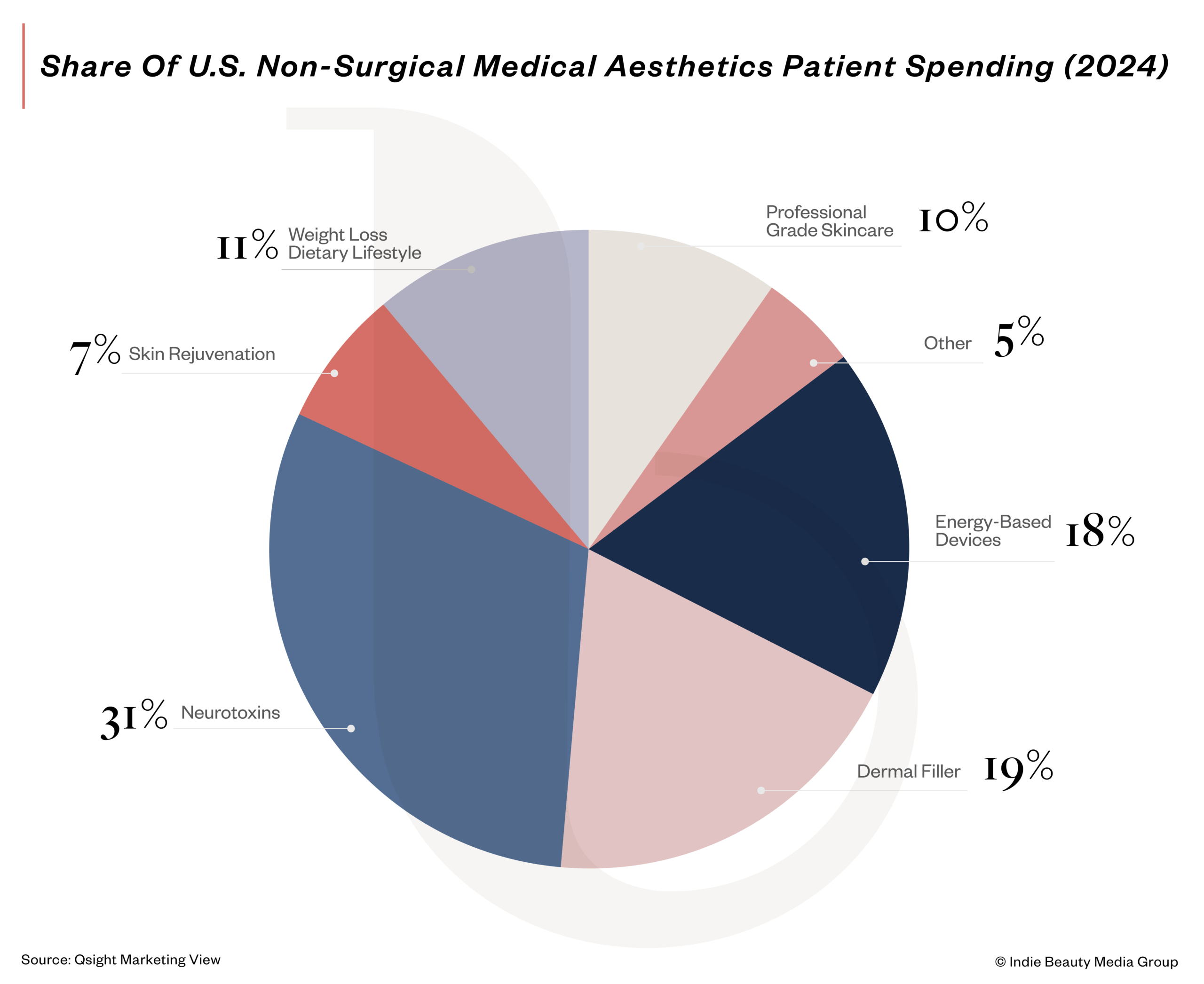

The report, called “Defining the Future of Aesthetics: A Market Coming of Age,” finds that spending at aesthetics practices in the United States rose 4% during the first three quarters of 2025 to reach $21 billion, a sharp falloff from the double-digit growth typical of the industry in recent years. In 2021, for example, it spiked 50%. Same-store growth at med-spas dipped below 1% last year, pushing providers to prioritize retention and per-patient value over new customer acquisition. Neurotoxins like Botox and Dysport accounted for about 31% of consumer spending in 2024, jumping 8% to $6.4 billion, while dermal fillers and energy-based devices declined year over year, underscoring the growing divergence across categories.

