Skincare Overtakes Fragrance As Beauty’s Leading Growth Driver In Late 2025

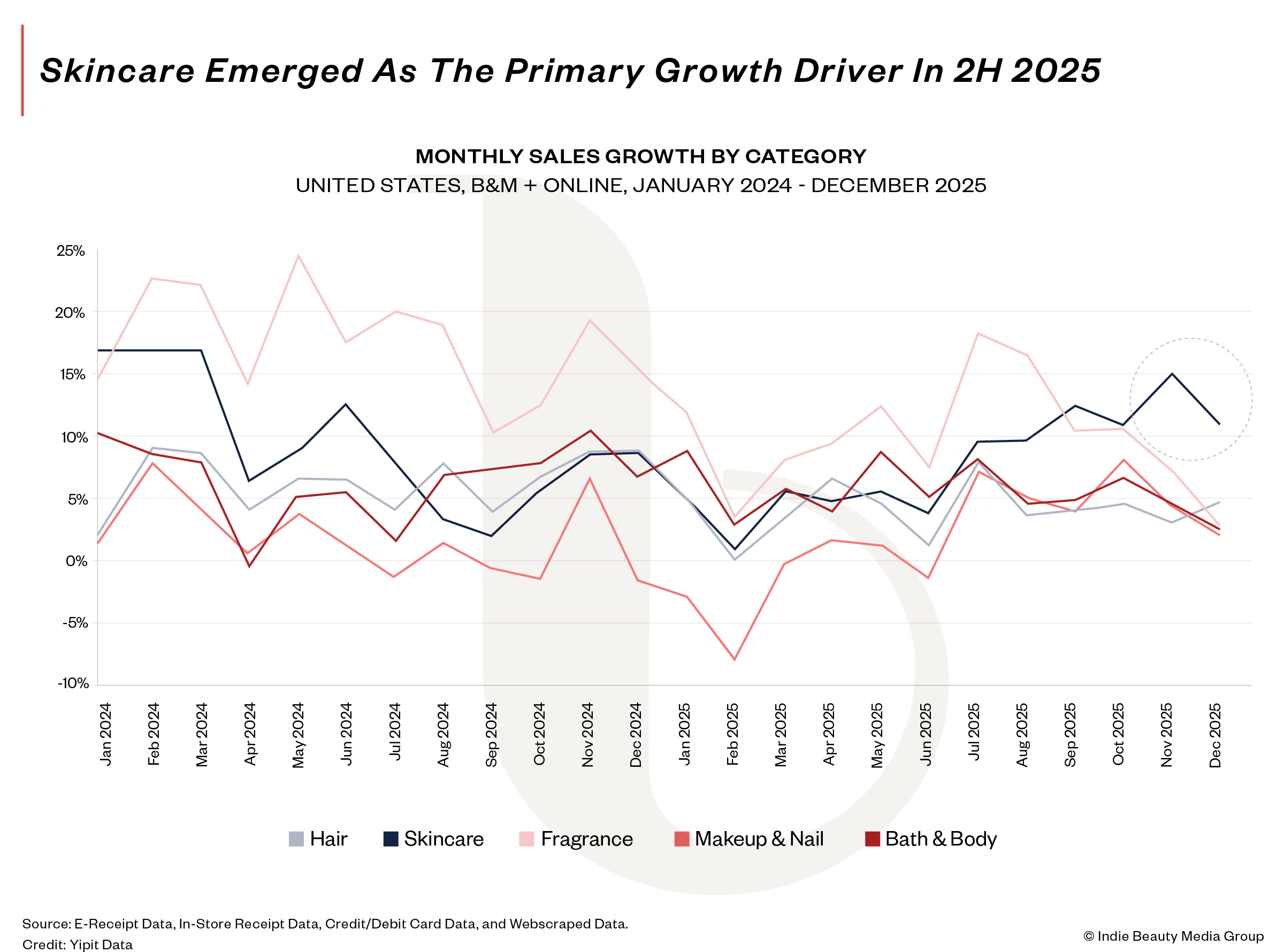

Skincare reclaimed the lead as beauty’s top growth driver in the final quarter of 2025, overtaking fragrance, according to new data from consumer insights firm YipitData.

