Obagi Enters Injectables With Obagi Saypha MagIQ And Rewrites The Economics Of Skin Health

For decades, Obagi Medical has occupied a distinctive position in professional skincare: physician-dispensed, clinically grounded, yet widely recognized by consumers as a brand in its own right. With the launch of Obagi Saypha MagIQ, that identity expands into new territory.

MagIQ marks the first time a United States Food and Drug Administration-regulated hyaluronic acid filler has launched under a brand historically associated with topical skincare. In doing so, Obagi and its parent company, Waldencast, are testing a broader thesis: that a trusted skincare brand can extend into injectables without diluting clinical credibility and that aesthetics may increasingly become brand-led, not molecule-led.

Waldencast CEO Michel Brousset says, “Bridging beauty and aesthetics under one trusted brand marks the first step toward building the first true skin health mega-brand spanning beauty, injectables, wellness and longevity.”

From Skincare Authority To Injectable Platform

MagIQ’s path to market began with Waldencast’s 2025 acquisition of Novaestiq, securing exclusive U.S. rights to Saypha, a dermal filler platform developed by Austrian manufacturer Croma-Pharma. Croma has produced HA fillers for more than four decades, with products sold in over 80 countries. The science was proven, a world-class manufacturing partner was on board, the question was how and under what name to introduce it in the U.S.

“You don’t just launch another filler and hope it finds oxygen,” says Drew Fine, U.S. general manager of Obagi’s professional channel. “The opportunity was to do something structurally different: bring injectables into a system that already has trust, education and scale.”

That system is Obagi, a pioneer of the modern doctor-brand model, entering this chapter with nearly four decades of credibility inside dermatology. The brand spans roughly 5,500 professional accounts with deep penetration across clinics and med-spas. It already sits inside treatment rooms and consumer regimens, giving it two key assets most new injectable platforms lack: embedded professional endorsement and an existing consumer base aligned with its clinical positioning.

The Size Of The Prize

Grand View Research estimates that the U.S. HA filler market generated approximately $1.8 billion in sales in 2024 and projects it will exceed $4 billion by 2033, implying a compound annual growth rate of around 10%, well ahead of the broader skincare market’s mid-single-digit growth. A recent accelerant has been demand from the expanding pool of GLP-1 users seeking to restore facial volume. But the attraction is structural as much as numerical.

While a prestige serum may retail for $150 to $300 and require quarterly replenishment. By contrast, a single HA syringe is priced to consumers at $500 to $800 and nets $120 to $250. Consumers often receive multiple syringes per visit and typically return annually.

The revenue event is materially larger. And once consumers establish a provider relationship and see visible results, cadence tends to persist.

Injector behavior compounds the effect. Once a clinician gains confidence in a filler—its extrusion, tissue integration and predictability—it frequently becomes a preferred platform across indications. Familiarity drives procedural fluency; fluency expands usage.

Injectables, therefore, operate on a fundamentally different lifetime value equation. It is no coincidence that publicly traded aesthetic companies with meaningful injectable exposure have historically commanded premium multiples relative to traditional beauty peers, reflecting higher per-visit revenue, recurring treatment cycles and structurally elevated consumer LTV.

For Waldencast, MagIQ is not adjacency. It is an opportunity to re-architect its economic profile.

Why Another Filler, And Why This One?

In a U.S. market dominated by multinational players, every new filler raises the same question, why add another? Fine points first to market structure. While Europe and parts of Asia offer dozens of HA fillers, the U.S. market includes roughly 30 stockkeeping units largely due to regulatory barriers rather than innovation gaps.