“The throughline is a market that is maturing, not slowing,” says Erika Sheyn, SVP of aesthetics at Guidepoint Qsight. “We continue to see durable strength in core injectables like neurotoxins, normalization within medical weight loss following rapid GLP-1 adoption and a gradual shift by providers toward more diversified, efficiency-driven service models that emphasize retention, repeat visits and per-patient value.”

The report also pours a bit of cold water on the feverish hype around the business impacts of GLP-1 weight loss drugs, which have been an important driver of aesthetics provider revenues. At practices that offered them in 2024, Guidepoint Qsight estimates that GLP-1s accounted for roughly 15% of monthly revenue, with about 40% of GLP-1 patients new to those businesses.

In the report, Guidepoint Qsight and Skytale chronicle that growth in the GLP-1 space sank to 55% in 2024 from 235% the prior year. In early 2025, the decline quickened after the United States Food and Drug Administration–recognized shortage of GLP-1s ended and compounded versions of the drug were disallowed. By the second quarter of last year, growth in the category was down to a single-digit percentage.

This year, Sheyn explains that the GLP-1 market will be defined more by spending allocation than a significant change in demand. While Danish pharmaceutical company Novo Nordisk made headlines this week for introducing the first oral version of its GLP-1 weight loss medication Wegovy to the American market, offering cheaper prices and an accessible format for injection-averse customers, it’s entering an aesthetics market that’s maturing, and industry experts aren’t convinced the new launch will propel substantial growth.

Sheyn predicts the oral medication won’t meaningfully affect the aesthetics market in the U.S. She mentions the upside from the new drug depends on how well aesthetics providers compete with telehealth and insurance-backed channels and whether they integrate GLP-1s into broader, stickier aesthetic models.

“Practices differentiate through in-person oversight, continuity of care and integration with other aesthetic services, while access to certain branded options may be more limited to specific patient populations,” she says. “For now, the market appears more focused on stabilization than acceleration.”