Between October and December, skincare sales increased 12% on a yearly basis, while makeup, fragrance, bath and body grew 5% and haircare rose 4%. Rhode, Eos, Burt’s Bees, Chapstick and K-Beauty brands Medicube, Dr. Melaxin Global and Anua lifted the skincare category. During the first half of the year, fragrance growth far outpaced skincare, makeup and haircare growth, increasing 14% on a yearly basis, though its momentum was cooling. YipitData sources its data on an omnichannel basis from credit and debit cards, web scraping and online and store receipts from a consumer panel of 11 million shoppers.

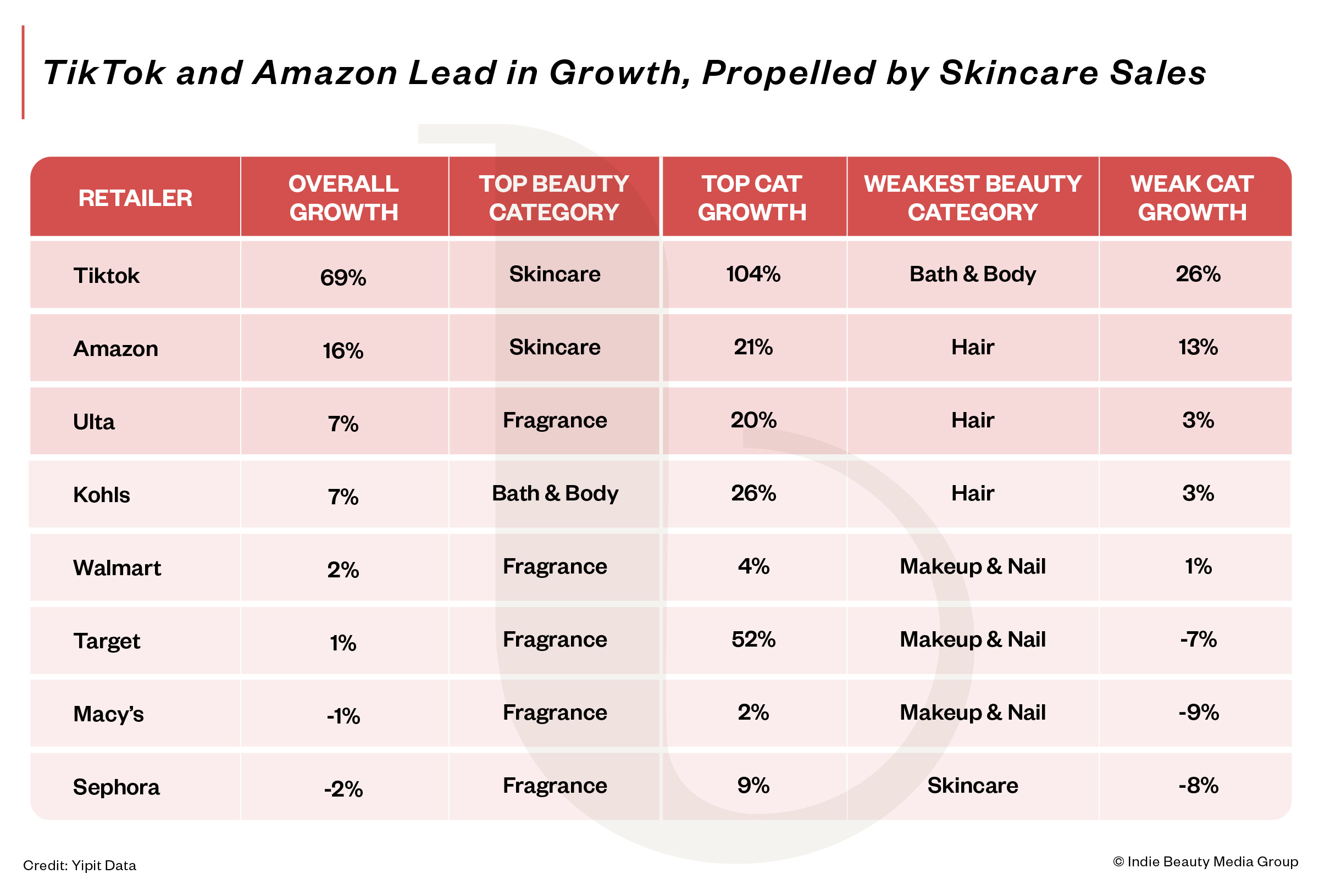

Skincare’s late-year gains were driven largely by surging demand on Amazon and TikTok Shop, where it emerged as the top-performing beauty category in 2025. According to YipitData, skincare sales grew 104% on TikTok Shop and 21% on Amazon last year. Fragrance, meanwhile, was the top growth driver at Ulta Beauty, Walmart, Target, Macy’s and Sephora. Overall, e-commerce expanded its share of beauty sales by three percentage points, rising from 27% to 30%. Mass, drug, warehouse club, specialty, department store and professional channels ceded ground. Yipit’s data wasn’t validated by Sephora or other retailers, and Sephora disputes the findings.