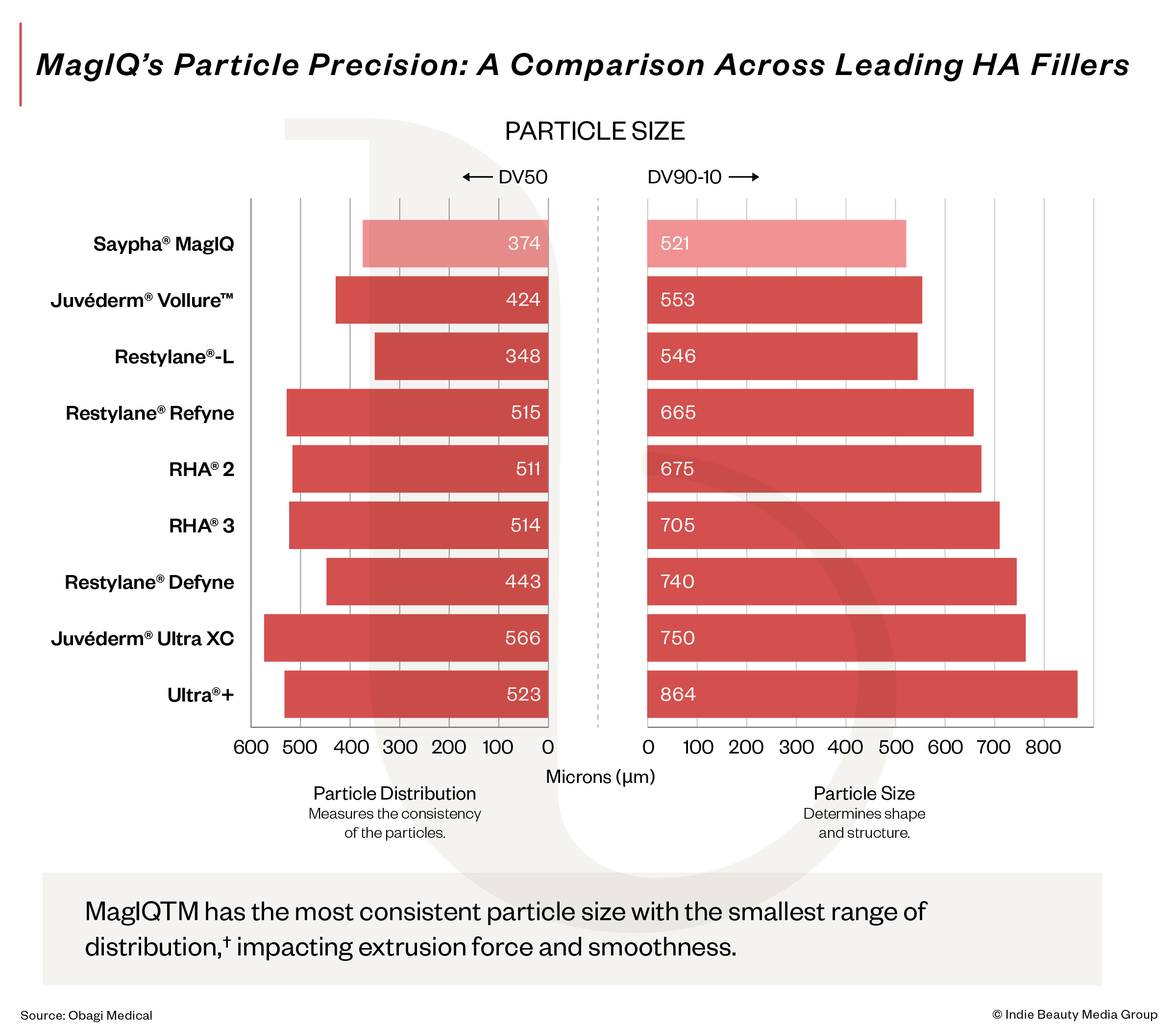

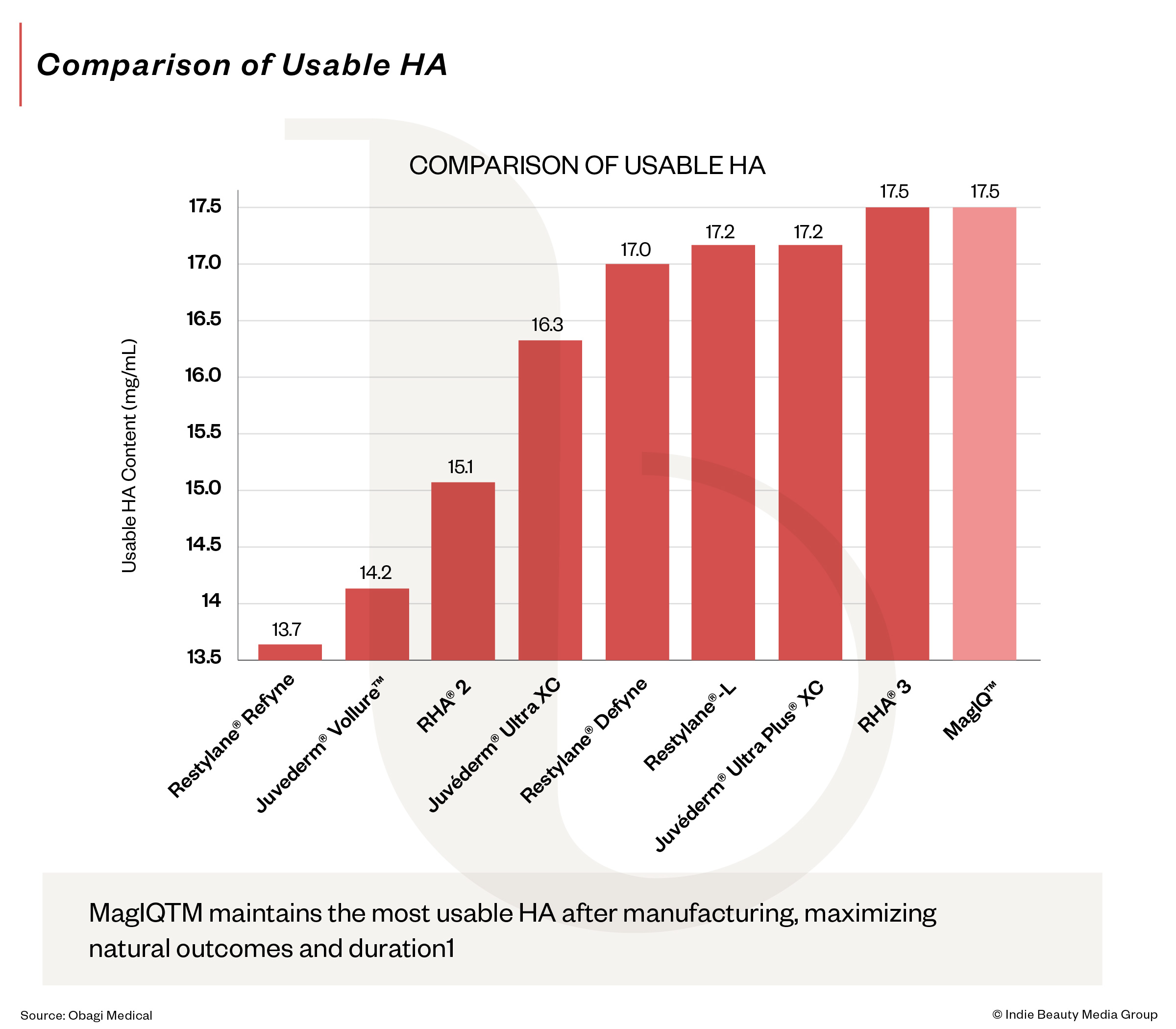

Second, MagIQ was designed around injector usability. Rather than emphasizing HA at the start of manufacturing, it measures usable HA in the final gel, aiming for consistent extrusion, smooth injection and predictable tissue integration.

“In real-world practice, what stands out is its consistency,” said dermatologist and cosmetic surgeon Dr. Suzan Obagi, chief medical director at Obagi. “I’ve seen predictable integration, natural-looking outcomes and a safety profile consistent with a high-quality HA filler.”

Beverly Hills dermatologist Ava Shamban describes a similar experience. She says it offers “smooth handling, predictable placement and intuitive results.”

The Role Of Real-World Evidence

Like virtually all other HA fillers on the U.S. market, MagIQ is pursuing FDA approval on a non-inferiority basis. “FDA studies in this indication are conducted to demonstrate safety and efficacy in defined patient populations,” notes Fine. “And the study conducted for MagIQ in this indication was the largest of its type.”

But registrational trials answer a narrow question. Does the product perform safely and effectively under controlled conditions? They do not capture the variability of everyday practice, differences in injector technique, patient anatomy and aesthetic preference. In injectables, those nuances can meaningfully shape adoption.

Obagi is attempting to bridge that gap through a program called ALOHA, which stands for Aesthetic Leadership with Obagi Hyaluronic Acid and is a broad initiative the company expects will become the largest structured real-world evidence effort of its kind, incorporating feedback from more than 2,000 providers.

“The ALOHA program reflects our commitment to transparency and collaboration,” says Brousset. “We’re investing in evidence that reflects everyday practice.”

Building Protocols And Leverage