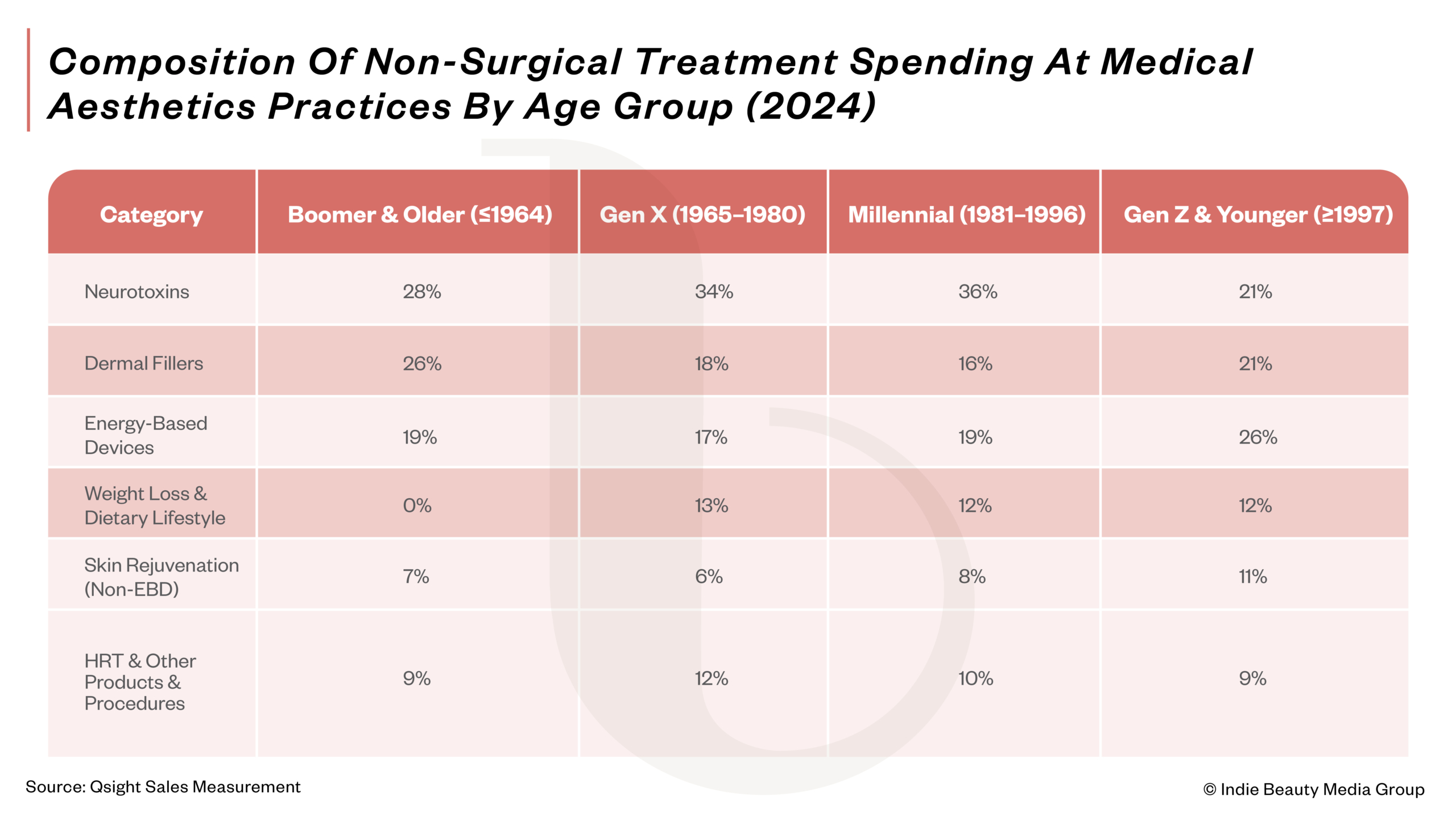

Spending on popular neurotoxins amounted to $3.3 billion through the second quarter of last year, representing a 7% increase over the same year-ago period. Millennials got more Botox than any other age cohort in 2024, accounting for 36% of the spend on it, followed by gen X at 34%, baby boomers at 28% and gen Z at 21%. Gen Z was the second-highest spending cohort after baby boomers on dermal fillers.

Legacy aesthetics categories like dermal fillers and energy-based devices such as light therapies, radiofrequency and ultrasound are registering downturns. Spending on dermal fillers declined by 3% in 2024 to reach $3.8 billion, while energy-based devices dipped by 5% to $3.6 billion.

Within each segment, there remain pockets of growth. In dermal fillers, biostimulators or injections that stimulate the body’s cells to produce collagen were up by 4% in 2024 to reach $787 million while hyaluronic acid-based fillers declined by 4% to $3 billion. In energy-based devices, skin rejuvenation and resurfacing procedures were the strongest performing subcategories. Laser hair removal and body contouring services decreased in demand.

Sales of professional-grade skincare, which Guidepoint Qsight defines as clinically formulated skincare products sold almost exclusively at aesthetics providers, increased by 3% during the first half of last year to reach $1.1 billion with brands like Plated Skin Science and Hydrinity leading the charge. In 2024, the category grew a modest 0.4%.

Science-backed skincare has been accelerating of late as skincare consumers gravitate toward efficacy and results-driven products. Alessandro Giombini, beauty and personal care manager at global management consulting firm Kearney, says that aesthetics providers have been in a unique position to benefit from this shift.

“Science has become the new luxury,” he says. “Med-spas and dermatology practices are becoming high-trust purchase environments, especially around pre- and post-procedure moments, which elevates these products from optional add-ons to essential parts of skincare regimens.”

Growth in science-backed products is expected to outperform the broader skincare market in the next year, according to Giombini. He elaborates, “Growth will be fueled by continued normalization of aesthetic procedures, expansion of med-spas as mainstream retail touchpoints and consumers seeking cost-effective ways to extend in-clinic results at home.”

Guidepoint’s report predicts that consolidation is expected to ramp up by about 10% over the next four to five years as financial conditions improve and investor interest in the aesthetics sector continues to steadily rise. At present, the U.S. market is largely unconsolidated, with the vast majority of providers owned and managed by independent operators. According to the American Med Spa Association, 81% of med-spas only had a single location in 2024.

The report underscores that consolidating med-spa companies will no longer simply roll up locations. They will centralize operations through technology, marketing, clinical protocols, training and data systems to drive margin and same-store growth.

“Like other healthcare subsectors in previous decades, founders now recognize that value creation is less about ‘adding locations’ and more about organization-building; from executive leadership, scalable systems, brand defensibility, provider diversification and operating leverage,” the report reads. “Founders who invest in clinical talent, operations and true multi-unit businesses are transacting at industry-leading valuations.”

While multiples have largely normalized since 2021 and 2022 in the aesthetics industry, the report highlights that top-tier chains are still fetching valuations between 30% and 100% higher than those without integrated operating systems and overall weaker clinician stability, recurring revenue and same-store growth. It says, “The sector is now entering its next maturation phase: from extremely rapid consolidation to more disciplined consolidation with a focus on value creation.”