Yipit estimates beauty sales in the United States across prestige and mass rose 5% in 2025 to about $114 billion. Growth was driven primarily by price increases rather than unit gains, as higher-income households earning more than $100,000 annually boosted beauty spending. Fragrance was the fastest-growing category for the year at 8.5%, followed by skincare at 8%, bath and body at 6%, haircare at 4% and makeup at 2%.

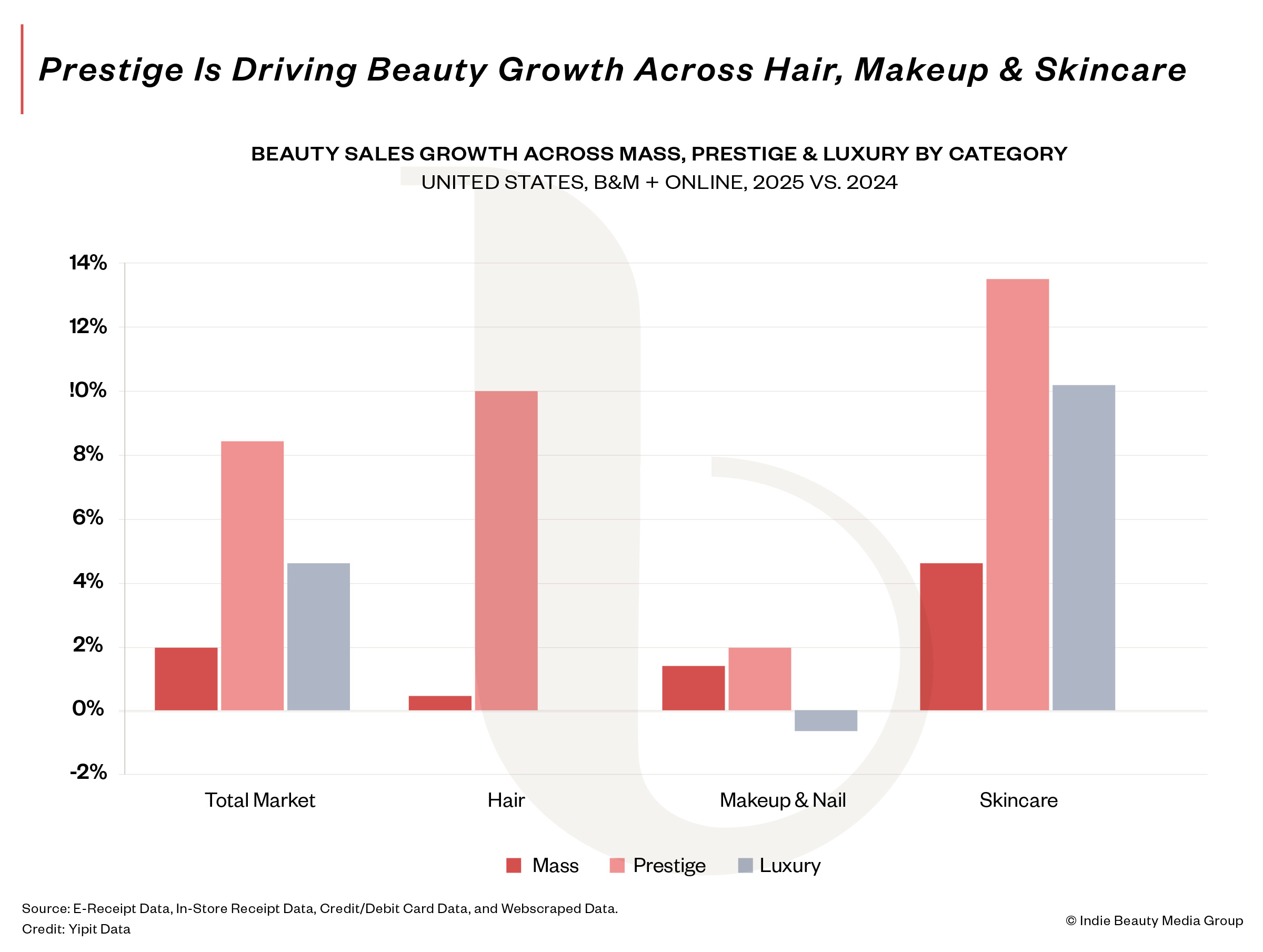

Circana’s data presents a different view of how growth was distributed between mass and prestige, even as it broadly supports skincare’s late-year rebound. The market research firm estimates total U.S. prestige and mass beauty sales reached roughly $108 billion in 2025, with prestige beauty retail dollar sales growing 4% to $36 billion and mass beauty sales increasing 5% to $72.7 billion. In prestige, skincare rebounded in the second half of the year and grew faster than fragrance during the holiday period, while fragrance remained the fastest-growing category for the full year—particularly in mass retail—reflecting continued normalization after several years of outsized gains.

YipitData’s analysis suggests prestige skincare and haircare outperformed mass in 2025, reflecting premiumization trends within specialty retail. According to the firm, Sephora benefited most from fragrance growth, and Ulta saw outsized gains in haircare treatments. Nutrafol, Redken, Kayali, Kerastase, Cécred and Tatcha were among brands fueling prestige growth last year.

“Prestige growth is really concentrated in those categories where there is strong storytelling, efficacy and gifting,” said Ally Flechsig, senior product manager at YipitData, during a webinar last week. “Shoppers are looking for very specific things when they are looking at prestige offerings within these categories.”

Makeup was prestige’s largest volume category last year, commanding roughly 42% market share and $7 billion in sales, according to data provider Daash. On a full-year basis, foundation, concealer and mascara powered the category, with Nars’ Radiant Creamy Concealer, One/Size’s On ’Til Dawn Mattifying Waterproof Setting Spray and Huda Beauty’s Easy Bake Blurring Loose Baking & Setting Powder ranking as the top makeup products of the year.