ALOHA supports the strategic objective of integrating injectables into Obagi’s skincare ecosystem. The company plans phase IV and observational studies evaluating combined protocols, pairing topicals with injectable treatments to assess satisfaction, outcomes and practice economics. Obagi says, “At Obagi, we view injectables as part of a comprehensive skin health approach, not a standalone solution.”

For Waldencast, the integration has second-order implications. When a consumer experiences a positive injectable outcome under the Obagi name, the brand relationship deepens. The filler becomes part of a broader system. That dynamic has the potential to strengthen adherence, encourage repeat visits and reinforce brand loyalty across both injectables and topicals.

Most new filler entrants must build distribution, education and brand awareness simultaneously. Obagi starts with all three. Its existing commercial infrastructure with field sales, education programs and long-standing account relationships reduces the cost and friction typically associated with launching a new injectable.

The wider industry appears aligned with this thesis. In 2025, L’Oréal invested roughly $5 billion to double its stake in Galderma from 10% to 20%, reinforcing the view that medical aesthetics represents a structurally attractive growth engine within the beauty-health continuum.

Injectables combine clinical authority, recurring cadence and premium economics. For companies already embedded inside treatment rooms, the leverage is amplified.

A Brand-Led Future

MagIQ reflects Waldencast’s conviction that modern aesthetics is converging with traditional beauty to be more brand-aware, consumer-conscious and increasingly integrated across modalities.

The initial focus remains provider education and clinical adoption. Over time, the company plans to activate consumer channels, encouraging consumers to seek Obagi injectables by name.

If successful, MagIQ will represent more than a product launch. It will demonstrate that, in aesthetics, the enduring advantage may belong not just to the best molecule, but to the strongest system.