Shoppers showed renewed interest in eyeshadow and eyeliners, while continuing to stock up on lip balms and lip liners. Longwear and waterproof claims lost some traction, according to Melissa Munnerlyn, co-founder and CMO of Daash Intelligence. “Consumers gravitated toward daily staples over occasional statement products,” she says. “Durability still matters, but it’s no longer the category’s momentum driver.”

In skincare, Daash identified Summer Fridays, The Ordinary and Tatcha as outperformers in 2025. The category generated roughly $3.6 billion in sales and accounted for 21.7% of the total beauty market. Moisturizers, serums and lip balms posted the strongest gains, led by Summer Fridays’ Lip Butter Balm Treatment, Tatcha’s The Dewy Skin Cream and Rhode’s Peptide Lip Tint Nourishing Glaze. Daash observed prestige skincare consumers shifting away from more aggressive brightening, contouring, exfoliating and anti-aging claims. Hydration remained the category’s top benefit, Munnerlyn notes, saying, “It’s now a baseline expectation.”

Fragrance winners in 2025 included Valentino’s Donna Born In Roma Eau de Parfum, Sol de Janeiro’s Cheirosa 62 Hair & Body Mist and Kayali’s Yum Boujee Marshmallow, with YSL, Valentino and Sol de Janeiro driving much of the category’s growth. Shoppers gravitated toward vanilla, jasmine and marshmallow scents, as well as daisy- and amber-forward rollerballs. Fragrance accounted for 16.8% of the total beauty market, generating an estimated $2.8 billion in sales.

In haircare, consumers prioritized hydrating, repairing and strengthening claims across shampoos, conditioners, masks and treatments, according to Daash. BabylissPRO’s Nano Titanium XL Spring Curling Iron and Nano Titanium 1.25-inch XL Spring Curling Iron were the top-performing hair products of the year, followed by Dae’s Cactus Fruit 3-in-1 Styling Cream. Consistent with Yipit’s findings, Daash named Redken, BabylissPRO and Kérastase as the leading brands in the category, which accounted for 13.8% of beauty market share and approximately $690 million in sales in 2025.